Crypto has loads of phrases that may sound complicated at first, however really aren’t. The excellence between fungible vs. non-fungible tokens is considered one of them. It’s essential to grasp when you’re entering into crypto, and it’s really easier than it appears. Fungible tokens work like forex, and non-fungible tokens (NFTs) are distinctive and characterize invaluable belongings. This information will let you know precisely how each work, why they matter, and the right way to inform them aside.

What Are Fungible Tokens?

A fungible token is a type of digital token the place all particular person models of a kind have equal worth, making them similar and interchangeable. Meaning one unit is at all times value the identical as every other, regardless of who owns it or the place it comes from. It makes them excellent for buying and selling, spending, or saving, similar to common cash.

There are numerous fungible tokens on the market, and most observe some type of customary, like ERC-20, which was launched on Ethereum in 2015. It ensures they’re uniform, simple to separate, and easy to commerce. They act like currencies or commodities, seamlessly circulating by way of the digital world with out shedding worth. Think about them like greenback payments. It doesn’t matter which one you hand over on the retailer. So long as it’s the identical denomination, it’s value the identical quantity all over the place.

Fungible tokens are the spine of the crypto financial system. They embrace Bitcoin (BTC), Ethereum (ETH), altcoins and stablecoins. As of April 2025, there are over 17,000 cryptocurrencies in existence—most of that are fungible tokens.

Examples

Listed below are a few of the hottest fungible tokens you’ll run into:

Bitcoin (BTC): The primary fungible asset in crypto. It set the usual for all digital cash.

Ethereum (ETH): Used for funds internationally, and working good contracts.

Tether (USDT) and USD Coin (USDC): Stablecoins that monitor the US greenback’s worth.

Uniswap (UNI) and Aave (AAVE): Utilized in DeFi platforms for buying and selling, lending, and governance.

Axie Infinity (AXS): A sport token that powers a play-to-earn financial system.

Use Circumstances and Purposes

Fungible tokens are actually all over the place in crypto. They can be utilized to:

Purchase items, pay for providers, switch funds globally.

Simply change cash on platforms like Binance or Coinbase.

Present liquidity, stake belongings, and earn yield in DeFi.

Function an in-game forex for blockchain video games.

Vote on adjustments in decentralized tasks.

Advantages and Challenges

What Are Non-Fungible Tokens?

A non-fungible token (NFT) is a digital asset that represents one thing distinctive, with its personal ID and metadata baked into the blockchain. That’s what makes it non-fungible—you possibly can’t swap an NFT for any one other. They don’t have equal worth and may’t be copied.

Most NFTs observe Ethereum’s ERC-721 customary, launched in 2018. It lets builders create tokens that show possession data of belongings with distinctive attributes. These belongings could possibly be something from artwork, a bit of digital land, a uncommon sport merchandise, or a music monitor.

Consider NFTs like household heirlooms or collectibles. Every one is considered one of a sort, with its personal story, that means, and totally different worth.

Examples

Right here’s the place you possibly can see non-fungible tokens in motion:

CryptoPunks: One of many first massive NFT collections, the place every punk avatar is totally different.

Bored Ape Yacht Membership: Distinctive ape photographs, typically used as profile pics.

Beeple’s “Everydays” NFT: Offered for $69 million at Christie’s in 2021.

NBA Prime Shot: Basketball spotlight clips as digital collectibles.

Decentraland Land Parcels: Items of the digital world you can purchase.

Use Circumstances and Purposes Past Digital Artwork

As of late, NFTs are about extra than simply artwork. You should use them in many various methods:

Digital Actual Property: Purchase land in video games like Decentraland or Sandbox.

In-Recreation Gadgets: Personal uncommon skins, weapons, or outfits which are uniquely yours.

Music and Media: Purchase strictly distinctive songs, movies, or albums.

Tickets and Memberships: Some NFTs give occasion entry or particular perks.

Bodily Items: Some manufacturers hyperlink NFTs to real-world objects like footwear or watches.

NFTs allow you to characterize possession of virtually something, from a digital file to real-world belongings.

Advantages and Challenges

Why So A lot Negativity Round NFTs in Common?

NFTs get hate for a few causes, and it’s essential to maintain these criticisms in thoughts when you’re considering of shopping for considered one of your personal. Some folks suppose NFTs are scams or overpriced. Others fear about their environmental impression, since some NFTs run on energy-heavy blockchains (although this has improved since Ethereum’s 2022 improve to proof-of-stake). Critics additionally level out that anybody can copy and use the digital file an NFT represents. Plus, markets are full of pretend collections and dangerous investments. All of this creates loads of unhealthy press.

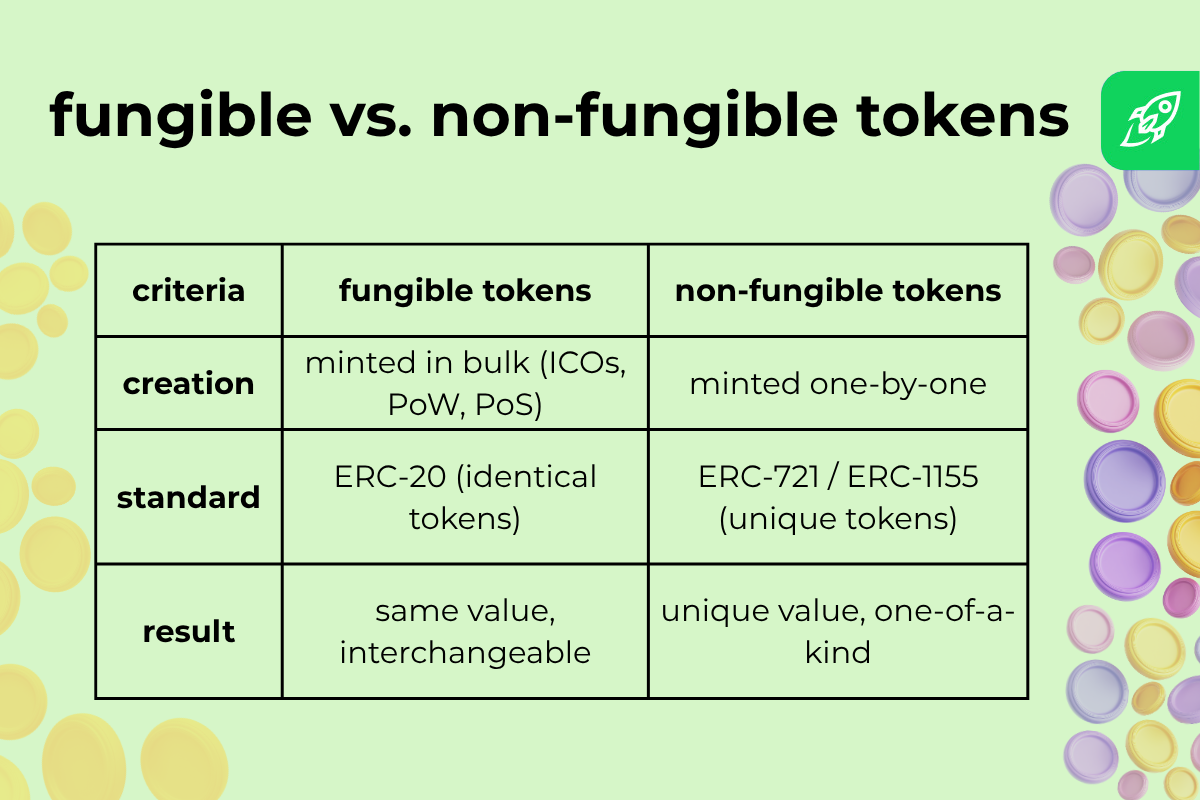

Key Variations Between Fungible and Non-Fungible Tokens

Each varieties dwell on the blockchain, however they work in very alternative ways and are use for various circumstances. Right here’s how fungible vs. non-fungible tokens differ:

Requirements

As we’ve coated above, fungible tokens often observe the ERC-20 customary. This makes positive each token of the identical kind works precisely the identical manner. You possibly can ship, obtain, or commerce them with out delving into the small print.

Non-fungible tokens (NFTs) observe ERC-721 or ERC-1155 requirements. Not like different tokens, these requirements enable builders to characterize distinctive belongings with their very own IDs and metadata, making every NFT distinct and indivisible.

Possession

With fungible tokens, possession is unfair. Should you maintain 1 ETH or 1 BTC, it has the identical worth as anybody else’s. It doesn’t matter which actual unit you personal.

With non-fungible belongings, possession is restricted. Every NFT represents distinctive possession of a digital asset. You personal that actual token and nobody else has something prefer it.

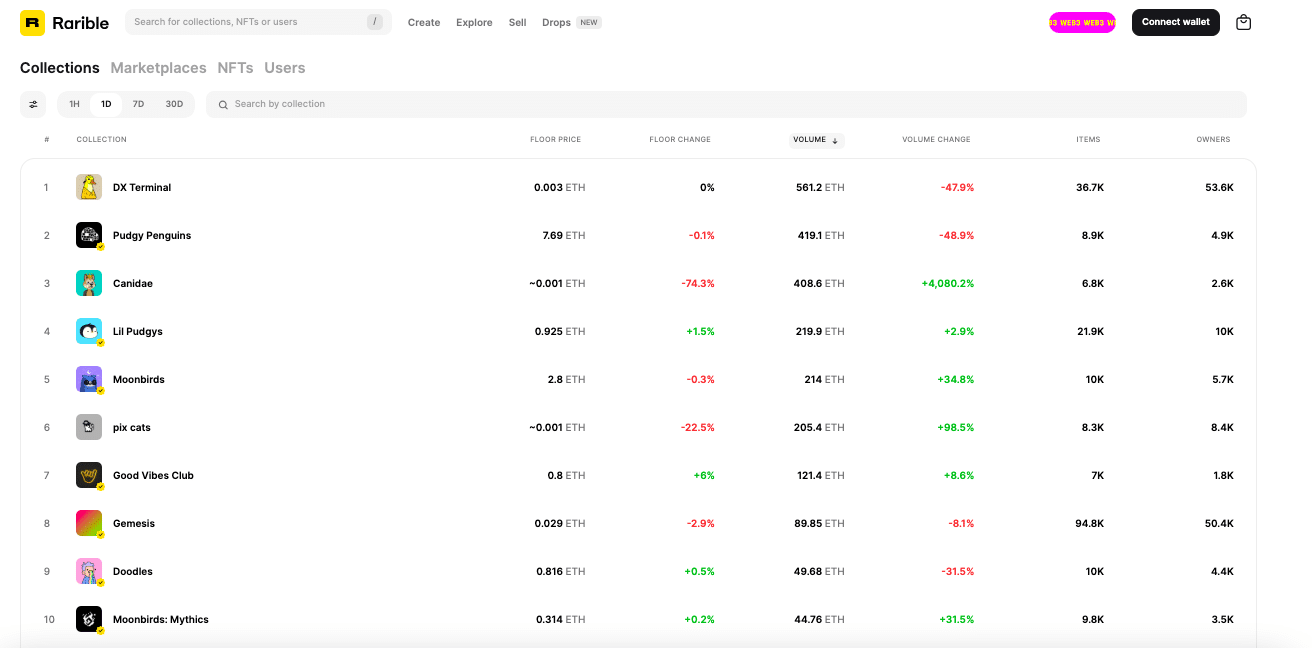

Marketplaces

You possibly can commerce fungible tokens on common crypto exchanges like Binance, Coinbase, or Kraken. These platforms deal with monetary transactions for tokens with the identical kind and worth.

For non-fungible belongings, you’ll must go to NFT marketplaces like OpenSea, Blur, or Rarible. These platforms allow you to purchase, promote, or public sale belongings which are distinctive and non-interchangeable.

Interchangeability

Fungible tokens are thought-about fungible as a result of they’re absolutely interchangeable. Meaning you possibly can swap one bitcoin for one more bitcoin, for instance, with no change in worth. It’s like exchanging two greenback payments or two gold bars of the identical weight for one another.

Non-fungible tokens are the precise reverse. Every one is totally distinctive. You possibly can’t commerce them on a one-to-one foundation as a result of all of them have a unique worth relying on what they characterize.

Divisibility

Fungible tokens are divisible. You possibly can break them into smaller elements. Bitcoin divides into satoshis, and Ethereum into GWEI. This makes them helpful for monetary transactions of any dimension.

Non-fungible tokens, nonetheless, aren’t divisible. You possibly can’t break up an NFT into items in any respect. It’s both the entire thing, or nothing. It’s in keeping with their philosophy of strict uniqueness.

Liquidity

Fungible tokens have excessive liquidity. You possibly can simply commerce them on exchanges on the similar worth as everybody else. It’s easy, like exchanging fiat cash at a forex counter.

Then again, non-fungible tokens have low liquidity. Meaning promoting them will depend on discovering the best purchaser who values that particular asset. It’s extra like attempting to public sale off your diamond ring, and generally, it may well take weeks to seek out somebody who will take it off your palms.

Creation

Fungible tokens are sometimes minted in bulk utilizing consensus strategies, token gross sales, or Preliminary Coin Choices (ICOs). For instance, Bitcoin is generated by way of proof-of-work mining, whereas Ethereum now points new tokens by way of proof-of-stake rewards after the Merge in 2022.

Non-fungible tokens are created individually by way of minting. This course of embeds the token’s metadata on the blockchain, giving every NFT a novel identifier and possession report. It’s like stamping a certificates of authenticity on a digital collectible.

Storage

Fungible tokens dwell solely on the blockchain. Your pockets doesn’t maintain the cash themselves, it simply shops your non-public key and reads the general public ledger to indicate you your steadiness. Wallets like MetaMask or Belief Pockets merely show that on-chain steadiness once you join.

Non-fungible tokens work in a different way. You retain possession data on-chain, however the precise information—photographs, movies, metadata—are often saved off-chain by way of options like IPFS. Your pockets simply holds the ID and factors to that file. Consider it like proudly owning a receipt: the token proves you personal one thing, whereas the asset itself lives in a separate vault.

Governance

Fungible tokens generally offer you voting energy. For instance, utility tokens like UNI or MKR let holders vote on challenge updates or payment adjustments. On this case, your fungible belongings can act like shares in an organization, with every token appearing as one vote.

Non-fungible tokens, in the meantime, often don’t have governance options. Proudly owning an NFT means you personal a novel asset, however you usually don’t get a say in platform selections.

Utility

Fungible tokens work like digital cash. You utilize them to facilitate transactions and pay, commerce, stake, or make investments. They energy DeFi apps, gaming economies, and day-to-day crypto transactions. Should you’re sending crypto to a good friend or shopping for cryptocurrency on an change, you’re utilizing fungible belongings.

Non-fungible tokens serve a unique function. They characterize possession of distinctive issues—like digital artwork, in-game objects, collectibles, or real-world belongings. Some NFTs unlock perks: occasion tickets, VIP memberships, or future proceeds from gross sales. Others simply sit in wallets, as collectibles or standing symbols.

Performance

Fungible tokens are constructed for velocity and ease. You utilize them to pay, commerce, stake, or switch worth. They gas on a regular basis crypto actions, and preserve the crypto financial system transferring by permitting quick, frictionless exchanges.

Non-fungible tokens serve a unique function. They’re designed for provenance and monitoring possession. Every NFT hyperlinks to a particular asset, and their perform is to show who owns what and keep that report ceaselessly on the blockchain.

Safety Dangers

Fungible tokens face safety points that focus on the underlying blockchain expertise, or person errors. They will embrace phishing, or change breaches, all of which If somebody will get your non-public key, they will drain your pockets. Sensible contract bugs may also result in stolen funds. One instance of that is the Poly Community hack of 2021, when a hacker took benefit of an exploit and drained over $600 million in ETH, USDT, and different belongings from the DeFi protocol.

