Meet the “toll sales space” of digital transactions: Visa. The Each day Breakdown dives into this firm’s enterprise to see what’s occurring underneath the hood.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our day by day insights, all it’s essential to do is log in to your eToro account.

Deep Dive

Yesterday we seemed on the charts for Visa and right this moment we’re taking a deeper dive into the basics. Visa shares have struggled for the reason that inventory hit a file excessive in June, down about 7.5%. Regardless of that, Visa is up about 26% over the previous 12 months and sports activities a formidable long-term observe file, up 368% during the last decade. For context, the S&P 500 is up “simply” 233% in that span.

The Enterprise

Buyers know Visa as a credit score and debit card firm — that a lot is apparent. However it’s sometimes called the “toll sales space” of digital transactions. MasterCard enjoys the same distinction. And whereas there are different bank card firms — like American Categorical, Capital One, and Synchrony Monetary — in addition they perform as banks. Whereas there are professionals and cons to every enterprise mannequin, Visa and MasterCard command a lot larger revenue margins with their enterprise.

Progress

Visa has grown its income and earnings at a compound annual progress fee (CAGR) of 11.1% and 15.7%, respectively. Wanting ahead, analysts anticipate spectacular outcomes as effectively, together with:

Income progress estimates*: 11.4% in 2025, 10.6% in 2026, and 10% in 2027.

Earnings progress estimates*: 15.3% in 2025, 12.3% in 2026, and 12.7% in 2027.

*Estimates in keeping with Fiscal.ai

Need to obtain these insights straight to your inbox?

Enroll right here

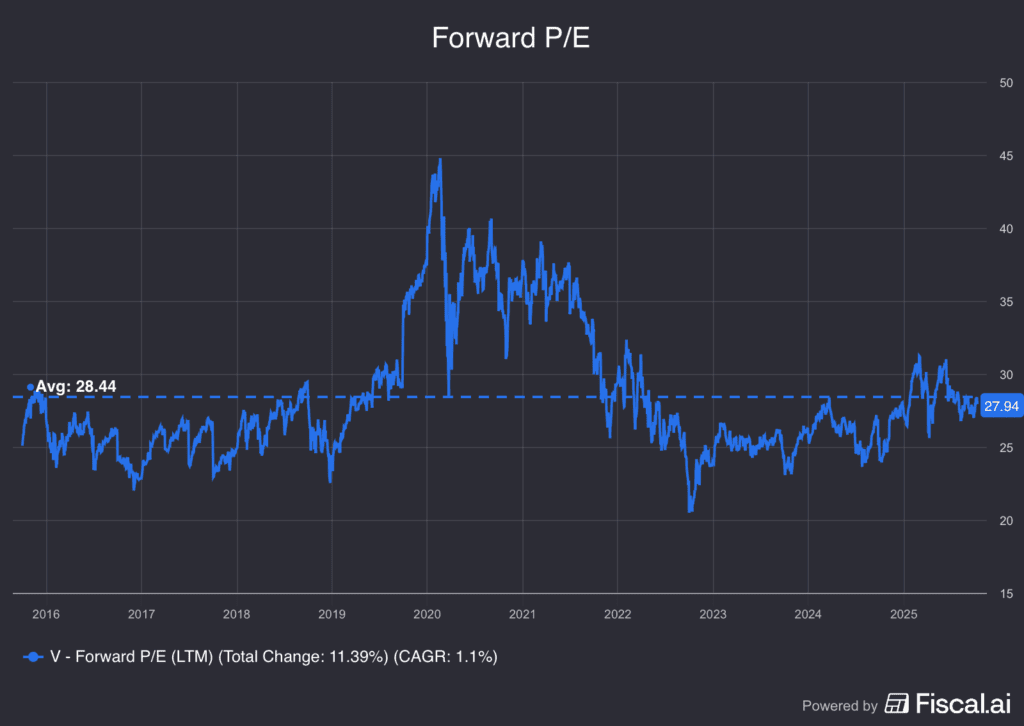

Diving Deeper: Valuation

Buying and selling at roughly 28x ahead earnings expectations, Visa inventory is about in-line with its long-term common. The inventory has been thought of comparatively low cost when shares commerce at about 23x to 24x ahead earnings and costly within the low- to mid-30x. Traditionally, many traders have justified Visa’s premium valuation as a consequence of its elevated progress charges and excessive margins.

Dangers & Backside Line

The principle dangers to Visa are fairly apparent: Market volatility and financial exercise.

If market volatility picks up, Visa isn’t immune. As an illustration, the inventory suffered a peak-to-trough decline of ~18.5% earlier this 12 months amid the tariff tantrum. Whereas this was really higher than the S&P 500’s swing of 21.3%, it’s nonetheless an enormous swing.

The opposite threat can be an financial slowdown or a recession. As a result of Visa is a worldwide firm, a worldwide or US slowdown can be a adverse for a lot of companies — bank card firms included — particularly in relation to consumption.

The Backside Line: Buyers who imagine Visa will proceed to generate sturdy top- and bottom-line progress might justify the inventory’s valuation, which is at a slight premium to the S&P 500 however roughly in-line with its long-term common. Those that view the inventory as unattractive at present ranges might look ahead to Visa’s valuation to doubtlessly dip to a extra engaging stage or they could not like Visa’s enterprise and determine to ignore it altogether.

Disclaimer:

Please observe that as a consequence of market volatility, a few of the costs might have already been reached and situations performed out.