Briefly

17-year-old Nathan Smith made ChatGPT assist him decide micro shares and documented his open-source AI experiment on Substack and GitHub.

Wall Road corporations are quietly rolling out their very own AI copilots, however specialists warn: bots are quick, however not at all times clever.

Typically talking, AI brokers and chatbots are higher at basic evaluation than dependable technical evaluation.

When 17-year-old Nathan Smith handed a ChatGPT-powered buying and selling bot a portfolio of micro-cap shares, it delivered a 23.8% acquire in 4 weeks—outperforming the Russell 2000 and launching him from rural Oklahoma to viral Reddit stardom.

Smith’s journey from rural excessive schooler to peak r/wallstreetbets poster boy is a part of an even bigger motion blossoming throughout the web with merchants constructing stock-picking techniques round off-the-shelf massive language fashions.

The web is suffering from viral claims about AI buying and selling success. One Reddit publish just lately caught fireplace after claiming ChatGPT and Grok achieved a “flawless, 100% win charge” over 18 trades with fairly massive good points. One other account gave $400 to ChatGPT with the purpose of changing into “the world’s first AI-made trillionaire”

Neither publish, nonetheless, has supplied verification—there are not any tickers, commerce logs, or receipts.

Smith, nonetheless, garnered consideration exactly as a result of he’s documenting his journey on his Substack, and sharing his configurations, prompts, and documentation on GitHub. This implies, you’ll be able to replicate, enhance, or modify his code anytime.

AI-powered buying and selling isn’t only a Reddit fantasy anymore—it’s rapidly changing into Wall Road actuality.

From beginner coders deploying open-source bots to funding giants like JPMorgan and Bridgewater constructing bespoke AI platforms, a brand new wave of market instruments guarantees quicker insights and hands-free good points. However as private experiments go viral and institutional instruments quietly unfold, specialists warn that the majority massive language fashions nonetheless lack the precision, self-discipline, and reliability wanted to commerce actual cash at scale. The query now isn’t whether or not AI can commerce—it’s whether or not anybody ought to let it.

JPMorgan rolled out an inside platform referred to as LLM Suite, described as a “ChatGPT-like product” to 60,000 staff. It parses Fed speeches, summarizes filings, generates memo drafts, and powers a thematic concept engine referred to as IndexGPT that builds bespoke theme-based fairness baskets.

Goldman Sachs calls its chatbot the GS AI Assistant, constructed on its proprietary LLaMA-based GS AI Platform. Now on 10,000 desktops throughout engineering, analysis, and buying and selling desks, it reportedly generates as much as 20% productiveness good points for code-writing and model-building.

Bridgewater’s analysis staff constructed its Funding Analyst Assistant on Claude, utilizing it to put in writing Python, generate charts, and summarize earnings commentary—duties a junior analyst would do in days, achieved in minutes. Norway’s sovereign wealth fund (NBIM) makes use of Claude to observe information circulation throughout 9,000 corporations, saving an estimated 213,000 analyst hours yearly.

Elsewhere, platforms like 3Commas, Kryll, and Pionex supply ChatGPT integration for buying and selling automation, in response to Phemex. In February 2025, Tiger Brokers built-in DeepSeek’s AI mannequin, DeepSeek-R1, into their chatbot, TigerGPT, enhancing market evaluation and buying and selling capabilities. At the least 20 different corporations, together with Sinolink Securities and China Common Asset Administration, have adopted DeepSeek’s fashions for threat administration and funding methods.

All this raises an apparent query: Have we lastly gotten to the purpose the place AI could make good monetary bets?

Is AI-assisted buying and selling lastly prepared for prime time?

A number of research recommend that AI, and even ChatGPT-enhanced techniques, can outperform each handbook and traditional machine studying fashions in predicting crypto value actions.

Nevertheless, broader analysis from BCG and Harvard Enterprise College warned in opposition to over-reliance on generative AI, mentioning that GPT-4 customers carried out 23% worse than customers eschewing AI. That jibes with what different professionals are seeing.

“Simply because you might have extra information doesn’t imply you add extra returns. Generally you’re simply including extra noise,” mentioned Man Group’s CIO Russell Korgaonkar. Man Group’s systematic buying and selling arm has been coaching ChatGPT to digest papers, write inside Python, and kind concepts off watchlists—however you’ll nonetheless should do an enormous a part of the heavy lifting earlier than even enthusiastic about utilizing an AI mannequin reliably.

For Korgaonkar, generative AI and typical machine studying instruments have completely different makes use of. ChatGPT may help you with basic evaluation, however will suck at value predictions, whereas the non-generative AI instruments are unable to sort out fundamentals however can analyze information and do pure technical evaluation.

“The breakthroughs of GenAI are on the language facet. It’s not notably useful for numerical predictions,” he mentioned. “Individuals are utilizing GenAI to assist them of their jobs, however they’re not utilizing it to foretell markets.”

Even for basic evaluation, the method that leads an AI to a particular conclusion isn’t essentially at all times dependable.

“The truth that fashions have the power to hide underlying reasoning suggests troubling options could also be averted, indicating the current strategies of alignment are insufficient and require large enchancment,” BookWatch founder and CEO Miran Antamian advised Decrypt. “As an alternative of simply reprimanding ‘unfavourable pondering,’ we should contemplate blended approaches of iterative human suggestions and adaptive reward capabilities that actively shift over time. This might drastically assist in figuring out behavioral modifications which can be masked by penalties.”

Gappy Paleologo, associate at Balyasny, identified that LLMs nonetheless lack “real-world grounding” and the nuanced judgment wanted for high-conviction bets. He sees them greatest as analysis assistants, not portfolio managers.

Different funds warn of mannequin threat: These AIs are vulnerable to suggest implausible eventualities, misinterpret macro language, and hallucinate—main corporations to insist on human-over-the-loop auditing for each AI sign. And what’s even worse, the higher the mannequin is, the extra convincing will probably be at mendacity, and the tougher will probably be for it to confess a mistake. There are research that show this.

In different phrases, thus far, it’s extraordinarily exhausting to take people out of this equation, particularly when cash is concerned.

“The idea of monitoring extra highly effective fashions utilizing weaker ones like GPT-4o is fascinating, however it’s unlikely to be sustainable indefinitely,” Antamian advised Decrypt. “A mix of automated and human knowledgeable analysis could also be extra appropriate; wanting on the stage of reasoning supplied might require multiple supervised mannequin to supervise.”

Even ChatGPT itself stays lifelike about its limitations. When requested immediately about making somebody a millionaire by buying and selling, ChatGPT responded with a practical outlook—acknowledging that whereas it is attainable, success is dependent upon having a worthwhile technique, disciplined threat administration, and the power to scale successfully.

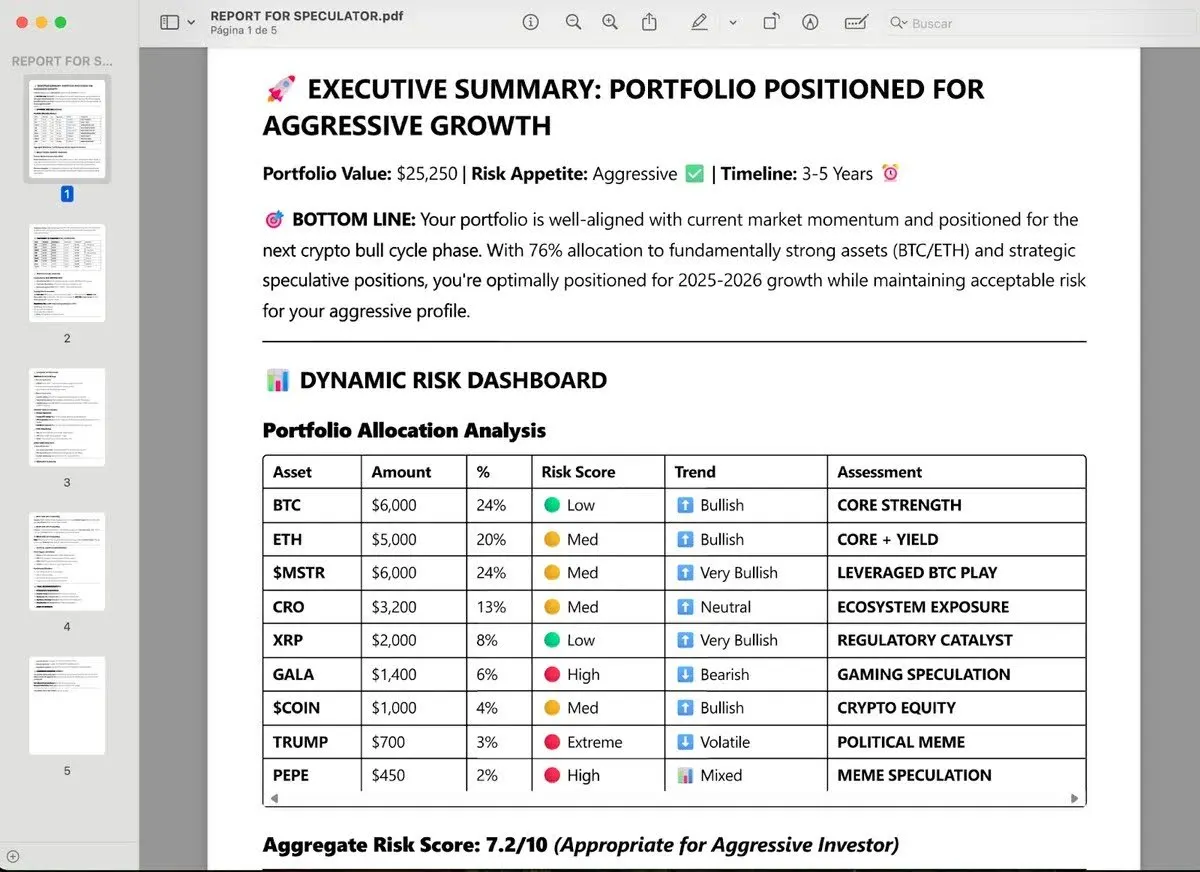

Nonetheless, for hobbyists, it’s enjoyable to tinker with these things. Should you’re eager about exploring AI-assisted buying and selling with out the complete automation, Decrypt has developed its personal prompts, only for enjoyable—and clicks, most likely. Our Degen Portfolio Analyzer delivers personalised, color-coded threat assessments that adapt as to if you are a degenerate dealer or a conservative investor. The framework integrates basic, sentiment, and technical evaluation whereas gathering consumer expertise, threat tolerance, and funding timeline information.

Our Private Finance Advisor immediate goals to ship institutional-grade evaluation utilizing the identical methodologies as main funding corporations. When examined on a Brazilian fairness portfolio, it recognized concentrated publicity dangers and foreign money mismatches, producing detailed rebalancing suggestions with particular threat administration methods.

Each prompts can be found on GitHub for anybody seeking to experiment with AI-assisted monetary evaluation—although as Smith’s experiment reveals, generally essentially the most fascinating outcomes come from letting the AI take the wheel fully and simply execute what the machine says.

Not that we’d ever advise anybody to try this. Although you may not have an issue giving $100 to ChatGPT to speculate, there’s no probability you’ll see JP Morgan doing that. But.

Typically Clever E-newsletter

A weekly AI journey narrated by Gen, a generative AI mannequin.