Non-fungible tokens have their very own dangers. For one, if the file linked to your NFT disappears from off-chain storage, you’re caught with a token that factors to nothing. Scams are frequent too, with faux collections, counterfeit NFTs, or hyperlinks to malicious websites. Simply take a look at the Developed Apes case, the place patrons paid for NFTs tied to a sport promised by the creators—who then vanished with $3 million.

Learn extra: Threat Administration in Crypto

Worth

Fungible tokens get their worth from market demand, and their worth distinction will depend on provide, hype, and real-world use—similar to shares. For instance, if extra corporations begin accepting Bitcoin as fee, demand will rise and the value will go up.

With NFTs, every token has its personal worth based mostly on its rarity and group curiosity. There’s a component of hype in what makes non-fungible belongings well-liked. One instance is the Bored Ape Yacht Membership, which shot up when celebrities like Snoop Dogg and Eminem purchased in and used their NFTs as profile pics, even performing as their avatars on the VMAs.

Future Views

The way forward for fungible and non-fungible tokens is trying vivid. For fungible tokens, adoption is on the rise. Increasingly corporations are accepting crypto funds, and stablecoin tasks comparable to Tether and Circle are partnering with companies like Visa, Mastercard, and PayPal. Non-fungible tokens are increasing, too, transferring past digital artwork into gaming, digital land, and real-world belongings. Even the New York Inventory Trade has filed logos for its personal potential NFT platform.

Learn extra: Actual-World Belongings In Crypto

Methods to Purchase Fungible Tokens

Changelly is a superb place to begin with crypto, and shopping for fungible belongings on the platform is quick, simple, and beginner-friendly. Right here’s the way it works:

Choose a token. You possibly can select Bitcoin, Ethereum, USDT, or over 1,000 others.

Enter your pockets deal with. That is the place your purchased belongings will go. Keep in mind to at all times double-check your deal with!

Pay with a debit or bank card, Apple Pay, or others. Changelly helps a number of fee choices, together with fiat currencies like USD or EUR.

Obtain your tokens. After fee, your belongings are despatched on to your pockets. No hidden charges or further steps.

You should purchase as much as $30,000 value of crypto in a single transaction on Changelly. That makes it simple to begin small, or go massive.

Closing Phrases

As we’ve seen, there are essential variations between fungible and non-fungible tokens within the crypto world. Fungible belongings are interchangeable and share the identical worth, serving as a type of digital forex and the core of the complete crypto group. Non-fungible belongings are all strictly distinctive, and are used to characterize artwork, collectibles, real-world belongings, and different invaluable commodities.

Fungible tokens are your finest wager for buying and selling, investing, or utilizing crypto as forex, whereas non-fungible tokens make sense when you’re trying to gather digital belongings, be a part of gaming ecosystems, or spend money on distinctive objects in the true world.

FAQ

Why would somebody purchase a non-fungible token?

To personal a completely distinctive digital asset, which could possibly be digital artwork, a collectible, or an in-game merchandise with particular attributes. Some folks additionally purchase NFTs as investments or standing symbols.

Do I want cryptocurrency to purchase NFTs?

Sure. You should purchase most non-fungible tokens (NFTs) with Ethereum or different cryptocurrencies. You’ll want a crypto pockets and a few ETH to buy on platforms like OpenSea or Blur.

Are NFTs or fungible tokens a greater funding?

It will depend on your targets. Fungible tokens are higher if you wish to use crypto like cash—for buying and selling, saving, or paying for issues. Non-fungible tokens are riskier, and don’t have any mounted worth, however they work higher for accumulating or long-term investing, particularly when you consider that the asset will improve in worth over time.

Are you able to make actual cash with NFTs?

Sure, however it’s not assured. You may make cash on an NFT by shopping for low and promoting excessive, similar to different crypto belongings. Some NFTs shoot up in worth when demand spikes, however others by no means do.

Can I convert NFTs to actual cash?

Sure, however it’s a two-step course of. You possibly can promote the NFT for crypto like ETH on a market. Then convert that into money utilizing an change.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.