The macro calendar is stacked in a manner that crypto hasn’t seen in months, with financial coverage, geopolitics and Washington dysfunction converging right into a single five-day window that additionally contains megacap tech earnings and the month-to-month candle shut for Bitcoin on Friday. As The Kobeissi Letter put it, “This week goes to be motion packed… All whereas President Trump meets with China’s President Xi on Thursday, 48 hours earlier than his 100% tariff is about to go ‘dwell.’ Buckle up for a wild week.”

Kevin (@Kev_Capital_TA) captured the market temper from the risk-asset aspect: “I’m very enthusiastic about this week. We’ve got Large Tech earnings, FOMC, Trump/XI assembly, and a possible finish to this annoying authorities shutdown. If all goes properly we will have nice earnings with high quality steering, a decrease fed funds fee, an finish to QT, a solidified commerce cope with China, and a reopened authorities. Sounds good to me. Ought to be enjoyable to look at.”

Joe Consorti went additional on the crypto read-through: “That is the week when the cloud of uncertainty that has loomed over Bitcoin might lastly carry… Couple this with traders already transferring into threat to juice their returns into year-end, and also you’ve bought all the catalysts wanted to ideally break BTC out of its 7-month consolidation interval.”

That is the week when the cloud of uncertainty that has loomed over Bitcoin might lastly carry.

• Trump-Xi commerce deal might be reached• The Fed will doubtless ship steering on the tip of QT• Alphabet, Amazon, Apple, Meta, and Microsoft, together with 20% of the S&P 500, will…

— Joe Consorti ⚡️ (@JoeConsorti) October 26, 2025

4 Issues To Watch This Week As Bitcoin Faces A Important Check

The Federal Reserve units the tone on Wednesday. The October FOMC assembly runs Tuesday–Wednesday, October 28–29, adopted by Chair Powell’s press convention. Markets will parse the assertion and any steering on the cadence and endpoint of balance-sheet runoff aka finish of quantitative tightening (QT) on condition that progress and labor indicators have softened into the autumn.

The second pillar is the US–China commerce deal. Into Thursday’s Trump–Xi assembly in South Korea, either side have signaled a “framework” to avert the administration’s threatened 100% blanket tariff on Chinese language imports. US and Chinese language officers spent the weekend crafting a tentative understanding that might lengthen a tariff truce and revive “substantial” agricultural purchases, with US Treasury Secretary Scott Bessent rising because the administration’s public level man.

Feedback late Sunday and early Monday described “consensus on main commerce points” after “frank and constructive” talks, and framed the leader-level assembly because the venue to finalize the deal structure. The market-moving toggle is binary: a signed framework that delays or rescinds the 100% tariff slated for November 1, or a breakdown that lets it activate. Within the wake of the information, the value of Bitcoin has already risen by over 4%.

Washington’s third stress level is the federal government shutdown, which entered its fourth week and approaches Day 27 as of Monday, October 27. The coverage relevance for Bitcoin and the broader crypto market is twofold.First, extended shutdowns have traditionally delayed knowledge releases and constrained regulatory processes that contact crypto markets on the margin. Second, the fiscal optics matter for the charges complicated forward of Wednesday.

Layered on high is Large Tech earnings. Alphabet and Microsoft report Wednesday after the bell, with Apple and Amazon following on Thursday, that means that outcomes and steering from roughly $15 trillion in market capitalization might be hitting the tape inside 36 hours of the FOMC. These releases can drive cross-asset volatility through index strikes, greenback sensitivity and broader threat sentiment, they usually typically spill over to Bitcoin and crypto when positioning is tight.

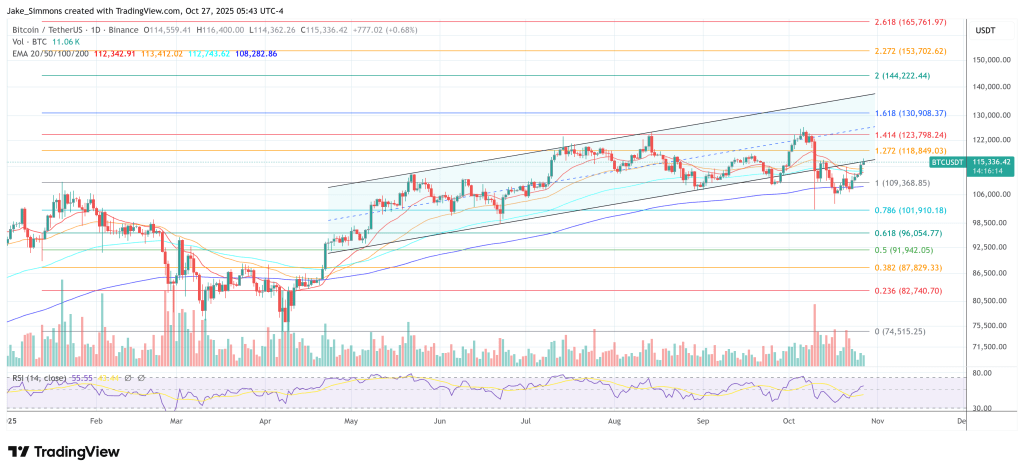

All of this lands simply as Bitcoin prints its October month-to-month shut on Friday, October 31. Technically, BTC has been compressing, with a number of analysts noting a uncommon four-month band of month-to-month opens and closes inside an ~single-digit proportion envelope and repeated assessments of the macro vary boundaries.

As Daan Crypto Trades noticed, “Bitcoin’s worth has opened & closed inside a small 8% worth vary in the course of the previous 4 months. A much bigger transfer is coming sooner or later.” Rekt Capital framed the present bounce as a “sturdy rebound from the Macro Vary Low,” whereas others pointed to the psychology of a whipsawing October: “this month-to-month candle has destroyed portfolios, desires, ambitions, aspirations, and hope—first for bulls, and now for bears… gross,” wrote @crypthoem.

A month-to-month shut above the September shut at $114,048 could possibly be a bullish signal after a turbulent October with probably the most brutal liquidations occasion in historical past for the market.

At press time, BTC traded at $115,336.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.