Aerodrome Finance, the most important DEX on Base, has warned customers to steer clear of its web site after a suspected DNS hijack turned its entrance finish right into a phishing lure. However what does it imply for AERO crypto value?

The crew mentioned on November 22, that it’s investigating a “front-end compromise” linked to a DNS takeover that focused its centralized net domains.

Replace: centralized domains (.finance and .field) stay compromised. Please don’t use both area for now.

Two decentralized mirrors stay secure to make use of:https://t.co/1NdyRo2x1whttps://t.co/YK9ZlPvAYi

All sensible contracts stay safe.

We’ll present additional updates because the… https://t.co/B7L4Kt4Z8I

— Velodrome (@VelodromeFi) November 22, 2025

The assault redirected guests to pretend variations of the location, the place customers have been proven malicious pockets prompts meant to steal funds.

Aerodrome urged customers to not open any of its URLs till the checks are full. The crew additionally famous that its on-chain sensible contracts seem untouched, as the problem is restricted to the online interface.

DISCOVER: High 20 Crypto to Purchase in 2025

How Critical Is the Entrance-Finish Compromise Affecting the Aerodrome and Velodrome?

Velodrome, a sister trade, issued the identical warning and requested its group to keep away from all official domains for now.

In a notice shared throughout trade channels, Aerodrome informed customers it was “actively investigating a frontend compromise” and urged them to keep away from the platform.

We’re actively investigating a frontend compromise.

Please don’t entry the location via any URL — main area or decentralized mirrors — till we affirm the whole lot is secure.

All sensible contracts seem safe. Updates quickly.

— Velodrome (@VelodromeFi) November 22, 2025

“Please don’t entry the location via any URL till we affirm the whole lot is secure. All sensible contracts seem safe,” the crew mentioned.

At first, Aerodrome directed customers to various entry routes, nevertheless it later expanded the alert and requested the group to remain off all hyperlinks till the investigation is full.

Is AERO Crypto SAFU?

AERO traded close to $0.70 at press time. The token was up about +3% prior to now 24 hours, with roughly $40M in quantity.

DNS hijacks strike the online layer, not the blockchain. They’ll redirect even a appropriately typed area to a pretend web page that asks victims for dangerous signatures or wide-open token approvals.

The Block reported that each Aerodrome on Base and Velodrome on Optimism have been hit by a coordinated front-end compromise, although the groups confused that their core sensible contracts stayed safe.

An analogous DNS difficulty affected the identical protocols in late 2023.

DISCOVER: 9+ Finest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

AERO Value Prediction: What Does the $0.60–$0.70 Help Imply for AERO’s Subsequent Transfer?

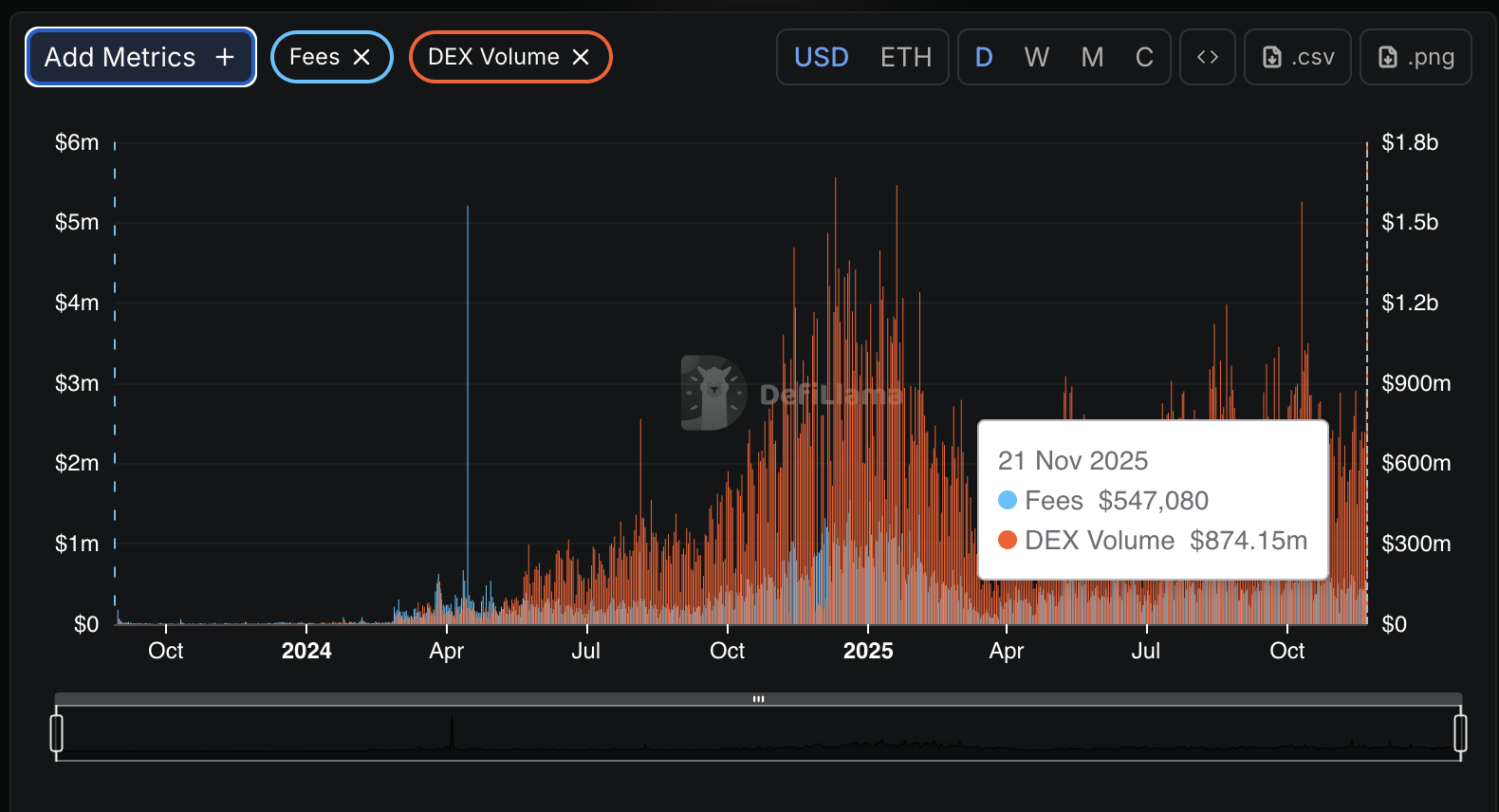

Aerodrome continues to play a central position on Base. It processes heavy swap exercise, and up to date DeFiLlama knowledge confirmed about $874M in 24-hour DEX quantity and roughly $547,000 in charges.

These numbers clarify why even non-contract incidents can unsettle customers and transfer markets.

By press time, Aerodrome and Velodrome mentioned their investigations have been nonetheless underway and pointed to centralized area suppliers as a part of the evaluate.

A now-deleted replace talked about direct outreach to the registrar. Customers who landed on spoofed pages normally reply by revoking current approvals and updating their credentials to restrict any threat.

Till Aerodrome publishes a full autopsy and proves the affected domains are clear, two issues matter most: the magnitude of consumer losses and the way shortly the crew can safe DNS and front-end safety with out chopping off entry to the trade.

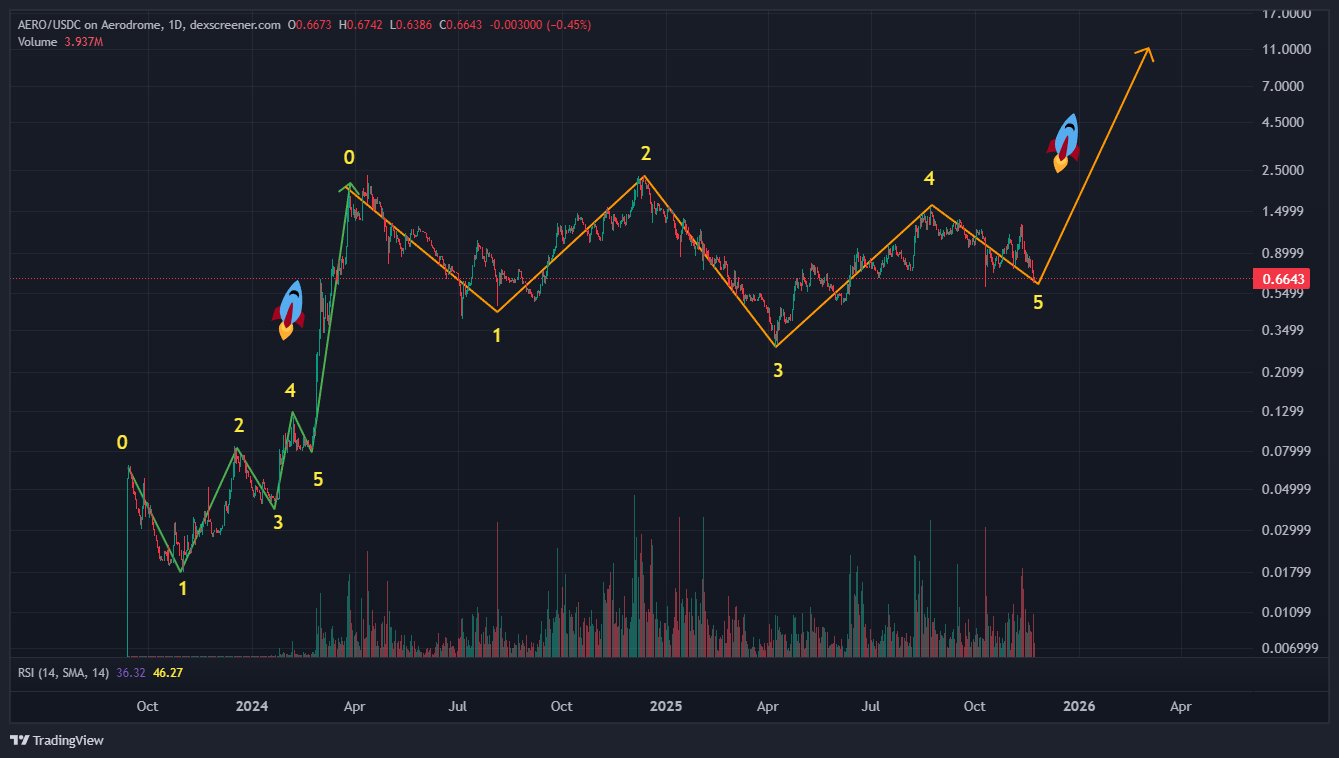

On the chart, AERO is shaping a large correction after its early-2024 breakout. The analyst sees a five-wave drop from the second main peak already completed.

Swing highs sit at “0, 2, and 4,” whereas lows line up at “1, 3, and 5.” The newest low fashioned close to $0.60–$0.70, a zone that matches older help.

Quantity jumps present up round key turning factors. Day by day RSI is within the mid-30s, which factors to weaker momentum, however not a transparent oversold wipeout but.

From this base, the projection attracts a pointy transfer increased into double-digit costs, however provided that a brand new impulse cycle begins.

EXPLORE: What’s Constancy Sensible Origin Bitcoin Fund (FBTC)?

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, traits, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now