Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged down a fraction of a p.c previously 24 hours to commerce at $123,748 as of 4:29 a.m. EST, as VanEck says that BTC may very well be value half as a lot as gold by its subsequent halving, which is slated for 2028.

In line with Mathew Sigel, head of digital asset analysis at VanEck, “We’ve been saying Bitcoin ought to attain half of gold’s market cap after the following halving.”

The latest rise in gold costs would place Bitcoin at $644,000 in “equal worth.”

The flexibility of the king of cryptocurrencies has, for a very long time, been in comparison with that of gold. Nonetheless, gold has outperformed BTC up to now this yr, rising 50% amid growing uncertainty over political developments.

Nonetheless, based on Sigel, youthful traders favor Bitcoin as a retailer of worth.

“Roughly half of gold’s worth displays its use as a retailer of worth moderately than industrial or jewellery demand, and surveys present youthful shoppers in rising markets more and more favor Bitcoin for that function,” he mentioned.

We’ve been saying Bitcoin ought to attain half of gold’s market cap after the following halving. Roughly half of gold’s worth displays its use as a retailer of worth moderately than industrial or jewellery demand, and surveys present youthful shoppers in rising markets more and more favor Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) October 7, 2025

Establishments Pour Into Bitcoin As ETFs Hit Report Highs

Sigel’s prediction comes amid sturdy curiosity for US-based spot Bitcoin ETFs (exchange-traded funds). These merchandise noticed inflows of $1.18 billion in a single day yesterday, their second-largest ever, coinciding with Bitcoin break to a brand new all-time excessive.

October’s complete ETF inflows now stand at about $3.47 billion over simply 4 buying and selling days.

Between then, the BlackRock iShares Bitcoin Belief (IBIT) dominated the surge, drawing roughly $970 million in new capital. Since their debut, Bitcoin ETFs have amassed round $60 billion in complete inflows, underscoring rising institutional confidence.

Bitcoin ETFs have taken in ~$60 billion since launch pic.twitter.com/UyjkhM5f8Y

— James Seyffart (@JSeyff) October 6, 2025

BTC rose to a brand new ATH on Monday, however is now 2% down. Can the value recuperate to soar to the degrees predicted by Sigel?

Bitcoin Value Motion Exhibits Bullish Continuation Inside Rising Channel

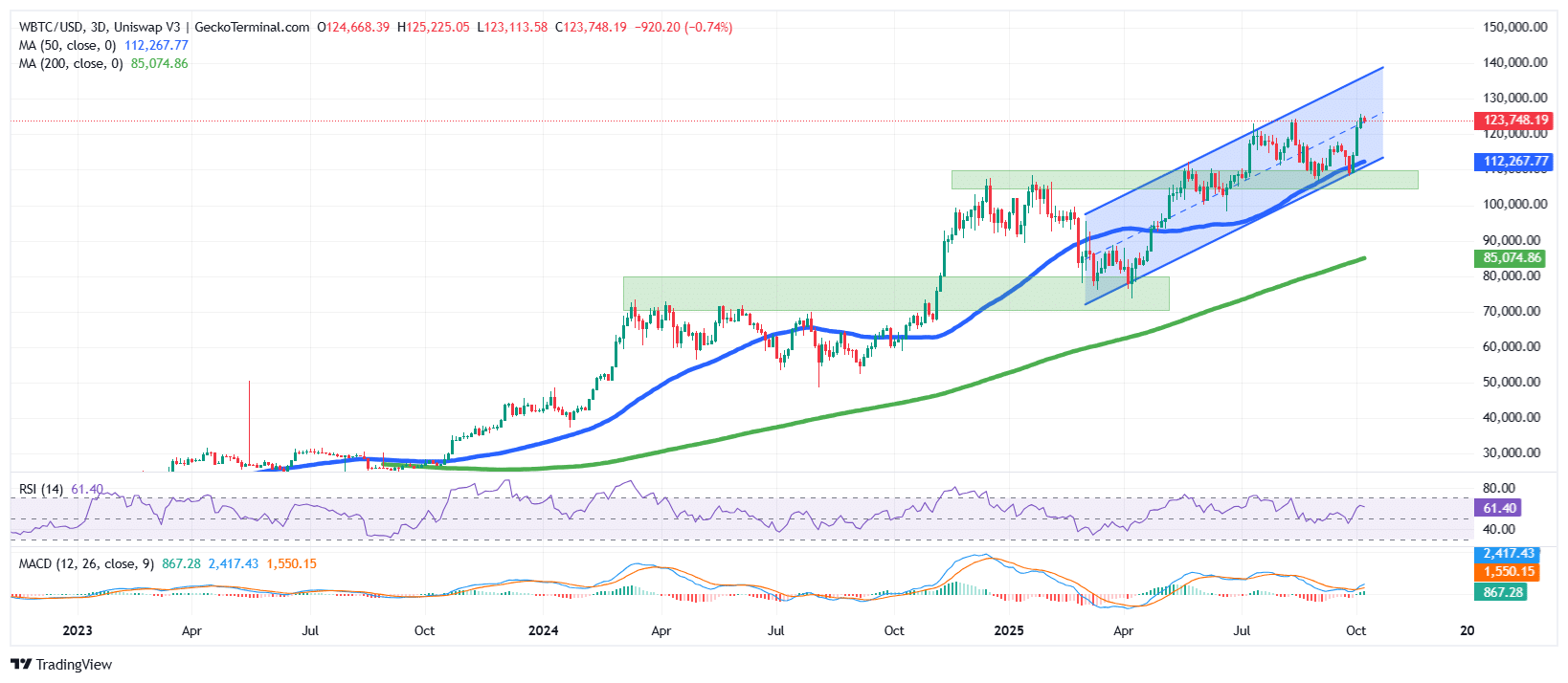

The BTC value on the 3-day chart reveals a robust bullish construction that has endured all through 2024 and into late 2025.

Bitcoin value motion has been transferring inside a rising channel sample, marked by increased highs and better lows, which is a sign of an uptrend.

After a short interval of consolidation close to the $90,000–$100,000 vary, consumers regained management, pushing the value of Bitcoin again above each the 50 and 200 Easy Shifting Averages (SMAs) on the 3-day chart.

The 50 SMA (round $112,000) is presently performing as dynamic help, whereas the 200 SMA (close to $85,000) stays nicely under, confirming the energy of the long-term bullish momentum.

In line with the chart, the previous resistances have now was stable help ranges, significantly round $100,000.

Every pullback into these zones has been met with renewed shopping for strain, suggesting that institutional demand continues to underpin the market.

BTC Momentum Indicators Sign Energy However Warn Of Close to-Time period Cooling

The chart’s momentum indicators additional reinforce the bullish sentiment, although they trace at the potential of short-term consolidation.

The Relative Energy Index (RSI) sits at roughly 61, comfortably above the impartial 50 mark however nonetheless under the overbought threshold of 70. This implies that whereas shopping for strain stays dominant, there may be room for both a continuation increased or a short pause earlier than the following breakout.

In the meantime, the Shifting Common Convergence Divergence (MACD) indicator presents a equally encouraging view.

The blue MACD line has crossed above the orange sign line, and the histogram is exhibiting constructive momentum, a bullish crossover that always precedes value growth phases.

If the channel construction holds, the BTC value may climb towards $135,000–$140,000 within the coming weeks, supplied it maintains help above $112,000.

A decisive break under that stage, nevertheless, may open the door for a deeper correction towards $100,000 earlier than consumers step again in.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection