The cryptocurrency market has had a 12 months crammed with ups and downs, with most large-cap digital property delivering combined performances in 2025. After a tough begin to the 12 months, issues began to lookup for the worth of Bitcoin within the second and third quarters, because it set a number of all-time highs throughout the six-month interval.

Nonetheless, the flagship cryptocurrency has largely struggled within the last months of 2025, wanting set to finish the 12 months within the crimson. Curiously, the newest on-chain knowledge and historic patterns counsel that the worth of Bitcoin could be set for a reasonably stronger yearly shut than anticipated.

No Detrimental Days Left In 2025, However 2026 Might Characteristic A Deep Correction

On Saturday, December 6, Alphractal CEO and founder Joao Wedson took to the X platform to share what to anticipate from the Bitcoin worth within the final days of 2025. In accordance with the on-chain skilled, the market chief is more likely to shut the 12 months in a sideways worth vary.

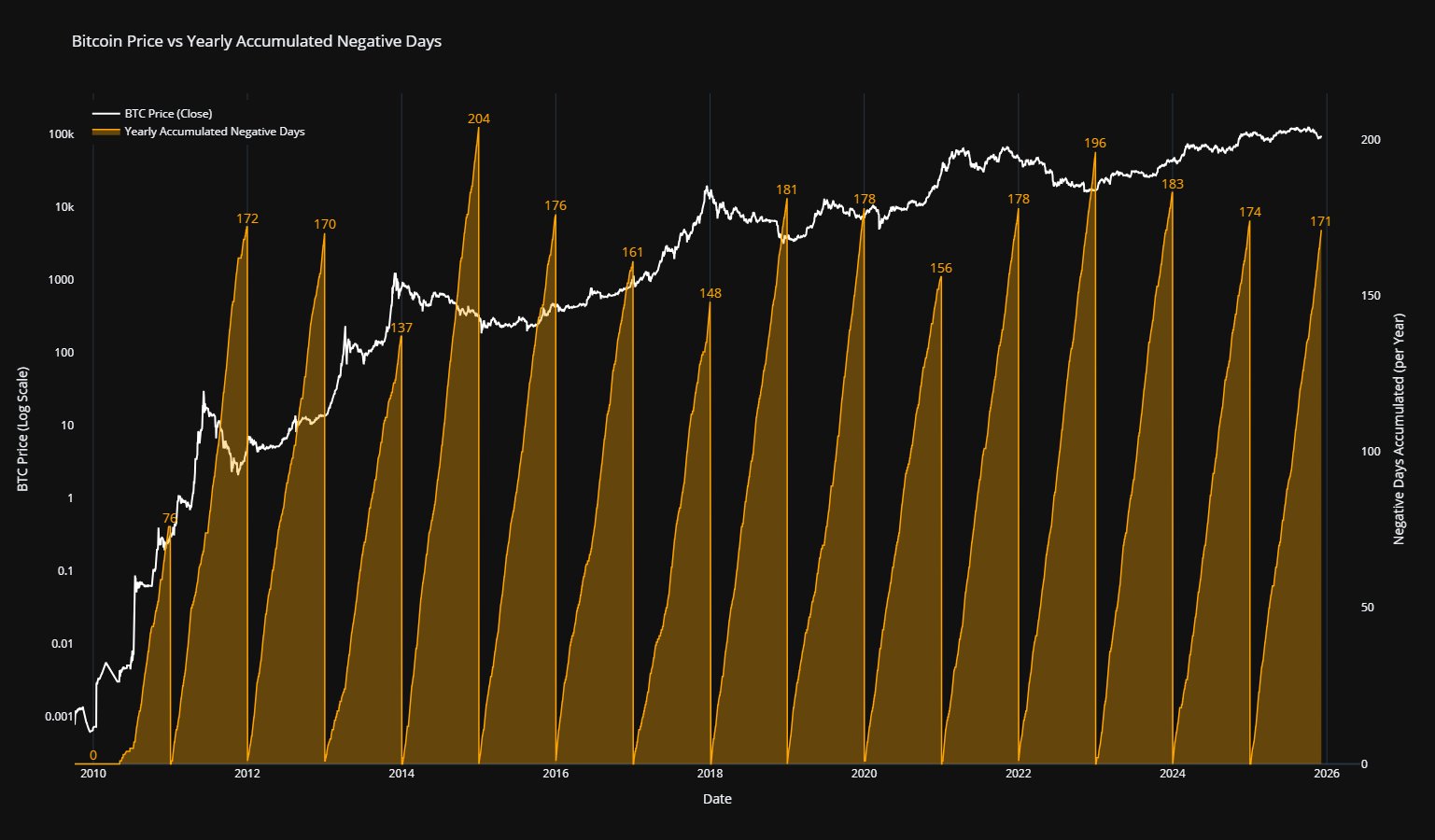

The related metric right here is the Yearly Collected Detrimental Days, which tracks market resilience by measuring the variety of days in a 12 months the place an asset’s each day worth candlestick closed within the crimson.

In accordance with historic knowledge and patterns, Bitcoin usually witnesses a median of 170 days of unfavorable worth motion in a 12 months. This imply determine or degree gives perception into the stress threshold for the world’s largest cryptocurrency by market cap.

Supply: @joao_wedson on X

When the variety of unfavorable days is approaching or exceeds this threshold of 170 days, as Bitcoin already has in 2025, the promoting stress available in the market tends to wane as fatigue units in among the many bears. Wedson revealed that the premier cryptocurrency has already gathered 171 unfavorable days up to now in 2025.

The on-chain skilled famous that exceeding this threshold “strongly suggests” that the worth of Bitcoin may not witness any extra unfavorable days within the last few weeks of 2025. Wedson stated that if a deeper correction is imminent for the market chief, it can almost definitely occur within the subsequent 12 months.

Nonetheless, because the Alphractal founder highlighted, the Bitcoin worth is extra more likely to finish the 12 months inside a consolidation vary. Including additional credence to this postulation is the dearth of market demand, as seen with decreased capital inflow into spot Bitcoin exchange-traded funds.

Bitcoin Worth At A Look

As of this writing, the worth of BTC stands at round $89,397, reflecting a mere 0.3% drop prior to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.