Donald Trump, a staunch crypto advocate, took workplace because the US President on January twentieth. This transfer reaffirms the ‘Make America Nice Once more’ pledge to different nations and alerts a bullish outlook for the cryptocurrencies surroundings.

Trump is displaying his friendliness in the direction of crypto

Supply: NBC Information

Regulatory Modifications

Trump has pledged to be the “most crypto-friendly president” and has made a number of guarantees that would affect regulation:

Fireplace Gary Gensler: Eradicating the present SEC chair, who’s seen by many within the crypto area as stifling innovation, may result in a extra favorable regulatory surroundings. Trump’s alternative for SEC management, Paul Atkins, is thought for his pro-crypto stance by actively holding the function of Chief Government of the consulting agency Patomak International Companions, which frequently advises cutting-edge cryptocurrency firms and conventional monetary companies on find out how to leverage digital property for progress.

Nationwide Bitcoin Reserve: The concept of a authorities Bitcoin reserve has been floated, which may theoretically enhance demand for Bitcoin however has been met with skepticism concerning its feasibility. Whereas the inauguration of President Trump might result in extra “snug” crypto rules, Cointelegraph reviews that some facets will nonetheless require time to regulate together with stablecoins.

Boosting US Bitcoin Mining: Throughout his election marketing campaign in July 2024, on the Bitcoin convention in Nashville, Donald Trump promised to encourage home Bitcoin mining operations, which he believes may help the trade’s progress within the US.

Regulatory Readability: The expectation is that the brand new administration would possibly present clearer and extra favorable rules for cryptocurrencies, presumably resulting in elevated institutional funding and mainstream adoption. ETFs are at the moment the premise for legalizing crypto, and on the similar time, they’re the bridge main the move of cash from the TradFi (Conventional) market to the crypto market. Nevertheless, the move of cash held by individuals is way bigger, it requires a authorized foundation to open the funding gate on a number of platforms for US residents, which is being utilized below the identify MiCA in Europe.

Learn extra: Finest Crypto Exchanges within the USA for January 2025

Trump’s Constructive Impression on Crypto

First, it’s important to spotlight that Trump’s total presidential marketing campaign concerned a protracted effort to influence the cryptocurrency group of his crypto-friendly insurance policies. Consequently, market costs typically moved in response to his actions and statements.

When Trump gained the presidential election on November 5, 2024, the crypto market entered a section of overwhelming positivity. Bitcoin, which had been experiencing six consecutive days of decline, rebounded swiftly and continued its upward momentum following Trump’s victory. This occasion is taken into account a outstanding catalyst that set the stage for BTC to interrupt new all-time highs (ATH) within the subsequent days.

Altcoins steadily observe Bitcoin’s value tendencies. Consequently, the full crypto market capitalization, which stood at roughly $2.29 trillion initially of November, surged to a brand new milestone of $3.73 trillion.

Donald Trump has shut ties with Elon Musk, the billionaire entrepreneur behind Tesla and SpaceX, identified for considerably impacting cryptocurrency costs along with his tweets. Dogecoin ($DOGE) serves as a major instance of this affect.

Lately, Trump signed an government order approving the Division of Authorities Effectivity (D.O.G.E.), headed by Elon Musk, a reputation that instantly evokes associations with Dogecoin.

A number of days earlier than his inauguration, Trump introduced the launch of a brand new memecoin named $TRUMP. Inside simply 36 hours of its launch, the token quickly surpassed a number of main tech initiatives, reaching a market capitalization of $15 billion and turning into the second-largest memecoin, solely behind Dogecoin. Since $TRUMP is a Solana-based token, the worth of $SOL surged to a document excessive of $294.33 this previous Sunday. This sharp enhance might mirror rising investor confidence within the Solana ecosystem, probably pushed by the success of $TRUMP and a number of other retailers additionally add in $MELANIA.

