Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has slid by a fraction of a proportion up to now 24 hours to commerce at $88,300 as of 11p.m. on a 20% surge within the day by day buying and selling quantity to

That is as CFTC Chair Michael Selig appoints Amir Zaidi as his chief of employees, marking an early management transfer because the company prepares for brand new regulatory challenges. Zaidi beforehand labored on the CFTC from 2010 to 2019, holding senior roles together with head of the Division of Market Oversight, the place he managed main derivatives insurance policies.

He was instrumental in introducing CFTC-regulated Bitcoin futures throughout Donald Trump’s first time period, an necessary step in bringing crypto-linked merchandise beneath federal oversight. The appointment comes as Congress considers digital asset laws that might develop the CFTC’s authority.

🚨BREAKING: CFTC Chair Selig appoints Amir Zaidi as Chief of Workers, highlighting his prior function in approving Bitcoin futures. pic.twitter.com/X5MfbfuK4o

— Coin Bureau (@coinbureau) December 31, 2025

Selig highlighted Zaidi’s expertise as vital for guiding the company by way of these potential modifications and serving to it adapt to new duties.

The Division of Market Oversight, beforehand led by Zaidi, supervises futures, choices, and swaps markets, screens compliance, and oversees exchanges and clearing businesses. Zaidi has a Juris Physician, earned cum laude from the College of Maryland College of Regulation, and a bachelor’s diploma in enterprise administration, summa cum laude, from Boston College.

As chief of employees, Zaidi will handle inner coordination, coverage planning, and operational oversight. He goals to deliver stability to the fee as derivatives and crypto markets evolve. Supporting the chairman’s agenda and making certain easy regulatory operations can be central to his function.

Zaidi’s return underscores the significance of expertise and institutional data on the CFTC, significantly because it prepares for an expanded mandate over digital property. His appointment positions the company to take care of sturdy oversight and adapt successfully to modifications in each conventional and crypto markets.

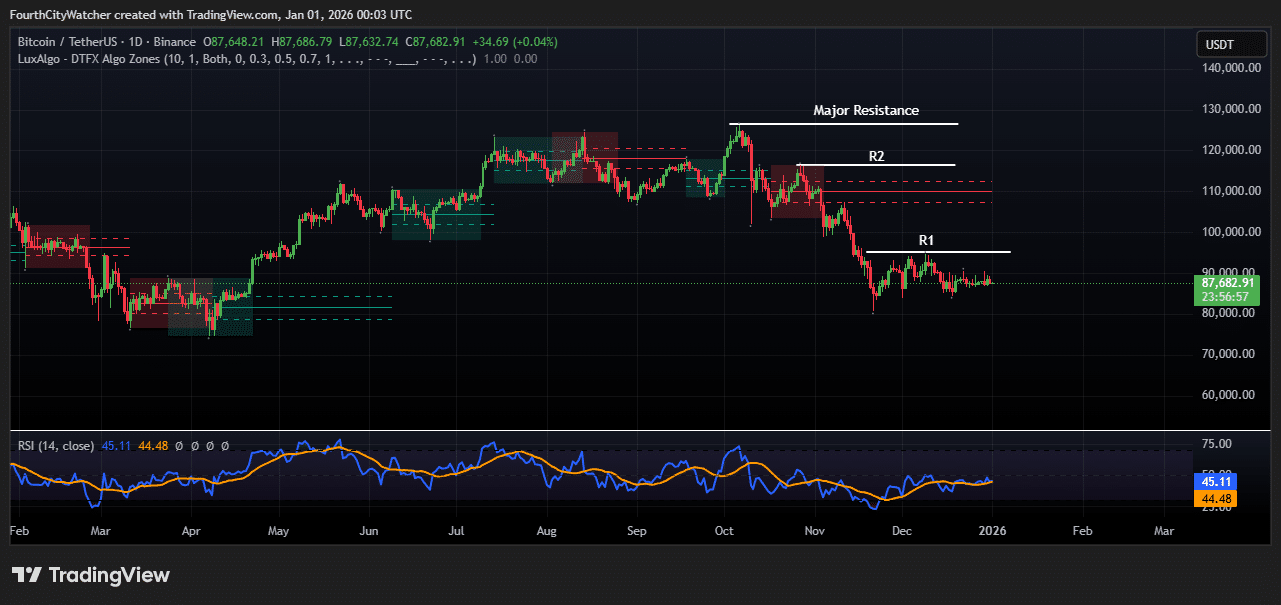

Bitcoin Sideways Motion Indicators Market Pause After October Drop

Bitcoin is at present buying and selling round $87,632, exhibiting sideways motion after its drop from earlier highs. On the chart, there are three notable resistance ranges: R1 at roughly $90,000, R2 close to $110,000, and a serious resistance degree between $125,000 and $130,000.

At this stage, R1 is essentially the most speedy and important degree to watch. A profitable break above this might open the trail towards R2; nevertheless, the gap from the present value suggests any upward momentum could also be gradual.

The latest slim buying and selling vary signifies a stability between patrons and sellers. This sideways motion means that the market is pausing after the sharp decline in October, with neither bulls nor bears holding clear management. Buyers seem like ready for a decisive sign earlier than committing to vital positions.

The RSI (Relative Power Index) is at present at 44.90, slightly below the impartial 50 mark. This displays delicate promoting stress with out indicating an oversold situation. An increase above 50 would counsel rising bullish momentum, whereas a fall under 40 might point out stronger promoting stress. Merchants ought to take note of how Bitcoin reacts across the $90,000 R1 degree, as it could decide the near-term development.

Technically, this consolidation part might function a basis for a rebound or sign a continuation of the downtrend if key help ranges fail. If Bitcoin struggles to surpass $90,000, the subsequent helps lie round $85,000 and $80,000. Worth motion close to these ranges can be essential in gauging whether or not the market finds stability or faces additional draw back stress.

General, Bitcoin stays in a cautious part, with speedy resistance at $90,000 and RSI pointing to delicate bearish sentiment. Merchants are intently watching the R1 zone to evaluate potential strikes.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection