Be part of Our Telegram channel to remain updated on breaking information protection

The BNB token recorded $3.6 billion in buying and selling quantity, as the value fell again to commerce throughout the falling wedge sample, because the Binance alternate disclosed plans to transform the SAFU fund’s $1 billion stablecoin reserves into Bitcoin inside 30 days to revive the fund to $1 billion if worth fluctuations push its worth beneath $800 million.

Binance Coin worth has dropped 5.1% within the final 24 hours to $841.54 as of 04:04 a.m. EST, because the crypto market additionally fell over 5% to $2.89 trillion, in line with Coingecko knowledge.

On account of this continued drop, BTC dropped sharply, reaching its lowest stage in over two months, as a wave of compelled liquidations hit leveraged merchants whereas traders weighed the potential affect of a US Federal Reserve management change.

Information from Coinglass present that roughly $1.74 billion in leveraged positions have been worn out over the previous 24 hours amid the sell-off, with 93% of those coming from lengthy positions.

Binance To Shift $1 billion Person Safety Fund Into Bitcoin

Binance, the world’s largest crypto alternate by buying and selling quantity, introduced a plan to transform your entire $1 billion reserve of its Safe Asset Fund for Customers (SAFU) from stablecoins into BTC over the following 30 days.

The fund was created to guard customers from losses attributable to unexpected occasions, comparable to knowledge breaches. It added that if bitcoin’s worth swings drop the fund’s worth beneath $800 million, the alternate will high it again as much as $1 billion.

“This initiative is a part of Binance’s long-term industry-building efforts, and we’ll proceed to advance associated work, progressively sharing extra progress with the neighborhood,” Binance stated on X.

https://t.co/tbXqWVtp95

— 币安Binance华语 (@binancezh) January 30, 2026

Underneath the outlined plan, the alternate will progressively purchase BTC as a manner of avoiding sudden market disruption, a daring transfer by a centralized alternate to again up person funds with BTC.

Changing $1 billion over 30 days implies roughly $33 million in day by day BTC purchases, which may, in flip, assist stabilize the cryptocurrency’s drawdowns.

Moreover, with the $800 million rebalance threshold, Binance will commit to purchasing the dip if the BTC worth falls sharply.

CZ Denies Giant-Scale BNB Promoting By Binance

Because the crypto market corrected, Binance founder Changpeng ‘CZ’ Zhao denied allegations that the alternate engaged in large-scale promoting of varied cryptocurrencies, which can have contributed to the sustained market decline.

Based on CZ, the unfavourable rumors are dangerous to the broader market however not personally impactful.

FUD would not harm the goal. My followers elevated.

FUD hurts the market (ie everybody).

I/Binance don’t promote in any significant quantities.

My promoting = I swipe my card and $5 price of BNB will get transformed/despatched to the espresso store.

I do not run Binance anymore, however primarily based on what I…

— CZ 🔶 BNB (@cz_binance) January 30, 2026

Based on CZ, he and Binance haven’t engaged in any “significant” promoting actions, and any private gross sales have been restricted to day by day bills.

CZ’s feedback comply with allegations that the co-founder and the alternate have engaged in market manipulation and self-serving practices over time.

Engaged on a comply with up article for these ….

Simply as Binance are nuking the market https://t.co/xgyg24N9Pn pic.twitter.com/vbNC8QB39C

