Discovering one of the best crypto copy buying and selling platform can change the way you spend money on 2025. As an alternative of spending years studying methods, you’ll be able to observe the actions of skilled merchants and be taught from their outcomes. These platforms cut back the guesswork in buying and selling by providing you with entry to real-time knowledge, confirmed methods, and threat administration instruments that aid you develop your portfolio with confidence.

On this information, we examine the highest crypto copy buying and selling platforms primarily based on efficiency, charges, and reliability. You’ll find out how copy buying and selling works, the various kinds of platforms out there, and the way to decide on the one that matches your buying and selling targets. Whether or not you’re new to crypto or trying to enhance your technique, this assessment will aid you discover one of the best copy buying and selling platform that crypto buyers belief in 2025.

High Copy Buying and selling Platforms in Crypto: Fast Comparability

PlatformCopy Buying and selling FeesCommission to Lead TraderSupported CryptocurrenciesMinimum Copy AmountRisk Controls AvailableNotable FeaturesBinance10% buying and selling payment fee.10% revenue share.500+$10Cease-loss, take-profit, max place dimension.Largest person base; superior charting instruments; spot and futures copy buying and selling.MEXC0% maker, 0.05% taker (spot); 0.02% taker (futures).50% low cost for holding 500+ MX tokens; 20% low cost for MX payment deductions.3000$5Cease-loss, take-profit.Enormous altcoin selection; versatile fee buildings.BingX0.1% (spot), 0.02%-0.05% (futures).8% revenue share.1000+$2Take-profit, stop-loss, every day copy margin limits.Sturdy social buying and selling neighborhood; crypto and conventional market property.eToro1% on crypto trades.Unfold-based charges.100+$200Cease-loss, take-profit.Regulated; beginner-friendly; combines social media with buying and selling.Bybit0.1% (spot), 0.02%-0.055% (futures).10% revenue share.300+$50Cease-loss, leverage changes, and duplicate mode settings.Consumer-friendly interface; sturdy futures market; threat administration per commerce.PrimeXBT0.05% buying and selling payment.20% revenue share.100+0.001 BTCCease-loss, take-profit.Covesting module for crypto and conventional CFD markets.OKX0.08% maker, 0.1% taker (spot); 0.02%-0.05% (futures).5% revenue share.350+$10Cease-loss, take-profit, order slicing.Excessive-performance engine; detailed dealer analytics; social buying and selling options.BitgetCharges vary from 0-50 USDT per technique.8% revenue share.800+$50Cease-loss, take-profit, max copy quantity per dealer.Pioneer in copy buying and selling; giant lead dealer neighborhood; one-click copy.CoinbaseN/A (No native function).N/A.250+N/AN/A.Newbie-friendly; extremely regulated; glorious security measures.Gate.ioNo particular charges.5% revenue share.3400+$10Cease-loss, take-profit.Intensive altcoin help; modern buying and selling instruments.

10 Greatest Crypto Copy Buying and selling Platforms in 2025

If you end up selecting your copy buying and selling platform, it’s essential test on particulars that actually matter. Dig deeper into charges, supported cryptocurrencies, threat controls, and KYC necessities that may impression your efficiency. By evaluating these components facet by facet, you could find a platform that matches your buying and selling type, targets, and threat tolerance. That can assist you make an knowledgeable resolution, listed here are the highest 10 finest copy buying and selling crypto platforms which might be main the way in which in 2025.

