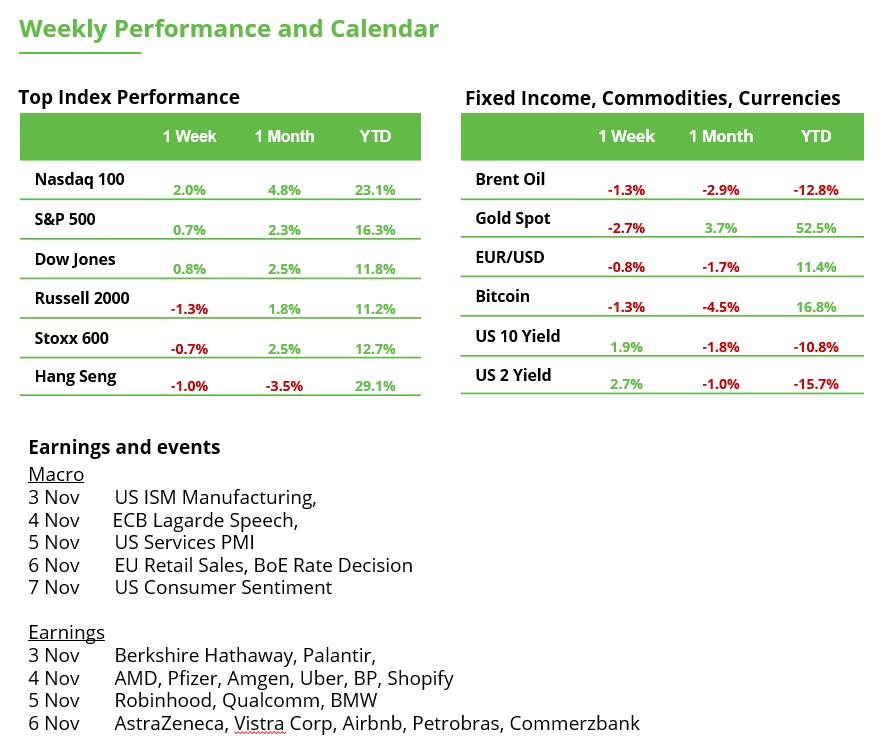

Analyst Weekly, November 3, 2025

Commerce Diplomacy: US’s “Asia Blitz” Targets China

Whereas D.C. argued over spending, the US administration was busy redrawing Asia’s commerce map. Offers have been performed with Malaysia, Cambodia, Vietnam, and Thailand, all carrying provisions designed to curb China’s affect, from banning items made with pressured labor to tightening export controls on delicate applied sciences.

On the similar time, Washington and Beijing reached a one-year “managed decoupling” truce: China paused new rare-earth export bans, the US delayed new sanctions on Chinese language corporations, and each side agreed to extra agricultural and vitality commerce. The purpose, a minimum of for now, is to sluggish the financial separation with out derailing international provide chains.

Investor Takeaway: Anticipate renewed momentum in “China-plus-one” commerce beneficiaries like Vietnam, Thailand, and India. ETFs monitoring rising Asian manufacturing may achieve from redirected provide chains. US semiconductor and vitality exporters additionally stand to learn as commerce flows rebalance.

Allies within the Fold: Japan, South Korea, and the AI Angle

The US additionally deepened its alliances with Japan and South Korea, hanging funding pacts throughout nuclear vitality, shipbuilding, and synthetic intelligence (AI). Japan dedicated to assist finance $80 billion price of US nuclear tasks, whereas South Korea’s $350 billion funding plan, a long-debated package deal, will now prioritize heavy manufacturing and maritime industries.

In the meantime, tech cooperation took heart stage: Washington and Tokyo agreed to coordinate AI and quantum computing growth, making certain that allies depend on US-made AI chips. Taiwan additionally reported “progress” in its personal commerce talks, reinforcing America’s expertise sphere of affect.

Investor Takeaway: This “friendshoring” momentum is bullish for AI infrastructure and chipmakers tied to US provide chains. Names in semiconductors, clear vitality, and industrial robotics may see sustained demand. Lengthy-term traders would possibly take a look at international thematic funds centered on AI or next-gen manufacturing.

Key Earnings Studies: Week of November 3, 2025

Palantir Applied sciences (PLTR): Buyers might be laser-focused on the uptake of Palantir’s new Synthetic Intelligence Platform (AIP) and its position in accelerating the corporate’s progress. The increasing industrial use-cases for Palantir’s AI-driven analytics have analysts predicting a ~50% YoY income leap, underscoring the view that Palantir is on the forefront of the AI revolution.

Pfizer (PFE): Buyers might be waiting for steerage and new product momentum, in search of indicators that Pfizer’s non-COVID portfolio (which grew 14% within the prior 12 months’s quarter) can offset the steep decline in COVID franchise gross sales and restore earnings progress.

Superior Micro Units (AMD): Wall Road is concentrated on momentum in AMD’s increasing AI and cloud segments, anticipating ~27% YoY gross sales progress fueled by demand for EPYC server processors and new AI accelerators; a development traders hope can preserve AMD’s 2025 rally intact within the face of PC market headwinds.

Uber Applied sciences (UBER): The highlight is on execution and margin self-discipline as Uber strives for sustainable profitability throughout rides and supply. Buyers are waiting for regular ride-hailing revenue margins and bettering unit economics in meals supply; stable bookings progress coupled with price management may lengthen Uber’s 2025 inventory surge, whereas any slip in effectivity or demand would elevate doubts about its post-pandemic revenue trajectory.

BP (BP): The main target might be on money move and strategic portfolio strikes amid an unsure oil value outlook. Buyers are eager for updates on BP’s plan to promote its Castrol lubricants unit, a divestment geared toward boosting shareholder worth, and can scrutinize how greater refining margins (anticipated to elevate quarterly income) are balancing out softer upstream earnings.

Qualcomm (QCOM): Qualcomm’s report will take a look at whether or not rising progress areas can overcome weak point in its core smartphone chip enterprise. Buyers will gauge if demand for Qualcomm’s AI-enabled chips and enlargement into PCs, autos, and IoT can offset continued softness in international handset gross sales, the smartphone market stays Qualcomm’s stronghold however has been sluggish, so any commentary on handset demand or diversification (e.g. wins in premium telephones or PC processors) will probably drive the inventory’s response.

Shopify (SHOP): The e-commerce platform’s valuation rests on balancing fast progress with bettering profitability. The important thing metric might be Shopify’s gross merchandise quantity (GMV) and income progress (guided within the high-20% vary) relative to its expense self-discipline, traders wish to see continued 20%+ GMV enlargement alongside proof that latest price cuts are boosting margins and free money move, which might validate Shopify’s post-rally valuation.

McDonald’s (MCD): The fast-food large’s same-store gross sales combine is the crucial focus this quarter. Buyers are watching how profitable McDonald’s new worth meal promotions have been in driving buyer site visitors versus their affect on common test measurement; early analyst insights recommend the September launch of Further Worth Meals probably lifted foot site visitors however dented common ticket, so the corporate’s comparable gross sales (anticipated ~+2.5% YoY) and administration’s commentary on pricing will set the post-earnings tone.

Novo Nordisk (NVO): The Danish pharma heavyweight’s outcomes will hinge on its blockbuster weight problems and diabetes medication. Ozempic and Wegovy now account for roughly 65% of Novo Nordisk’s gross sales, so traders might be laser-focused on the quarterly income from these GLP-1 medicines. Any replace on demand vs. provide constraints for Wegovy, and Novo’s skill to maintain excessive progress within the face of latest opponents, might be pivotal in driving the inventory’s response.

Moderna (MRNA): Moderna’s narrative is shifting from COVID windfall to pipeline promise. With COVID-19 vaccine income sharply down, the important thing for traders is any signal of stabilization in booster demand and progress in Moderna’s non-COVID pipeline. Particularly, updates on the uptake of its new fall COVID booster and the standing of upcoming vaccines (like RSV or flu) are essential – the market desires reassurance that Moderna’s subsequent era of merchandise can fill the hole as COVID gross sales fade.

AstraZeneca (AZN): As a UK-based pharma large reporting this week, AstraZeneca’s core oncology and uncommon illness drug gross sales would be the focus. Buyers are significantly tuned to progress traits for key most cancers therapies and the corporate’s outlook amid upcoming drug patent expirations. Any updates on its pipeline (particularly in areas like oncology and the burgeoning diabetes/weight problems market) and the way it navigates drug pricing pressures within the US and Europe will probably drive AstraZeneca’s shares following earnings.

Airbnb (ABNB): The house-sharing platform’s quarter will activate the power of journey demand and reserving traits. The metric to observe is nights booked and common every day charges, as Airbnb has been posting round 8 to 10% income progress. Buyers might be listening to administration’s commentary on reserving momentum into the vacations and any alerts of shopper journey urge for food or margin strain – it will decide if Airbnb can preserve its post-pandemic progress trajectory and excessive profitability into 2026.

Amgen (AMGN): As a newly inducted Dow element, Amgen’s story is about new medication changing previous ones. The main target is on whether or not Amgen’s lineup of newer therapies and its Horizon Pharma acquisition are producing sufficient progress to offset patent fades and biosimilar competitors on getting old blockbusters. Buyers will parse Amgen’s earnings and steerage for proof that its modern medication (and price cuts) are driving income positive aspects, a key issue behind Amgen’s market-beating efficiency this 12 months, as it will decide if the inventory’s outperformance can proceed.

Market Pulse: Vol, Skew, and a GLD Hangover

Regardless of political noise, the S&P 500 traded sideways by the heaviest stretch of earnings. Volatility cooled as earnings rolled on, with the VIX slipping under mid-October highs. Large Tech earnings have been combined: Meta and Microsoft slipped, whereas Google held up. A big gold name place that had pushed months of upside was minimize, signaling that the steel’s 2025 rally might have peaked.

Volatility stays inverted, with near-term choice costs greater than long-term ones; a setup that normally normalizes as earnings move.

Investor Takeaway: With short-term volatility easing, broader fairness participation may resume, assume mid-caps and worth shares. As gold cools, funds might rotate into equities or bonds. Buyers in search of diversification would possibly rebalance out of treasured metals and into dividend ETFs or high quality cyclical names.

Palantir: Sturdy Rally, Excessive Expectations Forward of Q3 Earnings

Palantir Applied sciences is ready to report its Q3 earnings after the shut on Monday. The corporate, which makes a speciality of information analytics and software program platforms, now ranks among the many 20 most respected corporations within the S&P 500. The inventory has surged greater than 160% this 12 months.

The market is at the moment in a brand new upward impulse, with the long-term uptrend confirmed by a recent document excessive final week. Within the short-term the inventory seems barely overbought, because the RSI sits above 70. With a ahead P/E above 260, the basic valuation could be very excessive, growing the chance of a correction. Even minor disappointments may set off important volatility.

Analysts count on Palantir’s income to have risen 50.5% year-over-year to $1.09 billion within the third quarter, whereas earnings per share are projected to have grown by 67.4% over the identical interval. Ought to the inventory come below strain within the coming days or perhaps weeks, there are two key assist zones (Honest Worth Gaps) to observe:

$171.26 to $172.84 – a zone examined 3 times already, with patrons defending it every time.

$160.87 to $161.06 – a deeper assist space that would come into focus if a correction unfolds.

Palantir, weekly chart. Supply: eToro

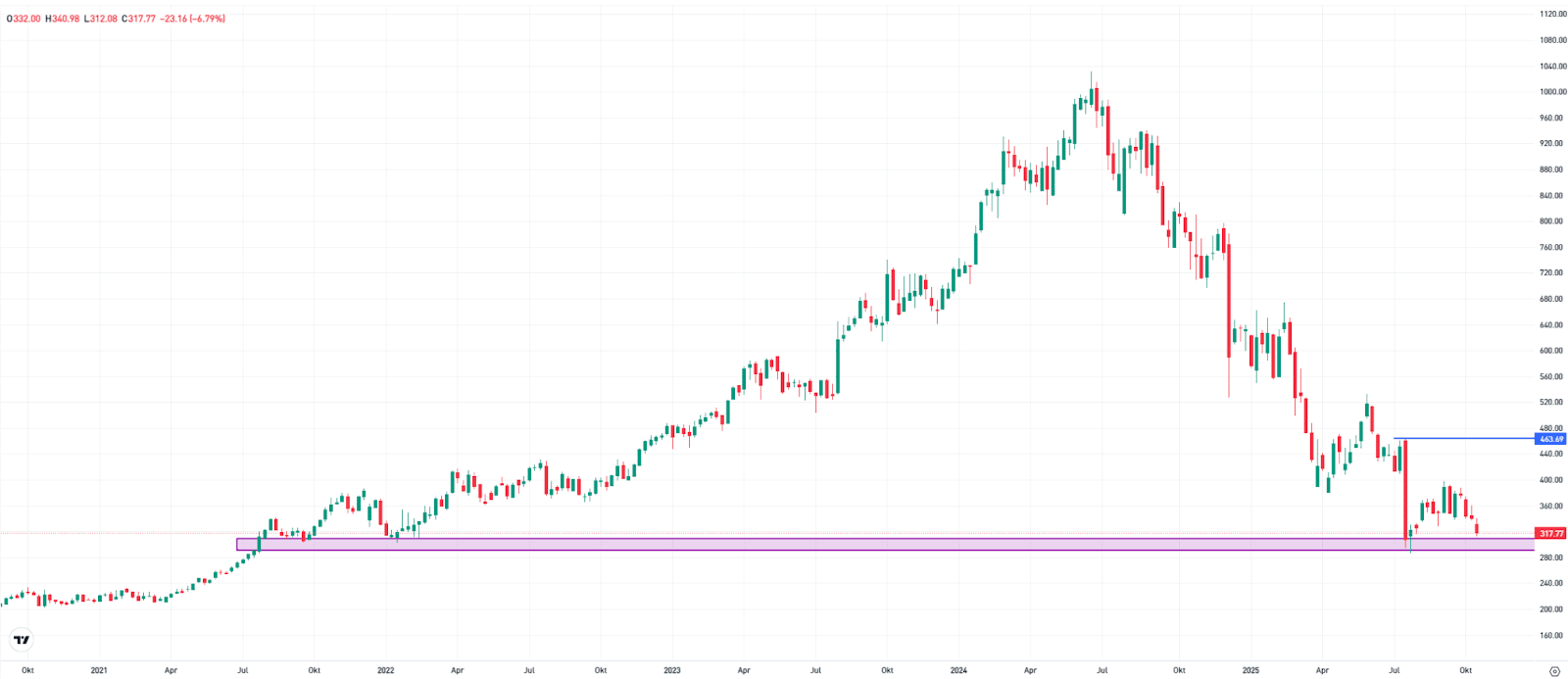

Novo Nordisk: Can Q3 Outcomes Forestall Additional Losses?

Novo Nordisk will report its third-quarter outcomes on Wednesday earlier than the European market opens. The inventory has been in a downtrend for over a 12 months and has misplaced round 70% of its worth for the reason that document excessive in July 2024.

In July and August, the share value reacted to a long-term assist zone (Honest Worth Hole) between 290 and 310 DKK, which dates again to the 2021 rally. Nevertheless, this response alone wasn’t sufficient to set off a sustained development reversal. Though there was a short-term rebound, solely a break above resistance at 463 DKK would considerably enhance the technical image.

The upcoming earnings report will probably be decisive, exhibiting whether or not Novo Nordisk will proceed its downward trajectory or if the long-term assist space provides an opportunity for a backside formation.

Analysts count on income within the third quarter to have risen 7.9% year-on-year to 76.9 billion DKK, whereas earnings per share are projected to fall 19.1% to 4.95 DKK.

Novo Nordisk, weekly chart. Supply: eToro

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.