Conventional remittance giants like Western Union and MoneyGram are struggling to maintain tempo in an evolving monetary ecosystem more and more formed by stablecoins.

Based on Matthew Sigel, Head of Digital Property Analysis at VanEck, downloads of remittance giants apps have dropped considerably, with Western Union seeing a 22% decline and MoneyGram experiencing a 27% discount.

In the meantime, this drop isn’t restricted to app downloads. The variety of month-to-month lively customers (MAU) partaking these platforms has remained beneath 3 million since 2021. From January to November 2024, these platforms have confronted regular declines in person exercise, signaling a shift in client habits.

The rise of stablecoins

Sigel advised that stablecoins are rising as a robust various to conventional remittance strategies by providing sooner, cheaper, and extra accessible cross-border transactions.

Blockchain evaluation agency Chainalysis reported that these digital property, that are pegged to secure values just like the US greenback, have develop into indispensable in areas going through forex instability or restricted entry to dependable banking programs.

The worldwide adoption of stablecoins continues to develop as they fill gaps left by conventional monetary providers. People and companies use stablecoins for worldwide funds, defend wealth from forex fluctuations, and handle liquidity effectively.

In contrast to conventional banking, stablecoins allow on the spot transfers, sidestepping the delays and excessive charges related to the older system.

In 2024, the stablecoin market hit a milestone, surpassing $200 billion in capitalization. The sector additionally noticed the rise of revolutionary digital currencies like Ethena’s artificial USDe stablecoin, which now competes with main gamers corresponding to Tether (USDT) and Circle (USDC).

Furthermore, the profitability of the stablecoin trade is equally notable, with issuers like Tether and Circle collectively incomes over $664 million final December—representing a good portion of the income generated by crypto protocols.

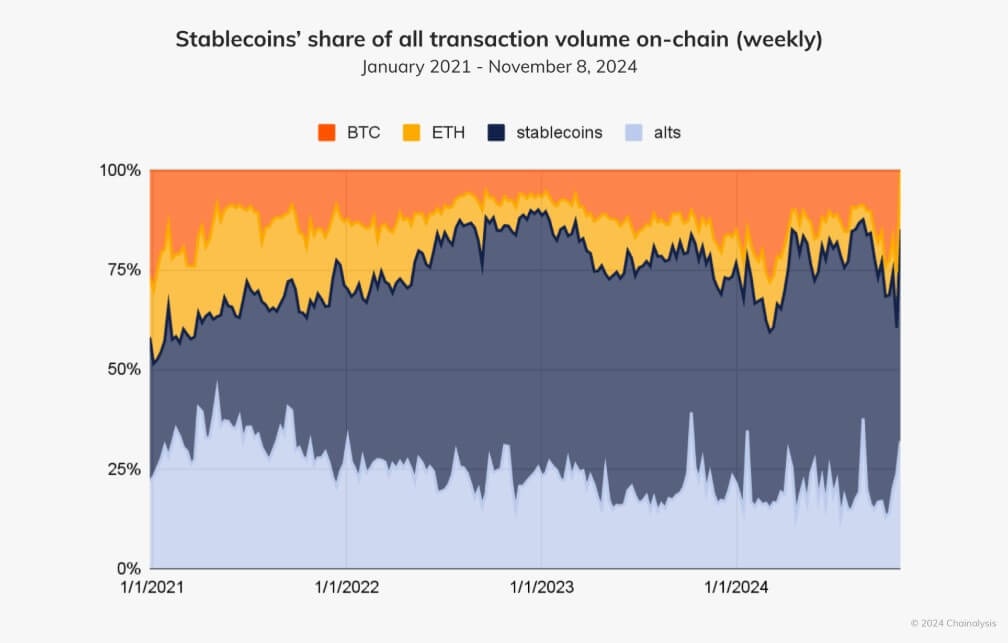

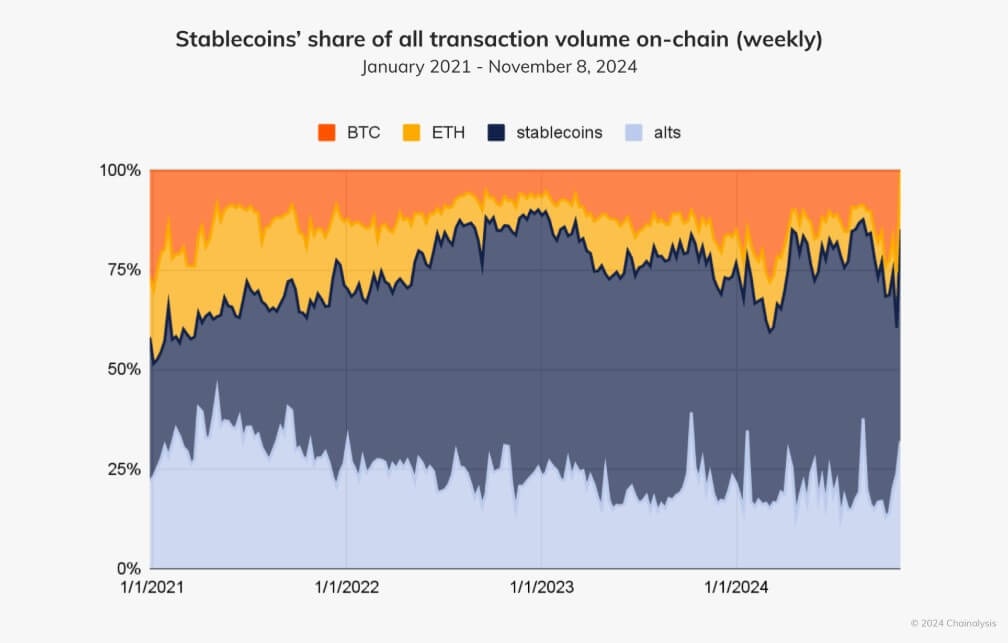

Moreover, Chainalysis identified that stablecoins are liable for over 75% of the trillions in crypto transactions recorded in current months.

This exceptional development has attracted consideration from conventional monetary establishments and blockchain firms, together with Ripple, that are exploring methods to faucet into this booming market.

Contemplating this, Liz Bazurto, the ecosystem engagement supervisor for MetaMask, stated the normal remittance giants would possibly embrace stablecoin funds for his or her operations. She stated:

“I can see a path for Western Union and MoneyGram to allow Stables. MoneyGram has enabled Stellar (USDC) for on and offramps.”

Talked about on this article