If you happen to’ve been researching the crypto trade and crypto investments, it’s essential to have come throughout Bitcoin in your search. Bitcoin is the primary cryptocurrency and most traded digital forex that powers peer-to-peer transactions with out intermediaries (comparable to conventional banks).

Over time, Bitcoin has turn out to be more and more fashionable, and person adoption has inspired extra buyers to contemplate investing in BTC. If you happen to’re on this boat, it’s only proper that you simply perceive the ins and outs of the crypto trade earlier than investing.

Due to this fact, this text covers what Bitcoin is and the way it works, its historical past, use instances, and Bitcoin mining. Moreover, we are going to present you purchase BTC and the dangers and challenges accompanying Bitcoin investments.

What’s Bitcoin and How Does it Work?

Bitcoin is a decentralized digital forex that operates on a peer-to-peer community with out a government. It really works utilizing a public distributed ledger referred to as the blockchain, which information Bitcoin transactions in chronological order. Every transaction is validated by a community of computer systems (nodes) by means of cryptographic proof, stopping fraud.

The blockchain consists of blocks, every containing a batch of verified transactions and a cryptographic hash linking it to the earlier block, forming a safe chain.

So as to add a block to the blockchain, a course of referred to as mining happens, through which specialised computer systems remedy advanced computational puzzles (proof-of-work). Mining not solely confirms transactions but in addition secures the community and rewards miners with new bitcoins.

Nevertheless, through the years, Bitcoin mining has turn out to be dearer. That is as a result of important improve within the community’s computational energy (hashrate) and the ensuing vitality consumption. The hashrate almost doubled lately, resulting in extra machines competing to mine fewer new Bitcoins.

One of many causes for that is Bitcoin’s halving occasions, which cut back the block reward over time. Therefore, miners should run extra highly effective {hardware} to unravel advanced cryptographic puzzles, and this requires extra electrical energy.

Presently, mining a single Bitcoin consumes about 854,400 kilowatt-hours of electrical energy, which is equal to the annual energy use of over 81 US households. The full electrical energy used to mine Bitcoin each day is immense, accounting for added overhead comparable to cooling and infrastructure inefficiencies.

This surge in vitality demand drives up operational prices, with electrical energy accounting for 60-80% of miners’ bills. In consequence, smaller, much less environment friendly miners are pushed out, with mining concentrating amongst large-scale operations which have entry to low-cost or renewable vitality sources.

Who Created Bitcoin?

Bitcoin was created by a person or group utilizing the pseudonym Satoshi Nakamoto. Nakamoto launched Bitcoin to the world in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Digital Money System,” which described the idea of a decentralized digital forex working with out central authority.

The Historical past and Evolution of Bitcoin

Bitcoin’s historical past started in 2008, when an nameless individual or group, utilizing the pseudonym Satoshi Nakamoto, printed a white paper describing the community and its operation. After this, the Bitcoin community was launched on January 3, 2009, when Nakamoto mined the genesis block.

This was the primary block on the Bitcoin blockchain, and it had an embedded message referencing the monetary disaster and symbolizing a brand new imaginative and prescient for decentralized finance. The primary Bitcoin transaction occurred later in 2009, when Nakamoto despatched 10 Bitcoins to pc scientist Hal Finney.

In 2010, Bitcoin gained real-world worth when a person purchased two pizzas for 10,000 BTC. This occasion is now celebrated yearly as Bitcoin Pizza Day. The next years noticed the rise of exchanges like Mt. Gox, which performed a vital function in Bitcoin’s early adoption. Though the trade finally collapsed on account of hacks.

Bitcoin advanced from a distinct segment digital forex right into a well known monetary know-how. Through the years, it has led to the creation of hundreds of different cryptocurrencies (altcoins) and a whole bunch of blockchain-based tasks.

Bitcoin’s Position in Shaping the Cryptocurrency Trade

Bitcoin has performed, and continues to play, a foundational function in shaping the whole cryptocurrency trade. It launched the idea of a decentralized digital forex primarily based on blockchain know-how.

Bitcoin set the usual for safety, transparency, and decentralization that many different cryptocurrencies now replicate or enhance upon. The truth is, Bitcoin’s market dominance influences altcoin costs and buying and selling volumes. Many buyers use it as a benchmark or gateway into the crypto market.

The Expertise of Bitcoin’s Blockchain

The know-how behind Bitcoin’s blockchain is a decentralized, public ledger maintained by a P2P community of computer systems, referred to as nodes. Here’s a breakdown of the know-how behind Bitcoin’s blockchain and why encryption is a useful a part of the ecosystem.

Blockchain

Bitcoin’s blockchain operates with out a government. It depends on a proof-of-work (PoW) mechanism to safe the community and stop double-spending. So as to add new blocks, miners compete to unravel computationally troublesome cryptographic puzzles. The primary miner to discover a legitimate resolution earns the fitting so as to add a brand new block of transactions to the blockchain.

This course of confirms transactions and rewards miners with new Bitcoin, creating an incentive encouraging miners to proceed securing the community.

The community mechanically adjusts the mining issue roughly each two weeks to make sure that new blocks are added at a gradual tempo, whatever the complete mining energy.

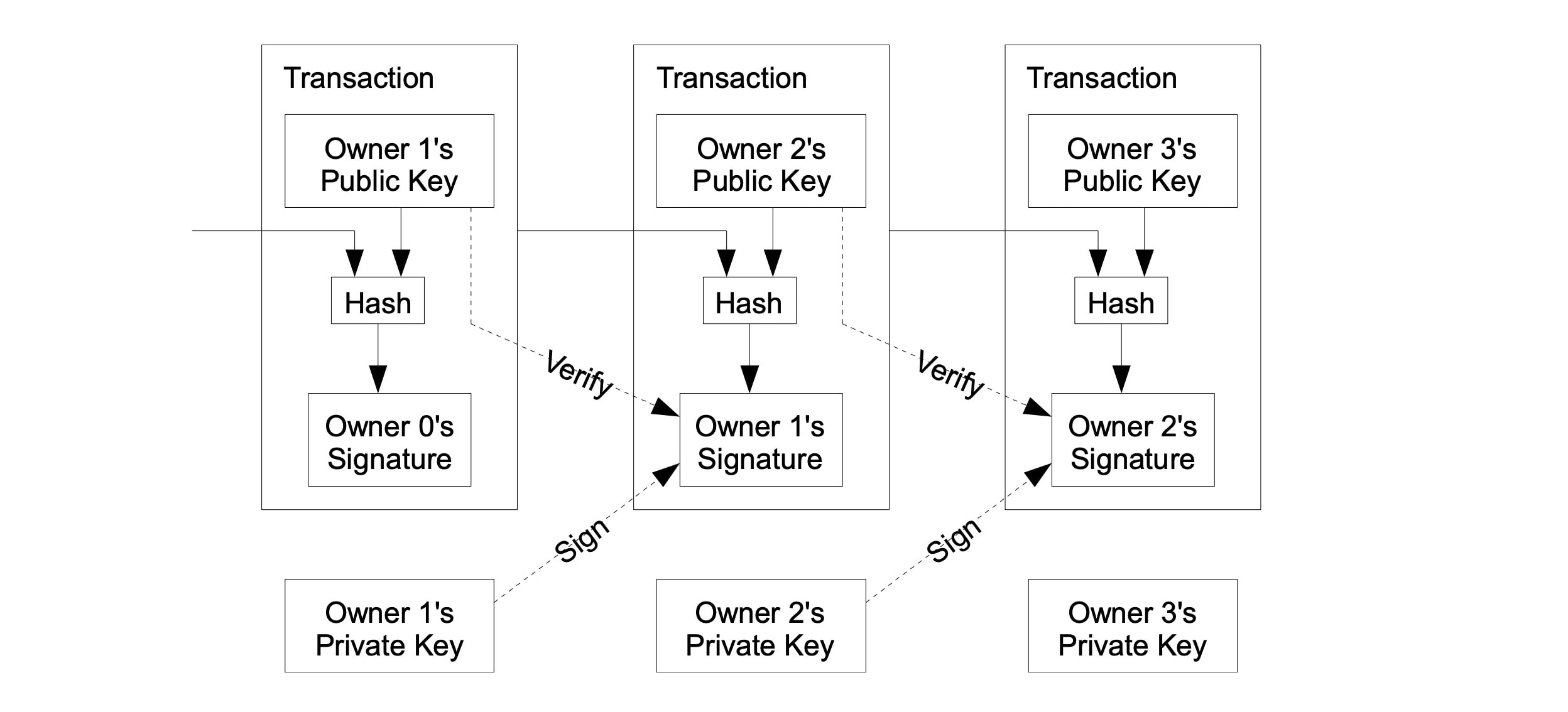

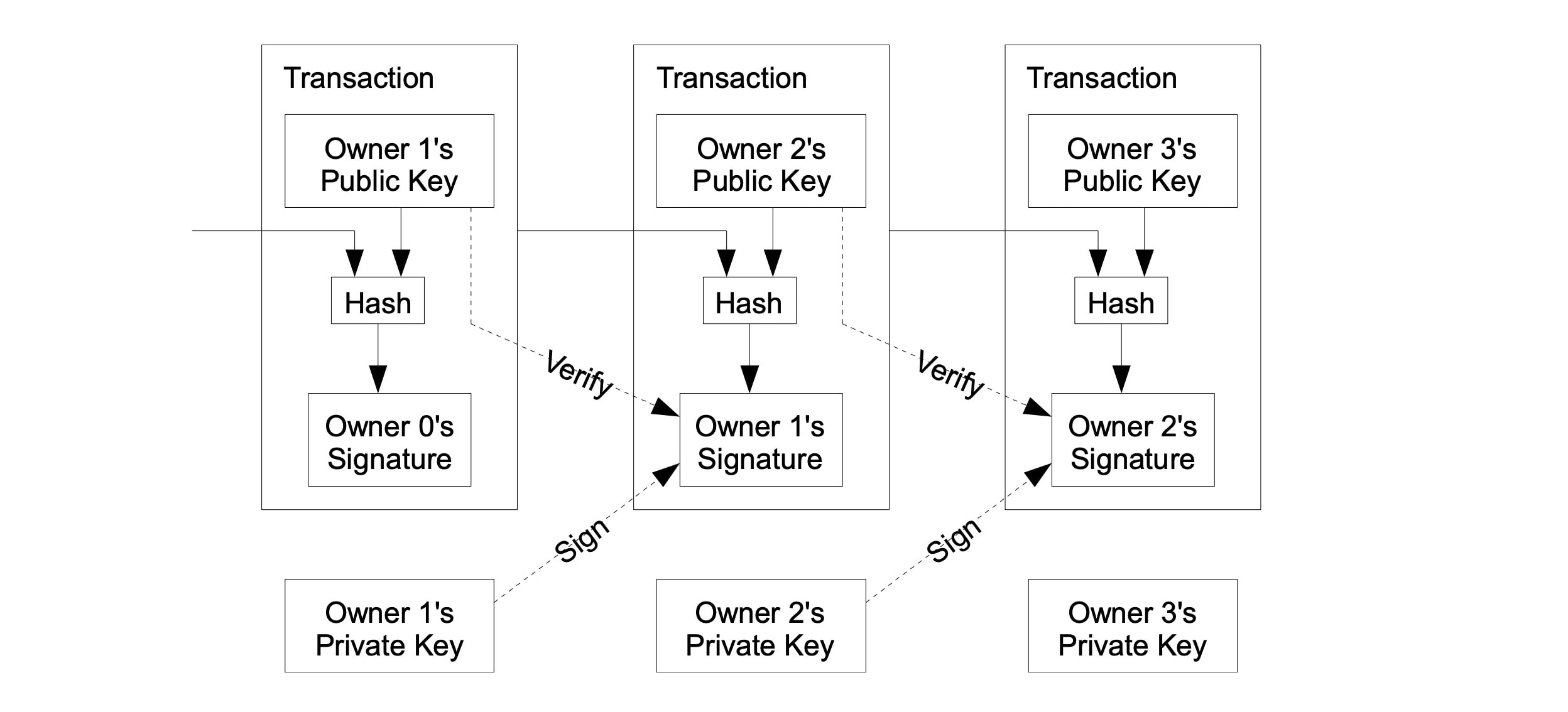

For transactions, Bitcoin makes use of elliptic curve cryptography (ECC) to generate non-public–public key pairs. This enables customers to show possession and securely signal transactions.

The transactions observe the UTXO mannequin, the place every transaction consumes earlier outputs and creates new ones. With this, each coin might be traced again by means of the chain.

As a result of full nodes retailer the whole blockchain from the genesis block onward, each transaction in Bitcoin’s historical past stays publicly verifiable. This preserves the community’s transparency, safety, and immutability.

Encryption

Blockchain know-how depends closely on encryption to make sure the safety, integrity, and privateness of knowledge saved and exchanged inside it. Encryption transforms knowledge into an unreadable format to guard it from unauthorized entry.

There are two key methods encryption is utilized in blockchain:

Hash Capabilities: Blockchain makes use of cryptographic hash features, comparable to SHA-256 in Bitcoin, to transform knowledge into fixed-length, irreversible hash values. These hash values hyperlink blocks collectively in a sequence, guaranteeing immutability. So any change in a block would alter its hash and break the chain. This protects knowledge integrity and prevents tampering throughout the blockchain.Public Key Cryptography: Blockchain employs uneven encryption, the place every person has a private and non-private key pair. The general public key acts because the receiving tackle, whereas the non-public key indicators and authorizes asset transfers. Digital signatures confirm transaction authenticity and guarantee solely the rightful proprietor can spend the property.

These encryption strategies utilized by blockchain safe transactions and knowledge communication. In addition they assist preserve the trustless and decentralized nature of blockchain, and allow encryption of delicate on-chain knowledge.

What Is Bitcoin Used For?

Bitcoin is a significant a part of the decentralized ecosystem, providing many use instances that different altcoins draw inspiration from. A few of Bitcoin’s use instances embody:

Peer-to-Peer Funds: Bitcoin permits direct digital funds between folks anyplace on this planet with out the necessity for intermediaries like banks, permitting quick, borderless, and forex conversion–free transactions.Funding and Hypothesis: Many individuals purchase and maintain Bitcoin as a long-term funding or commerce it for revenue on cryptocurrency exchanges, viewing it as a hedge in opposition to conventional monetary markets.Crowdfunding: Bitcoin permits world crowdfunding with out third-party involvement, permitting tasks to lift funding from worldwide supporters with out forex conversion.On-line Playing: Some playing platforms, particularly crypto playing websites, settle for Bitcoin for deposits and withdrawals, providing sooner, cheaper, and extra non-public transactions.Buying Items and Companies: Companies throughout industries settle for Bitcoin funds, enabling prospects to purchase services and products shortly and cheaply, no matter location.Remittances: Bitcoin permits sending cash throughout borders extra effectively and cheaply than conventional remittance providers.

What Is Bitcoin Mining and How Does It Work?

Bitcoin mining is the method by which new bitcoins are launched into circulation and transactions are verified and added to the blockchain. Miners use highly effective computer systems to unravel advanced cryptographic puzzles, referred to as proof-of-work, which contain discovering a hash that meets particular standards.

When a miner efficiently solves these puzzles, they validate a brand new block of transactions, add it to the blockchain, and are rewarded with newly minted bitcoins and transaction charges. This course of helps the community’s safety and integrity by stopping fraud and sustaining transparency.

Nevertheless, Bitcoin mining just isn’t typically accessible as a result of excessive prices. Mining BTC requires specialised {hardware}, comparable to ASICs (application-specific built-in circuits), which carry out the SHA-256 hashing algorithm to quickly generate and check potential options. The method is aggressive, with miners worldwide competing to unravel the puzzle first.

The decentralized nature of mining ensures no central authority controls the Bitcoin community. In the meantime, the issuance of recent bitcoins follows a halving schedule that reduces block rewards roughly each 4 years to regulate inflation.

How Do You Purchase Bitcoin?

For crypto buyers who aren’t miners or don’t have entry to mining {hardware}, the best way to personal BTC is to purchase it. Observe these simple steps to purchase Bitcoin.

Select a Pockets: Resolve which sort of pockets you’ll use to retailer your Bitcoin. You may select a software program or {hardware} pockets should you choose to retailer your BTC offline.Choose a Crypto Alternate: Select a good crypto buying and selling platform or trade that helps Bitcoin transactions primarily based on charges, safety, and person expertise. You may go for both centralized (CEXs) or decentralized crypto exchanges (DEXs), relying in your buying and selling objectives and necessities.Create an Account: Enroll on the chosen trade by offering private data and finishing KYC verification (particularly for CEXs), together with importing a government-issued ID and probably proof of tackle.Deposit Funds: Add fiat forex to your trade account utilizing supported fee strategies comparable to financial institution switch, credit score/debit card, or e-wallet. You may as well fund your account by transferring Bitcoin from one other pockets if you have already got one.Place an Order: Go to the buying and selling part, choose Bitcoin buying and selling pair (e.g., BTC/USD or BTC/USDT), select order kind (market order for rapid buy or restrict order to specify a value), enter the quantity, and ensure the acquisition.

Apart from this course of, many exchanges supply P2P marketplaces, the place merchants should purchase BTC straight from different buyers utilizing native fee strategies. All it’s important to do is create your account and navigate to the P2P Buying and selling part, then choose an advert and add particulars of your commerce to proceed.

Methods to Retailer Bitcoin Safely

To retailer and use Bitcoin safely, the secret’s selecting the best kind of pockets and following safety finest practices. Right here’s go about it:

{Hardware} Wallets: These are crypto wallets that retailer BTC offline. These wallets supply the best safety for long-term storage by holding non-public keys offline. Examples embody Ledger Nano X, Trezor Mannequin T, and Tangem Pockets. They’re extremely immune to hacking, malware, and phishing assaults as a result of non-public keys by no means go away the gadget.Chilly/Offline Wallets: Just like {hardware} wallets, these are absolutely offline (e.g., paper wallets or {hardware} gadgets) and very best for storing giant quantities of Bitcoin over the long run. Even exchanges use a lot of these wallets to retailer the vast majority of person monetary property, safeguarding them from safety breaches.Scorching Wallets: Scorching or software program wallets are related to the web, making them appropriate for frequent monetary transactions however extra weak to safety threats. Examples embody non-custodial wallets comparable to Belief Pockets and Metamask. Establishing these wallets is straightforward; here’s a detailed information to organising a MetaMask pockets.Custodial Wallets: These wallets are centralized exchanges that allow merchants to purchase, maintain, commerce, and promote Bitcoin, with the platform appearing as an middleman. They’re handy, however they require customers to belief the supplier for safety and transparency.

Is Bitcoin a Good Funding?

Bitcoin generally is a good funding in 2025. The cryptocurrency has proven constant value will increase through the years, hitting an all-time excessive of $126,198.07 in October 2025. Seeing the regular progress over the previous decade, many analysts and buyers stay optimistic about Bitcoin’s potential. Due to this fact, predicting important value will increase within the subsequent few years.

Nevertheless, Bitcoin is very risky, and its value can decline sharply. For example, the all-time excessive standing from October didn’t final lengthy as the value of BTC dipped to 89,000 the next month. So should you’re contemplating investing in Bitcoin, put together for potential volatility and deal with it as a long-term funding relatively than a fast revenue automobile.

Dangers and Challenges of Investing in Bitcoin

Whereas there are lots of benefits to investing in BTC, it additionally carries related dangers and challenges, which we’ve highlighted beneath.

Excessive Volatility: Bitcoin costs are extremely risky, with giant value swings that may result in important monetary losses if buyers promote throughout downturns. This volatility is greater than that of conventional property like shares, bonds, or gold, requiring a long-term perspective and a excessive danger tolerance.Safety Issues: Dangers from pockets hacks, fraudulent schemes, trade vulnerabilities, and crypto theft are rising by the day as scammers discover new and superior methods to entry buyers’ (each people and establishments) accounts, wiping out their balances.Market Manipulation: Bitcoin costs might be influenced by whales (giant holders) and coordinated market strikes, resulting in unpredictable value shifts and potential manipulation.Complexity and Charges: Shopping for, storing, and securing Bitcoin requires some technical information. Charges on exchanges and transaction prices might be greater than these of conventional monetary providers.Unsure Lengthy-Time period Standing: Regardless of rising adoption and robust use instances, it’s unclear whether or not Bitcoin will preserve its present place or be supplanted by different applied sciences or regulatory modifications within the subsequent 10–15 years.

Bitcoin and the Way forward for Cryptocurrency

Specialists predict Bitcoin has sturdy progress potential over the following decade, with many forecasts starting from $150,000 to over $500,000 by 2030, relying on adoption and macroeconomic circumstances.

Mass adoption of Bitcoin and different cryptocurrencies can also be anticipated to skyrocket. Primarily on account of elevated use instances comparable to funds, remittances, and decentralized finance (DeFi) providers. These newer tasks are supported by enhancements in scalability, privateness, and person expertise.

Moreover, many nations settle for crypto as a authorized tender and a part of a nationwide reserve technique. For example, President Donald Trump introduced a Strategic Reserve that features SOL, XRP, ETH, BTC, and extra property earlier in 2025.

Trump’s government order displays a shift in official coverage in the direction of embracing crypto property at a strategic stage. This may affect market sentiment, regulatory readability, and infrastructure improvement within the cryptocurrency area.

In all these, challenges lie forward, together with regulatory scrutiny, innovation from competing blockchains, and scalability and vitality consumption considerations.

Conclusion

Bitcoin has reworked varied industries. It has improved cross-border fee processing and offered people and establishments with alternatives to retailer, purchase, promote, and trade digital property.In case you are contemplating investing in BTC, first perceive the know-how behind it. Then discover ways to purchase and commerce simply and decide whether or not you might have ample capital to purchase a considerable quantity. In case your buying and selling capital is inadequate, contemplate investing in different altcoins to spice up your income.

FAQs

What Makes Bitcoin a New Type of Cash?

Bitcoin is taken into account a brand new type of cash on account of decentralization, fastened provide and shortage, P2P funds, transparency, and immutability. In contrast to conventional cash, Bitcoin operates on a decentralized community of hundreds of nodes worldwide, eradicating the necessity for central authority.

How A lot is 1 Bitcoin in US {Dollars}?

On the time of writing, 1 Bitcoin (BTC) is buying and selling at roughly $89,800 USD. This displays the most recent market knowledge, however Bitcoin’s value is very risky and may change quickly inside brief time frames.

What Occurs if You Make investments $100 in Bitcoin Right this moment?

Since one Bitcoin is at present buying and selling at $89,800 USD, investing $100 would offer you roughly 0.001113 Bitcoin. This implies you personal roughly 0.1113% of 1 Bitcoin on your $100 funding at that value. Future positive aspects or losses rely upon Bitcoin’s value motion from that time, however your preliminary allocation is predicated on that ratio.

Can You Convert Bitcoin Into Money?

Sure, you’ll be able to convert Bitcoin into money by means of a number of channels, together with crypto exchanges, Bitcoin ATMs, P2P platforms/marketplaces, and debit/bank cards by way of third-party fee processors.