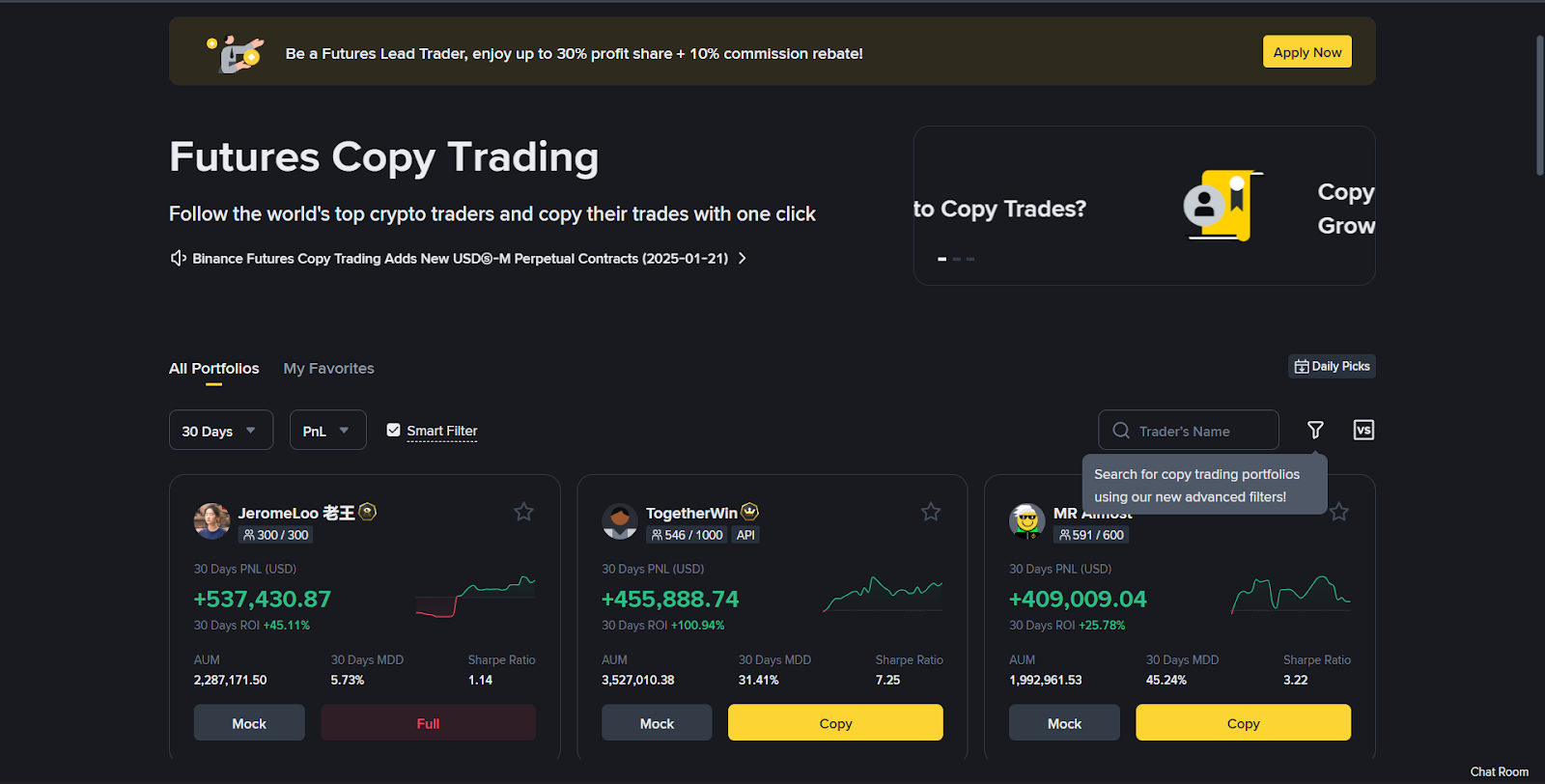

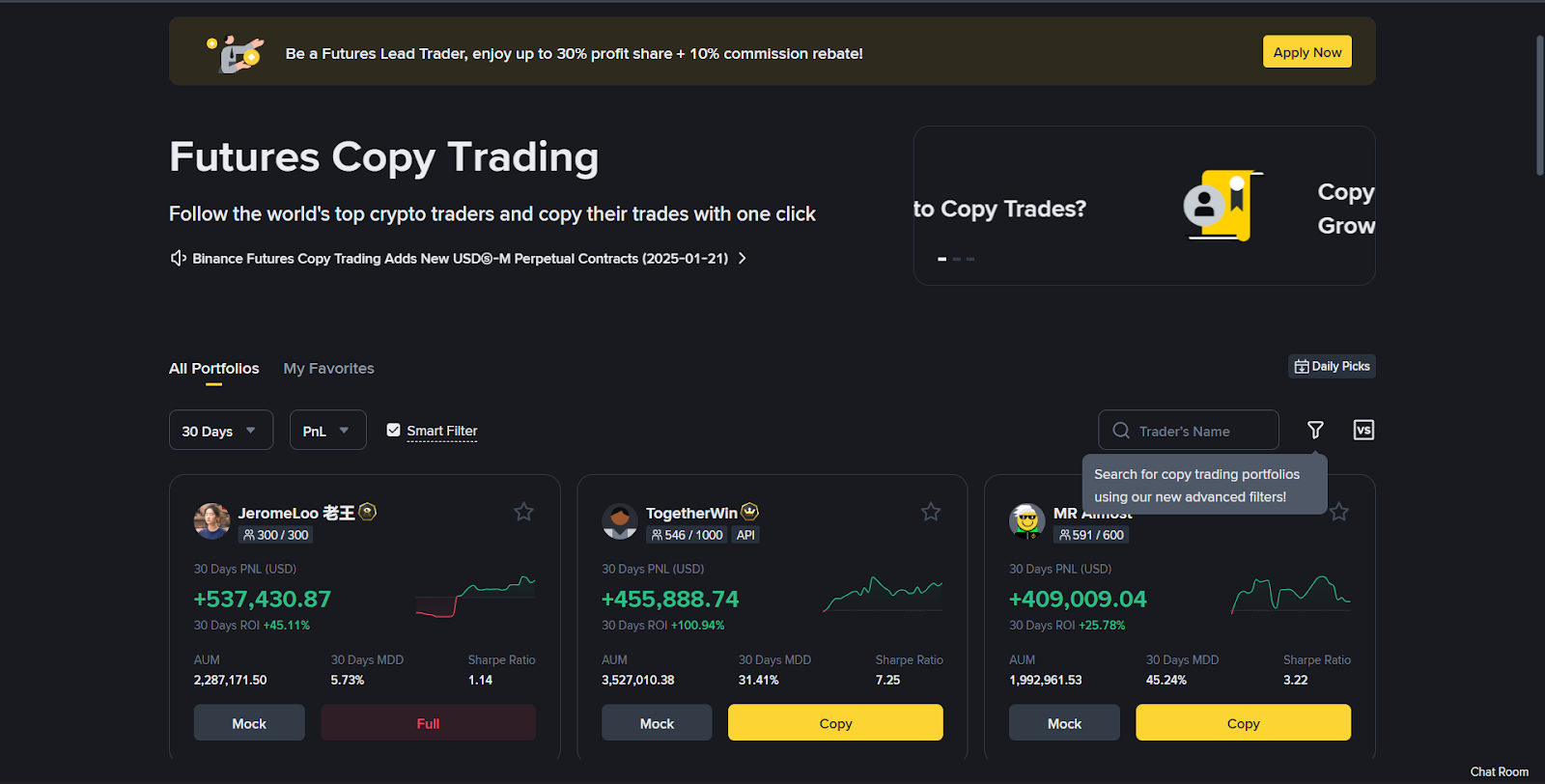

1. Binance

Since its launch in 2017, Binance has grown to change into the biggest trade by buying and selling quantity, supporting over 500 cryptocurrencies and all kinds of buying and selling pairs. Moreover, its international presence in over 180 nations ensures accessibility and compliance with native rules, making it a dependable selection for merchants worldwide.

Professionals & Cons of Binance

ProsConsEntry to over 500 cryptocurrencies and quite a lot of buying and selling pairs.Superior options may be overwhelming for inexperienced persons.Helps each spot and futures copy buying and selling.Regulatory restrictions in some areas.Excessive liquidity ensures fast commerce execution.Buyer help may be gradual throughout peak occasions.Low buying and selling charges with reductions for utilizing Binance Coin (BNB).The interface might have a studying curve for brand new customers.

Key Options of Binance Copy Buying and selling

Various Buying and selling Choices: Binance helps each spot and futures copy buying and selling platforms, providing you with the pliability to decide on methods that match your buying and selling type. Detailed Dealer Profiles: You’ll be able to assessment metrics like return on funding (ROI), win price, and asset allocation, serving to you make knowledgeable selections about who to observe.Threat Administration Instruments: Binance prioritizes your monetary security by providing instruments like stop-loss orders, take-profit ranges, and most funding limits. These options can help you handle your threat successfully and defend your capital.Versatile Copy Modes: You’ll be able to select between fastened ratio and glued quantity modes, tailoring your copy buying and selling expertise to your portfolio dimension and threat urge for food.

Copy Buying and selling Charges on Binance

Binance’s payment construction is simple and aggressive, solidifying its repute as the most effective copy buying and selling platform crypto choices. There are not any extra subscription charges for copy buying and selling. As an alternative, customers pay the usual buying and selling charges, that are among the many lowest within the trade. Lead merchants earn a ten% share of the earnings they generate for his or her followers, creating a robust incentive for them to carry out nicely.

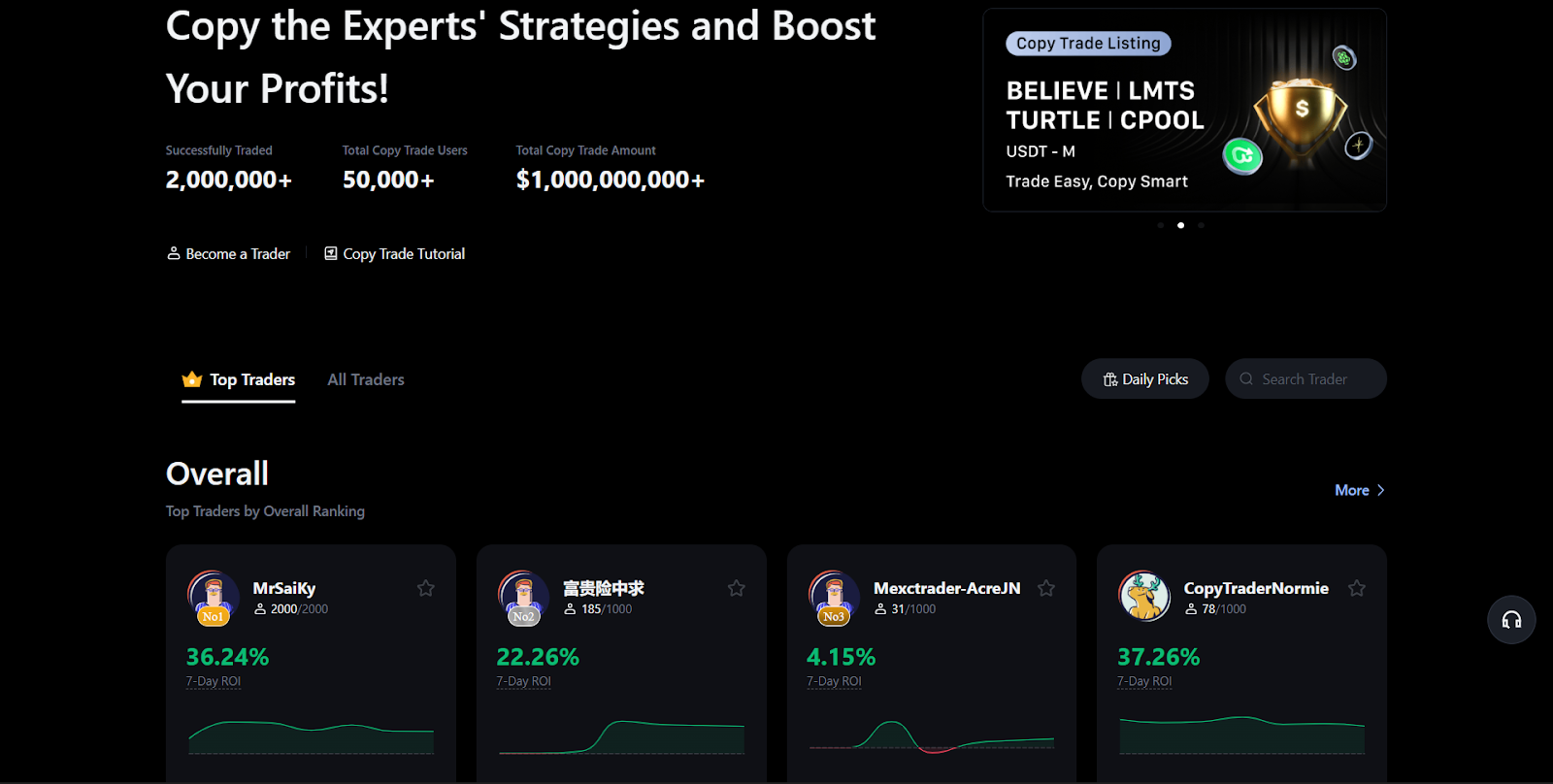

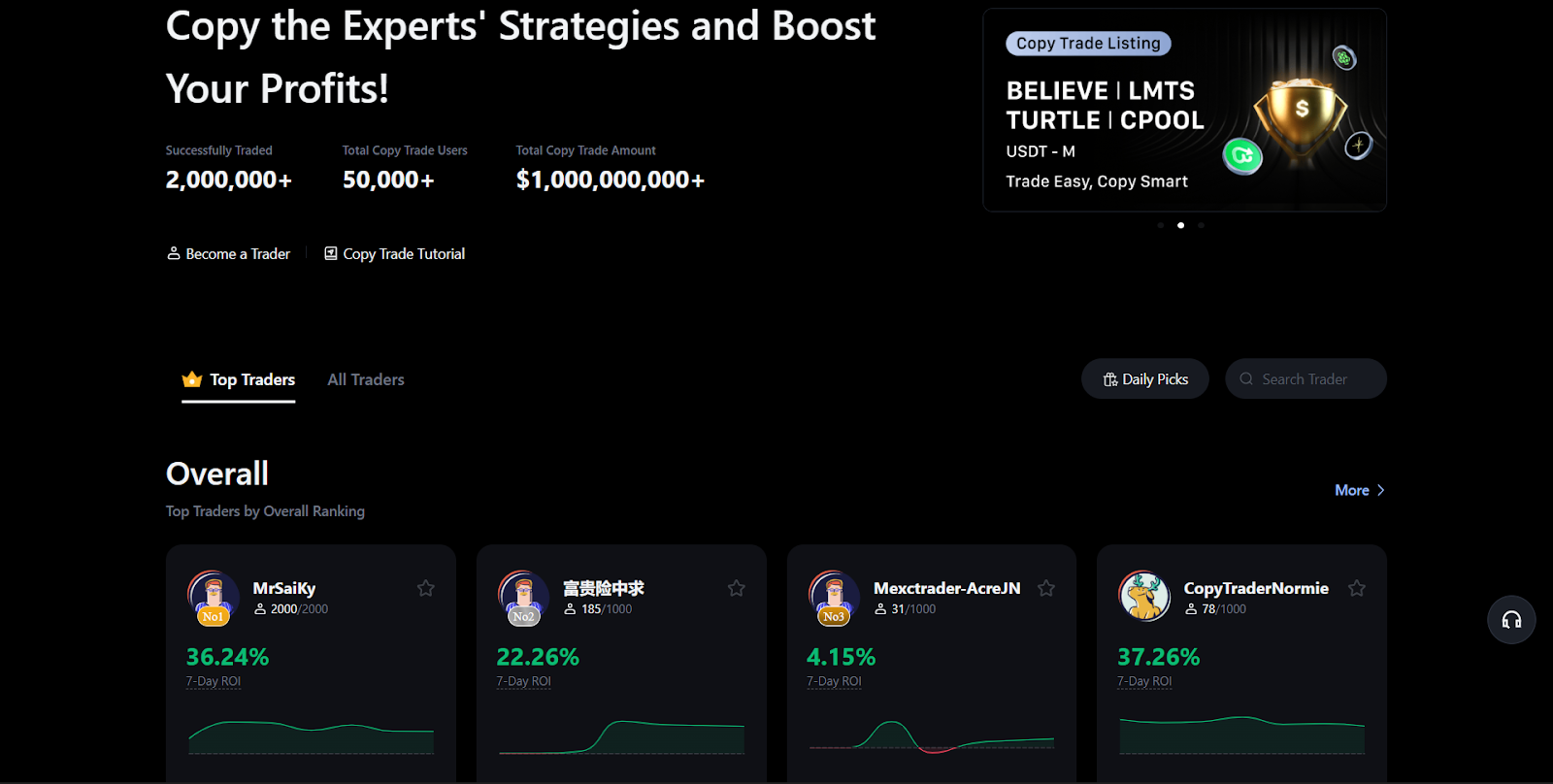

2. MEXC

MEXC is your gateway to a world of cryptocurrency alternatives. Since 2018, MEXC has been empowering over 30 million merchants throughout 170+ nations, making it some of the trusted and versatile exchanges available in the market. With entry to greater than 3,000+ buying and selling pairs, you’ll discover the whole lot it’s essential diversify your portfolio and seize new alternatives.

Professionals & Cons of MEXC

ProsConsCommerce over 3000+ cryptocurrenciesRestricted availability in areas just like the US, UK, and Canada.Save with zero maker charges and low taker charges (0.05% for spot, 0.02% for futures).No direct fiat-to-bank withdrawals in most nations.Use superior instruments like demo buying and selling and as much as 500x leverage for futures.Fewer fiat currencies supported for P2P buying and selling.Defend your property with sturdy safety measures, together with a $100M Guardian Fund.Pay as much as 15% fee on copy buying and selling earnings.

Key Options of MEXC Copy Buying and selling

Comply with the Greatest: MEXC makes it straightforward to repeat top-performing merchants. You’ll be able to assessment their ROI, PNL, and win price, then let the platform replicate their trades for you.Save Extra, Commerce Extra: Get pleasure from zero maker charges and low taker charges, and minimize your prices even additional with a 50% low cost if you maintain MX tokens.Keep in Management: Use instruments like stop-loss and take-profit orders to handle your threat and defend your investments.Study With out Threat: Observe your methods in a demo buying and selling surroundings earlier than committing actual funds.

Copy Buying and selling Charges on MEXC

MEXC retains charges easy and reasonably priced. You’ll pay zero maker charges and low taker charges, 0.05% for spot buying and selling and 0.02% for futures buying and selling. If you happen to maintain MX tokens, you’ll unlock a 50% low cost, saving you much more. For copy buying and selling, you solely pay as much as 15% of your earnings as a fee to steer merchants, guaranteeing you solely pay if you succeed.

