Espresso (ESP) is designed to resolve one of many largest challenges in blockchain at present: fragmented liquidity and remoted chains. The community offers shared sequencing, quick finality, and safe consensus by HotShot BFT, enabling rollups to work together seamlessly whereas sustaining decentralization.

This text breaks down how the community works, its native token and tokenomics, staking, and what makes ESP a singular participant within the modular blockchain ecosystem.

What Is Espresso (ESP)?

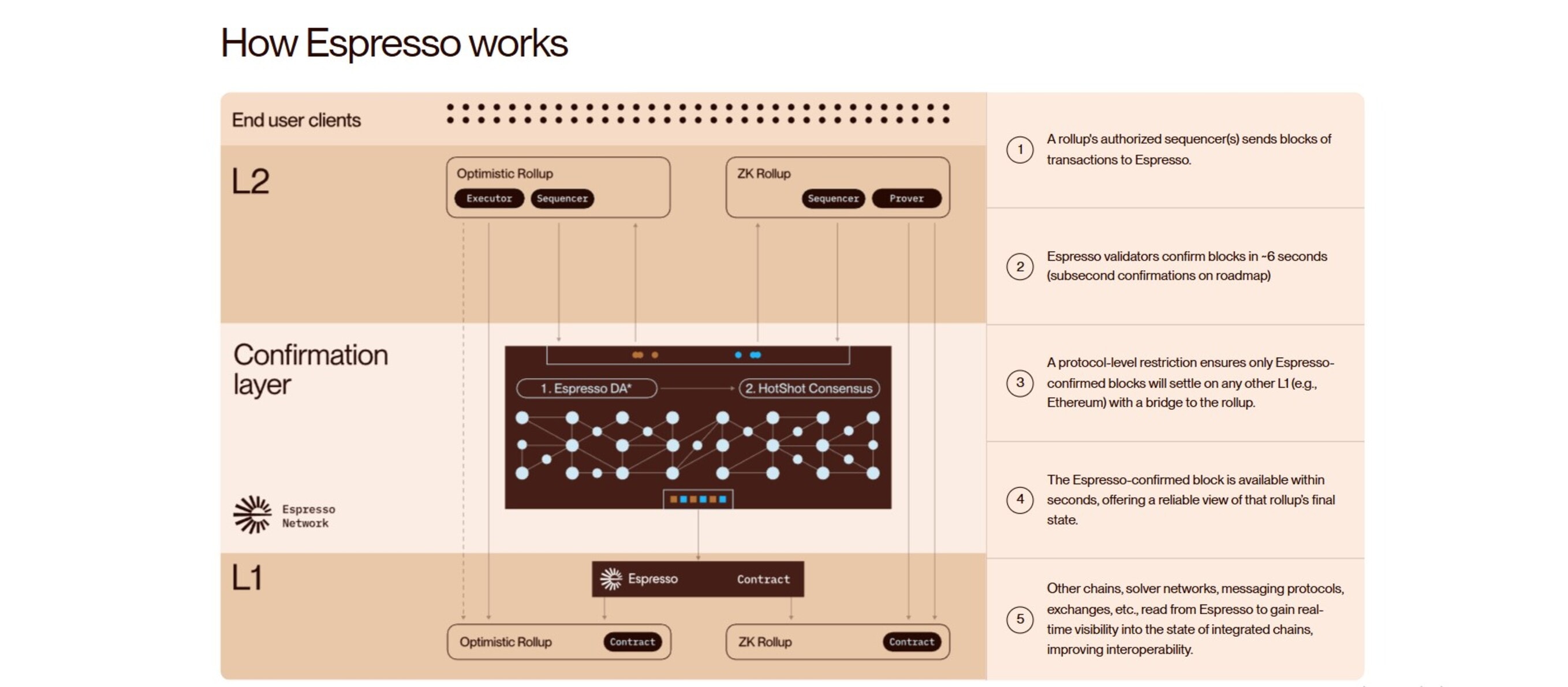

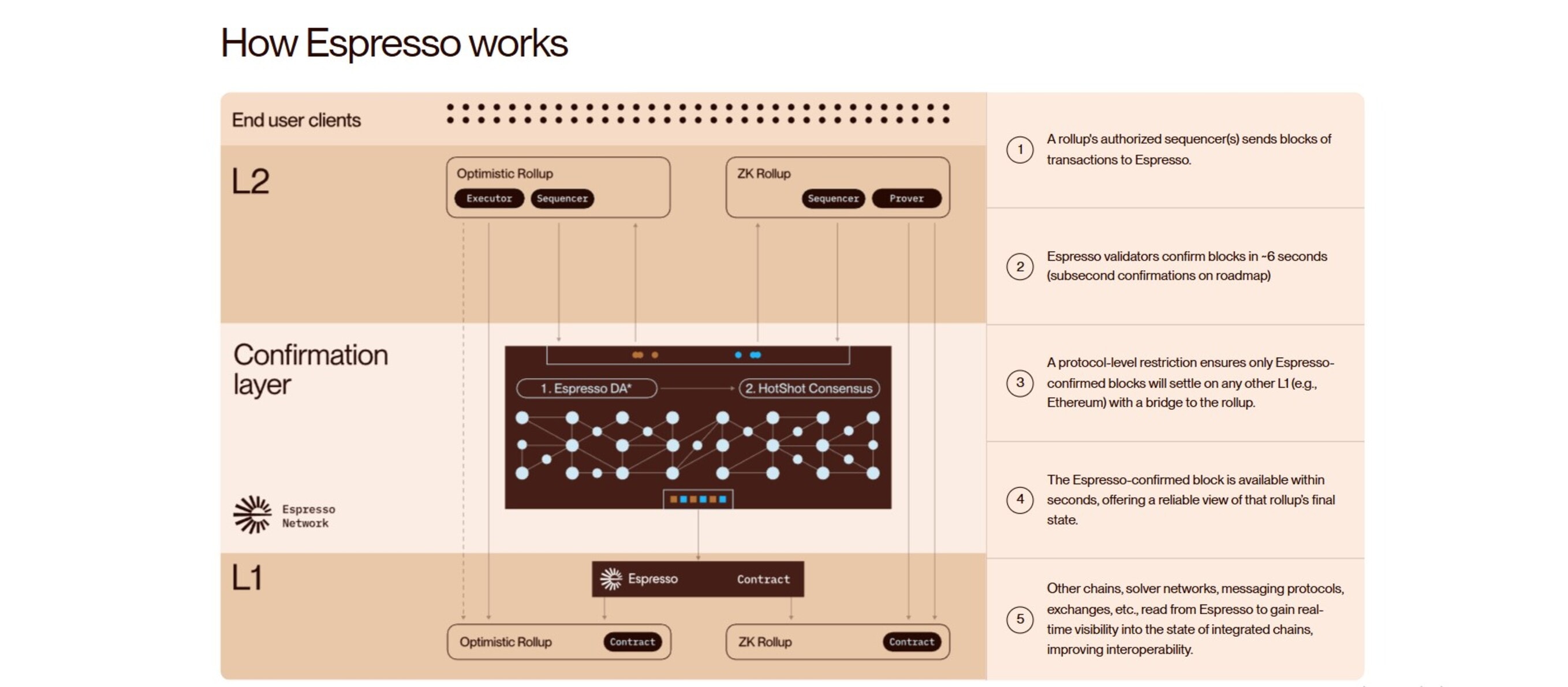

Espresso is a shared sequencing, coordination, and finality layer constructed for rollups. The Espresso Community acts as an infrastructure that sits alongside a number of chains, ordering transactions earlier than they choose their respective base layer. As an alternative of every rollup working its personal centralized sequencer, Espresso offers a distributed community that coordinates exercise throughout chains.

This design helps rollups obtain quick finality whereas enhancing interoperability throughout the broader ecosystem. By appearing as a layer for rollups, Espresso reduces fragmented liquidity and makes it simpler for customers to maneuver throughout chains with out counting on a single chain for coordination.

The community is secured by its native token, ESP. Validators stake ESP to take part in BFT (Byzantine Fault-Tolerant) consensus, affirm blocks, and shield the protocol from compromise or error. In return, token holders can earn staking rewards, aligning incentives throughout early ecosystem individuals, contributors, and the broader market.

What Drawback Does Espresso Remedy?

