Bitcoin’s mining trade is feeling rising pressure as the important thing profitability gauge, hash value, slides towards ranges that would push smaller operators offline and put stress on mining tools suppliers and repair companions.

Hash Worth Nears Hazard Degree

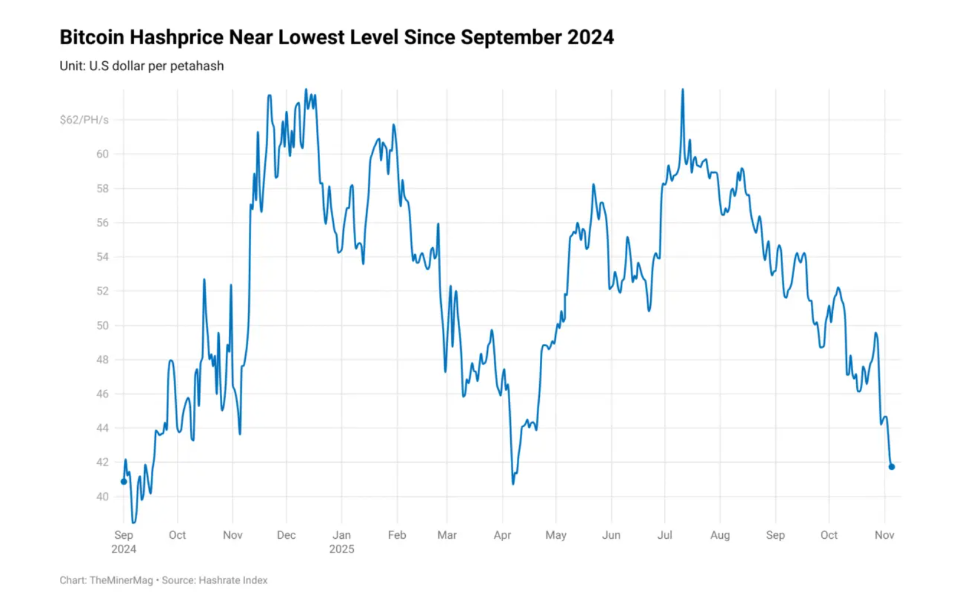

Based on trade studies, hash value — the anticipated each day income per unit of computing energy — is about $42 per PH/s at this time, down from above $62 per PH/s in July.

That dip towards the $40 mark is forcing some smaller and fewer environment friendly miners to weigh powering down their rigs. Stories have disclosed that when income falls this far, operators with skinny margins can now not cowl energy and upkeep payments.

{Hardware} makers and internet hosting corporations are being affected. Orders for machines have slowed, and any revenue tied to Bitcoin has misplaced worth after the market slide in October.

Some producers have began mining with their very own machines to offset weaker buyer demand. Bitdeer and related corporations have been reported to increase self-mining operations to fill gaps in gross sales.

Hash value drops and approaches a important degree. Supply: TheMinerMag

Miners Transfer Into AI Compute

Excessive capital prices and regular will increase in hashrate make working ASIC farms harder, particularly after the April 2024 halving lower the block reward to three.125 BTC.

Again in 2009, the block reward was 50 BTC and folks might mine with CPUs. Immediately, solely specialised {hardware} makes mining viable for many operators. That shift has pushed some corporations to transform capability into common compute for AI workloads.

Primarily based on studies, massive offers present the development is actual. Cipher Mining signed a $5.5 billion, 15-year deal to produce compute energy to Amazon Net Providers in October.

IREN later agreed to offer GPU companies to Microsoft in a contract valued at $9.7 billion. These strikes are supposed to deliver regular income when Bitcoin mining earnings shrink.

Market Stoop Provides To Miner Stress

Bitcoin’s value weak spot has compounded the issue. The token briefly fell beneath $100,000, buying and selling as a lot as 20% beneath the October 6 excessive of above $126,000.

Analysts level to heavy promoting by long-term holders: since late June, internet gross sales from that group have topped 1 million bitcoin, in response to Compass Level analyst Ed Engel.

A big liquidation of leveraged positions on Oct. 10 additionally shook the market and knocked out help ranges close to $117,000 and $112,000.

Picture: Dragos Condrea / Getty Photos

Picture: Dragos Condrea / Getty Photos

Markus Thielen, founder and CEO of 10X Analysis, stated the market’s failure to reclaim key ranges suggests bearish circumstances, and his agency maintains that bitcoin might nonetheless fall additional earlier than a backside seems.

His crew had earlier forecast a drop to $100,000 and now says a buyable backside could also be “just a few weeks away.”

Featured picture from Pexels, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.