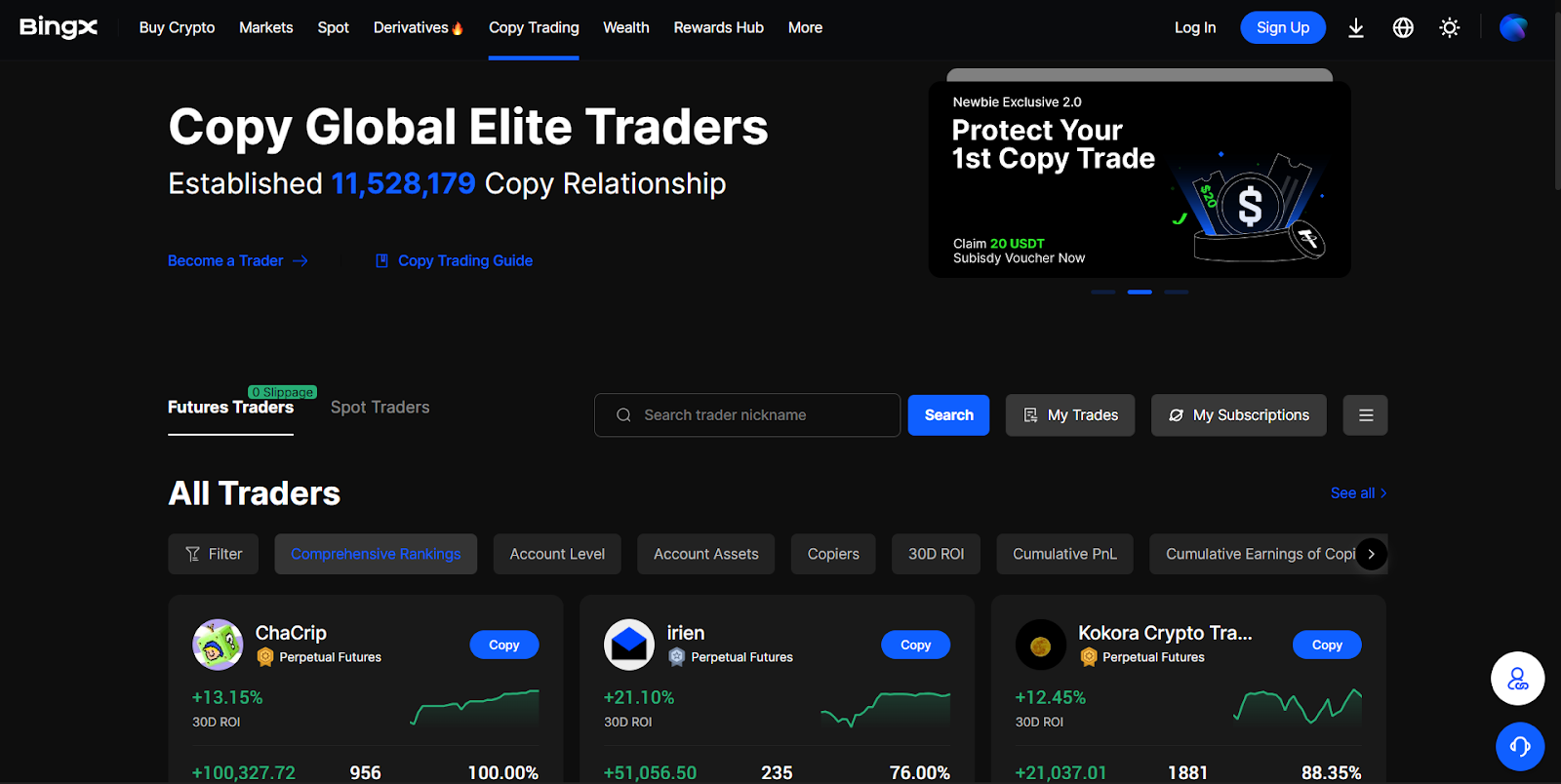

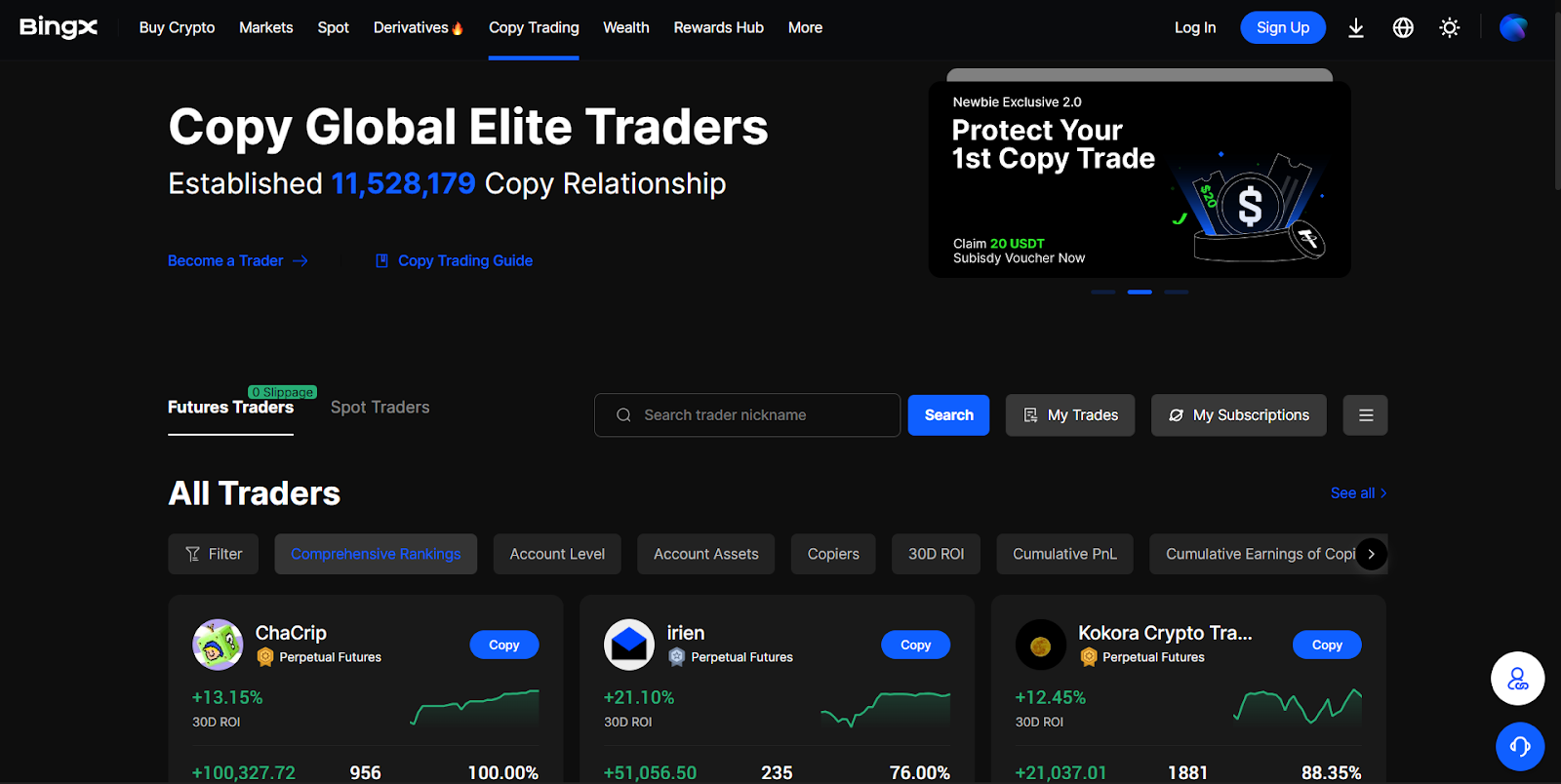

3. BingX

BingX has carved out a distinct segment for itself as a number one social buying and selling community, designed to attach novice merchants with seasoned specialists. Launched in 2018, the platform has grown quickly, specializing in making cryptocurrency buying and selling accessible and user-friendly. If you happen to’re trying to step into the world of copy buying and selling, BingX supplies an surroundings that’s each intuitive and highly effective, permitting you to be taught from and replicate the methods of profitable merchants.

Professionals & Cons of BingX

ProsConsHelps each spot and futures copy buying and selling.Not out there to customers in america and Canada.No Know Your Buyer (KYC) requirement for fundamental use.Withdrawal limits are decrease for non-verified accounts.Entry to a big pool of over 17,000 elite merchants to repeat.The platform may be overwhelming for absolute inexperienced persons.Consumer-friendly interface with detailed dealer analytics.Restricted fiat forex deposit choices.

Key Options of BingX Copy Buying and selling

Huge Dealer Choice: You’ll be able to select from an enormous neighborhood of over 40,000 skilled merchants. The platform supplies in-depth statistics, together with return on funding (ROI), threat degree, and previous efficiency, so you could find a dealer who suits your type.Spot and Futures Choices: BingX affords the pliability to repeat trades in each the spot and futures markets. This lets you diversify your methods, from lower-risk spot buying and selling to higher-leverage futures contracts.Threat Administration Instruments: You may have management over your investments with customizable settings. You’ll be able to set a most quantity per order, a every day copy buying and selling restrict, and a stop-loss ratio to guard your capital.Voucher-Primarily based Buying and selling: For futures copy buying and selling, BingX makes use of a novel voucher system. This implies you’ll be able to check out futures buying and selling with platform-provided vouchers, minimizing your private threat whilst you be taught.

Copy Buying and selling Charges on BingX

BingX maintains a aggressive and clear payment construction for its copy buying and selling providers. For spot buying and selling, each maker and taker charges are set at 0.1%. Within the futures market, the maker payment is 0.02% and the taker payment is 0.05%.

Whenever you copy one other dealer, you’ll additionally share a portion of your earnings with them. Lead merchants on BingX can earn an 8% to 10% fee on the web earnings generated by their followers. This performance-based payment ensures that lead merchants are motivated to execute profitable methods, making a win-win state of affairs for each events.

4. eToro

eToro was launched in 2007 and has made copy buying and selling easy for everybody. You’ll be able to observe prime buyers in crypto, shares, and different property with out a sophisticated setup. Each investor profile shows clear stats, like buying and selling historical past and threat degree, so you recognize precisely what you’re moving into. You keep in management with choices to vary, pause, or cease copying anytime.

Professionals & Cons of eToro

ProsConsStraightforward, beginner-friendly copy buying and selling setup1% crypto buying and selling payment is increased than some rivalsCopy buyers throughout crypto, shares, & extra$200 minimal to repeat a dealerRegulated, safe, and trusted globallyCharges for withdrawals and forex conversionTons of helpful efficiency and threat knowledgeNot all cash may be transferred to a pockets

Key Options of eToro Copy Buying and selling

Begin copying prime merchants in crypto, shares, ETFs, and more-all from one account.Verify in-depth efficiency stats, previous outcomes, and threat scores earlier than you begin.Set a cease loss to handle your threat throughout your complete copied funding.Easy pricing: pay a 1% payment if you purchase or promote crypto, with no hidden fees.Be a part of an enormous, lively neighborhood the place you’ll be able to observe, copy, and be taught daily.

Copy Buying and selling Charges on eToro

You’ll pay a 1% payment if you purchase or promote crypto. There are not any administration or copy charges for utilizing the copy buying and selling service. Bear in mind that eToro additionally fees for withdrawals and forex conversions.

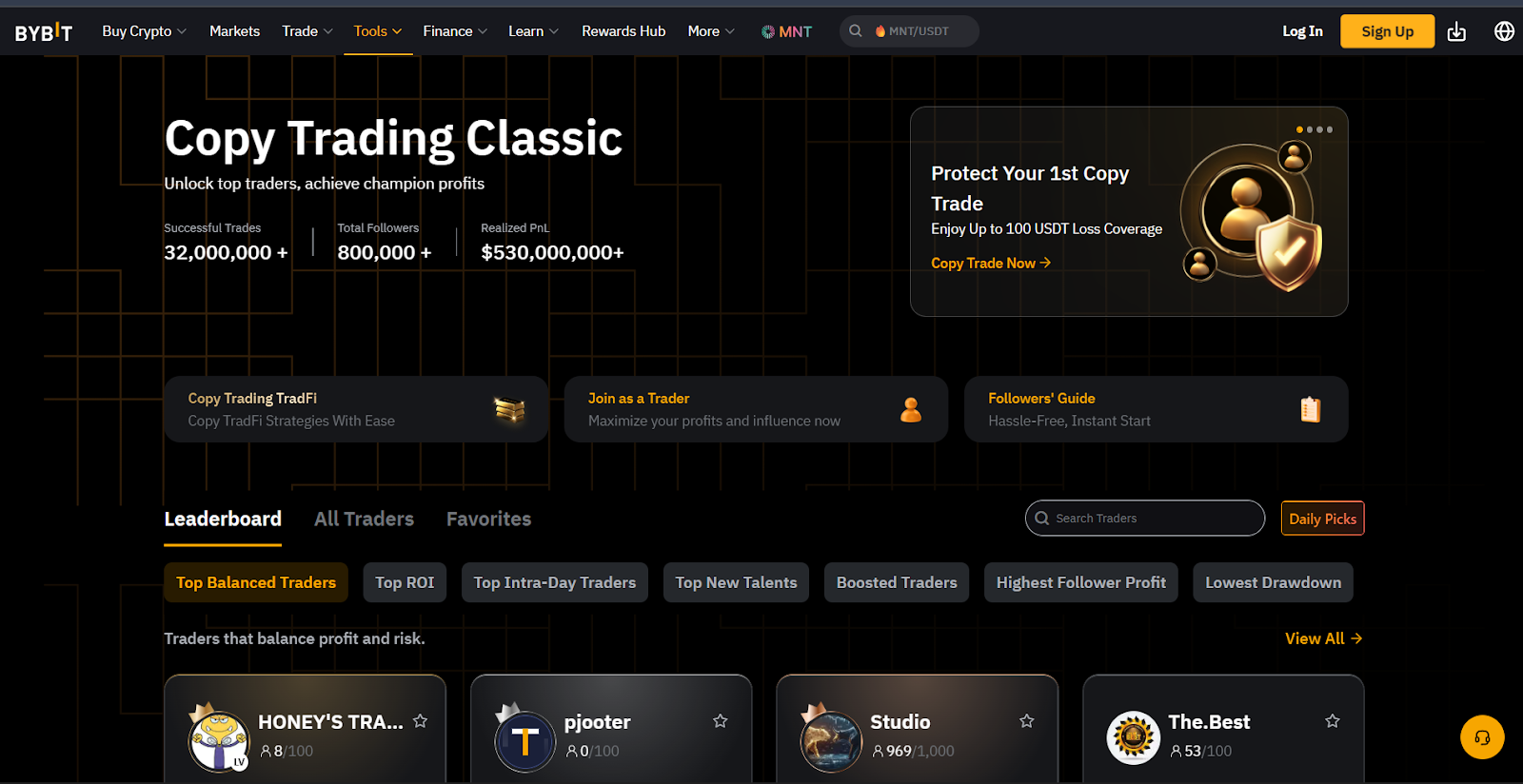

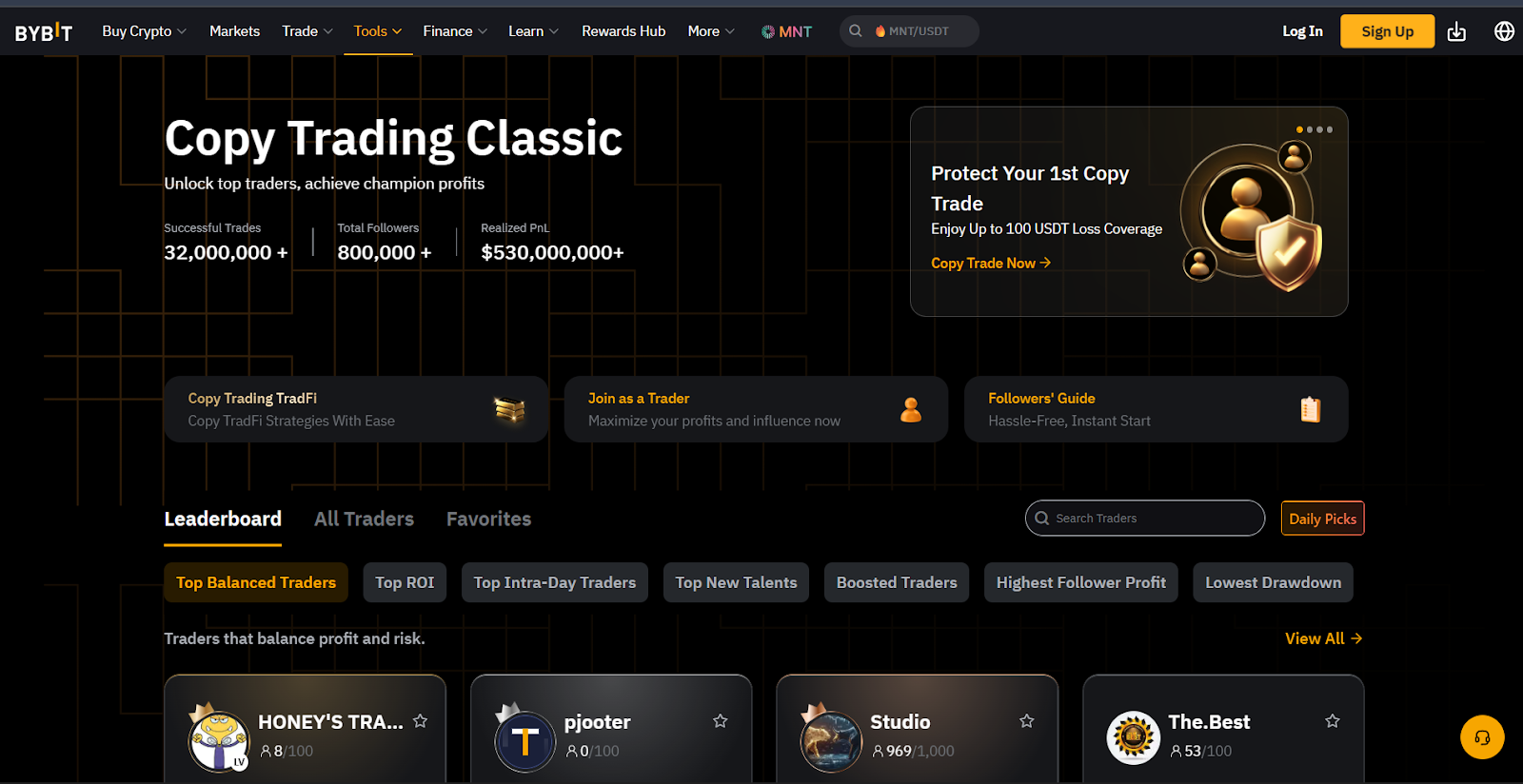

5. ByBit

ByBit has made a reputation for itself as a powerhouse within the crypto derivatives house since its launch in 2018. The platform has expanded its providers to incorporate a strong copy buying and selling system, letting you faucet into the methods {of professional} merchants on a platform constructed for efficiency.

Professionals & Cons of ByBit

ProsConsSuperior buying and selling engine with excessive liquidity.Platform could also be advanced for full inexperienced persons.Helps each spot and futures copy buying and selling.Unavailable to customers in america and the UK.Low buying and selling charges and aggressive revenue sharing.Numerous options can really feel overwhelming.Sturdy threat administration instruments for followers.Focuses extra on derivatives, which carry increased threat.

Key Options of ByBit Copy Buying and selling

Various Buying and selling Choices: You’ll be able to copy trades throughout each spot and futures markets. This flexibility permits you to select methods that match your threat urge for food.Bybit Buying and selling Bots: You’ll be able to copy not simply particular person merchants but additionally their automated buying and selling bots. This provides you entry to methods that run 24/7, just like the Futures Grid Bot or DCA Bot, with no need to configure them your self.Detailed Dealer Analytics: Earlier than you commit, you’ll be able to dig into the efficiency of every Grasp Dealer. ByBit exhibits you key stats like their return on funding (ROI), win price, most drawdown, and most well-liked property, so you may make a wise selection.Follower Safety: The platform features a function referred to as CopyGuard. This instrument helps you routinely alter your trades if there’s vital slippage, defending you from getting into a place at a a lot worse worth than the Grasp Dealer.

Copy Buying and selling Charges on ByBit

The usual buying and selling charges apply to all copied trades. For spot buying and selling, each the maker and taker charges are 0.1%. For futures buying and selling, the maker payment is 0.02%, and the taker payment is 0.055% In terms of revenue sharing, you’ll give a portion of your web earnings to the Grasp Dealer you observe.

6. PrimeXBT

Launched in 2018, PrimeXBT integrates these various property into its copy buying and selling module, permitting you to observe merchants who specialise in a variety of monetary devices. What this implies for you is the flexibility to construct a extra resilient portfolio by mirroring specialists from completely different markets.

Professionals & Cons of PrimeXBT

ProsConsEntry to a variety of markets, together with crypto and Foreign exchange.Increased minimal follower deposit in comparison with different platforms.Clear efficiency metrics and public leaderboards.Restricted variety of cryptocurrencies out there.Sturdy security measures, together with chilly storage for property.UI may be advanced for these new to buying and selling.No KYC necessities for crypto deposits and withdrawals.Primarily targeted on CFD buying and selling, which may be high-risk.

Key Options of PrimeXBT Copy Buying and selling

Multi-Asset Methods: You’ll be able to copy merchants who’re lively in varied markets, not simply crypto. This consists of Foreign exchange, inventory indices just like the S&P 500, and commodities like gold and oil, all from a single account.Clear Leaderboards: The platform incorporates a public leaderboard that ranks technique managers primarily based on their complete earnings. You’ll be able to see their detailed efficiency historical past, which helps you select a supervisor who aligns along with your targets.Superior Threat Administration: When following a method, you’ll be able to set your personal stop-loss and take-profit ranges. This provides you better management over your funding and helps you handle your threat publicity successfully.Peer-to-Peer Performance: It creates a peer-to-peer surroundings the place merchants can monetize their buying and selling abilities. As a follower, you get to leverage their experience, whereas profitable merchants are rewarded for his or her efficiency, making a motivated neighborhood.

Copy Buying and selling Charges on PrimeXBT

PrimeXBT’s payment construction for copy buying and selling relies on a profit-sharing mannequin. There’s a platform entry payment of 1% that followers pay to begin copying a method. Past that, the first value is the efficiency payment paid to the technique supervisor.

You’ll pay a 20% fee on the earnings you make from copying a profitable technique. This payment is barely charged on worthwhile trades, so that you’re solely sharing your success. The usual buying and selling charges of the platform additionally apply to all copied trades, that are 0.01% for crypto property and 0.05% for indices and commodities.

7. OKX

If you happen to’re a dealer trying modern platform, OKX affords a complete copy buying and selling system that allows you to mirror the trades of skilled professionals. OKX has established itself as a top-tier crypto trade since its launch in 2017, recognized for its intensive options and extremely safe buying and selling surroundings. This is a perfect resolution if you wish to get into buying and selling however don’t have the time or experience to investigate the markets your self.

Professionals & Cons of OKX

ProsConsEntry to over 500 buying and selling pairs for copy buying and selling.Not out there to customers in america.Low buying and selling charges and aggressive profit-sharing mannequin.The huge variety of options may be overwhelming for brand new customers.Sturdy safety with a big proof-of-reserves fund.Requires KYC verification to entry all options.Consumer-friendly interface with detailed dealer analytics.The platform’s main focus is on extra skilled merchants.

Key Options of OKX Copy Buying and selling

Intensive Market Entry: You’ll be able to copy profitable merchants’ trades throughout greater than 500 buying and selling pairs. This huge choice permits you to observe merchants with various methods and acquire publicity to a variety of market alternatives.Detailed Efficiency Metrics: OKX supplies a clear look into every lead dealer’s efficiency. You’ll be able to assessment key knowledge reminiscent of their revenue and loss (PnL), win price, threat rating, and asset preferences. This helps you make an knowledgeable resolution and discover a dealer who matches your funding type.Versatile Funding Modes: You may have the selection between two funding modes: a hard and fast quantity or a proportion of your portfolio. This flexibility helps you to management precisely how a lot capital you need to allocate to every commerce, serving to you handle your threat extra successfully.Observe with a Demo Account: If you happen to’re new to repeat buying and selling, you should utilize a demo account to get snug with the platform. This allows you to apply following merchants and testing methods with digital funds.

Copy Buying and selling Charges on OKX

The usual buying and selling charges for the platform apply to all copied trades. For futures buying and selling, the maker payment is 0.02% and the taker payment is 0.05%. These low charges aid you maintain extra of your returns. As well as, the profit-sharing price is usually between 8% to 13%. This fee is barely paid on worthwhile trades, which implies the lead dealer’s success is immediately tied to yours.

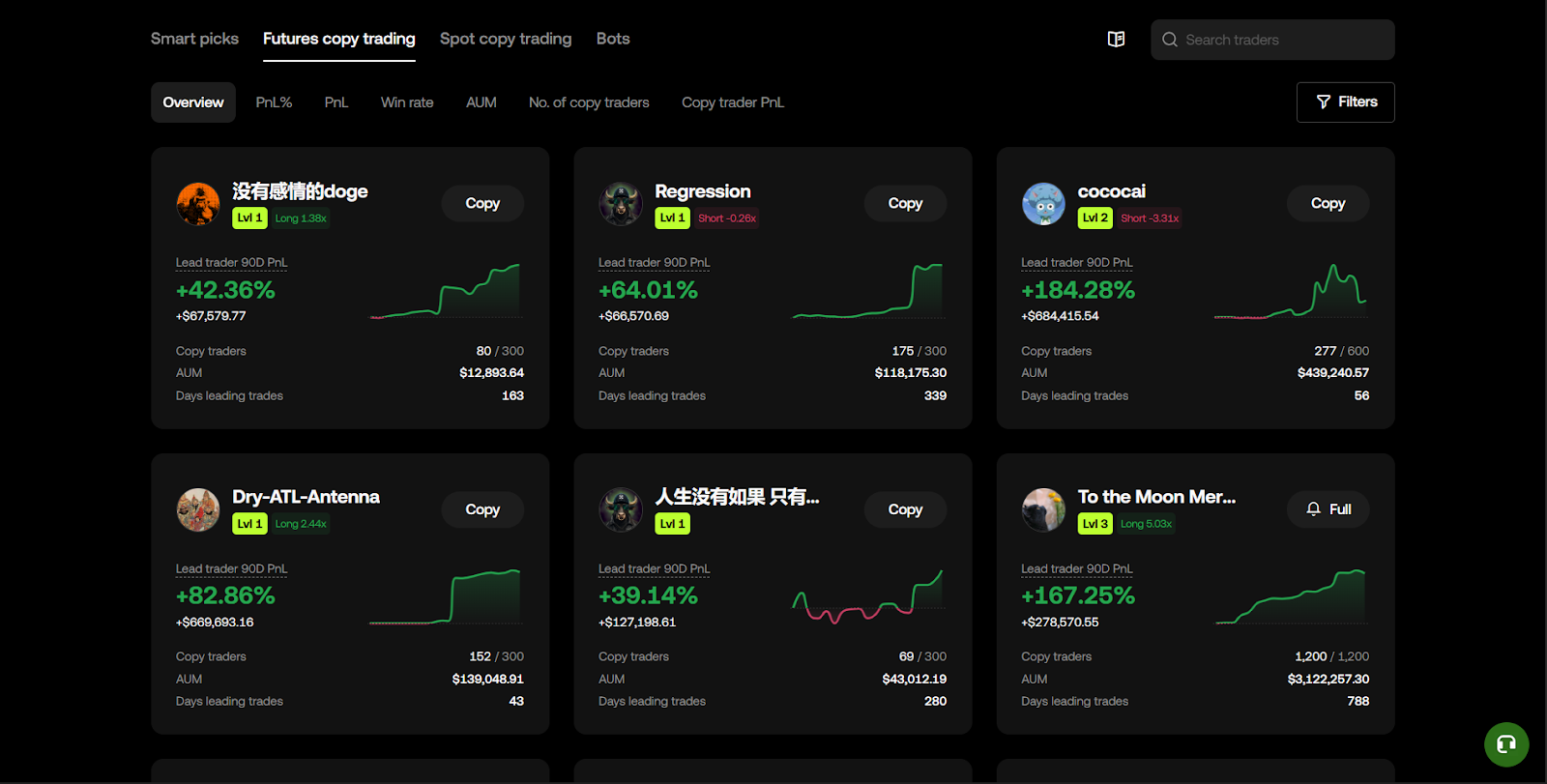

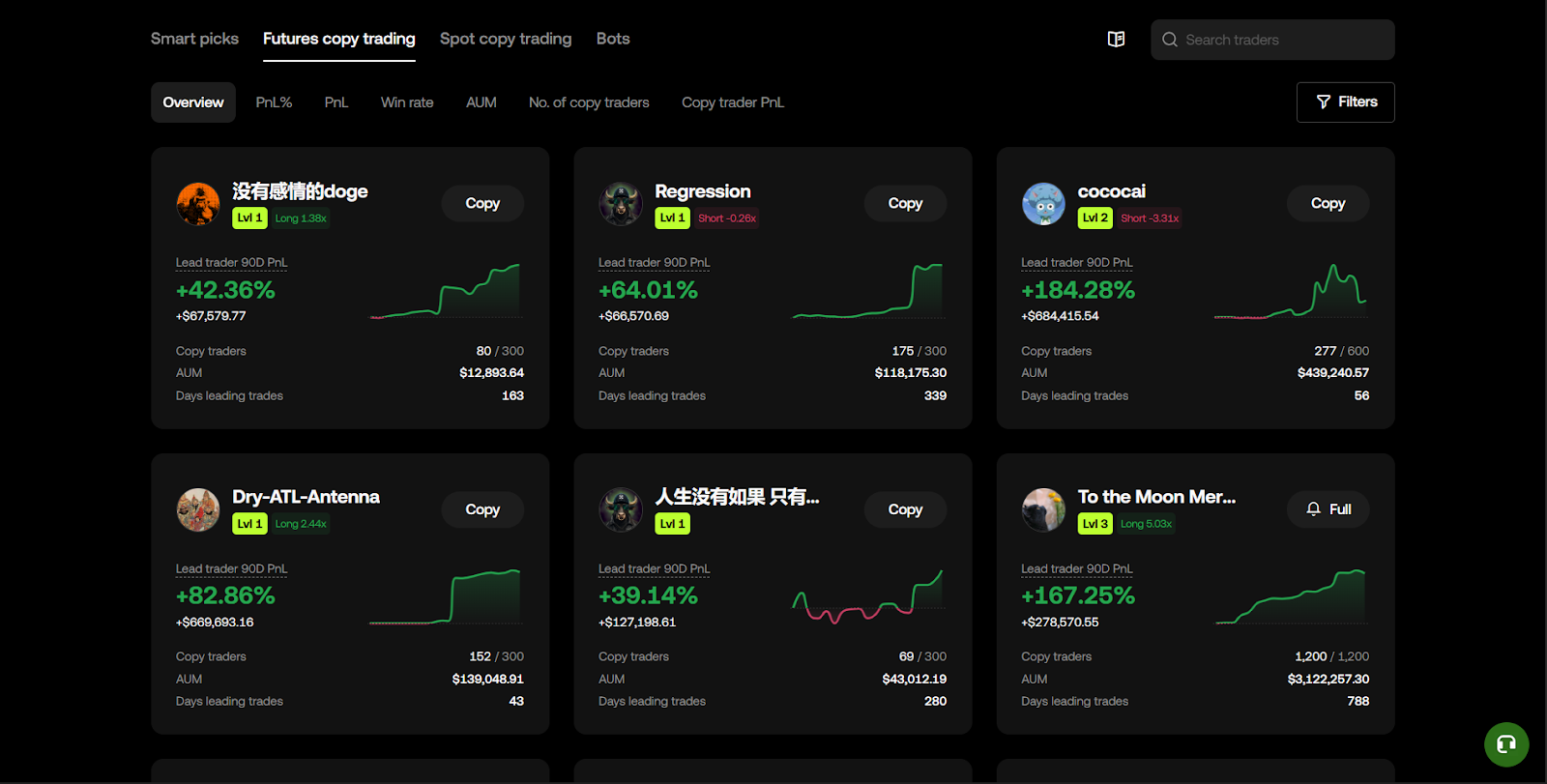

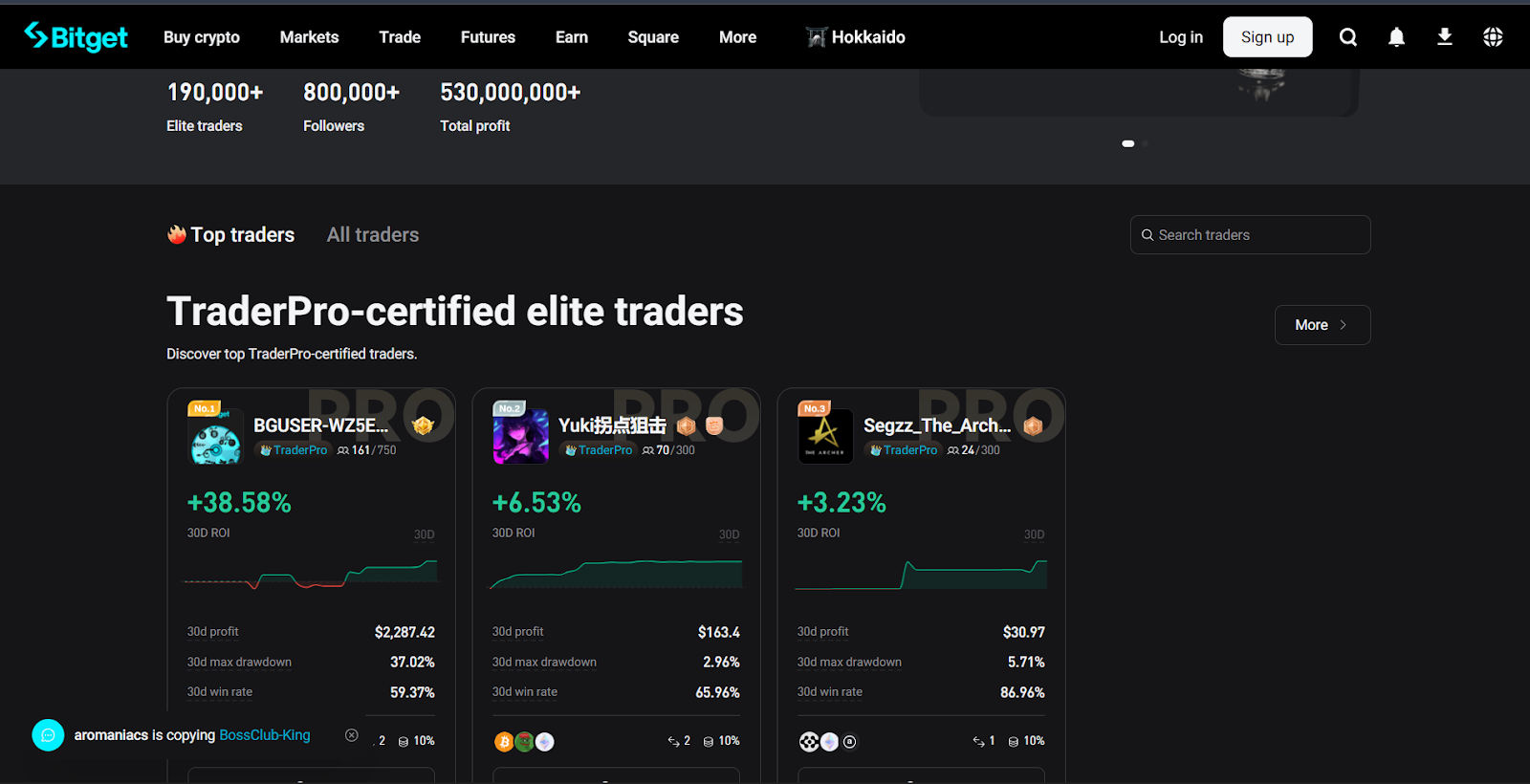

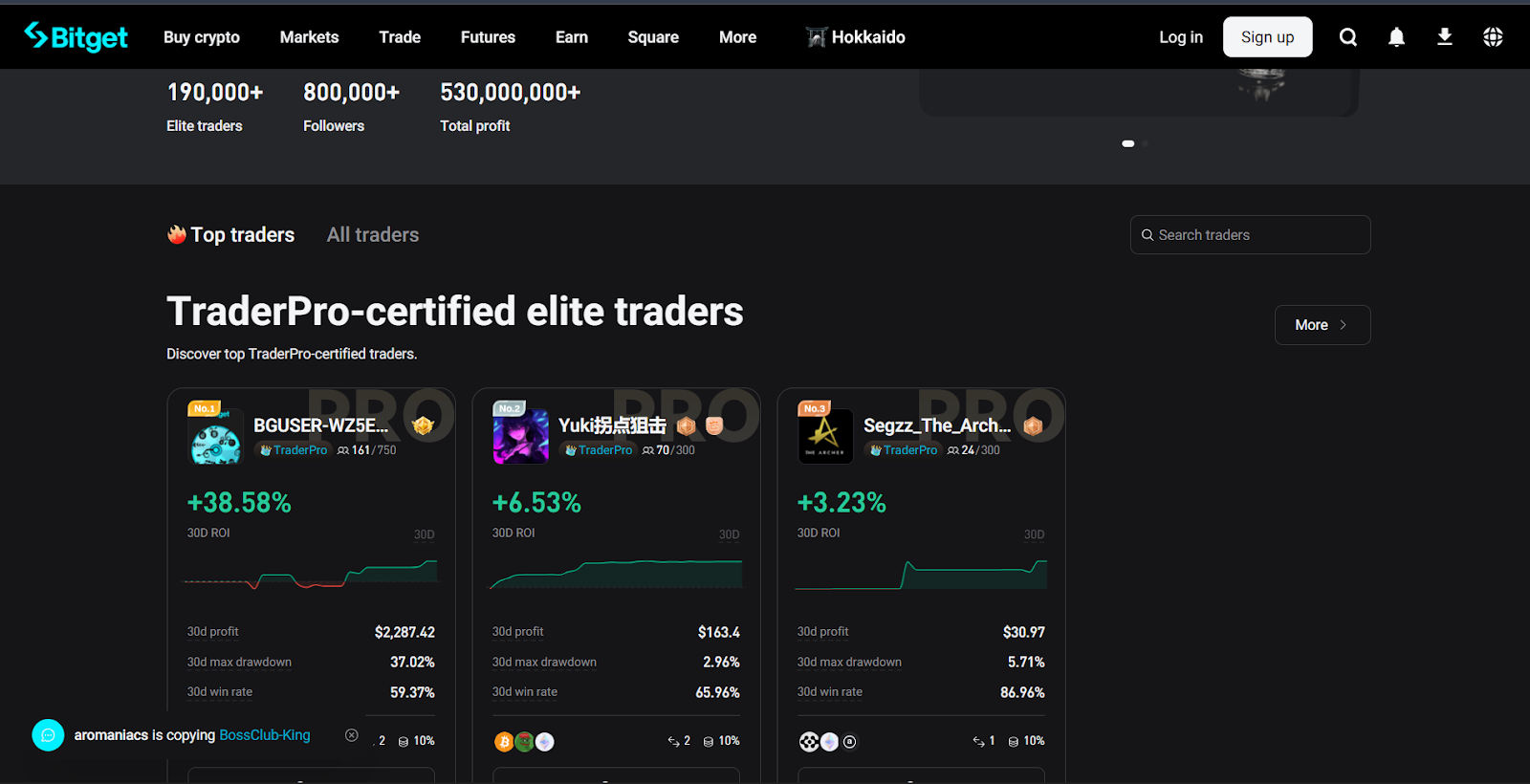

8. Bitget

Bitget has change into a significant participant within the crypto house since its launch in 2018, particularly for its pioneering work in copy buying and selling. The platform was one of many first to introduce one-click copy buying and selling, which has made it a favourite for merchants who need to automate their methods by following seasoned professionals.

Professionals & Cons of Bitget

ProsConsOne of many largest copy buying and selling platforms with an enormous person base.Not out there to customers in america and Canada.Low buying and selling charges and a simple profit-sharing mannequin.The platform can really feel crowded with so many merchants to select from.Helps each spot and futures copy buying and selling.Requires Know Your Buyer (KYC) verification for full entry.Sturdy threat administration options for followers.The cellular app may be much less intuitive than the desktop model.

Key Options of Bitget Copy Buying and selling

Huge Pool of Elite Merchants: You get entry to one of many largest networks {of professional} merchants. The platform hosts over 130,000 elite merchants, providing you with an infinite vary of methods and types to select from and observe.Complete Efficiency Information: Bitget provides you all the knowledge it’s essential make a good move. You’ll be able to test a dealer’s complete revenue and loss (PnL), ROI, win price, and AUM (Belongings Below Administration) to seek out somebody who suits your threat tolerance.Spot and Futures Copy Buying and selling: The platform helps copy buying and selling in each the spot and futures markets. This lets you diversify your method, whether or not you like the lower-risk nature of spot buying and selling or the high-leverage potential of futures.Customized Threat Controls: You keep in charge of your cash. Bitget permits you to set particular parameters in your copied trades, together with the quantity per commerce, stop-loss ranges, and take-profit targets.

Copy Buying and selling Charges on Bitget

All copied trades are topic to the platform’s normal buying and selling charges. For spot buying and selling, maker and taker charges are 0.1%. If you happen to use Bitget’s native token (BGB) to pay for charges, you get a 20% low cost. For futures buying and selling, the maker payment is 0.02% and the taker payment is 0.06%.

The profit-sharing mannequin is easy. Whenever you observe an elite dealer, you comply with share a portion of your web earnings with them. This fee ranges from 4% to 10%, which the elite dealer units. You solely pay this payment on trades that earn money, guaranteeing that the dealer you’re copying is motivated to carry out nicely.

9. Coinbase

Based in 2012, Coinbase has earned a stable repute for security, ease of use, and regulatory compliance. Whereas buying and selling crypto is simple on Coinbase, its tackle copy buying and selling stands out. The trade doesn’t provide a built-in copy buying and selling function; as an alternative, it helps you to hyperlink your Coinbase account to trusted third-party platforms for automated, social buying and selling.

Professionals & Cons of Coinbase

ProsConsExtremely safe and controlled platform.No native, in-house copy buying and selling function.Straightforward for inexperienced persons to navigate.Buying and selling charges may be increased than different giant exchanges.Out there to customers in america and lots of different areas.Depends on exterior companions for copy buying and selling performance.Properly-known model with deep liquidity.Entry relies on options provided by associate platform.

Key Options of Coinbase Copy Buying and selling

Fund Safety: Your crypto stays in your Coinbase account, protected by the trade’s safety. Regulated Integrations: You’ll be able to solely connect with social buying and selling companions that meet excessive requirements for security and compliance.Fast Setup: You hyperlink your Coinbase account, choose a dealer to observe, and set your funding quantity.Excessive Liquidity for Trades: Trades are executed on Coinbase, so that you profit from fast order fills and minimal worth slippage.

Copy Buying and selling Charges on Coinbase

The charges for copy buying and selling with Coinbase come from two locations. You pay Coinbase’s aggressive buying and selling charges, that are usually 0.05%–0.60% for maker orders and 0.10%–0.80% for taker orders, primarily based in your month-to-month buying and selling quantity. The associate platform might add a profit-sharing fee, normally about 10% of any web earnings earned from copied trades.

10. Gate.io

Established in 2013, Gate.io is without doubt one of the oldest and most complete cryptocurrency exchanges available in the market. Its platform is understood for providing an infinite collection of digital property, making it a vacation spot for merchants in search of entry to new and rising cash. Gate.io has built-in a robust copy buying and selling system that allows you to faucet into this huge market by following the methods of knowledgeable merchants.

Professionals & Cons of Gate.io

ProsConsEnormous collection of over 3,400 cryptocurrencies.Not out there to customers in america and Canada.Superior filtering choices to seek out prime merchants.The sheer variety of choices may be overwhelming for inexperienced persons.Sturdy safety with 100% proof-of-reserves.Consumer interface is extra suited to skilled merchants.Aggressive payment construction and profit-sharing mannequin.Requires KYC verification for full platform entry.

Key Options of Gate.io Copy Buying and selling

Unmatched Asset Choice: You get entry to one of many largest choices of cryptocurrencies out there for copy buying and selling. With over 3,400 cash, you’ll be able to observe merchants who specialise in the whole lot from main gamers like Bitcoin to obscure, high-potential altcoins.Superior Dealer Analytics: Gate.io supplies an in-depth take a look at every lead dealer’s efficiency. You’ll be able to assessment their complete funding, ROI, win price, and previous trades. Customizable Copying Parameters: The platform permits you to set a hard and fast quantity or a multiplier in your copied trades. You may as well implement a stop-loss ratio to routinely exit positions and defend your capital.Leaderboard and Filtering: The platform’s leaderboard helps you rapidly determine top-performing merchants. You’ll be able to filter them by varied metrics, together with ROI, complete revenue, and the variety of followers, making it simpler to seek out an funding technique that aligns along with your monetary targets.

Copy Buying and selling Charges on Gate.io

All copied trades are topic to the platform’s normal spot buying and selling charges, that are 0.2% for each makers and takers. If you happen to maintain the platform’s native GateToken (GT), you’ll be able to obtain reductions on these charges. Whenever you copy a lead dealer, you agree to present them a 5% fee in your web earnings. This payment is barely charged when a commerce is worthwhile.

What’s Copy Buying and selling in Crypto?

Copy buying and selling in crypto is a technique the place you replicate the buying and selling actions of skilled merchants. This may be executed manually by observing their trades or routinely by way of platforms that sync your buying and selling account with theirs. It’s notably fashionable amongst inexperienced persons because it permits them to be taught buying and selling methods whereas probably incomes earnings.

The method is social in nature, usually involving leaderboards or profiles the place you’ll be able to analyze a dealer’s efficiency, threat ranges, and methods earlier than deciding to observe them. Many crypto trade platforms, like eToro and PrimeXBT, provide built-in instruments for copy buying and selling, whereas others permit integration with third-party providers.

Is Crypto Copy Buying and selling Worthwhile in 2025?

Copy buying and selling may be worthwhile in 2025, however its success largely relies on a number of components, together with the dealer you select to observe, your threat administration methods, market situations, and the underlying causes for partaking in crypto buying and selling. Right here’s what it’s essential think about:

Selecting the Proper Dealer: Profitability hinges on deciding on a talented and constant dealer. Search for merchants with a confirmed monitor file, excessive win charges, and low drawdowns. Market Volatility: Crypto markets are inherently risky, which may amplify each positive aspects and losses. Whereas skilled merchants might navigate this volatility successfully, it’s essential to grasp that no technique is foolproof.Threat Administration: Even with copy buying and selling, you stay in charge of your investments. Setting stop-loss limits, diversifying your portfolio, and never over-allocating funds to a single dealer will help to mitigate dangers.Revenue-Sharing Charges: Most copy buying and selling crypto platforms cost a proportion of your earnings as a fee to the dealer you observe. Whereas this aligns their pursuits with yours, it’s vital to issue these charges into your total profitability.

Forms of Crypto Copy Buying and selling Platforms

Crypto copy buying and selling platforms are available varied types, every catering to completely different merchants and buyers. Listed here are the principle classes.

1. Dealer-Built-in Copy Platforms

These platforms are constructed immediately into cryptocurrency exchanges or brokers, reminiscent of eToro or PrimeXBT. They permit customers to copy knowledgeable trades seamlessly with no need exterior instruments. The benefit is comfort and safety, as your funds stay throughout the dealer’s ecosystem.

2. Third-Occasion Platforms and Aggregators

Third-party platforms like ZuluTrade or Covesting connect with a number of exchanges through APIs. They mixture merchants from varied platforms, providing you with a broader collection of methods to repeat. Whereas they provide flexibility, you’ll want to make sure the safety of API connections and be aware of extra charges these providers might cost.

3. Social Buying and selling Platforms

Social buying and selling platforms, reminiscent of these provided by Binance or KuCoin, mix copy buying and selling with neighborhood interplay. They permit customers to observe, focus on, and be taught from skilled merchants in a social surroundings. These platforms are perfect for many who worth collaboration and need to interact with a neighborhood whereas buying and selling.

The right way to Select the Proper Crypto Copy Buying and selling Platform?

Choosing the right copy buying and selling platform crypto requires cautious consideration of a number of key components. Right here’s what to guage:

Platform Repute and Trustworthiness. Analysis the platform’s historical past, person critiques, and safety monitor file. Established platforms have a confirmed repute for reliability and transparency.Dealer Efficiency Metrics. Search for platforms that present detailed analytics on lead merchants, reminiscent of ROI, win price, drawdowns, and buying and selling historical past. Supported Cryptocurrencies. Make sure the platform helps the property you need to commerce. Some platforms concentrate on main cryptocurrencies like Bitcoin and Ethereum, whereas others provide a broader vary, together with altcoins.Group and Assist. Platforms with lively communities and responsive buyer help can improve your expertise. Regulatory Compliance. Verify if the platform complies with native rules and affords providers in your area.

The right way to Begin & Succeed with Crypto Copy Buying and selling

Beginning with crypto copy buying and selling includes selecting a reliable platform and setting clear targets. First, hyperlink your account to verified merchants whose efficiency is open and simple to guage. Resolve how a lot cash to speculate, use built-in instruments like stop-loss and take-profit limits, and repeatedly test your outcomes. Keep away from copying too many merchants directly; concentrate on understanding how every technique performs in numerous market conditions. Consistency, self-discipline, and good threat administration are important for long-term success.

The right way to Select the Greatest Crypto Merchants to Copy

Search for merchants with a stable historical past of being profitable, low drawdowns, and methods that suit your threat degree. Study metrics like crypto ROI, win price, and common commerce period to guage efficiency. Keep away from merchants who take large dangers or have inconsistent outcomes. One of the best copy buying and selling crypto methods come from merchants who concentrate on regular development, clear communication, and efficient threat management.

Confirmed Copy Buying and selling Methods That Work in 2025

Diversify Your Portfolio: Comply with a number of merchants with completely different methods to scale back threat. A balanced mixture of short-term, long-term, and sector-focused merchants will help stabilize returns when the market fluctuates.Set Cease-Loss Limits: Defend your investments by limiting potential losses. Automated stop-loss settings maintain you in management, even when the market modifications unexpectedly.Monitor Efficiency Often: Repeatedly assess the merchants you observe and make modifications when mandatory. Monitor their success charges, threat scores, and buying and selling frequency to remain according to your revenue targets.Begin Small: Begin with a small funding to get a really feel for the platform earlier than growing your stake. This methodology helps you perceive how the platform operates and enhance your technique with out risking an excessive amount of of your capital.

Ultimate Verdict: Which Platform Ought to You Select?

One of the best copy buying and selling crypto platform relies on your buying and selling type. eToro is a superb possibility for inexperienced persons due to its regulated surroundings and lively dealer neighborhood. Bitget and Binance are higher for customers who want superior instruments, excessive liquidity, and the prospect to repeat futures merchants.

If low charges and quite a lot of methods are your prime priorities, MEXC and Gate.io present glorious flexibility. Bybit and OKX are good for merchants looking for entry to analytics, leverage, and customizable copy buying and selling choices.

Whatever the platform you choose, make sure that to assessment every dealer’s historical past, set clear threat limits, and begin with small quantities. Copy buying and selling may be an efficient strategy to be taught and earn when paired with constant threat administration and the fitting platform in your aims.

FAQs

What’s the most profitable copy buying and selling platform?

Probably the most profitable copy buying and selling platform delivers constant outcomes, helps a big community of merchants, and affords options that match your buying and selling targets.

What’s the most dependable copy dealer?

A dependable copy dealer exhibits regular earnings, maintains low drawdowns, and follows a method that matches your threat tolerance.

Do you want KYC for copy buying and selling?

Sure, KYC is usually required for copy buying and selling. This course of ensures compliance with rules and enhances the safety of your buying and selling actions.

Is copy buying and selling an excellent possibility for inexperienced persons?

Sure, copy buying and selling is an effective selection for inexperienced persons. It permits them to be taught from skilled merchants whereas getting actual market expertise. Beginning small and diversifying helps decrease threat and construct confidence.

Are you able to lose cash whereas copy buying and selling?

Sure, dropping cash is feasible in copy buying and selling as a result of it includes market dangers. Even one of the best merchants can expertise losses, so it’s vital to watch your investments and set stop-loss limits.