As we step into 2025, it’s time to take a measured and analytical strategy to what the 12 months may maintain for Bitcoin. Taking into consideration on-chain, market cycle, macroeconomic knowledge, and extra for confluence, we will transcend pure hypothesis to color a data-driven image for the approaching months.

MVRV Z-Rating: Loads of Upside Potential

The MVRV Z-Rating measures the ratio between Bitcoin’s realized value (the common acquisition value of all BTC on the community) and its market cap. Standardizing this ratio for volatility offers us the Z-Rating, which traditionally gives a transparent image of market cycles.

View Dwell Chart 🔍

At present, the MVRV Z-Rating suggests we nonetheless have important upside potential. Whereas earlier cycles have seen the Z-Rating attain values above 7, I imagine something above 6 signifies overextension, prompting a more in-depth take a look at different metrics to establish a market peak. Presently, we’re hovering at ranges similar to Could 2017—when Bitcoin was valued at just a few thousand {dollars}. Given the historic context, there’s room for a number of lots of of % in potential positive aspects from present ranges.

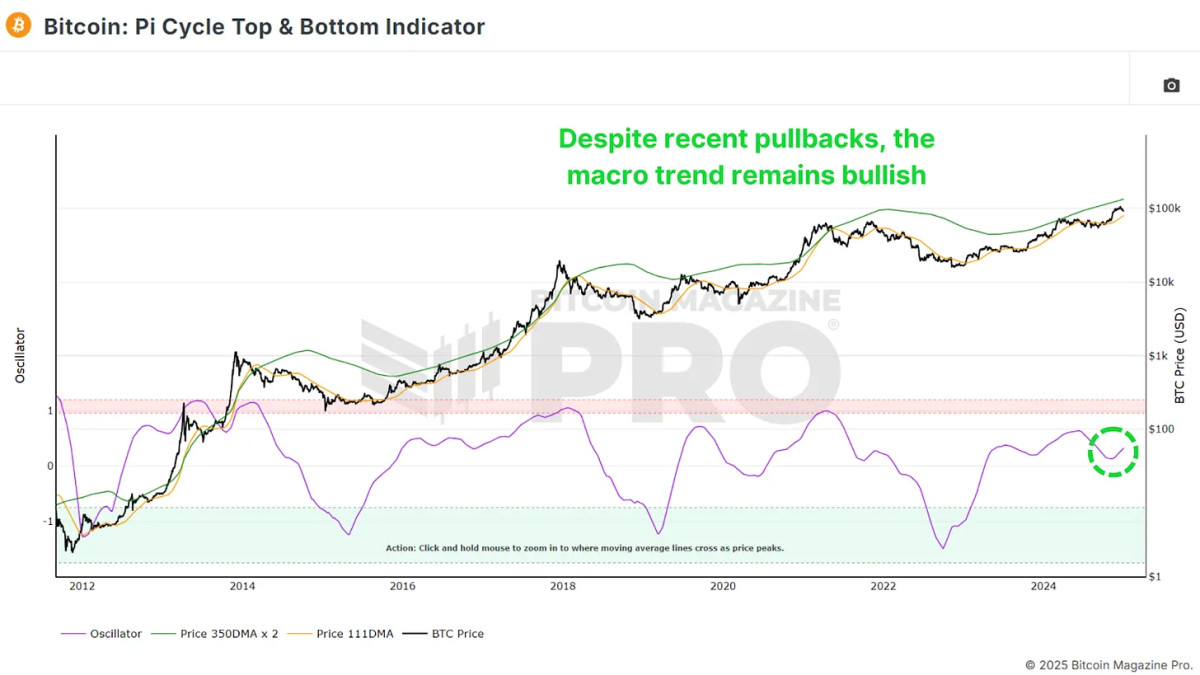

The Pi Cycle Oscillator: Bullish Momentum Resumes

One other important metric is the Pi Cycle Prime and Backside indicator, which tracks the 111-day and 350-day shifting averages (the latter multiplied by 2). Traditionally, when these averages cross, it typically alerts a Bitcoin value peak inside days.

View Dwell Chart 🔍

The gap between these two shifting averages has began to development upward once more, suggesting renewed bullish momentum. Whereas 2024 noticed intervals of sideways consolidation, the breakout we’re seeing now signifies that Bitcoin is getting into a stronger progress section, doubtlessly lasting a number of months.

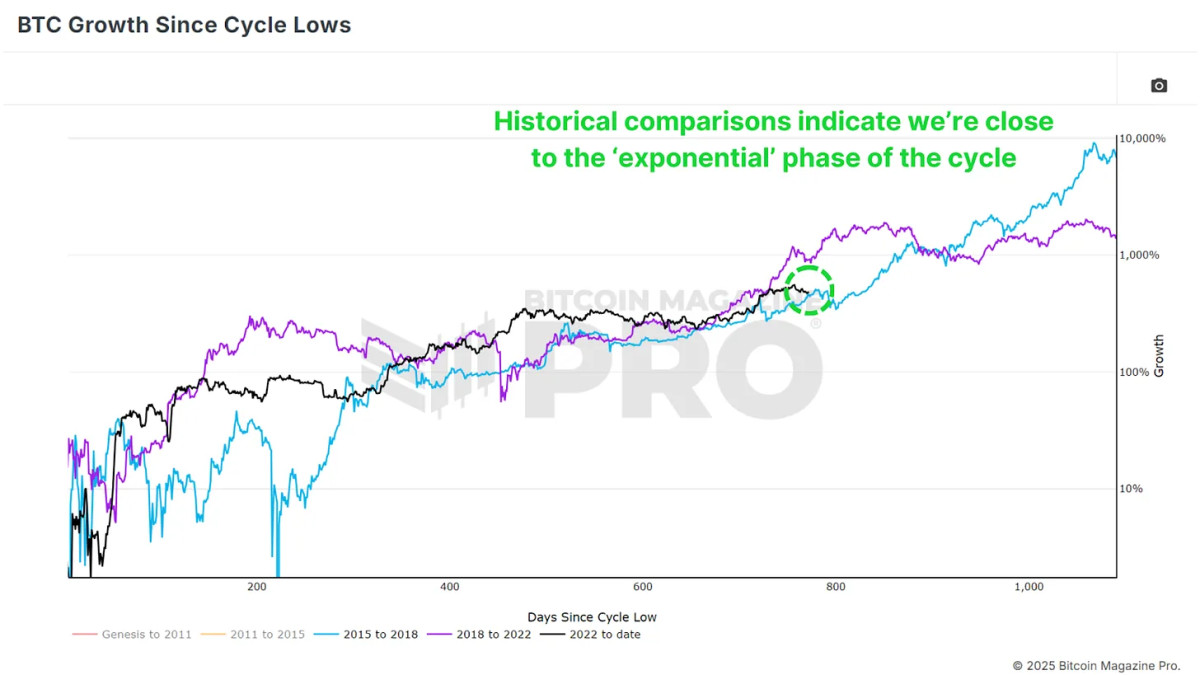

The Exponential Section of the Cycle

Taking a look at Bitcoin’s historic value motion, cycles typically function a “post-halving cooldown” lasting 6–12 months earlier than getting into an exponential progress section. Primarily based on earlier cycles, we’re nearing this breakout level. Whereas diminishing returns are anticipated in comparison with earlier cycles, we may nonetheless see substantial positive aspects.

View Dwell Chart 🔍

For context, breaking the earlier all-time excessive of $20,000 within the 2020 cycle led to a peak close to $70,000—a 3.5x improve. If we see even a conservative 2x or 3x from the final peak of $70,000, Bitcoin may realistically attain $140,000–$210,000 on this cycle.

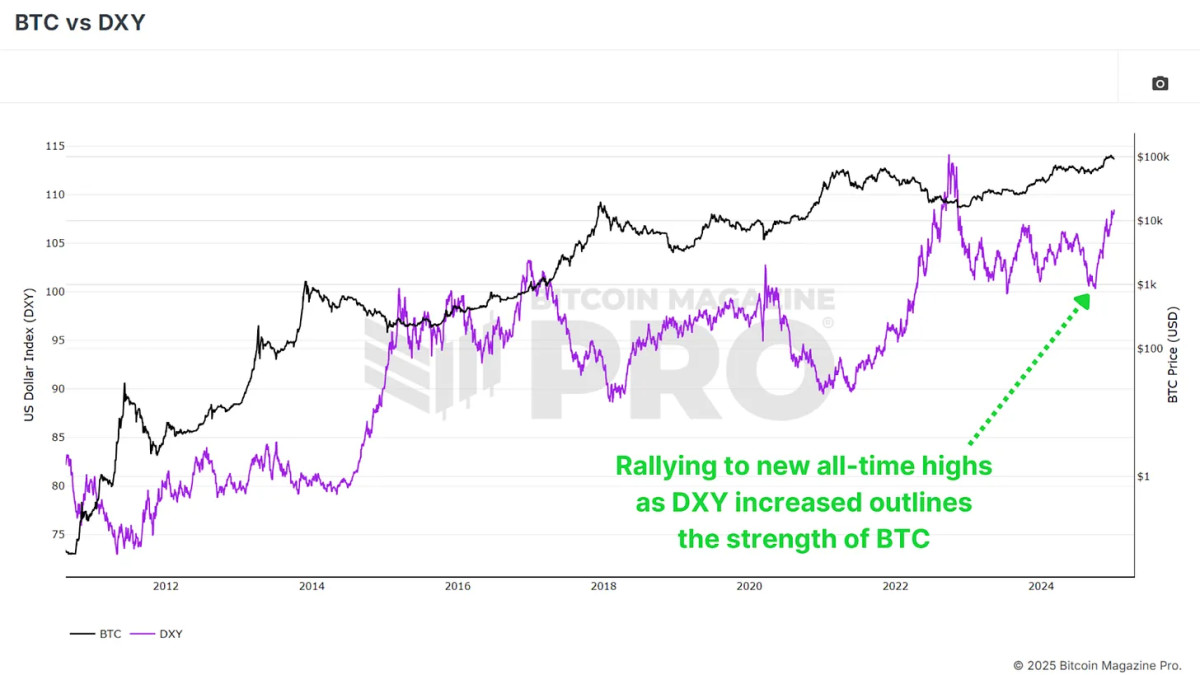

Macro Elements Supporting BTC in 2025

Regardless of headwinds in 2024, Bitcoin carried out strongly, even within the face of a strengthening U.S. Greenback Index (DXY). Traditionally, Bitcoin and the DXY transfer inversely, so any reversal within the DXY’s power may additional gas Bitcoin’s upside.

View Dwell Chart 🔍

Different macroeconomic indicators, corresponding to high-yield credit score cycles and the worldwide M2 cash provide, recommend bettering situations for Bitcoin. The contraction within the cash provide seen in 2024 is predicted to reverse in 2025, setting the stage for an much more favorable surroundings.

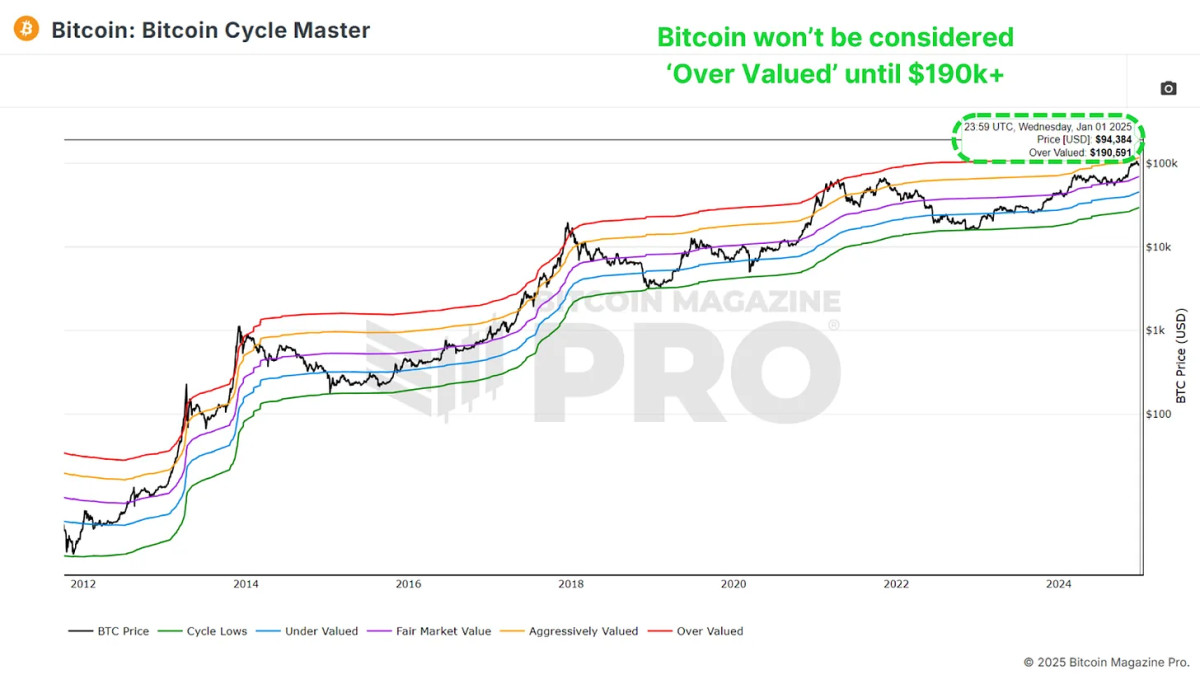

Cycle Grasp Chart: A Lengthy Approach to Go

The Bitcoin Cycle Grasp Chart, which aggregates a number of on-chain valuation metrics, exhibits that Bitcoin nonetheless has appreciable room to develop earlier than reaching overvaluation. The higher boundary, presently round $190,000, continues to rise, reinforcing the outlook for sustained upward momentum.

View Dwell Chart 🔍

Conclusion

At present, nearly all knowledge factors are aligned for a bullish 2025. As all the time, previous efficiency doesn’t assure future outcomes, nonetheless the information strongly means that Bitcoin’s greatest days should lie forward, even after an extremely optimistic 2024.

For a extra in-depth look into this matter, try a current YouTube video right here: Bitcoin 2025 – A Knowledge Pushed Outlook

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, customized indicator alerts, and in-depth trade studies, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.