Key Takeaways:

BlackRock tokenized $500 million on Avalanche and till the tip the final quarter 2025, the overall tokenized Actual World Asset (RWA TVL) on this has reached as much as $1.33 billionBitwise and VanEck ETF filings additionally included staking, which counsel extra institutional crypto vibesHowever the utilization of the community hit an all-time excessive when AVAX worth fell practically 60% that quarter

Avalanche closed This fall/2025 with sturdy participation stage from organizations and all-time onchain actions. The fund stream has been moved into tokenized property, ETF and enterprise platforms, whatever the AVAX’s important lower strain.

Learn Extra: First-Ever AVAX ETF Hits Nasdaq as VanEck Waives Charges on $500M for Avalanche Publicity

BlackRock and Establishments Push RWA Development on Avalanche

Tokenized real-world property turned Avalanche’s fastest-growing section in late 2025. RWA whole worth locked rose 68.6% quarter over quarter and practically 950% yr over yr, ending December at $1.33 billion.

The primary driver was BlackRock’s launch of its USD Institutional Digital Liquidity Fund (BUIDL) on Avalanche. The agency tokenized $500 million in property, giving the community one of many largest onchain cash market funds in manufacturing.

Different establishments adopted. Fortune 500 fintech FIS partnered with Intain to convey tokenized mortgage markets to Avalanche, permitting roughly 2,000 U.S. banks to purchase, promote, and securitize billions of {dollars} in loans with near-instant settlement. One other entry level was made by S&P Dow Jones who joined forces with Dinari to introduce the S&P Digital Markets 50 Index, a tokenized instrument, combining crypto-linked equities and crypto-assets.

Exercise was not restricted to the U.S. In Japan, Progmat migrated greater than $1.1 billion in tokenized securities to a devoted Avalanche L1, whereas fee big TIS Inc. launched a multi-token banking platform through AvaCloud.

Learn Extra: Avalanche Basis Eyes $1B Institutional Capital through US Company Treasuries

ETF Filings Add Staking as AVAX Worth Slides

The institutional curiosity leaked into regulated funding merchandise. Bitwise and VanEck revised their Avalanche ETF filings however added staking to it. Bitwise’s proposed BAVA belief plans to stake as much as 70% of its holdings, permitting buyers to earn native yield reasonably than rely solely on worth appreciation.

Community Exercise Decouples From Token Worth

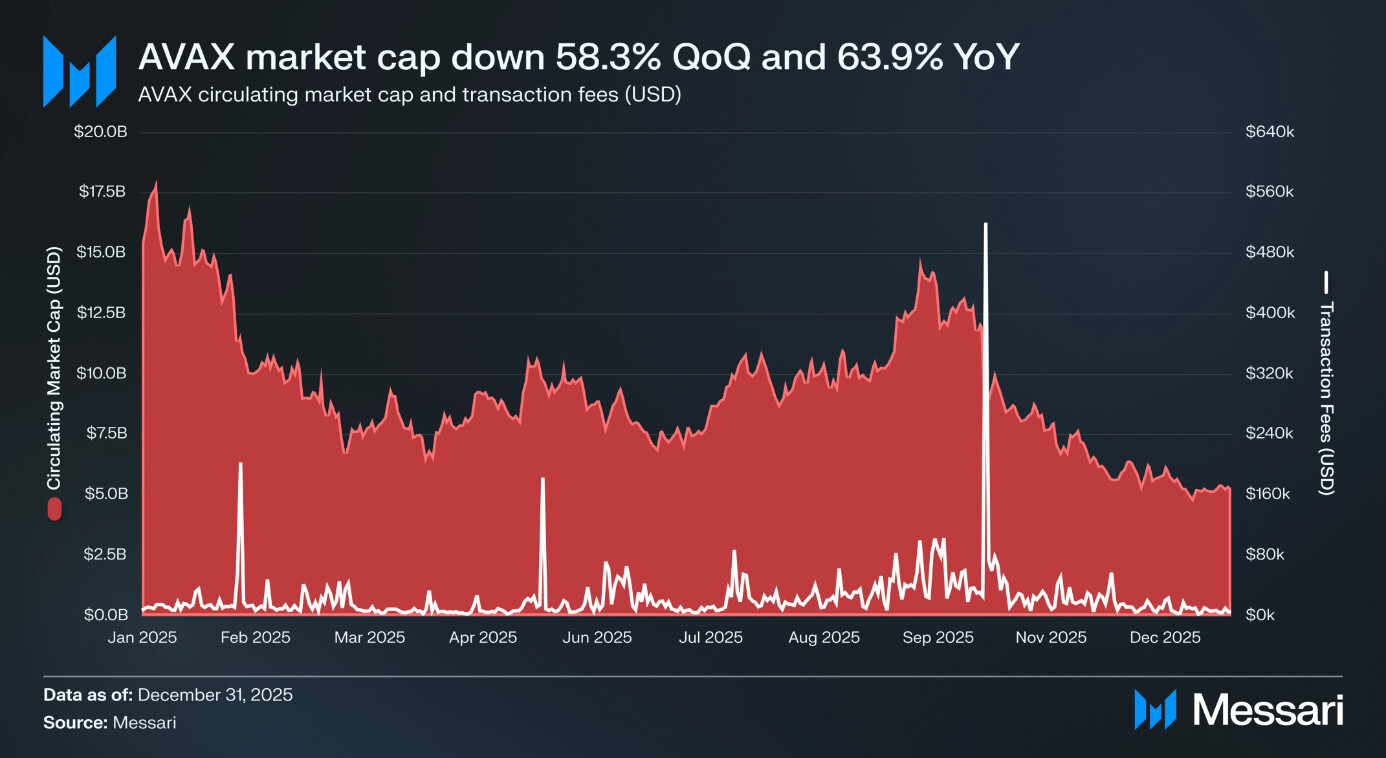

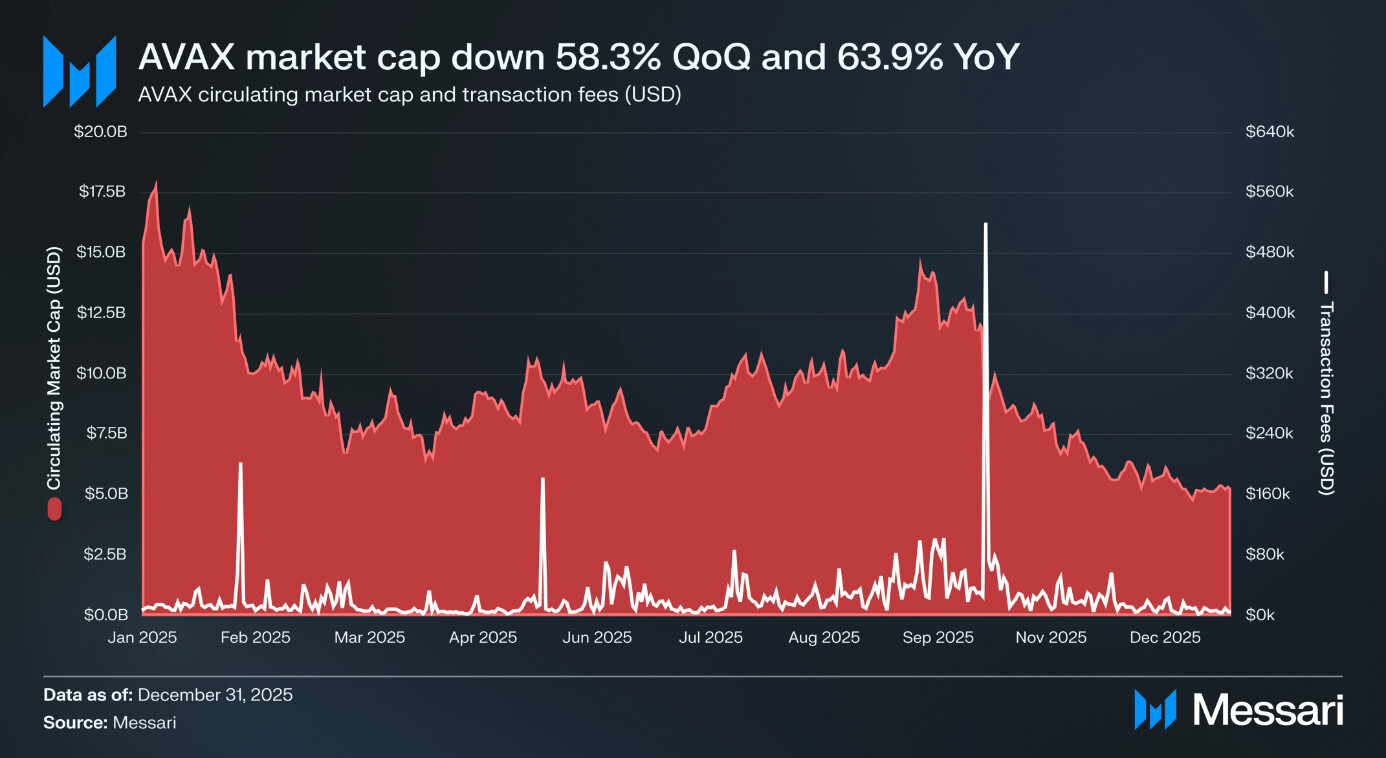

AVAX ended the quarter at $12.3, having fallen 59% on the fourth quarter, and over 65% in comparison with the identical quarter a yr in the past. Market cap rankings decreased, relocating AVAX to the twenty first place out of the 14th rank.

Nonetheless, community utilization shot up. The variety of charges paid in AVAX kind of elevated by practically 25% factors quarter-to-quarter, and common each day C-Chain transactions elevated by 63% to 2.1 million. Volatility on the October crash generated the biggest single-day price income because the first months of 2024.

DeFi Liquidity Stays Sticky as Utilization Hits Information

DeFi liquidity stays seductive as it’s used to file file numbers. Avalanche DeFi ecosystem continues to be very sturdy, with TVL by way of AVAX greater than 34% in This fall indicating that customers had been holding property and non-native currencies on-chain reasonably than transferring liquidity to different areas.

Exercise on the community stage was taken to new heights. Every day C-Chain and Avalanche L1s transactions elevated to 38.2 million and each day lively accounts reached virtually 25 million. This rise was partly because of the adoption of Avalanche L1 in Asia the place ten to tens of tens of millions of customers had been onboarded on telecom networks onboard.