Learn extra: The best way to Purchase Solana (SOL) – 2025 Information

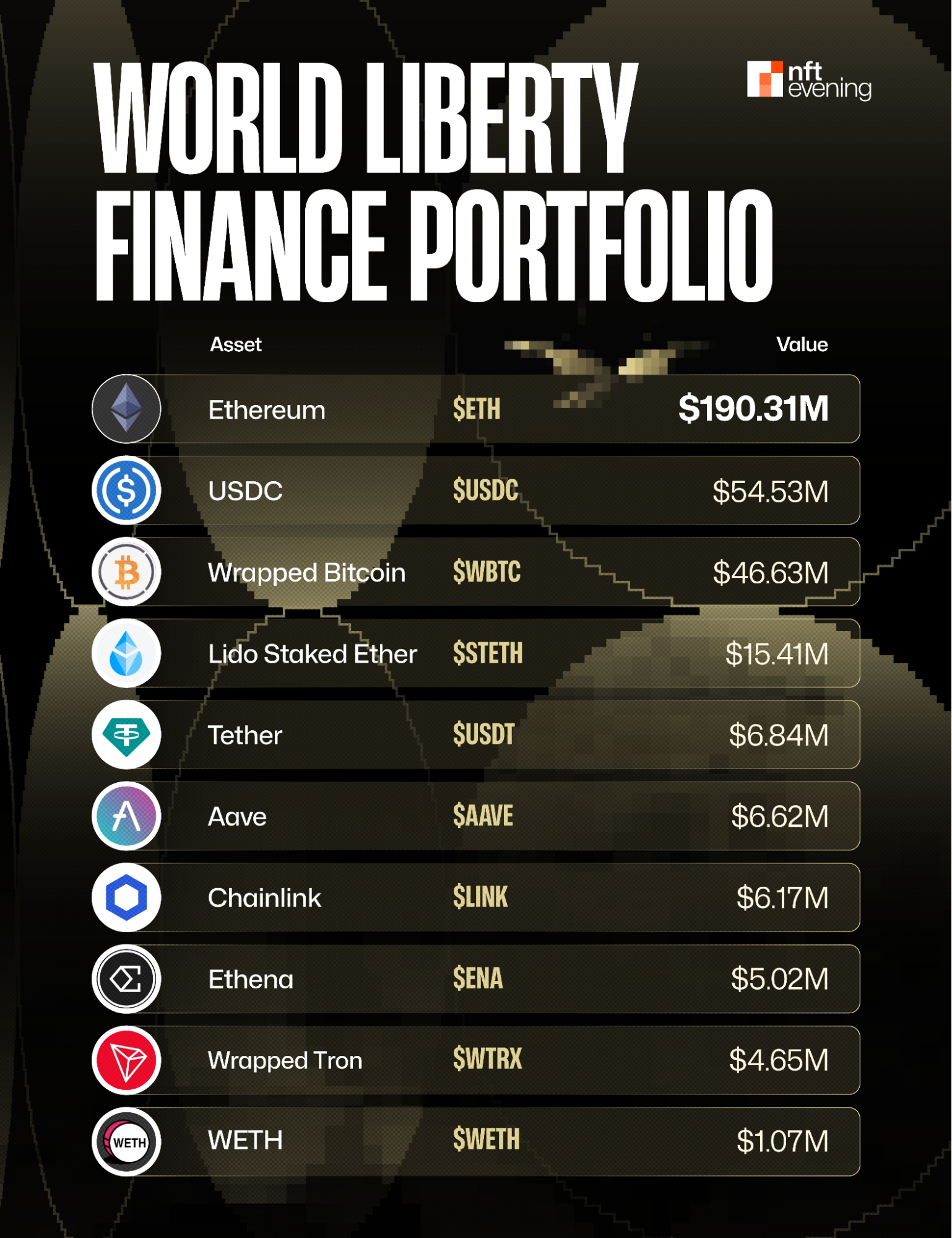

World Liberty Monetary, an impartial cryptocurrency initiative related to Trump, revealed on Monday that it efficiently concluded its preliminary token sale, securing $300 million in funding, and would look to problem further tokens of 5% because of excessive demand. At the moment, the fund behind Mr. Trump is step by step stepping up the acquisition of main cash together with $ENA, $ETH, $AAVE or $LINK.

Learn extra: Finest Crypto Exchanges within the USA for January 2025

World Liberty Finance Portfolio

The intention behind the launch of the $TRUMP

The $TRUMP memecoin is designed to resonate with supporters of Donald Trump, leveraging his political persona and the “Make America Nice Once more” (MAGA) slogan. This makes it a cultural phenomenon, aligning with meme tradition whereas additionally serving as a political assertion or image of help for Trump’s ideologies and insurance policies. That is evident from posts on X the place customers describe it as a tokenized manifestation of political actions or sentiments related to Trump.

Given the fast rise in worth and substantial market capitalization shortly after its launch, the $TRUMP coin appears to be geared toward capitalizing on Trump’s model and affect for monetary achieve. Experiences counsel that a good portion of the coin’s provide is managed by entities related to Trump, indicating a direct monetary curiosity in its success. The coin’s market dynamics, together with its preliminary surge and subsequent fluctuations, underline its use as a speculative asset slightly than one with intrinsic utility.

