This report is dropped at you in partnership with WEEX Change, a platform dedicated to transparency and innovation in crypto buying and selling. Collectively, we purpose to make crypto extra accessible and comprehensible for everybody.

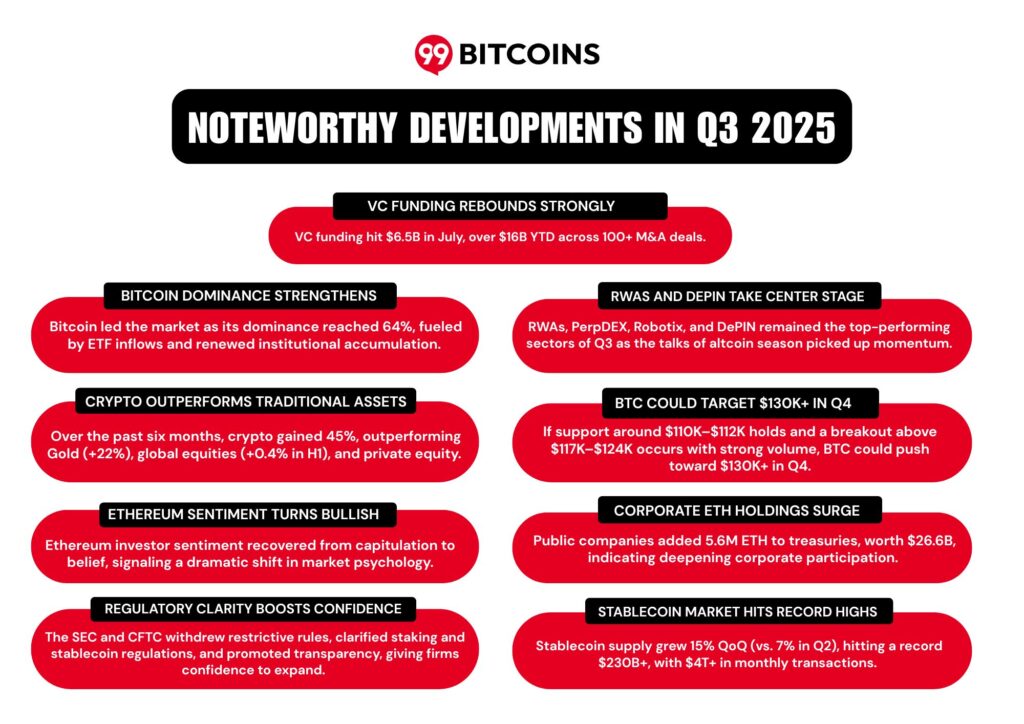

In Q3 2025, the crypto market grew by 23%, following a 22% rise in Q2. This regular progress got here in 1 / 4 that has traditionally been extra risky than Q1 and This fall. As compared, international fairness markets reached $127.71 trillion within the first half (H1) of 2025, displaying solely a small improve of 0.4% from the second half (H2) of 2024, and a average 6.24% acquire from H1 2024.

The crypto market additionally outperformed non-public fairness and Gold. Over the previous six months, Gold returned round 22%, whereas crypto gained greater than 45%.

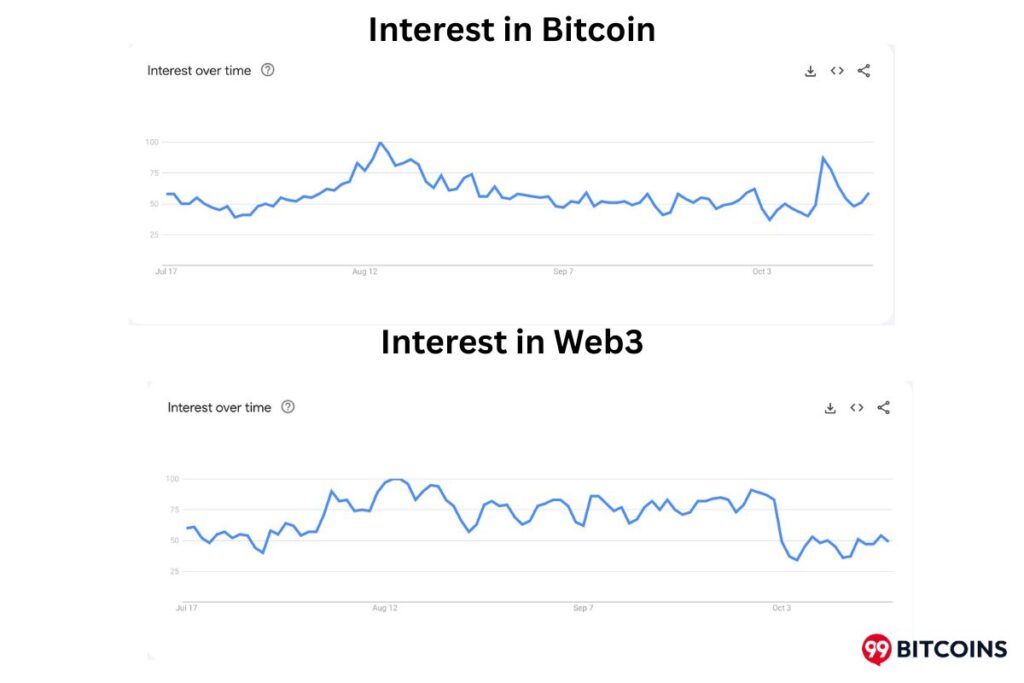

99Bitcoins discovered that curiosity in crypto and Bitcoin has dropped in comparison with the height throughout final yr’s U.S. Presidential election. Whereas curiosity remains to be robust, it hasn’t returned to these ranges. Actually, this quarter, folks on X talked extra about altcoins than Bitcoin. Nonetheless, Google searches for “Web3” have been near document highs, displaying that traders have been actively in search of early alternatives.

Curiously, in August, SEC filings reached an all-time excessive of 8,110 blockchain mentions, 3620 of which have been about Bitcoin. This implies extra companies are holding, buying and selling, or constructing merchandise tied to Bitcoin and blockchain. The SEC, on the similar time, is paying nearer consideration and pushing firms to be clear about any crypto publicity.

Crypto Market Report Q3: Abstract

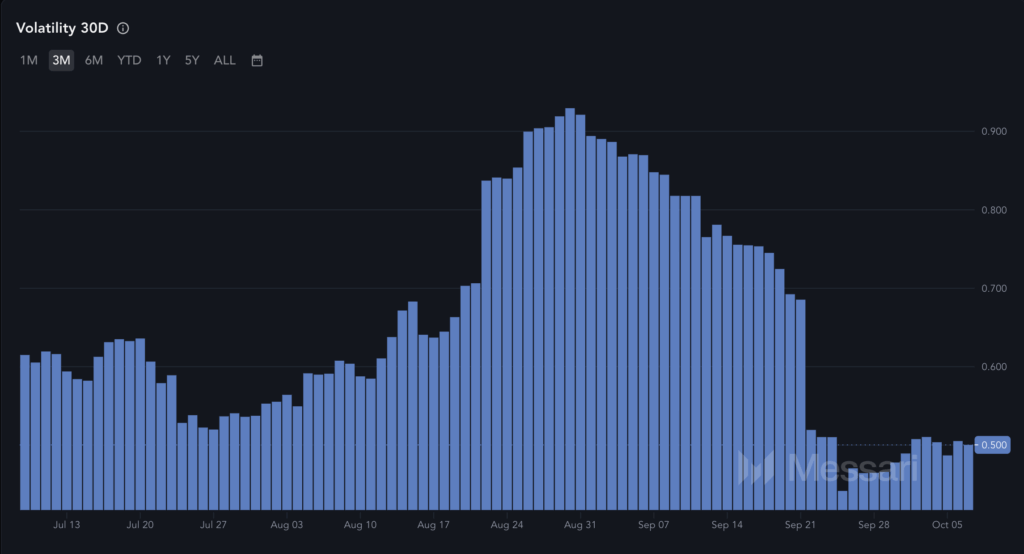

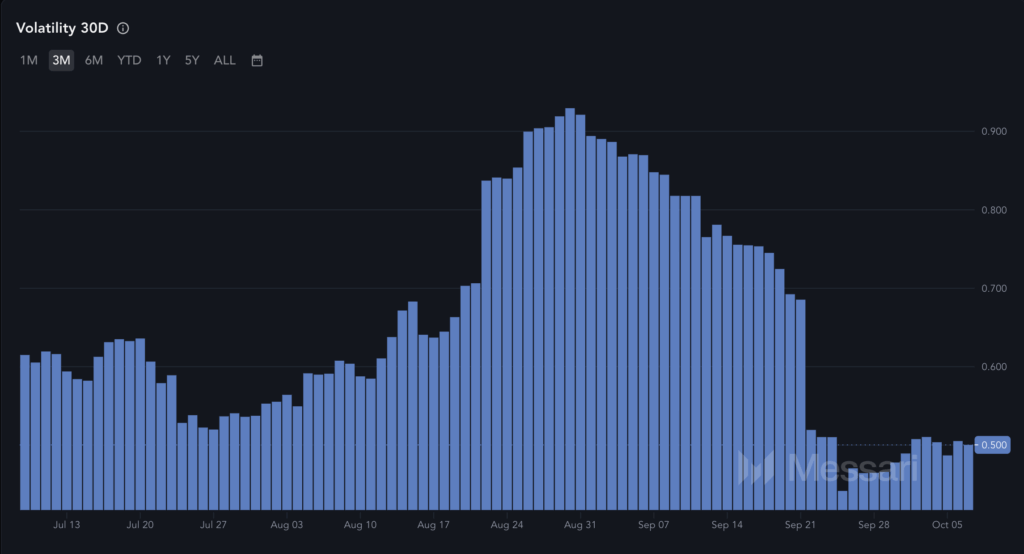

Just like the final quarter, institutional adoption continued to realize traction, whereas retail investor exercise was comparatively subdued. Many of the cash flowed into the highest 20 crypto property, and the speak of an anticipated ‘altcoin season’ dominated the market sentiment. In response to the Crypto Volatility Index (CVI), the market was most unstable in July and the primary week of September. However as soon as the rate of interest lower was confirmed, volatility dropped noticeably.

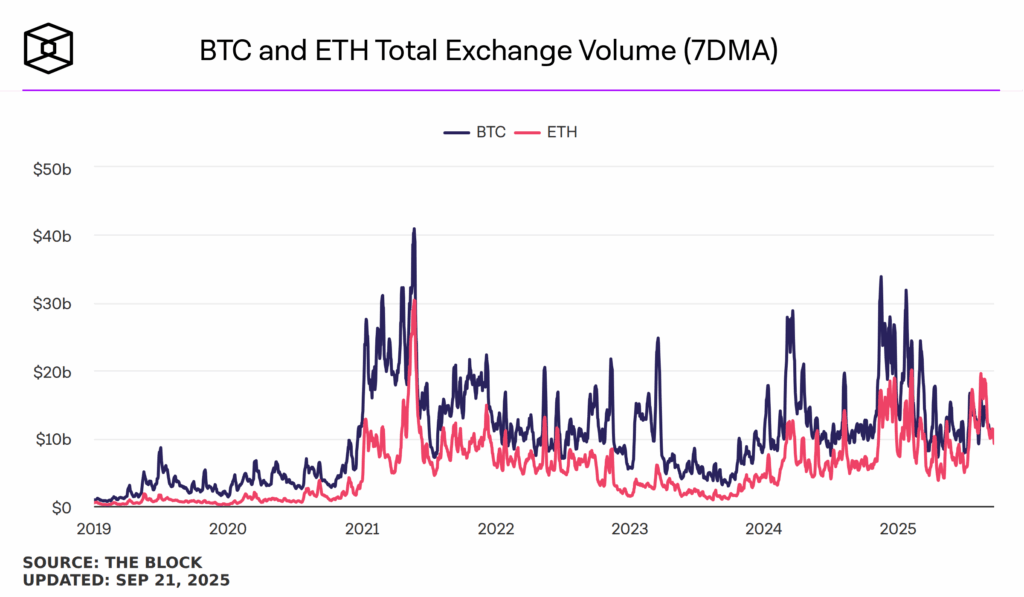

99Bitcoins discovered the danger of stagflation was within the air as buying and selling volumes surged. In July, Centralized Exchanges (CEX) dealt with about $1.7 trillion whereas Decentralized Exchanges recorded round $1 trillion, with Solana and Hyperliquid driving a lot of the exercise. That gave DEXs a 37% share of the entire buying and selling. In August, nonetheless, the image modified; DEX share dropped to 16.5%, with volumes at $369 billion in comparison with $1.86 trillion on CEXs, the very best since January 2025. In September, buying and selling exercise on each CEXs and DEXs remained robust.

State of the Cryptocurrency Market in Q3 2025

From mid-July to mid-August, market sentiment leaned in the direction of greed. However the concern and greed index stayed in impartial territory for many different buying and selling periods. 99Bitcoins discovered Bitcoin’s dominance was comparatively robust in July, at round 60%- 65%. By August, it slipped to roughly 59%, and in September, it settled within the 57%- 60% vary.

Many long-term Bitcoin holders who had made robust earnings began shifting a few of their cash into cash outdoors the highest 10. Consequently, the entire market cap of all cryptos excluding the highest 10 climbed to $343 billion, a degree not seen in 9 months. Liquidity in Q3 was higher than in Q2, however nonetheless beneath the highs of 2024’s November and December. Take into account this – every day alternate quantity didn’t move its 23 July peak of $77 billion. On the spot market facet, Binance remained probably the most liquid alternate.

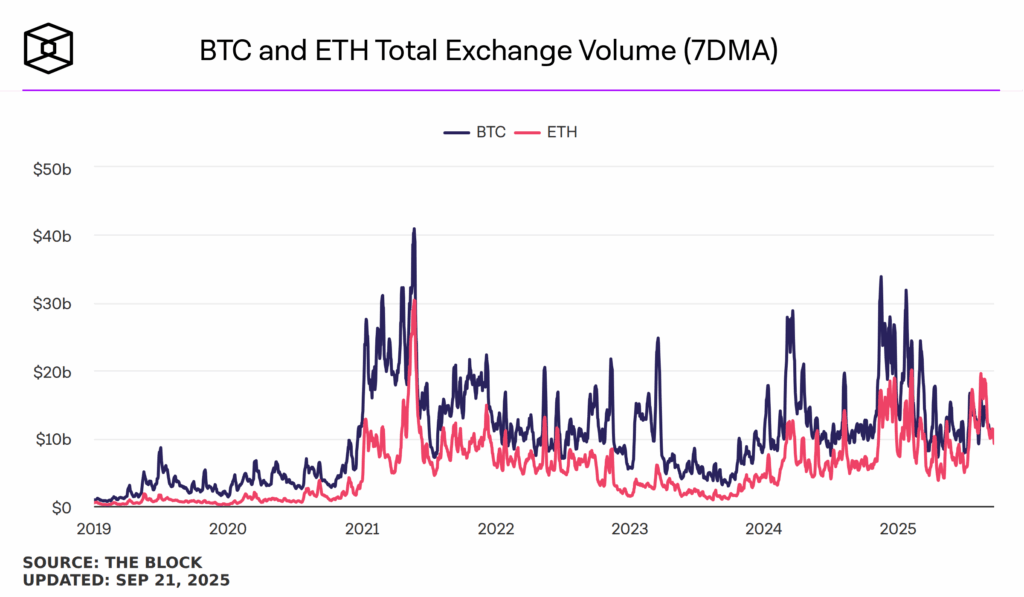

For the primary time in historical past, Ethereum’s complete alternate quantity overtook Bitcoin’s. This milestone got here on 22 July, when ETH recorded $16.94 billion in quantity in comparison with Bitcoin’s $16.64 billion. Ethereum saved its lead all through August, the identical month it reached a brand new all-time excessive. Nonetheless, by September, BTC regained the highest spot, however the hole between the 2 remained small.

This quarter, the stablecoin market grew by about 15%, twice the 7% progress seen in Q2. The whole provide hit a document of $230 billion+, and month-to-month transactions exceeded $4 trillion. This progress was fueled by the U.S. passing the GENIUS ACT in July 2025. This new legislation has given the stablecoin market a lift by setting clear guidelines on how they’re issued, what reserves should again them, and the way issuers report their holdings.

VC Funding in Crypto

Enterprise Capital Funding in Q3 rose sharply, although it nonetheless hasn’t matched the highs of the 2021 bull run. In July alone, crypto initiatives raised over $6.5 billion, with robust funding persevering with by way of August and September. The comparative decline in VC funding is as a result of competitors rising from massive monetary companies. They’re shifting deeper into crypto with Stablecoins, tokenization, and DeFi, which is leaving much less room for enterprise capital traders. Nonetheless, thus far this yr, crypto firms have secured greater than $16 billion and accomplished over 100 M&A offers. Leo Zhao, Funding Director at MEXC Ventures, advised 99Bitcoins,

As we speak, enterprise capitalists are naturally way more selective as the main target has shifted from chasing hype cycles to supporting initiatives with robust fundamentals. Whereas the general funding quantity is beneath 2021 highs, it’s truthful to say that the standard of initiatives receiving backing in the present day is considerably increased, which is able to set the muse for a stronger and extra resilient subsequent cycle.

About one-third of the cash went into DeFi, launchpads and perpetuals, whereas the remainder went into greater performs like ETFs, real-world property and IPO-linked firms. Token listings dropped in 2025; actually, initiatives that depend upon token launches are struggling to lift funds with out robust market traction. In the meantime, the IPO market has picked up once more, with 95 firms going public within the U.S. this yr and elevating $15.6 billion by mid-June. Virtually 9 massive firms are set to launch their IPOs in 2026 and one other 9 in 2027. This IPO growth has been primarily supported by favorable regulation within the U.S.

U.S. Insurance policies That Impacted the Broader Crypto Market

Over the previous 9 months, U.S. authorities insurance policies have largely favored the crypto trade, bringing a number of regulatory modifications that positively impacted the market. Listed below are the highest insurance policies that you need to be aware of –

Date (2025)

Coverage

Key Influence

1 Jan

Institution of the Crypto Process Pressure

Launched job pressure for trade engagement, steerage, and a much less enforcement‑first strategy.

23 Jan

Government Order: Professional‑Crypto Route

Ended CBDC exploration, shaped President’s Working Group on Digital Asset Markets, and directed companies to overview crypto guidelines.

23 Jan

Accounting & Custody Aid (SAB 122 Rescinded)

Eliminated onerous accounting/custody guidelines for custodians and exchanges.

27 Feb

Employees Assertion on Memecoins

Division of Company Finance employees expressed the view that memecoins should not securities, decreasing authorized uncertainty.

6 March

Strategic Bitcoin Reserve

U.S. authorities created a Strategic Bitcoin Reserve and Digital Asset Stockpile, signaling recognition of Bitcoin.

20 March

Assertion on Proof-of-Work Mining Actions

The govt.. clarified that protocol mining will not be thought-about a securities providing, giving extra readability.

28 March

Withdrawal of Employees Advisory No. 18-14

CFTC scrapped its 2018 steerage, leaving exchanges & clearinghouses extra flexibility in itemizing crypto derivatives.

4 April

Assertion on Stablecoins

SEC employees clarified USD-pegged fee stablecoins aren’t securities, exempting issuers and redeemers from registration.

10 April

H.J.Res.25, Disapproval of IRS Rule

Congress overturned the IRS dealer reporting rule, eradicating tax reporting necessities for DeFi platforms, exchanges, and pockets suppliers.

10 April

Assertion on Choices & Registrations of Securities within the Crypto Asset Markets

SEC employees set clear disclosure guidelines for firms elevating cash or registering securities tied to crypto.

28 Might

Rescission of 2022 Steering on Cryptocurrency 401(ok) Plans

The govt.. withdrew its 2022 warning on crypto in 401(ok) plans, easing restrictions for fiduciaries to supply crypto investments.

29 Might

Assertion on Sure Protocol Staking Actions

SEC employees clarified that self-staking and sure custodial staking aren’t securities, marking a shift from earlier lawsuits in opposition to Coinbase and Kraken.

12 June

Withdrawal of Amendments to Change Act Rule 3b-16

SEC rolled again plans to categorise DeFi platforms as exchanges, eradicating necessities for them to register beneath Regulation ATS or as broker-dealers.

12 June

Withdrawal of Safeguarding Advisory Consumer Belongings Rule

The SEC dropped its plan that may have pressured funding advisers to retailer all shopper crypto with certified custodians, easing custody guidelines for digital property.

1 July

Assertion on Crypto Asset Change-Traded Merchandise

SEC employees outlined disclosure necessities for crypto ETP issuers, together with dangers, custodians, charges, administration, and monetary particulars beneath Rules S-Ok and S-X.

18 July

U.S. Stablecoins (GENIUS) Act (S.1582)

The GENIUS Act set federal guidelines for fee stablecoins, requiring 1:1 reserves, month-to-month disclosures, and AML compliance, whereas confirming they don’t seem to be securities.

The U.S. authorities’s friendlier strategy to crypto and the EU’s MiCA guidelines have created a big rise in hiring for compliance, authorized, and AML/KYC roles in Web3. Main companies like BlackRock, JPMorgan, and Constancy are additionally bringing in additional quant merchants, threat analysts, and good contract engineers to develop their digital property groups. And in 2025, about 70% of all Web3 job placements have been distant.

Bitcoin Market Insights Via Quantitative Evaluation

Bitcoin’s efficiency in Q3 stood out strongly. Over the previous yr, it gained round 70% after inflation, whereas during the last seven years, it delivered a formidable 1,250% actual return. In distinction, the S&P 500 World returned about 16% previously yr and averaged 13-14% yearly over seven years, when adjusted for inflation. BTC’s 1-year historic volatility stays excessive at roughly 43%.

In essence, Bitcoin continues to outperform conventional property. Current U.S. fiscal developments have strengthened its position as a retailer of worth. In Q2 and Q3, establishments and corporates elevated their publicity to BTC. A lot of that is taking place by way of U.S. Bitcoin Spot ETFs, that are progressively being built-in into wealth administration platforms. Based mostly on Q2 SEC 13F filings,

Funding advisors managing over $100 million now maintain the equal of 167k BTC, up 30% quarter-over-quarter.

Retail nonetheless performs a giant position; about 75% of ETF AUM (property beneath administration) is held by non-13F filers.

The long-term pattern appears to be like very clear: advisors are more and more allocating a selected portion of shopper portfolios to Bitcoin.

13F filer information confirmed that there was $33.4 billion in BTC ETF holdings at Q2 finish, up 57% from $21.2 billion in Q1. The broader U.S. Bitcoin ETF market grew 45% to $103 billion AUM, with institutional share rising barely to 24.5%. In the meantime, Europe remains to be trailing the U.S. within the crypto ETF/ETP house, although there are indicators of motion. 99Bitcoins spoke with André Dragosch, Bitwise’s Head of Analysis – Europe, to know the primary hurdles stopping European establishments from allocating extra considerably to digital property. He defined,

One of many key drivers of adoption tends to be social proof – it sounds trivial however “maintaining with the Joneses” is a crucial a part of the institutional adoption of cryptoassets. That’s the reason the launch of the Bitcoin ETFs by the likes of Blackrock and Constancy within the U.S. have been so highly effective. I believe European regulation is already very benign and the EU MiCA pointers have already created regulatory readability.

how fiduciaries have behaved over time, André opined,

The infrastructure to speculate through ETPs is already properly established. That being stated, I believe it should take a bit extra time although till optimistic performances of these managers which have invested into cryptoassets can be considerably increased than people who didn’t. However I’m satisfied that not investing into cryptoassets will more and more turn into a profession threat for asset managers due to growing strain from rivals and shoppers.

Whereas Europe is taking a wait-and-see strategy, U.S. 13F filings detailed notable strikes by massive gamers within the U.S. Take into account this –

Brevan Howard shifted from a hedge fund to an funding advisor and boosted holdings from 12.3k BTC to 21.4k BTC.

JPMorgan disclosed its first place, 1.9k BTC equal.

Wells Fargo expanded its publicity practically 5x to 1.7k BTC equal.

Harvard made its first reported allocation to Bitcoin.

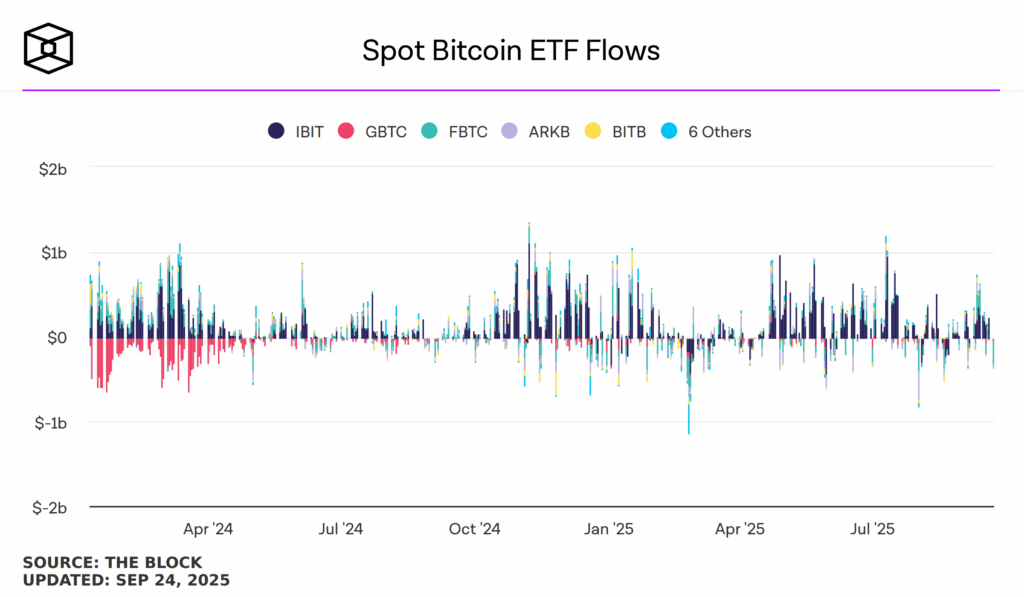

On 10 July, spot Bitcoin ETFs recorded $1.2 billion in inflows, the second-largest single-day influx in ETF historical past. July total ended web optimistic, with a lot of the inflows coming from BlackRock’s IBIT. In contrast, 1 August marked the second-largest outflow on document, totaling $812.3 million. In September, inflows picked up once more, with a number of days exceeding $500 million, signaling a renewed demand. Nonetheless, volatility endured; on 22 September, ETFs noticed a pointy $363 million outflow. In all, September remained web optimistic however extremely risky, with Grayscale’s GBTC contributing probably the most to outflows as traders continued rotating into cheaper ETF choices.

Analyzing Bitcoin’s Value Motion: Technical Outlook

Bitcoin’s Q3 worth motion has been outlined by reversal patterns (double-top, head and shoulders) and range-bound buying and selling between $105k-$123k. Bitcoin’s every day chart was dominated by the formation of higher-highs, and patrons had an higher hand for a lot of the buying and selling periods.

Across the $110k degree, Bitcoin shaped a double high, signaling a bearish reversal and sparking a pointy correction by way of late January and February. From there, BTC rebounded into an ascending channel, climbing steadily from $80k to $112k with robust bullish momentum, rising volumes, and help from the 50 and 100 EMAs. Driving this shopping for strain, Bitcoin pushed to a brand new all-time excessive of $123k. Nonetheless, the rally stalled as a head and shoulder sample emerged, triggering one other draw back transfer that pulled BTC again to check the $107k help degree. Within the early week of October, although, bulls took over and BTC marked a brand new all-time excessive of $126,199.

Assist, Resistance & Indicators

Q3 Assist Vary – $101k-$110k demand zone has been examined a number of instances, and stays a vital space for patrons.

Resistance – $118k to $123k remained a provide zone, the place the pinnacle and shoulders neckline and prior highs created a robust resistance barrier.

EMA 50/100: All through July, BTC used the EMA 50/100 as robust help. However by mid-August, it slipped beneath the 50 EMA and closed beneath the averages a number of instances. In early September, BTC briefly reclaimed the EMAs, solely to reverse once more and deal with them as near-term resistance by late September.

Choppiness Index (CHOP): The indicator confirmed BTC trending strongly in July, turning uneven throughout August’s sell-off, then shifting impartial in September. This shift highlighted weakening momentum, with BTC caught between robust $105K help and heavy $118K-$123K resistance.

Inside Bitcoin’s Derivatives Market

Bitcoin’s derivatives buying and selling quantity stayed robust throughout futures, choices, and perpetual markets. In August 2025, BTC futures quantity throughout all exchanges reached $1.74 trillion, with Binance main volumes all year long. Curiously, ETH’s futures buying and selling quantity surpassed that of Bitcoin’s in majority of Q3. This confirmed traders have been extra fascinated with speculating on ETH’s worth strikes.

Bitcoin choices buying and selling quantity hit a document excessive of $144 billion in August. Of this, Deribit dealt with $114 billion. On the similar time, BTC’s implied volatility (the market’s forecast of worth swings) saved falling. In the meantime, Deribit’s complete open curiosity in Bitcoin choices rose to $52 billion, its highest degree since 2021. This implies more cash was locked into excellent contracts, signaling confidence and deeper liquidity in Bitcoin’s choices market.

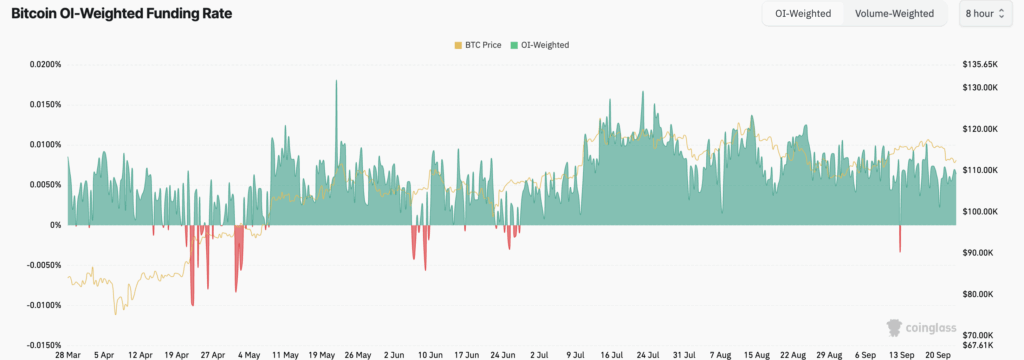

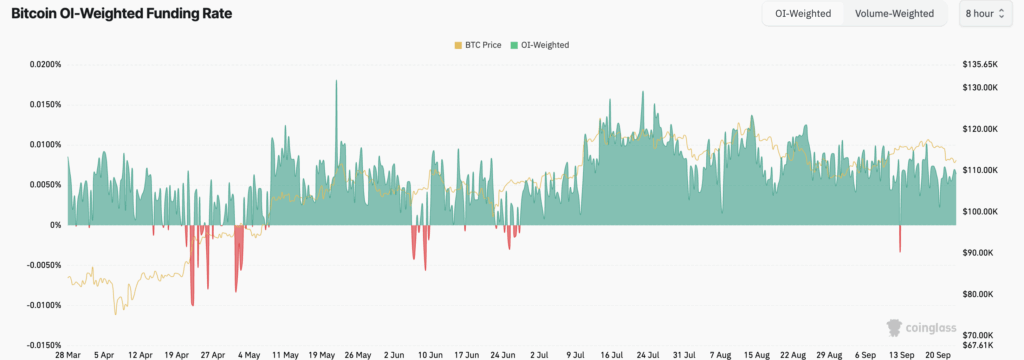

For many of this quarter, funding for perpetual futures remained optimistic, highlighting that longs dominated and merchants stayed bullish. Occasional dips into adverse territory mirrored short-term bearish bets throughout worth drawdowns. Curiously, in July, when Bitcoin hit a excessive of $124k, funding charges spiked increased, highlighting robust lengthy positioning. Some analysts argue that the market is overheated, and a possible lengthy squeeze may quickly be on the horizon if sentiment shifts.

In Q3, Bitcoin’s liquidation heatmap confirmed heavy clusters forming across the $113k-$114k zone, the place many brief positions have been constructed up. Every time BTC pushed in the direction of this degree, it triggered brief squeezes, which in flip drove costs increased. This made the world a key strain level for the market.

On the draw back, the $105k-$111k vary emerged as a liquidation pocket for over-leveraged longs. When BTC dipped into this zone, lengthy liquidations added to the promoting strain and pushed the market down. General, the quarter was just about formed by this tug-of-war between liquidation bands.

Key Elements Behind Bitcoin’s Value Transfer

Bitcoin’s worth motion was pushed by a mixture of forces, from macroeconomic tendencies and on-chain exercise to geopolitical tensions, the worldwide commerce battle and the U.S. coverage selections. Bitcoin has accomplished 4 cycles that every included each bull and bear markets. For about two years, BTC’s worth motion within the 2022-2025 cycle regarded similar to the way it moved throughout 2015-2018. However in Q1 2025, it diverged; as an alternative of constant to reflect that previous cycle, the value began shifting in another way.

Macroeconomic Elements

World debt reached a document $324 trillion in Might 2025, which is greater than 235% of the world’s GDP. On the similar time, belief in governments, banks and the media has fallen sharply. U.S. bond yields are rising at historic costs, and virtually the identical is the case with different G7 international locations. Billionaire investor Ray Dalio calls this stage the long-term debt cycle, whereas historians William Strauss and Neil Howe describe it because the Fourth Turning, a interval of main change that tends to occur each 20 years or so. Even the usage of divisive language has risen by over 500% since 2010. All of this information exhibits that traders are progressively dropping religion in debt-fueled economies and are more and more turning to Bitcoin.

Actually, the U.S. now spends extra on curiosity funds for its debt than on its complete defence funds. The Federal Reserve’s stability sheet additionally exhibits a pointy decline in U.S. property. In the meantime, the greenback’s international dominance is weakening. BRICS international locations are more and more settling trades of their native currencies; about 90% of their commerce now makes use of native currencies, up from 65% simply two years in the past.

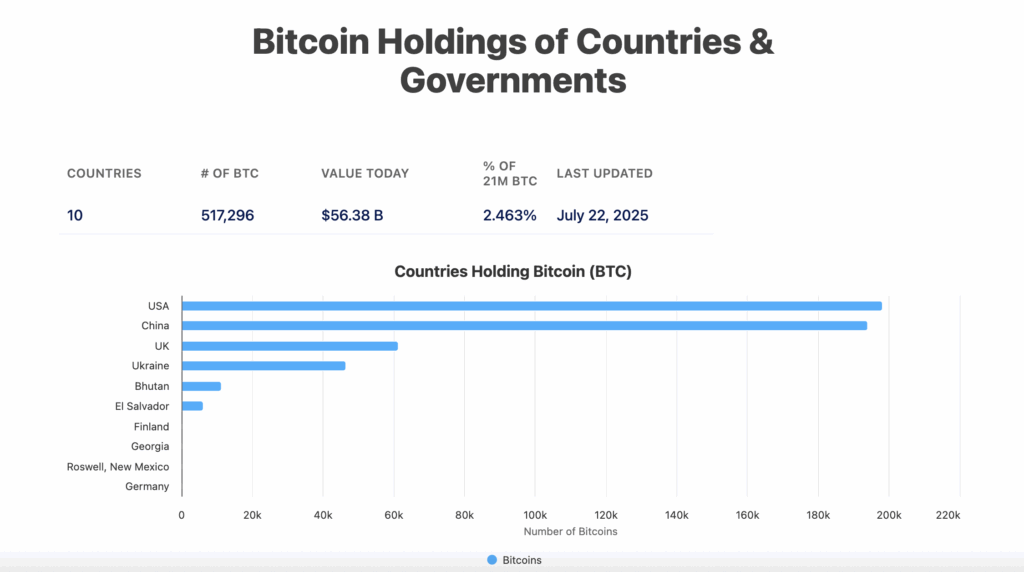

Many international locations are additionally decreasing their reliance on the U.S. greenback as a reserve forex, whereas sovereign wealth funds are shopping for extra Bitcoin than ever earlier than. Governments now maintain about 517,296 Bitcoin, which is 2.46% of the entire provide. The U.S. is the most important holder with 1,980,000 BTC, adopted carefully by China with 1,94,000 BTC. Even the world’s largest sovereign wealth fund, Norway’s Norges Financial institution Funding Administration, elevated its Bitcoin-related holdings by 83% in Q2.

Greater than sovereign wealth funds, companies are placing a bigger share of their cash into Bitcoin, with many making it a key a part of their treasury reserves. The worth of those Bitcoin treasury firms has been rising in a short time, which is turning into a matter of concern for a lot of analysts.

Technique is the clearest instance, holding over 630,000 BTC (value greater than $70 billion as of September), whereas its inventory worth has jumped greater than 1000% in simply two years. Many specialists suppose that such a heavy focus of Bitcoin in a number of firms additionally will increase the danger of market instability. Altogether, Bitcoin treasury firms now maintain over 1 million BTC, or about 4.7% of the entire provide, with Technique alone controlling 2.7% of all Bitcoin.

Fed Fee Cuts, Inflation Stress & Weak Financial Knowledge

The U.S. cash provide is close to document highs, including to inflation and widening the wealth hole. On the similar time, the U.S. authorities’s excessive tariffs have made imported items costlier. Economists warn that this might trigger much more inflation and the next rate of interest in the long term. For now, although, the tariff-driven rise in costs is already pushing traders to hunt safer shops of worth than {dollars}, which is not directly boosting demand for Bitcoin.

The Fed’s looser financial coverage has additionally added to inflationary strain. Manufacturing stayed weak by way of the summer season: the PMI got here in at 49% in June, dipped to 48% in July and edged up barely to 48.7% in August, all signaling contraction. In contrast, the providers sector confirmed modest progress, with the providers PMI at 50.8% in June and 50.1% in July, marking two straight months of enlargement.

The labor market softened, and personal sector payrolls rose by 1,04,000 in July however slowed to simply 54,000 in August, properly beneath expectations. Jobless claims hovered across the 218,000-229,000 vary between late July and September, displaying solely slight motion. Non-farm payrolls averaged simply 29,000 new jobs monthly within the three months to August, far weaker than final yr’s 82,000 tempo. In the meantime, job openings fell in July to their lowest degree, hardly ever seen because the COVID-19 pandemic, confirming the slowdown.

In response, the Fed lower charges on 17 September by 25 foundation factors to 4%-4.25%. It was the primary charge lower of 2025 and notably the primary time the Fed lower the rate of interest when inflation remained above its goal.

On the coverage entrance, the upcoming Market Construction Invoice and the Readability Act will make crypto guidelines clearer. They clarify whether or not the SEC or CFTC ought to oversee sure digital property, set limits for exemptions, and create a extra organized system for launching and buying and selling tokens. For Bitcoin, the primary profit is that this clearer rulebook. Many establishments have stayed away due to confusion, however with extra certainty, recent cash may move in, liquidity will go up, therefore pushing BTC’s worth upwards.

Curiously, even the Large Lovely Invoice will carry extra liquidity to the crypto market, which can enhance BTC’s demand in the long run. 99Bitcoins spoke with Markus Levin, Co-Founding father of XYO, the primary crypto undertaking authorized by the SEC beneath Reg A, who defined,

The Large Lovely Invoice is a posh piece of laws, and covers numerous areas, however probably the most pertinent for the digital property trade are tax lower extensions. By extending the 2017 tax cuts and elevating the SALT deduction cap, and proposing no tax on time beyond regulation or suggestions and different components the invoice delivers extra disposable earnings to each households and better earners.

Additional, U.S. lawmakers are pushing the SEC to implement Trump’s government order, which might enable Individuals so as to add Bitcoin and different cryptocurrencies to their 401(ok) retirement plans. If authorized, the impression could possibly be large. Every year 401(ok) plans see about $550 billion in new contributions. Even a small 5% allocation to Bitcoin may herald $30-$40 billion yearly, including as much as round $343 billion by 2035, over six instances the inflows that U.S. spot Bitcoin ETFs have attracted thus far.

Lastly, we should additionally observe that geopolitical tensions just like the Russia-Ukraine battle and the Israel-Gaza battle have not directly strengthened Bitcoin’s attraction. These crises have strengthened its position as a retailer of worth and a hedge in opposition to uncertainty.

On-Chain Elements

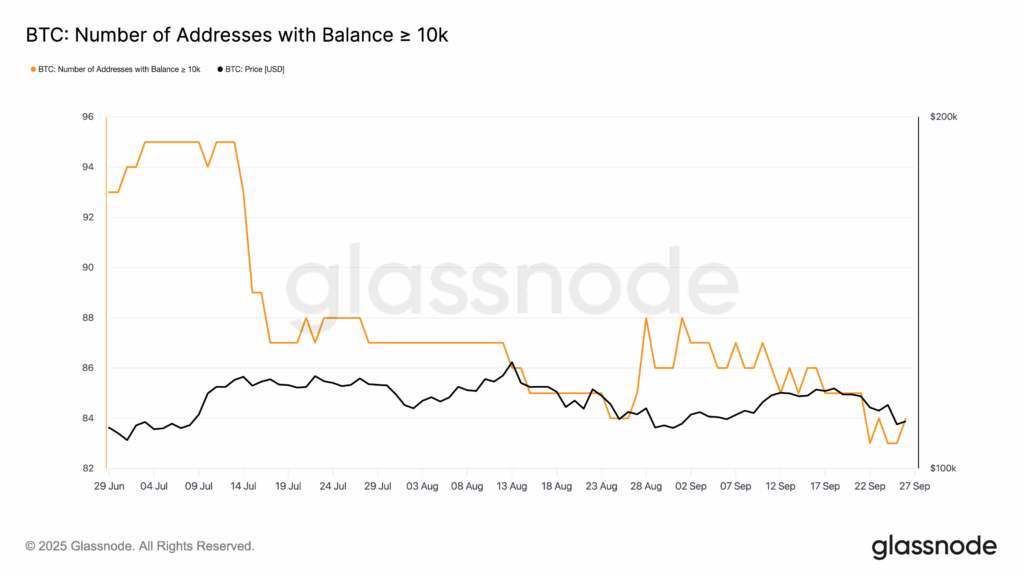

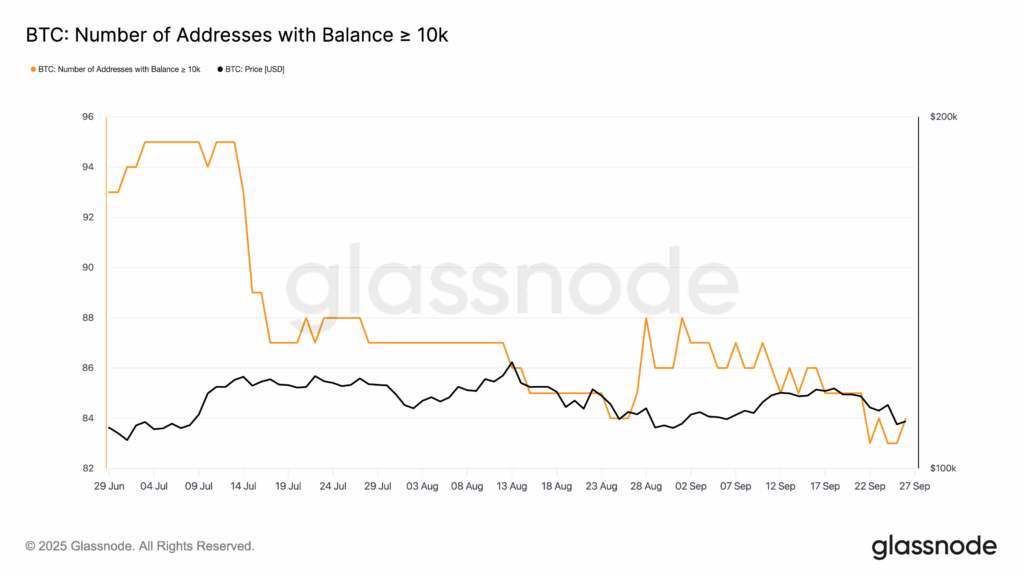

Bitcoin’s liquid provide (cash moved inside three months) rose by 12% in Q2, whereas the illiquid provide (cash held for over a yr) dipped solely 2%. Since January, Bitcoin alternate reserves have steadily declined, reflecting robust HODLing in Q3 regardless of a short profit-taking spike in mid-August. By late September, 92% of addresses have been in revenue, although the variety of wallets holding greater than 10,000 BTC fell sharply, particularly in the course of the 15-16 July sell-off.

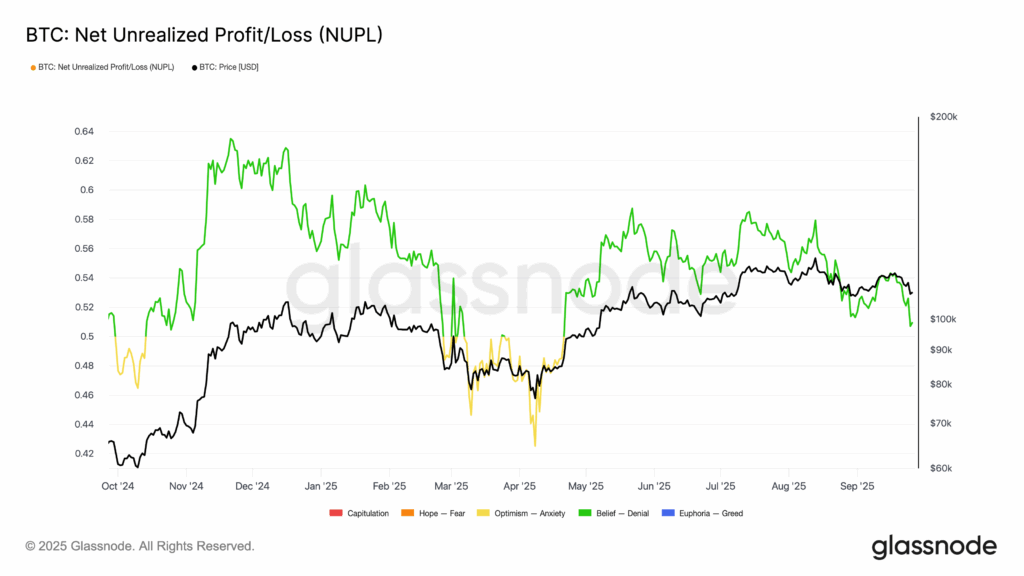

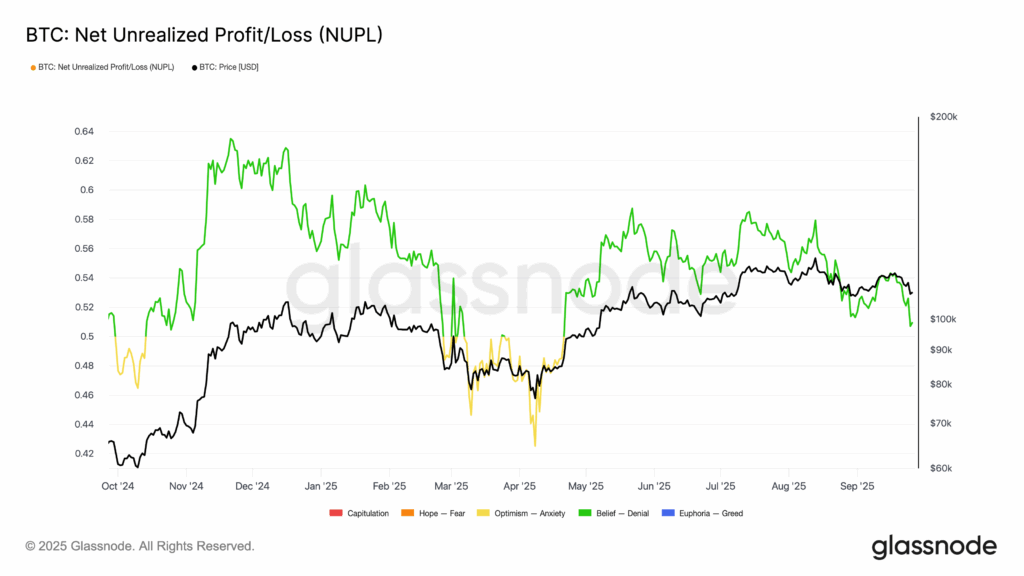

For everything of Q3, the Internet Unrealized Revenue/Loss (NUPL) metric stayed within the inexperienced, displaying that almost all traders have been sitting on earnings. This degree is commonly known as the belief-denial section. On this stage, confidence available in the market grows as costs rise, and the traders begin to imagine that the bull run may proceed. On the similar time, some stay cautious, considering the rally may not final. It’s often a transitional stage the place optimism builds, however not but on the euphoria ranges seen close to market tops.

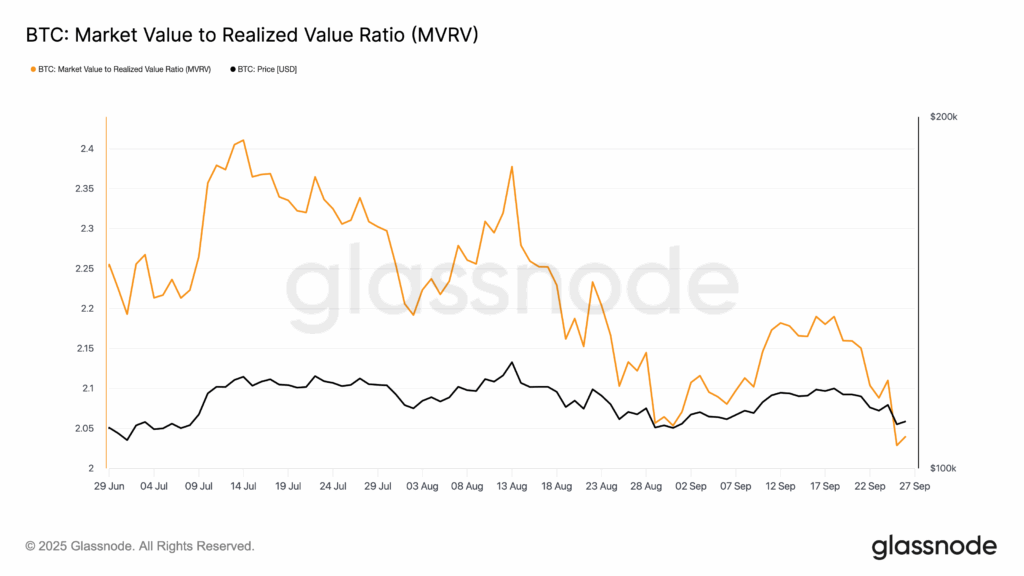

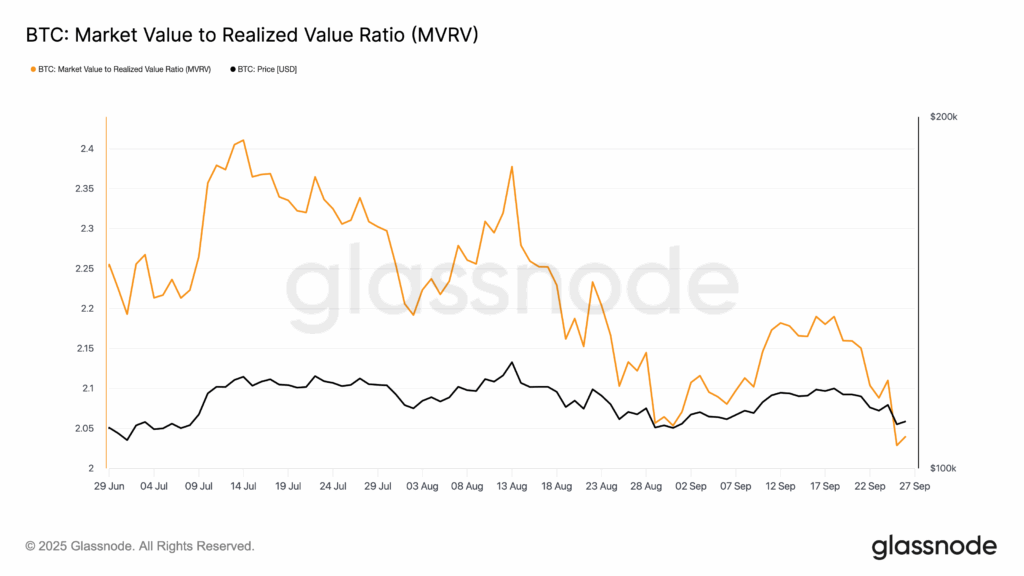

After mid-July, MVRV trended decrease whilst worth held regular round $100k-$110k, suggesting new patrons have been coming into at increased prices whereas total profitability declined. By late September, each worth and MVRV dropped sharply, displaying a reset in market worth. General, Q3 started with substantial earnings and confidence however ended with shrinking margins and elevated promoting strain.

Bitcoin’s social dominance declined in August whilst transaction volumes stayed excessive. Miner revenues held at elevated ranges, with month-to-month electrical energy consumption additionally remaining robust. On the similar time, whales continued to develop their holdings steadily.

What to Count on From BTC in This fall?

Although there was vital profit-taking, the demand for BTC is method increased. Firms investing in Bitcoin are shopping for excess of miners are producing, which is pushing costs increased. Miners create about 900 BTC per day, however companies are shopping for round 1,755 every day, with ETFs including one other 1,430 on high of that. Bitcoin in This fall has the next chance of sideways to bullish motion, with the bottom case being a spread between $110K-$130K.

Value: $109.5K, sitting at a key horizontal help zone (white line).

Development: Decrease highs since July, descending construction (gentle downtrend).

Indicators:

RSI (49) – Impartial, no momentum edge.

CMF (close to 0) – Capital inflows are flat, no robust accumulation.

Bollinger Bands – Value testing the mid/decrease band, volatility compression attainable.

Quantity Profile (VPVR) – Large help zone close to $100K, main liquidity pocket.

Chart Sample: Value is squeezed between descending resistance and horizontal help, a triangle construction forming.

Chances for This fall

As per the technical chart, we are able to take a look at three possibilities within the upcoming quarter.

Base Case – Vary/Gradual Restoration (45%)

BTC holds the $105K-$110K help vary and slowly grinds increased.

Doubtless resistance zones: $115K, then $120K.

Suits with impartial RSI and sideways CMF, extra consolidation than breakout.

Bullish Breakout – Push towards $130K (35%)

If BTC breaks the descending trendline ($115K), momentum patrons may step in.

First main goal at $125K-$130K. It may go even as much as $138k

Would doubtless want macro tailwinds (the 2 anticipated Fed cuts and robust risk-on urge for food).

Bearish Case – Drop to $95K-$100K (20%)

If the $105K-$110K help cracks, VPVR exhibits the subsequent liquidity cluster at $95K.

This could align with sellers forcing a deeper correction earlier than the subsequent leg up.

Key Ranges to Watch in This fall

Assist: $105K (fast), $100K (robust), $95K (vital).

Resistance: $115K (trendline), $120K, $130K (extension goal).

From the macroeconomic perspective, we predict Bitcoin may attain $150k-$160k by This fall, and the low could possibly be $60k-$72k.

Usually, Bitcoin’s four-year cycle peaks 15-18 months after a halving. The final halving was in Might 2024, but it’s nonetheless unclear if the highest has been reached. If the normal cycle holds, the height may come round November-December 2025. Nonetheless, there’s additionally the opportunity of a lengthening cycle, which could push the highest into Q1 or Q2 of 2026.

On the technical facet, the 200-week shifting common has traditionally been a dependable sign for Bitcoin cycle tops. Every time it has crossed a earlier all-time excessive, it has marked the height with 100% accuracy. Based mostly on this sample, if we undertaking ahead on the chart, the subsequent cycle high may align with June-July 2026.

Bitcoin’s yearly share change, a transparent sample stands out, three years of bull market good points adopted by one bear yr with a giant drop. In 2021, the final yr of the bull run, BTC nonetheless grew 61%. If we assume the same 60% acquire this cycle (being conservative), and since Bitcoin began 2025 at $98K, that may level to a year-end goal of round $150K-$160K if the cycle high lands in This fall.

We additionally want to think about the World Liquidity Index (GLI), which tracks the general move of cash on this planet financial system by way of measures like central financial institution stability sheets, credit score progress, and cash provide. Bitcoin has proven a robust correlation with this index, usually reacting with a couple of 75-day lag.

The Mayer A number of compares Bitcoin’s worth to its 200-day shifting common. Traditionally, it has proven diminishing returns every cycle, that means the peaks are getting smaller over time. Based mostly on this sample, if the Mayer A number of and 200-day MA relationship holds, it factors to a attainable cycle high of round $220K by June. This outlook matches the view of Juan Leon, Senior Funding Strategist at Bitwise, who advised 99Bitcoins,

If the macro backdrop is favorable and we see continued approval of BTC ETFs on main wirehouse and wealth administration platforms driving adoption, together with continued ramp up in BTC treasury firm adoption, we may see BTC rally to $200,000 or above in This fall 2025/Q1 2026.

Ethereum Q3 Assessment and Insights

Ethereum carried out exceptionally properly in Q3, displaying robust upward motion on its every day chart. After rising about 31% in Q2, it surged by over 70% in Q3. It even hit a brand new all-time excessive of $4,956 on 24 August, thus bringing recent optimism into the market.

The Complete Worth Locked (TVL) on Ethereum grew steadily from $63 billion on 1 July to $89 billion by 30 September. The liquid staking protocol Lido maintained its lead with $40 billion in TVL, adopted by AAVE at $36.83 billion. By way of income, Tether held the highest spot with $22.53 million, whereas Circle generated $7.82 million. In the meantime, Uniswap recorded the very best buying and selling quantity amongst all of the protocols.

ETH’s volatility has gone up by 10.43% during the last yr. It stayed average in July 2025, spiked in August, and eased again down in September.

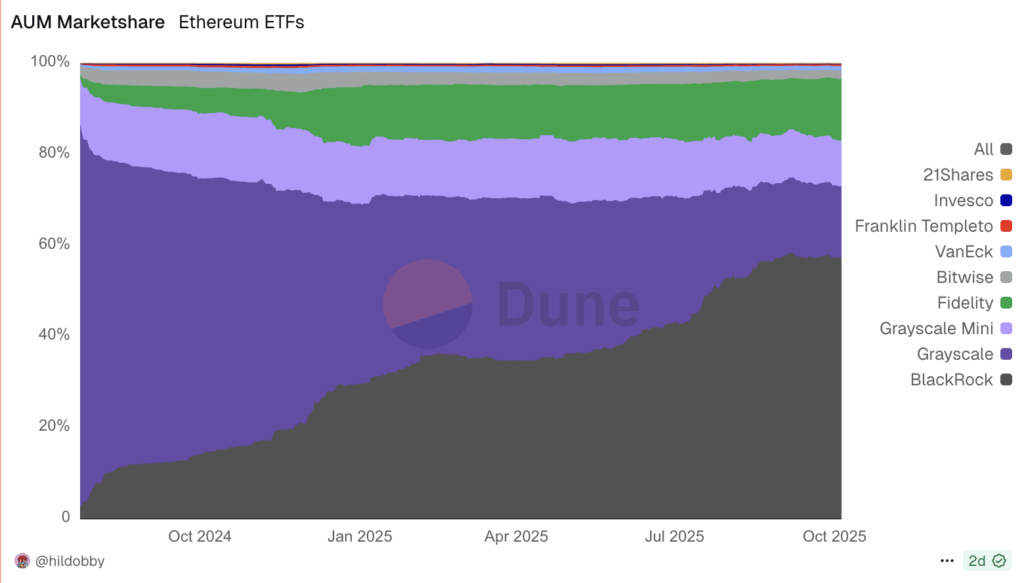

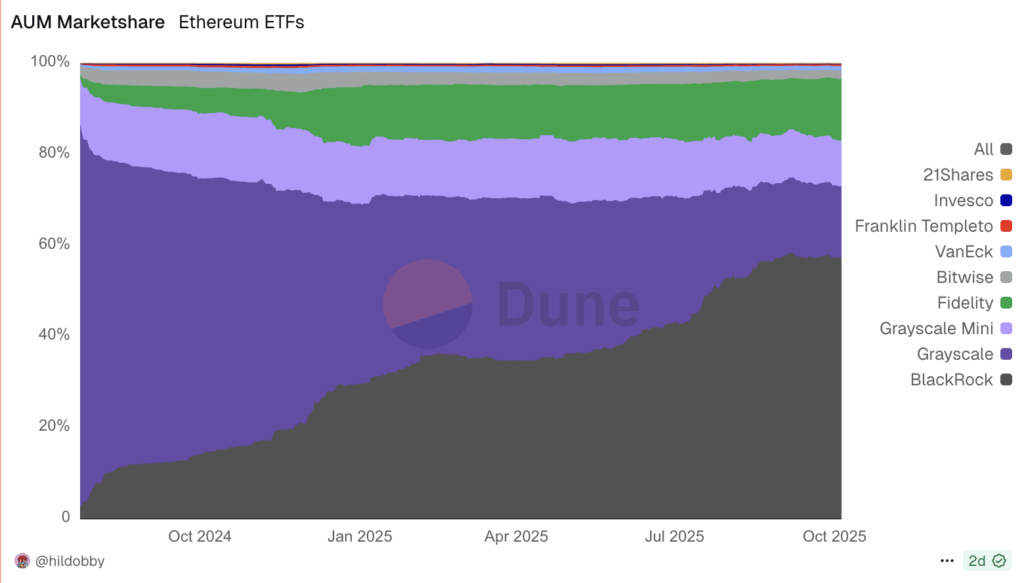

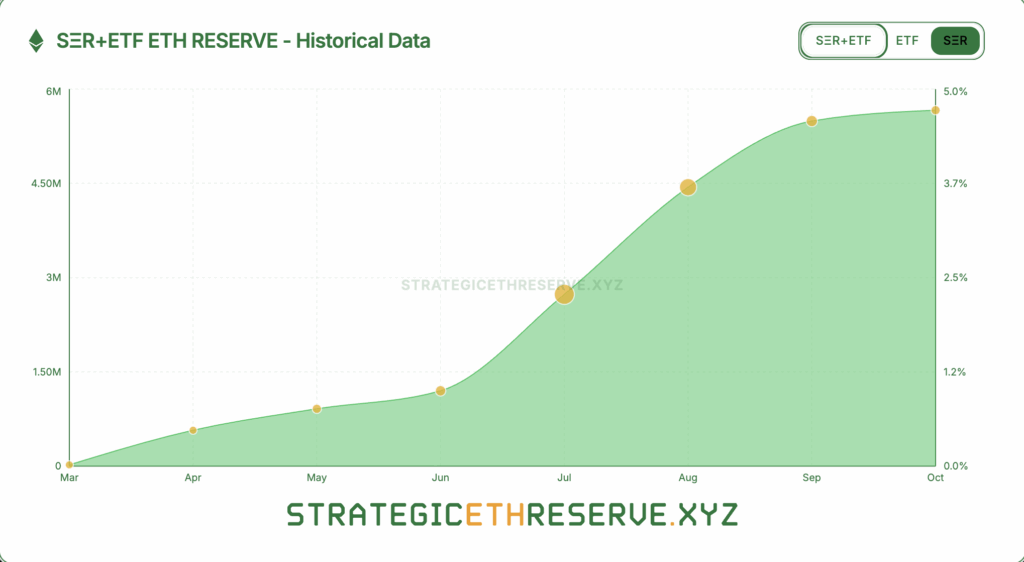

Beginning in June, the entire worth of ETH staked noticed a pointy improve of practically $2 million. Ethereum spot ETFs additionally carried out strongly, with complete Belongings Underneath Administration (AUM) reaching $25.79 billion. ETF-related buying and selling exercise remained sturdy, with the very best every day quantity so far recorded at $7.27 billion on 22 August. Since their launch, web inflows have totaled 3.82 million ETH, whereas on-chain ETF holdings stand at 6.75 million ETH. General, ETH ETFs account for five.45% of the present provide, with an annualized provide absorption charge of three% over the previous month.

Amongst all ETH ETFs, BlackRock’s ETHA has dominated the market, accounting for a median of 57.3% of complete ETF buying and selling quantity. Grayscale’s ETHE adopted in second place with a 15.7% share.

Specialists imagine the current rise in reputation of ETH ETFs is especially as a result of GENIUS Act, which has supplied clearer laws for stablecoins. Since Ethereum holds the most important share of stablecoin provide amongst all Layer 1 blockchains, it’s anticipated to learn probably the most as stablecoins turn into extra broadly used.

Ethereum additionally leads in tokenized complete worth locked (TVL), one other fast-growing space in crypto. With robust progress potential in each stablecoins and tokenization, traders see Ethereum as being well-positioned to benefit from each tendencies.

In Q3 2025, a number of publicly traded firms introduced plans so as to add Ethereum to their treasuries, just like what number of already maintain Bitcoin. Collectively, they gathered 5,663,855 ETH (value $26.61 billion, or 4.68% of the entire provide) by the tip of the quarter. This made Ethereum a key asset on many company stability sheets, and the pattern is anticipated to develop even quicker in This fall.

Ethereum’s community charges have been on a gradual decline since peaking over the past bull market in This fall 2021. In Q2 2025, charges dropped to multi-year lows in each ETH and USD phrases. Community charges in ETH fell 37% quarter-over-quarter (QoQ) whereas charges in USD decreased 53% QoQ, dropping from $216.4 million to $102.3 million.

This decline was primarily pushed by customers shifting their exercise from Ethereum Layer 1 to Layer 2 networks and different competing Layer 1 blockchains. Amongst these, TRON ($165.2 million) and Solana ($121.2 million) have been the one L1s that recorded increased community charges than Ethereum in Q2. In a method, we are able to additionally say that traders are rotating their capital from ETH to different high-quality altcoins. Polygon Labs’ World Head of Funds, Aishwary Gupta, confirmed to 99Bitcoins,

DeFi is in a ‘high quality rotation.’ TVL is consolidating into protocols with actual charges, higher threat controls, and asset-backed yields (T-bills, credit score, RWAs). Count on fewer mercenary incentive loops and extra chain-abstracted front-ends that path to one of the best worth/liquidity beneath the hood. The catalysts: fiat-on/off ramps embedded in wallets, compliant KYC swimming pools for establishments, and RWAs offering sturdy base yields that stabilize DeFi cycles.

Ethereum’s Community Overview

The whole variety of transactions on the Ethereum community hit an all-time excessive of 51.77 million in August, with energetic addresses additionally reaching their peak in the course of the month. Nonetheless, the variety of new addresses declined, suggesting that Ethereum’s exercise was pushed primarily by current, skilled customers fairly than new retail individuals, reflecting a extra mature person base.

Ethereum’s on-chain quantity rose QoQ, reaching its year-to-date excessive of $15.41 billion on 15 August. Since Might 2025, the share of ETH provide in revenue has additionally been on the rise. On the similar time, the entire variety of deployed good contracts has continued to develop steadily since March, reflecting ongoing community improvement.

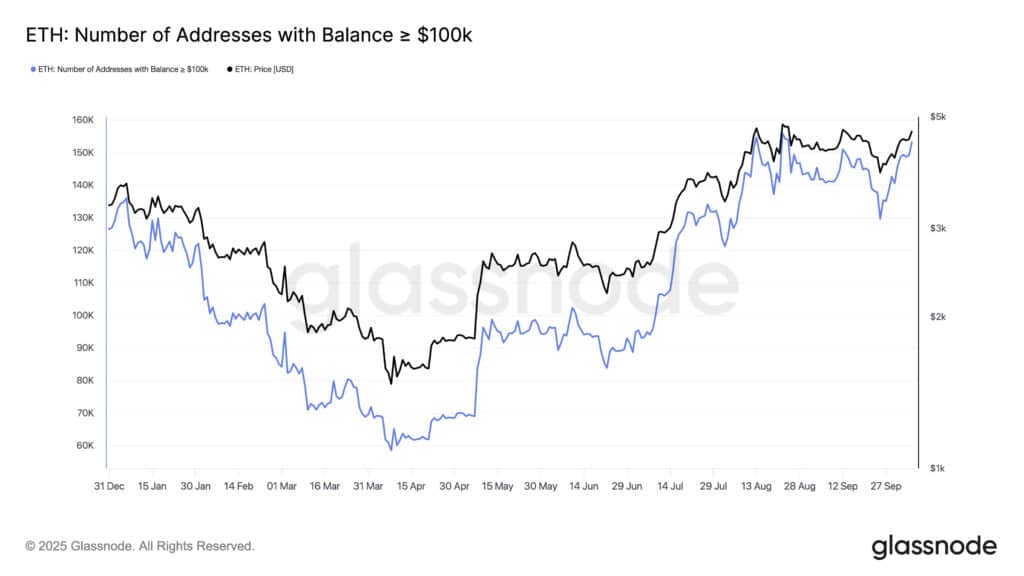

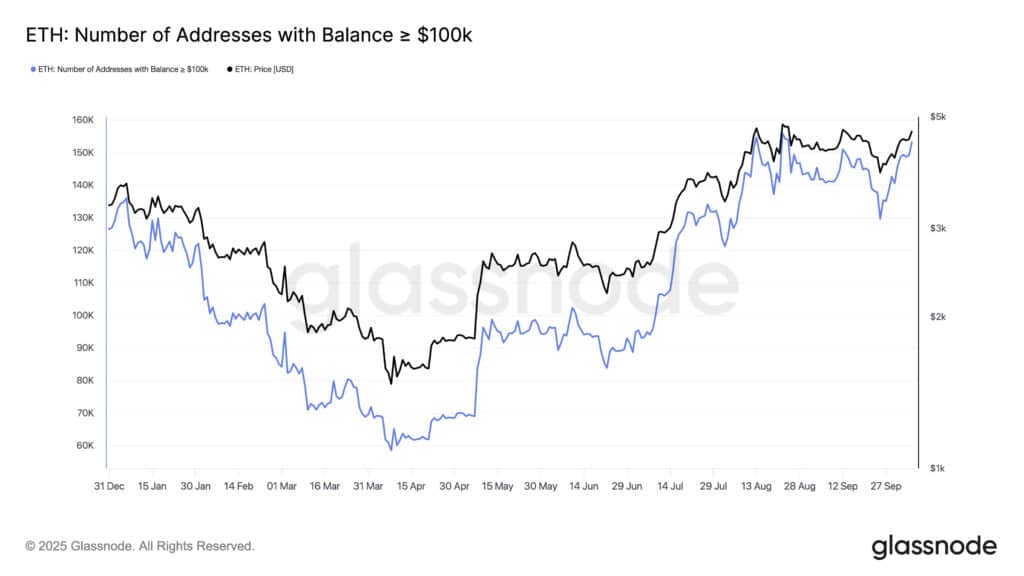

Curiously, the variety of addresses holding greater than $1 million in Ethereum rose sharply in Q3. In Q1, these addresses had declined, and Q2 confirmed solely slight progress, however Q3 noticed a shocking leap. The identical pattern was seen in addresses holding greater than $1,000 or $100,000.

This improve means that each whales and retail holders added extra Ethereum to their wallets. It additionally exhibits rising confidence in Ethereum’s future, pushed by optimistic market sentiment, ETF developments, and stronger fundamentals.

From a broader financial view, simpler financial insurance policies and better authorities spending are creating loads of liquidity available in the market. This has made threat property like Ethereum and Bitcoin extra interesting to traders. On the similar time, AI and tech shares are hovering, driving more cash into property that may defend in opposition to inflation. Nonetheless, very like in 1999, this wave of pleasure comes with each optimism and uncertainty, as volatility and rising valuations are happening facet by facet.

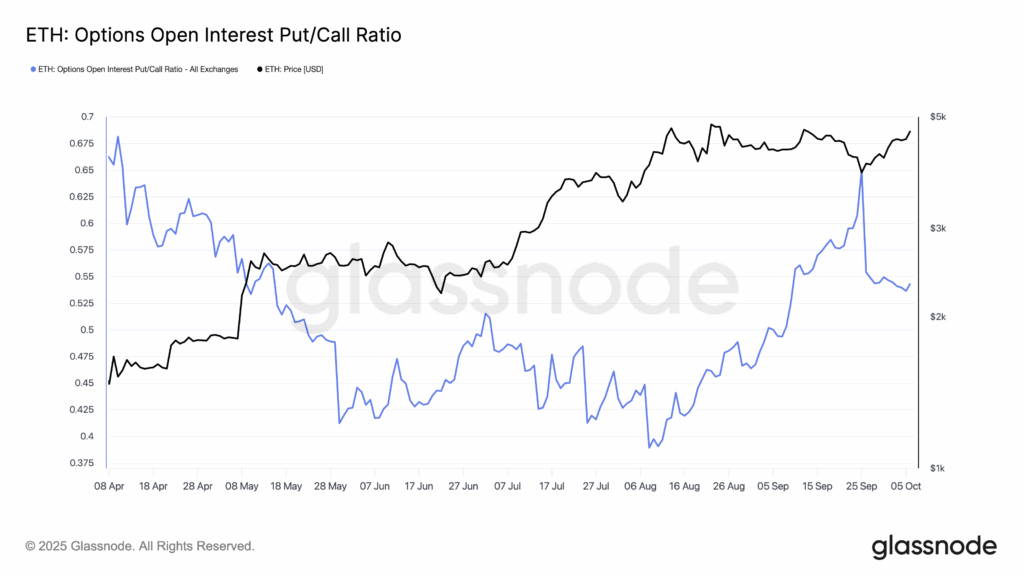

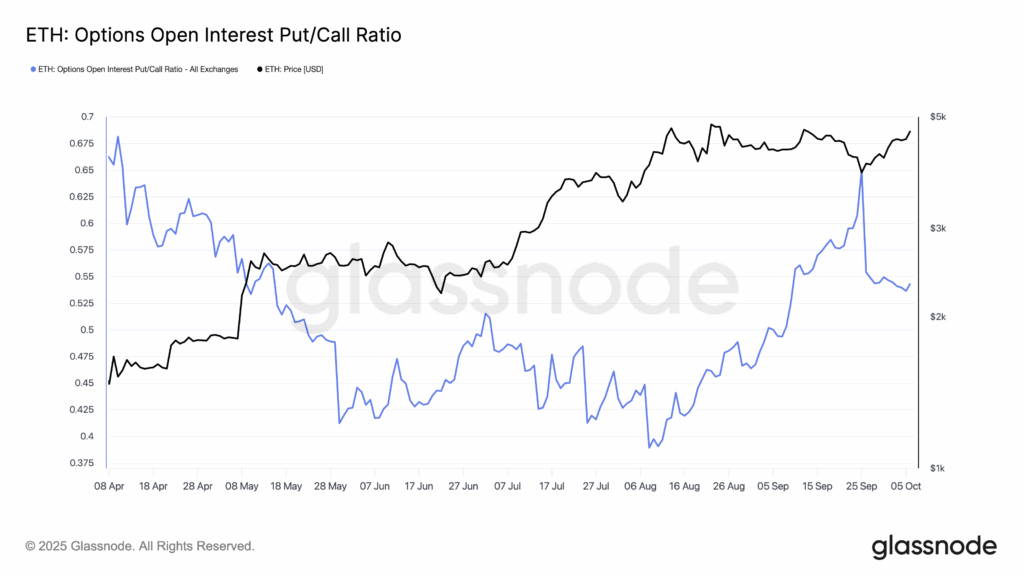

The core logic of this bull cycle has shifted from “fundamentals-driven” to “liquidity and sentiment-driven.” On the spinoff facet of the market, we noticed traders’ rising confidence by way of Q3. From April to early August, the Put/Name Ratio declined, indicating rising bullish sentiment as ETH’s worth climbed steadily. Round mid-September, the ratio spiked, suggesting a brief rise in bearish bets. This was a time when merchants have been hedging after robust worth good points. After that, the ratio dropped once more, displaying that optimism returned as ETH costs neared $5000 degree.

What’s Subsequent for Ethereum in This fall?

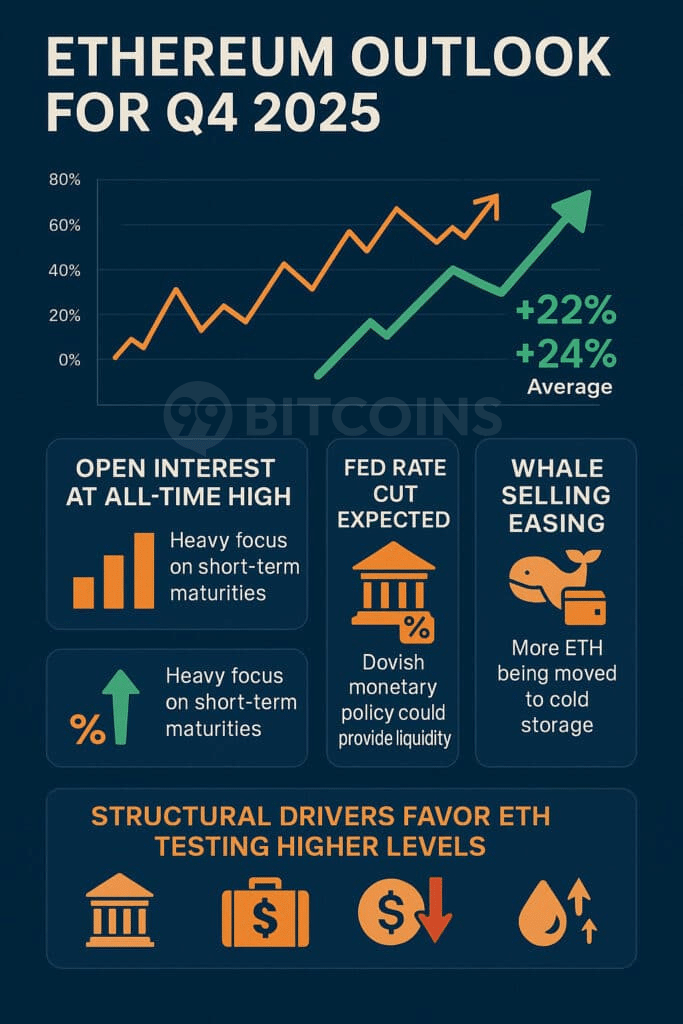

This fall begins with October, a month typically seen as bullish for the crypto market and generally known as ‘Uptober.’ Traditionally, This fall has been Ethereum’s strongest quarter, with a median return of round 22% and a median return of round 24%. Nonetheless, Ethereum in 2025 is a really completely different asset in comparison with earlier years. So, its efficiency could not totally observe previous seasonal patterns.

Open curiosity (OI) on the CME has climbed to document highs, primarily concentrated in short-term contracts (one to a few months). This factors to energetic institutional buying and selling, although it might additionally carry short-term volatility round contract expirations. In the meantime, longer-term contracts (three to 6 months) are steadily growing, displaying rising institutional confidence in Ethereum’s outlook.

Within the futures market, merchants are pricing in a probable Fed charge lower, which may enhance market liquidity and supply extra help for ETH.

On the similar time, whale promoting has slowed, and lots of massive holders are shifting their ETH to chilly storage, signaling long-term confidence forward of potential market strikes.

Whereas profit-taking could trigger transient pullbacks, the general setup for This fall appears to be like robust. A mixture of supportive macro circumstances, together with political uncertainty, rising institutional participation, a weaker greenback, and ample liquidity, all recommend that Ethereum may push towards the upper ($6k-$8k) degree within the coming quarter.

Breakdown of Main Crypto Sectors

Amongst all crypto sectors, RWAs, PerpDEX, Robotix, and DePIN gained probably the most traction in Q3, fueling hypothesis that the market could also be on the verge of coming into altcoin season. Actually, a number of indicators recommend we’re doubtless coming into the altcoin season. Take into account this – The Altcoin Season Index is above 55, highlighting altcoins’ higher efficiency relative to Bitcoin.

We additionally discovered the king coin’s dominance progressively declining in the direction of the tip of Q3, displaying capital rotation. Rising stablecoin inflows point out recent liquidity coming into the market. Nonetheless, retail curiosity in altcoins remains to be in a lull. Google Tendencies information exhibits that folks aren’t in search of altcoins as they did again within the 2021 bull run. Additional, the SEC faces 16 spot ETF selections in October; if most of those selections are optimistic, the altcoin market will get an enormous enhance of liquidity. So, total, the info offers a blended sign. We haven’t entered the alt season but, however we are able to’t rule out its risk in This fall.

DeFi Market

The DeFi market was led by Ethereum which held $99 billion in Complete Worth Locked (TVL) throughout 1,623 protocols. Solana ranked second with $13 billion in TVL and 375 protocols. Nonetheless, the standout performer was the BSC Chain, with $9 billion in TVL. Over the previous month, BSC’s TVL surged by 26%, considerably outpacing Ethereum’s 9% progress. BSC Chain additionally recorded the very best DEX quantity, reaching $4.14 billion.

Out of the highest 10 DeFi cash, we discovered XRP’s worth motion fairly intriguing. It crossed the $3 mark, signaling an upside potential of round 40%, with goal costs projected between $3.98 and $4.32. The U.S. SEC is anticipated to approve the primary XRP spot ETF by 18 October, a transfer that might appeal to as much as $5 billion in new capital inflows and additional enhance XRP’s market exercise.

Hyperliquid processed practically $330 billion in buying and selling quantity in July 2025, briefly surpassing Robinhood. Over the previous month, its buying and selling quantity surged by round 90%, reflecting robust market exercise. Whereas month-to-month energetic customers dipped in July, the quantity rebounded in August and September. Nonetheless, improvement exercise confirmed a slight slowdown throughout July earlier than choosing up once more later.

RWA Protocols

The TVL locked in RWA protocols jumped sharply from $3.4 billion on 1 July to $16 billion by 30 September. Authorities securities made up the most important share of the RWA market capitalization by product class (every day).

In the meantime, the entire worth of on-chain RWAs reached $33.2 billion, marking a 13% improve over the previous month. The variety of asset holders rose to 417,583 (+8.9%), whereas asset issuers totaled 224. The whole stablecoin worth climbed to $293.1 billion (+5.5%), with 194.7 million holders, up 1.9% from 30 days in the past.

Ethena, Sky, and Maple remained the highest three protocols by TVL. Amongst them, Ethena’s quantity jumped by 24% previously month, whereas Sky Protocol led the best way with the very best quantity of $1.4 billion.

Meme Cash

Among the many high 10 meme cash, Dogecoin stood out with robust efficiency in Q3 2025, practically doubling in worth by September. On the every day chart, $0.31487 served as a key near-term resistance degree. After a quiet Q2, improvement exercise confirmed renewed momentum in September, although social dominance remained decrease than the highs seen in April 2025.

Up to now 30 days, the STOSHI meme coin recorded the very best good points, hovering by 5,390%. Over the previous yr, nonetheless, GOHOME stood out with a unprecedented 9.29M% improve. These initiatives seem to indicate indicators of short-term hype or pump-and-dump habits, fairly than being sustainable, long-term initiatives.

The launch of meme cash hasn’t slowed down. Day-after-day, hundreds of latest tokens seem, many utilizing copied code or created by unknown builders. This has raised critical cybersecurity considerations. Hackers are profiting from the political coin pattern by sharing faux airdrop hyperlinks and harmful browser extensions that faux to be pockets boosters or token declare instruments.

DePIN Sector

Although the variety of DePIN initiatives and gadgets grew rapidly in June, the general market cap stayed a lot decrease than it was in January. In Q3, Akash Community led the decentralized computing house, Filecoin remained on high in decentralized storage, and Ankr Protocol dominated the infrastructure sector.

DePIN noticed a 400% trade surge in 2024, as per Messari. As of September 2025, the sector’s complete market cap exceeded $37 billion. The World Financial Discussion board (WEF) predicts DePIN may develop into the trillions by 2028, remodeling computing by way of a extra distributed infrastructure.

NFT Market

In Q3 2025, NFT gross sales reached $1.66 billion, up 20% from the earlier quarter. Ethereum-based NFTs led the market with $97 million in gross sales, adopted by Bitcoin-based NFTs at $60 million.

The NFT house is shifting from the speculative hype in 2021 to a extra utility-focused market. NFT gaming now makes up 38% of all transactions.

Excessive-end assortment attracted demand, a CryptoPunk just lately offered for $218,540, reflecting rising curiosity in blue-chip NFTs. In the meantime, institutional traders now account for 15% of complete NFT income, supported by clearer SEC and MiCA laws.

This fall Watchlist: Key Strikes & Tendencies to Carry on Your Radar

Earnings Season: Institutional sentiment from This fall earnings may spill over into crypto markets.

Retail Re-entry: Retail traders are slowly coming again to gold and crypto as charges ease.

Fed Coverage Path: All eyes on the Federal Reserve’s subsequent transfer, extra cuts or a pause?

Key Knowledge: CPI, unemployment, and wage progress will drive the speed and inflation expectations.

Rising Bond Yields: G7 yields are climbing at a historic tempo; tighter liquidity forward.

U.S. Tariffs: Greater tariffs and commerce tensions may gasoline inflation once more.

Geopolitics: Ongoing international tensions could set off risk-off sentiment.

Stablecoins: Fast stablecoin provide progress alerts extra liquidity in crypto markets.

BTC Whales: Watch on-chain whale actions for indicators of accumulation or sell-offs.

EIP-4844 Adoption: Ethereum’s proto-danksharding improve may enhance L2 exercise.

GENIUS Act: U.S. implementation could carry clearer guidelines for stablecoins and funds.

SEC Rulemaking: New digital asset laws may form institutional participation.

Labor Market: Weak job information could push the Fed towards extra easing, however trace at slowdown dangers.

Assist Our Analysis

We might recognize it should you may credit score our Q3 2025 Crypto Market Report with a hyperlink when utilizing any information or insights from this evaluation.

Disclaimer: This report is for informational functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. At all times do your personal analysis earlier than making monetary selections.

A Particular Due to Our Accomplice: WEEX

WEEX crypto alternate stands out for its simplicity, belief and innovation. The platform makes buying and selling straightforward with clear charges, clean onboarding, and highly effective instruments for all customers. It gives copy buying and selling, perpetual futures, and a $30,000 welcome bonus (circumstances apply) to reinforce the buying and selling expertise. As a centralized alternate, WEEX helps spot, futures (as much as 400x leverage), OTC, and duplicate buying and selling throughout 1,000+ cryptocurrencies.

To make sure transparency and security, WEEX maintains a 1,000 BTC USDT person safety fund with public Proof of Reserve and makes use of superior safety methods. Relying on the person degree, KYC verification may be required for added account safety. 99Bitcoins discovered WEEX to be a dependable and easy-to-use alternate with robust liquidity and clean efficiency. We extremely suggest giving it a attempt.

Go to WEEX

References

Why you may belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto specialists since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Professional contributors

2000+

Crypto Initiatives Reviewed

Observe 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now