As extra rollups launch, liquidity and customers have gotten fragmented throughout chains. Every layer-2 community (L2) operates in isolation, leading to excessive latency for cross-chain interactions that require Ethereum settlement.

Espresso Community solves the fragmentation downside by offering a shared sequencing market the place rollups outsource ordering to decentralized nodes, utilizing auctions for rights and HotShot consensus for sub-4-second finality.

Rollups retain sovereignty by flooring costs and income sharing, with EigenLayer restaking for safety. This permits quick, coordinated transactions throughout chains with out bridges and with out compromising safety or decentralization.

How Does Espresso Work?

Espresso makes use of a distributed sequencing protocol powered by BFT (Byzantine Fault Tolerance). Validators stake ESP tokens to take part in ordering transactions and confirming blocks throughout a number of rollups.

As an alternative of every rollup managing its personal centralized sequencer, Espresso acts as a shared coordination layer. Transactions are ordered by the community after which settled on their respective base-layer chains.

This design improves safety and permits quick finality throughout Espresso-integrated rollups. It additionally offers cryptographic proof that transactions have been correctly sequenced, rising confidence amongst customers and buyers.

Espresso (ESP) Use Circumstances

Community Staking and Safety: Customers stake ESP tokens as validators or delegates to safe the HotShot BFT consensus, incomes staking rewards whereas risking slashing for downtime, errors, or malicious habits.Shared Sequencing Participation: Validators stake ESP to take part in ordering transactions throughout Espresso-integrated rollups. The community acts as a coordination and finality layer, guaranteeing that transactions are sequenced appropriately earlier than they choose their respective base-layer chains.Protocol Charges: ESP pays for transaction ordering, knowledge availability by way of the Tiramisu layer, and cross-chain providers, with charges supporting community incentives.Cross-Rollup Interoperability: Permits atomic transactions and quick finality (sub-6 seconds) throughout chains like ApeChain, RARI Chain, Celo, and Katana, for seamless NFT minting or DeFi actions with out bridges.Protocol Execution and Operations: ESP powers community operations and rollup interactions by sensible contract infrastructure, guaranteeing safe and verifiable execution of transactions throughout chains.

How Many ESP Tokens Are There?

Espresso (ESP) has a complete provide of 3.59 billion tokens. The circulating provide is round 520.55 million ESP, with a completely diluted valuation (FDV) of about $207 million, primarily based on current market knowledge. About 2.49% went to public sale, whereas the remaining was allotted to staking incentives, ecosystem development, group vesting, and operations. This construction prioritizes long-term community safety by way of Proof-of-Stake participation.

Espresso (ESP) Tokenomics

In contrast to some crypto tasks, there’s no mounted most provide as a result of staking rewards can introduce new tokens over time to assist validator participation and community safety.

Right here’s how the preliminary provide was distributed:

27.36% to contributors with multi-year vesting14.32% to buyers underneath vesting schedules10% allotted for a group airdrop, absolutely unlocked at launch24.81% reserved for future grants, incentives, and ecosystem development15% for basis operations to assist infrastructure growth4.5% for liquidity assist and market exercise3.01% for staking bonuses and decentralization incentives.

For a deeper dive into allocation methods and financial design, see ESP tokenomics construction.

Workforce & Challenge Background

Espresso Methods was based in 2020 by Stanford cryptography researchers Ben Fisch (CEO), Benedikt Bünz (Chief Scientist), Jill Gunter (Chief Technique Officer), and Charles Lu (COO). The group makes a speciality of zero-knowledge proofs and sequencing expertise, with prior expertise contributing to Monero, Ethereum Basis tasks, and Libra.

Whereas the group started working in 2020, Espresso emerged from stealth in 2022 with $33 million in seed funding from Greylock, Polychain, and Coinbase Ventures, adopted by $32 million in Collection B funding from a16z and Sequoia, for a complete of $ 64 million raised.

Though Espresso has launched its first mainnet, lots of its key options are nonetheless being rolled out. Regardless, the group’s experience in distributed programs and deal with coordination infrastructure proceed to place Espresso as a high-performance base layer for rollups.

For a deeper dive into how settlement and sequencing work on the protocol degree, try blockchain finality and settlement defined.

Is Espresso (ESP) a Good Funding?

Whether or not ESP is an effective funding is determined by your threat tolerance and outlook on rollup infrastructure. The challenge targets a core crypto downside of sequencing and finality for rollups which might drive demand if adoption grows.

Nonetheless, blockchain markets are unstable, and ESP’s worth hinges on community utilization, staking rewards, and wider ecosystem traction. All the time do your personal analysis and by no means make investments greater than you possibly can afford to lose.

For extra steerage on investing in promising tasks, try greatest cryptocurrency to purchase.

Tips on how to Purchase Espresso (ESP)

Step 1: Create and Confirm an Change AccountTo start out, select a good crypto change that lists ESP, reminiscent of KuCoin or Binance. It’s essential present an e-mail or cellphone quantity and create a powerful password. Most exchanges additionally require identification verification (KYC), which implies submitting a government-issued ID and typically a selfie for proof of identification.

Step 2: Deposit FundsAs soon as your account is verified, you want funds to purchase ESP. You possibly can deposit fiat currencies like USD or EUR immediately or switch different cryptocurrencies reminiscent of USDT, ETH, or BTC.

Step 3: Purchase ESPAfter funding your account, go to the change’s spot market and seek for ESP or purchase immediately if the platform has a “Fast Purchase” possibility. You possibly can place a market order, which buys immediately on the present worth, or a restrict order, which executes when ESP reaches a worth you set.

Step 4: Safe Your Tokens

Whereas exchanges present handy storage, it’s greatest to retailer ESP safely in a crypto pockets. {Hardware} wallets, cellular wallets, or browser wallets appropriate with ERC‑20 tokens offer you management of your non-public keys. Safe wallets cut back the danger of hacks or change failures and allow you to take part in staking or governance with out leaving tokens on the change.

ESP Vs Bitcoin

CharacteristicEspresso (ESP)Bitcoin (BTC)Major PositionShared sequencer for Ethereum L2 rollups phemex+1Digital gold, Layer 1 retailer of worthConsensusHotShot (BFT, Proof-of-Stake)Proof-of-Work (mining)Transaction VelocitySub-second pre-confirmations10-60 minutesFocusCross-chain composability and scalingSafety & decentralizationWhole Provide3.59B21MLaunch 12 monthsMainnet 20242009Market Cap (Feb 2026)$32MTrillions

Dangers and Concerns

Investing in ESP comes with a number of dangers that merchants and token holders ought to perceive. Market volatility is a significant component, as ESP’s worth can swing sharply attributable to crypto cycles, community adoption, and speculative buying and selling.

Whereas Espresso is designed to cut back liquidity fragmentation and enhance interoperability, liquidity fragmentation stays a priority, as low liquidity on sure rollups might have an effect on buying and selling effectivity.

Lastly, the community continues to be evolving, with key options reminiscent of permissionless staking, full validator decentralization, and built-in rollups being rolled out, which might have an effect on the community’s stability and token demand as upgrades progress.

Conclusion

Espresso (ESP) presents a singular answer for rollup coordination, combining quick finality, staking incentives, and interoperability. Whereas the community reveals robust potential, take into account market volatility, protocol dangers, and evolving options. ESP’s function in securing the community and supporting the ecosystem makes it an necessary token to look at.

FAQs

What makes Espresso (ESP) completely different?

Espresso stands out as a shared sequencing and finality layer for rollups, quite than a conventional base layer. It makes use of HotShot BFT consensus to offer quick finality, cut back fragmented liquidity, and allow seamless interoperability throughout a number of chains.

What’s Espresso (ESP) used for?

ESP is the native token of the community, used for staking, securing the protocol, incomes rewards, and collaborating in community incentives. It aligns the pursuits of validators, early ecosystem individuals, and different customers.

The place can I purchase ESP tokens?

You should buy ESP on main crypto exchanges that listing the token, utilizing fiat or different cryptocurrencies. After shopping for, we advocate storing ESP safely in a crypto pockets.

What blockchain does Espresso run on?

Espresso operates as a layer for rollups quite than a single chain. It integrates with a number of chains and rollups, offering coordination and finality whereas supporting cross-chain interoperability.

Does Espresso have staking or governance options?

Sure. Customers can stake ESP to take part in community consensus and earn rewards. Token holders additionally affect governance choices, together with protocol upgrades and basis operations.