In accordance with NYDIG analysis, Bitcoin’s value strikes are pushed extra by the energy of the US greenback and broad liquidity situations than by direct ties to inflation.

Greg Cipolaro, NYDIG’s world head of analysis, stated the info present weak and inconsistent hyperlinks between inflation measures and Bitcoin. That view shifts consideration away from the outdated narrative that Bitcoin is principally an inflation hedge.

Associated Studying

Inflation Hyperlink Weak

Cipolaro argued that expectations for inflation are a barely higher sign than headline inflation readings, however nonetheless not a good predictor of Bitcoin’s value.

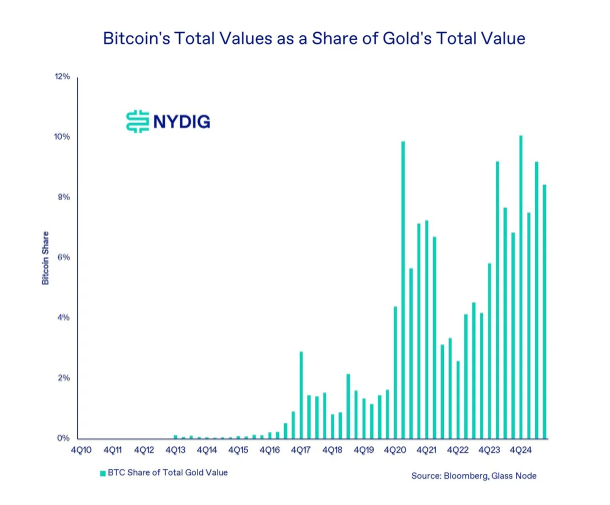

As a substitute, Bitcoin and gold each have a tendency to realize when the US greenback weakens. Whereas gold’s inverse relation with the greenback is lengthy established, Bitcoin’s reverse motion to the greenback is newer however seen.

Gold And Bitcoin React To Greenback Strikes

Primarily based on reviews, gold has traditionally climbed because the greenback falls. Bitcoin is following that sample, although its correlation is much less regular than gold’s.

As Bitcoin turns into extra linked with mainstream finance, NYDIG expects that its inverse relationship with the greenback will doubtless strengthen.

This is smart to merchants who value every part in {dollars} and search options when the buck loses buying energy.

Curiosity Charges And Cash Provide

Cipolaro highlighted rates of interest and cash provide as the 2 main macro levers that transfer each gold and Bitcoin.

Decrease rates of interest and looser financial coverage have tended to assist increased costs for these belongings.

In easy phrases: when borrowing prices drop and liquidity rises, Bitcoin typically advantages. The word framed gold as extra of a real-rate hedge, whereas Bitcoin is described as appearing like a gauge of market liquidity — a refined however necessary distinction for traders.

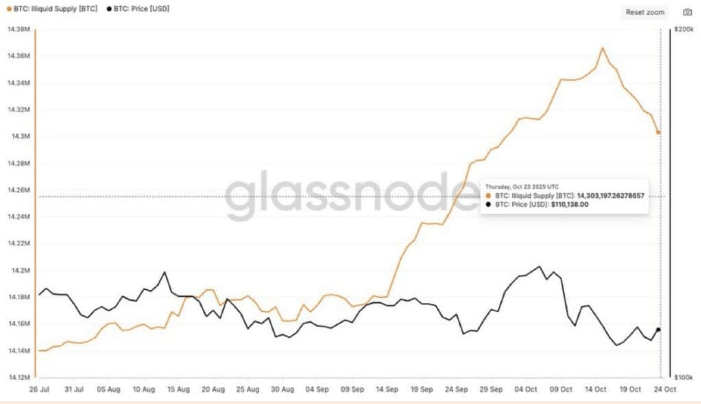

Illiquid Provide Drops, Promoting Strain Returns

On-chain information present indicators of renewed promoting. Stories say illiquid Bitcoin — cash held in long-dormant wallets — fell from 14.38 million earlier in October to 14.300 million on the twenty third of October.

Associated Studying

That change means roughly 62,000 BTC, value about $6.8 billion at latest costs, moved again into circulation. Prior to now, massive inflows did exert value stress. In January 2024, a considerable sum of cash got here out there that induced the worth momentum to melt.

In accordance with Glassnode information, there was a constant selloff from wallets holding from 0.1 to 100 BTC, and first-time purchaser provide has contracted right down to ~213,000 BTC.

The general evaluation from a macro perspective and on-chain metrics isn’t favorable. Demand from new consumers seems to be lighter, momentum merchants seem to have stepped apart, and extra cash are actually out there to commerce. This mixture can blunt rallies or deepen pullbacks till liquidity situations enhance or the greenback weakens.

Featured picture from Gemini, chart from TradingView