MicroStrategy ($MSTR): The Company Bitcoin Treasury Pioneer

MicroStrategy, as soon as primarily an enterprise analytics software program agency, has radically reinvented itself because the world’s main publicly-traded company Bitcoin treasury. Underneath the imaginative and prescient of its govt chairman and co-founder, Michael Saylor, the corporate has deployed a simple but highly effective technique: to amass and maintain Bitcoin as its main treasury reserve asset.

This daring company maneuver has created a brand new area of interest within the monetary world, providing conventional fairness traders a well-recognized automobile for gaining publicity to Bitcoin’s worth actions. Nonetheless, this technique is a high-stakes endeavor, tying the corporate’s destiny on to the risky cryptocurrency market. The current sharp decline in Bitcoin’s worth from its October 2025 peak has positioned MicroStrategy’s mannequin below a extreme stress check, revealing each its inherent vulnerabilities and the steadfast conviction of its management.

Bitcoin/USD worth chart illustrating the current drop

Supply: ProRealTime.com

The Mechanics of a Bitcoin Treasury Firm

A Bitcoin treasury firm allocates the vast majority of its company reserves to Bitcoin. The core philosophy is to deal with Bitcoin not as a speculative asset, however as a long-term retailer of worth a hedge towards inflation and a diversifier away from conventional fiat currencies.

MicroStrategy’s execution of this mannequin includes a number of key mechanisms:

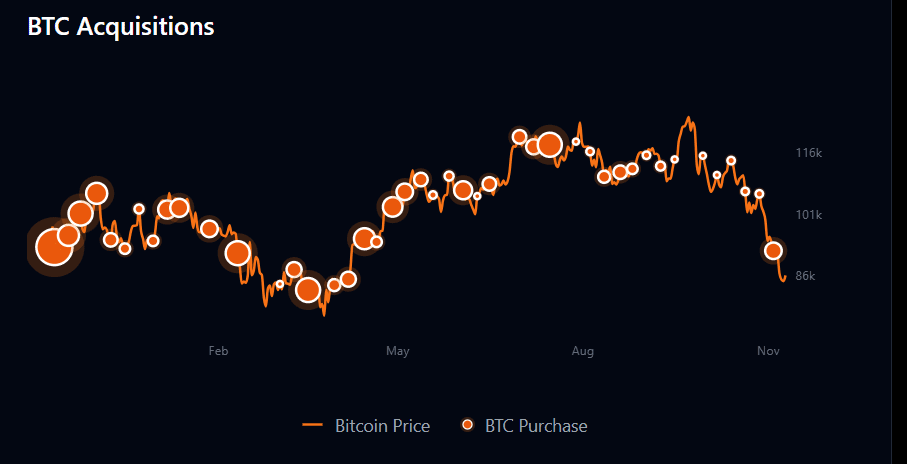

Capital Elevating and Acquisition: The corporate funds its Bitcoin purchases by elevating capital by way of fairness gross sales and issuing convertible debt. This money is then deployed to build up Bitcoin. For instance, in November 2025 alone, the corporate acquired over $1.5 billion price of Bitcoin.

The Strategic Flywheel: At its peak, MicroStrategy employed a self-reinforcing cycle. It could subject shares, use the proceeds to purchase Bitcoin, after which leverage the following rally in Bitcoin’s worth to justify additional fairness issuance and accumulation. This as soon as allowed its market worth to commerce at a major premium to the underlying worth of its Bitcoin holdings.

Holding and Accounting: The corporate’s Bitcoin is recorded on its steadiness sheet. Underneath relevant accounting guidelines, the worth of those holdings is adjusted every quarter. A rising Bitcoin worth results in unrealized beneficial properties, whereas a fall triggers unrealized losses, creating vital earnings volatility.

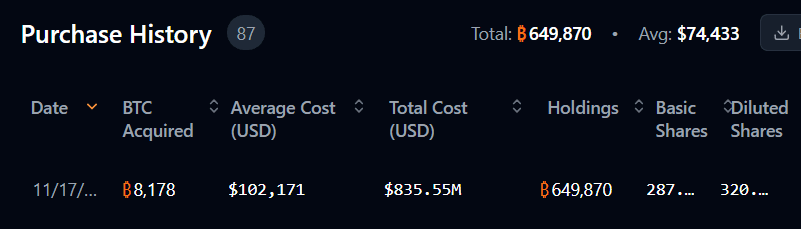

As of mid-November 2025, MicroStrategy holds a staggering 649,870 BTC, acquired at a mean worth of $74,433 per Bitcoin. Regardless of the current downturn, this place nonetheless reveals an unrealized revenue of roughly $6.1 billion, highlighting the preliminary success of its aggressive accumulation.

Supply: https://saylortracker.com/?tab=house

Supply: https://saylortracker.com/?tab=house

Important Dangers Uncovered by a Falling Bitcoin Worth

The current market correction has laid naked the acute dangers embedded in MicroStrategy’s mannequin.

1. Inventory Worth Correlation and Liquidity PressureMicroStrategy’s inventory (MSTR) is extremely correlated with Bitcoin. As Bitcoin fell from its all-time excessive of over $126,000 in October 2025 to round $91,600 in November, MSTR’s inventory worth plummeted by almost 60% from its July highs. The corporate’s main asset is Bitcoin, making its inventory a direct proxy.

MSTR inventory worth chart illustrating the current drop

Supply: ProRealTime.com

2. Dilution and Eroding PremiumTo proceed shopping for Bitcoin through the downturn, MicroStrategy has repeatedly issued new shares, resulting in vital shareholder dilution. Its frequent inventory depend ballooned from 160 million to over 286 million shares in only one 12 months. Moreover, the premium traders had been as soon as keen to pay for MSTR’s strategic execution has largely evaporated. Its market web asset worth (mNAV) has slipped to simply beneath 1 (0.97), that means the inventory trades solely marginally decrease than the worth of the Bitcoin it holds . This means fading investor conviction within the firm’s strategic premium.

Supply: https://saylortracker.com/?tab=house

3. A Pure, Unhedged BetUnlike another entities, MicroStrategy doesn’t use hedging methods (like choices) to guard towards draw back volatility. Its treasury depends “totally on the motion of the Bitcoin worth,” making it a pure, unhedged wager. With out complementary income streams or yield-generating methods, the corporate is totally uncovered to market swings.

4. Regulatory and Index Exclusion RisksThere is rising scrutiny of firms holding huge digital belongings. Main index supplier MSCI is contemplating excluding Bitcoin-heavy corporations like MicroStrategy from its flagship fairness indexes, doubtlessly categorizing them as “funding funds.” JPMorgan warns this might set off as much as $2.8 billion in compelled promoting from passive funds, creating large downward stress on the inventory.

The Deconstructed Danger Framework

Major Danger: Bitcoin Volatility: MSTR’s destiny is inextricably linked to Bitcoin’s worth, with declines usually magnified attributable to leverage.

Solvency Danger: The Debt Spiral: The convertible debt used to fund purchases creates hazard. A extreme worth drop may set off margin calls, doubtlessly forcing the corporate to promote Bitcoin at a loss and making a catastrophic suggestions loop.

Competitors from Spot Bitcoin ETFs: The arrival of low-cost, liquid, and debt-free Spot Bitcoin ETFs (e.g., from BlackRock, Constancy) challenges MSTR’s worth proposition. Buyers can now acquire pure Bitcoin publicity with out MSTR’s company and leverage dangers.

Regulatory and Accounting Uncertainty: Hostile laws or modifications in accounting requirements to implement “mark-to-market” reporting may cripple the treasury’s worth or introduce excessive earnings volatility.

Company Execution Dangers: The technique represents an excessive focus in a single asset, is extremely depending on Michael Saylor’s management, and dangers neglecting the core software program enterprise that generates operational money stream.

Potential Alternatives and the Bull Case

Regardless of the clear dangers, the mannequin presents compelling alternatives for its proponents.

Leveraged Bitcoin Publicity: For believers in Bitcoin’s long-term rise, MSTR provides a strategy to acquire leveraged publicity by way of a conventional inventory, as every share represents a declare on a rising, debt-funded pool of Bitcoin.

The “Digital Gold” Conviction: Saylor and MicroStrategy are making a long-term wager on Bitcoin as “digital gold.” From this attitude, short-term crashes are shopping for alternatives, not technique failures, as evidenced by the corporate’s continued purchases through the downturn.

Compelling Valuation Metrics: The current crash has pushed MicroStrategy’s price-to-earnings (P/E) ratio right down to a seemingly low 8.67. Worth traders might even see this as a shopping for alternative, assuming the core software program enterprise retains worth and the Bitcoin thesis finally prevails.

The Highway Forward

The way forward for MicroStrategy ($MSTR) hinges on Bitcoin’s worth restoration. Till then, the inventory will doubtless stay below stress. The corporate should additionally navigate the potential fallout from doable exclusion from main inventory indexes, which might shrink its investor base.

The current turmoil has sparked a debate in regards to the sustainability of “passive” Bitcoin hoarding versus extra energetic, yield-generating methods. MicroStrategy’s unwavering, unhedged strategy is the last word check of a single thesis: that Bitcoin’s long-term worth appreciation will eclipse all short-term volatility and dangers.

Disclaimer: This text is predicated on data accessible as of November 2025. The state of affairs surrounding MicroStrategy and cryptocurrency markets is extremely dynamic and topic to fast change.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.