This memecoin additionally serves to have interaction and mobilize Trump’s group, not simply financially but in addition when it comes to participation within the cryptocurrency ecosystem. The launch was introduced by Trump himself on social media platforms, suggesting an intent to have interaction his followers instantly on this enterprise. It’s famous that such cash typically entice funding because of the hype they generate, even when they lack basic worth. This facet of hypothesis and group interplay is essential for meme cash, which thrive on social media consideration and the viral unfold of enthusiasm.

Nevertheless, timing and method of $TRUMP launch have raised moral issues, particularly given Trump’s impending return to workplace with a pro-crypto agenda. Critics have identified potential conflicts of curiosity, the place Trump may affect rules or coverage in a means that advantages his monetary pursuits within the coin. This has sparked discussions on the ethics of a political determine launching such ventures, notably with the backdrop of regulatory scrutiny over cryptocurrencies, per CNN.

Bull Season 2025?

Sometimes, after Bitcoin completes its halving cycle, the next yr witnesses outstanding progress in each BTC and the broader crypto market. This pattern has been constantly noticed within the halving occasions of 2012, 2016, and 2020, with the subsequent anticipated in 2024. Certainly, Bitcoin has already reached an all-time excessive of $109,000 this yr, with sturdy potential for additional will increase.

Public confidence in cryptocurrency is pushed by greater than its cyclical nature. The re-election of Trump has opened the door to legitimizing Bitcoin and different cryptocurrencies, making it simpler for huge liquidity from traders to move into the crypto market.

A notable instance is Coinbase, a pioneering U.S.-based cryptocurrency trade led by Brian Armstrong, which not too long ago introduced a delay in processing withdrawals on the Solana community and with the $SOL token because of overwhelming FOMO (worry of lacking out) related to the $TRUMP memecoin.

The introduction of $TRUMP, a token constructed on the Solana blockchain, triggered a surge in demand for $SOL, as customers required the token to purchase or commerce $TRUMP. This spike in demand briefly constrained the availability of $SOL on Coinbase, as customers moved the token off the platform to take part in buying and selling the brand new memecoin. Speculative traders seemingly transferred $SOL from Coinbase to capitalize on the rising hype, both buying $TRUMP or holding $SOL in anticipation of a value surge pushed by the excitement surrounding the token.

The congestion on Coinbase’s $SOL provide attributable to a 36-day-old memecoin like $TRUMP raises important questions. If substantial liquidity from the U.S. market continues to flood into different initiatives, what number of tokens will expertise comparable and even larger value spikes? Notably, based on a latest survey performed by NFTevening, many Individuals admitted that $TRUMP was their first cryptocurrency funding.

Furthermore, as the USA more and more opens its doorways to cryptocurrencies amid unprecedented FOMO, it’s value asking whether or not different main nations, together with China and Russia, will stay passive observers. The continuing crypto season guarantees much more pleasure and alternatives for traders forward.

USA coin initiatives will achieve most important advantages

Trump’s presidential election in November 2024 sparked optimistic hypothesis throughout the crypto market. This hypothesis contributed to a major market rise, accompanied by sturdy efficiency from USA-related tokens:

$XRP (Ripple): +564% (New all-time excessive)

$XLM (Stellar): + 579% (New all-time excessive)

$BTC (Bitcoin): +61% (New all-time excessive)

$SUI (Sui): +192% (New-all-time excessive)

$SOL (Solana): +91% (New all-time excessive)

USA-related coin Ecosystem by MarketCap

Moreover, there are discussions and proposals suggesting tax advantages for the US-based cryptocurrencies. For instance, there’s hypothesis about making capital positive aspects from sure U.S.-based cryptos tax-free, which might considerably profit token holders by lowering their tax liabilities. To draw liquidity amongst residents, the US surroundings permits for the creation of latest monetary devices via tokenization, which might provide distinctive funding alternatives not out there in conventional markets together with ETFs and ETPs. This innovation can result in tokens with novel advantages or use circumstances.

Remaining Thought

Trump’s presidency may probably catalyze a major enlargement within the crypto ecosystem throughout the U.S., positioning the nation as a world chief in blockchain know-how. Nevertheless, the long-term implications rely closely on how these insurance policies are carried out, their international reception, and the stability between fostering innovation and guaranteeing market integrity.

The crypto group’s sentiment on social media, appears optimistic in regards to the speedy results however cautious in regards to the sustainability and long-term penalties of those insurance policies.