The Day by day Breakdown takes a deep dive into Ferrari, uncovering its margins, steering out to 2030, and the valuation for RACE inventory.

Earlier than we dive in, let’s ensure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our day by day insights, all you should do is log in to your eToro account.

Deep Dive

Ferrari is finest identified for its luxurious supercars and System 1 legacy. Whereas it’s been constructing automobiles for greater than 75 years, the inventory — buying and selling below the ticker image “RACE” — will mark its 10-year anniversary as a public firm on October 21. Since its debut, shares have climbed greater than 600%, simply outpacing the S&P 500’s ~230% achieve over the identical interval.

Regardless of its long-term success, Ferrari hit a pace bump lately. From its October 2 excessive to its October 14 low, shares dropped over 25%. The decline adopted its Capital Markets Day, the place administration issued new long-term steering. The headline takeaway? Slower progress, however stronger profitability.

Administration now expects 2030 income of roughly €9 billion — beneath analysts’ estimates and implying 5% annual progress versus the 9% forecast from its 2022 to 2026 plan. Nevertheless, margins impressed: Ferrari anticipates EBITDA margins of a minimum of 40% and EBIT margins of a minimum of 30%, each above prior steering. Additional, industrial free money move is predicted to almost double to €8 billion between 2026 and 2030 (up from the €4.6 billion to €4.9 billion anticipated in 2022 to 2026).

Above is a chart of the corporate’s working margin and free money move margin — the latter which means how a lot of each greenback in income falls all the way down to the corporate’s free money move. Discover how robust of margins Ferrari generates (vs. the single-digit percentages we frequently see within the auto house).

The TLDR for buyers: Ferrari is steering towards slower gross sales progress, however greater profitability and money move.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper — Valuation

In terms of Ferrari, it could be tough to distinguish the enterprise from different low-margin automakers. Administration rigorously builds an order guide — one that’s now stretching into 2027, per administration’s remarks on the latest convention name — after which focuses on execution and supply.

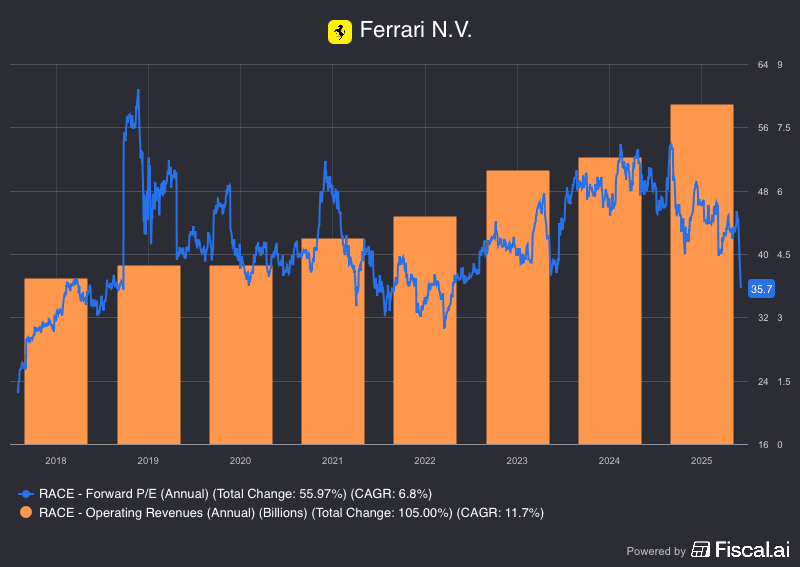

We are able to see that steadiness within the chart beneath too, which highlights income (in orange) and the ahead P/E ratio (in blue).

Discover two key factors: first, Ferrari’s income held regular by way of the pandemic-related logistical challenges of 2020 and continued climbing regardless of the 2022 bear market, which was marred by hovering inflation and rising rates of interest. Second, discover how the valuation is approaching its lowest a number of since mid-2022, when the inventory bottomed amid the broader market correction.

Dangers and the Backside Line

Keep in mind, as a result of Ferrari has much better margins than different automakers, it’s going to command the next valuation. Nevertheless, it nonetheless faces the chance of valuation compression, because the market could determine the inventory now not deserves as a lot of a premium given slower income progress expectations. Tariff-related headlines might additionally spook buyers, whereas a world slowdown or pandemic-like shock would threaten demand and operations. Lastly, the inventory is out of favor proper now and it’s not clear when that may change. Traders ought to take that into consideration when assessing this inventory for his or her desired timeframe.

The Backside Line: Some buyers could really feel Ferrari is just too uncovered or too costly to warrant a place. Others could really feel that the latest ~26% correction was an overreaction and should discover its valuation low-cost when in comparison with the final a number of years.

Disclaimer:

Please be aware that attributable to market volatility, a number of the costs could have already been reached and situations performed out.