— $trong (@StrongHedge) January 29, 2026

BNB Worth Drops Beneath Key Assist, Dangers A Sustained Plunge

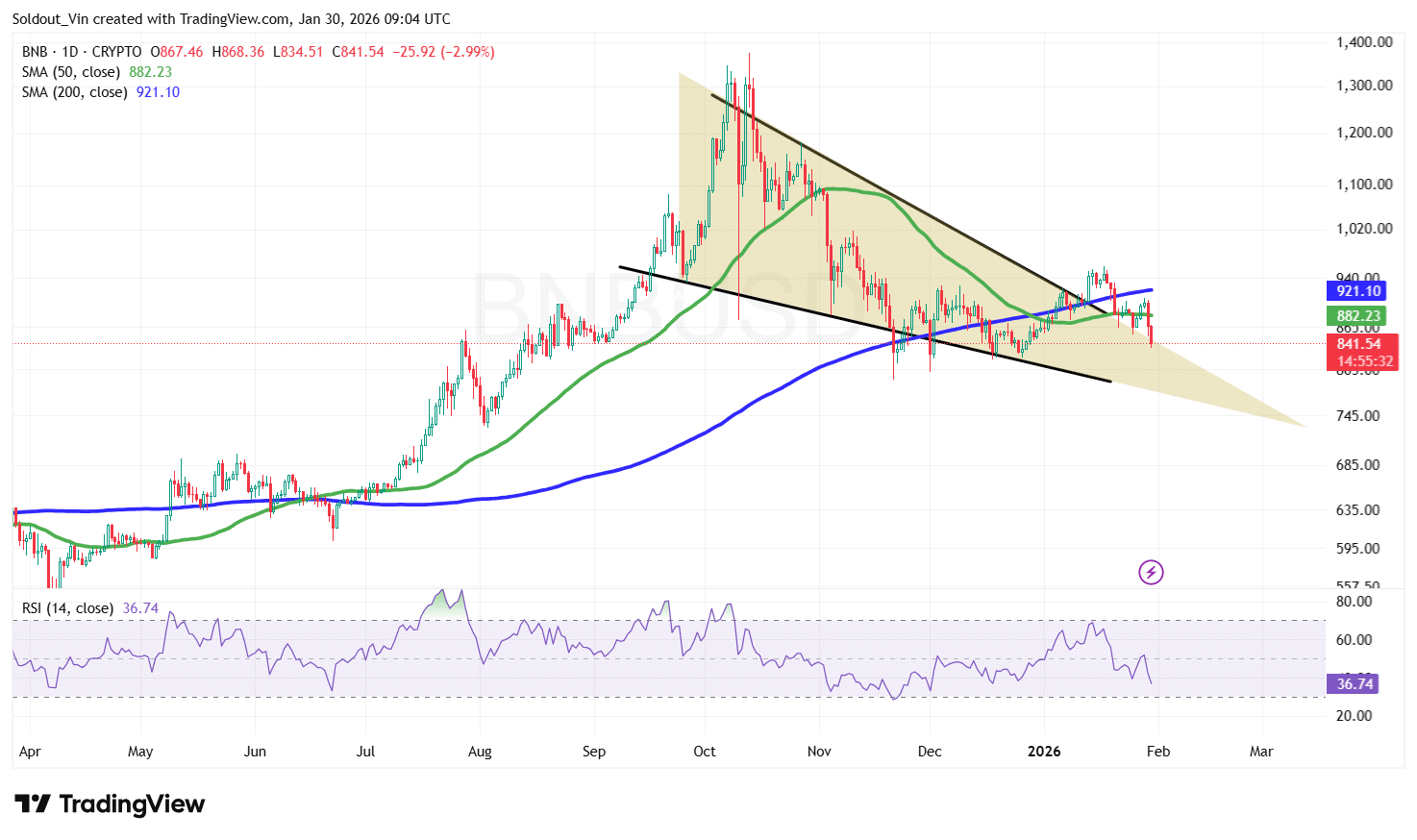

The BNB worth has fallen again beneath the 50-day Easy Transferring Common (SMA), reinforcing the narrative of a sustained decline.

After a dramatic surge in October 2025, Binance Coin entered a correction and started buying and selling inside a well-defined falling wedge sample.

After a breakout early this yr, the value of BNB is again beneath the decrease boundary of the wedge, as sentiment modified to bearish.

BNB’s Relative Energy Index (RSI) additionally helps the general bearish pattern, because it continues to drop in the direction of the 30-oversold area, presently at 36.74.

With the value of the Binance Coin dropping again throughout the higher boundary of the falling wedge sample, the outlook is presently bearish, as the value now dangers a sustained drop again deep throughout the wedge.

If the bears proceed to exert stress, BNB dangers a continued downtrend in the direction of the $820.63 help space, which acted as a robust demand space in late 2025. This might be pushed by the SMAs forming round $884.27, with the 200-day SMA transferring above the 50-day SMA.

Conversely, if the Binance Coin reclaims the 50-day SMA resistance stage round $882.23 and manages to shut above the 200-day SMA ($921), the following key goal would be the $1,000 psychological zone.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection