This 12 months marks the 12 months of the stablecoin, particularly within the US. From the beginning of the 12 months, we’ve watched as stablecoins advanced from an idea in trials abroad to a market pressure attracting billions in day by day transaction quantity, partnerships with main cost networks, energetic pilots amongst US banks, and a central focus of US monetary regulation within the type of the GENIUS Act.

After the passage of the GENIUS Act in July, Ernst & Younger’s (EY) technique consulting providers group EY-Parthenon surveyed greater than 350 executives from monetary and nonfinancial sectors about their views on stablecoins. Based mostly on its findings, the agency generated a 31-page report that highlights adoption, utilization, advantages, challenges, regulatory implications, and extra. We’ve highlighted the report’s 5 main takeaways under.

Stablecoins are now not fringe

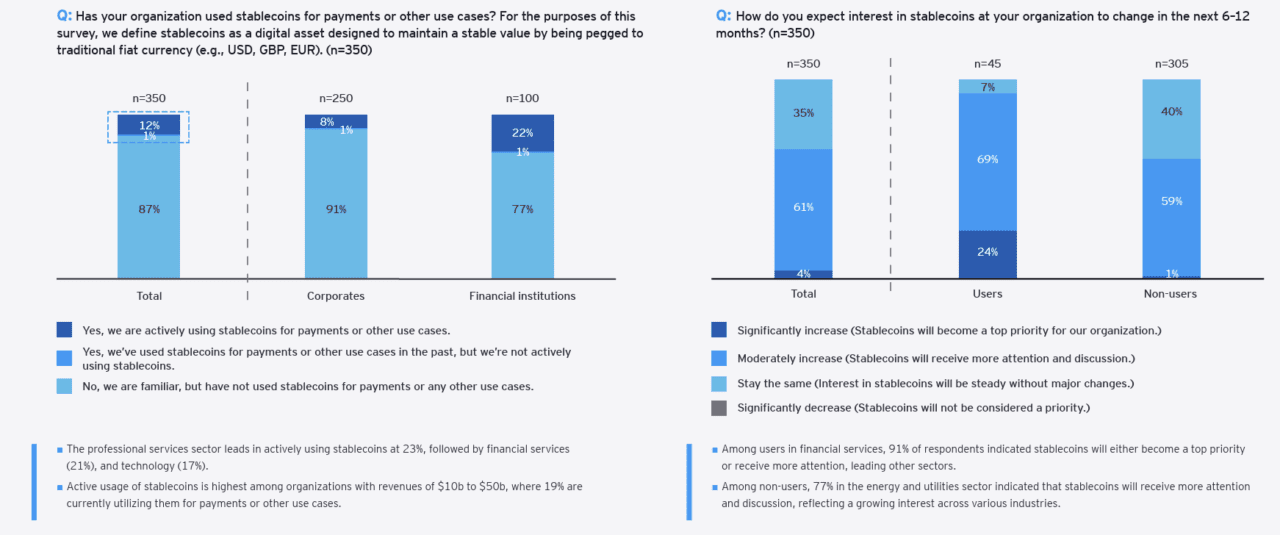

All the 350 executives surveyed are conscious of stablecoins. Of these, 13% have already used stablecoins and 65% count on curiosity in stablecoins to rise within the subsequent 6 to 12 months.

The truth that 100% of executives surveyed are conscious of stablecoins demonstrates how rapidly stablecoins have moved into the mainstream. For banks and corporates, the dialog round stablecoins is now not a query of “if,” however slightly “how briskly” adoption spreads and what function the group ought to play. This shift from area of interest to norm reveals that establishments that wait to make a transfer could miss out on shaping requirements and capturing early market share.

Charts from EY-Parthenon

Stablecoin utilization

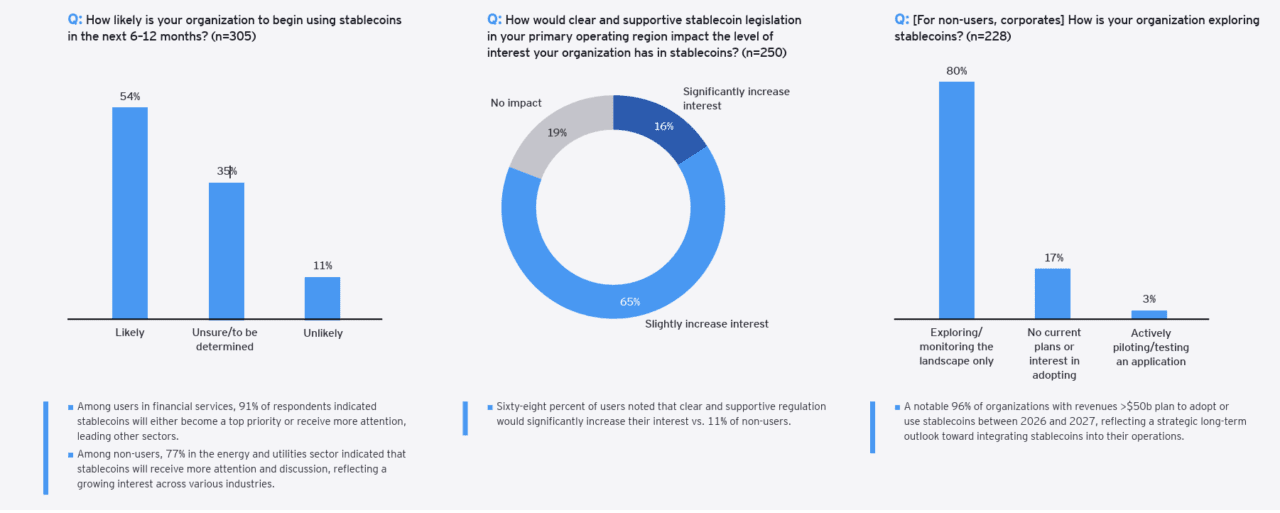

Greater than half, 54%, of economic establishments and corporates that aren’t utilizing stablecoins count on to start utilizing them within the subsequent 6 to 12 months. For 81% of contributors surveyed, clear and supportive laws will increase their curiosity in stablecoins, both considerably or barely.

With greater than half of companies signaling plans to undertake stablecoins inside a 12 months, the market will possible see an acceleration in utilization. For policymakers, this highlights the significance of regulatory readability, provided that it will immediately increase adoption. For banks, it reveals a possibility to deepen their relevance by providing compliant, stablecoin-enabled providers earlier than rivals get there first.

Charts from EY-Parthenon

Cross-border fund transfers are the highest use case

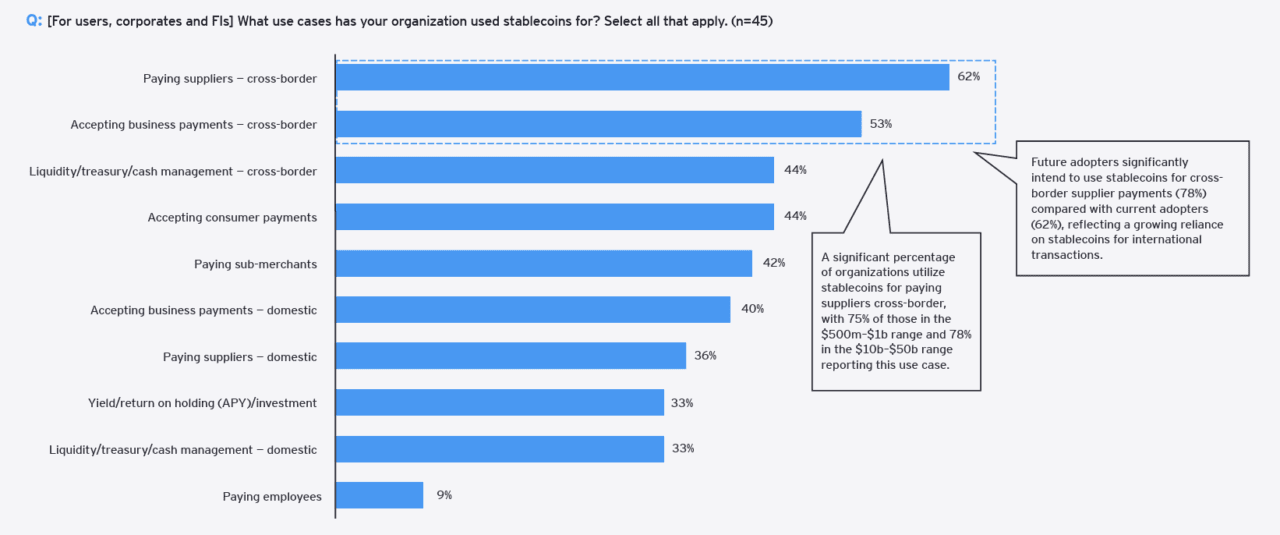

The survey requested about 10 completely different use instances. Of these ten, the highest three use instances centered round cross-border funds.

This reveals that stablecoins are tackling actual, persistent ache factors, particularly in cross-border funds. Regardless of earlier disruption by various gamers akin to Smart, Remitly, and Revolut, worldwide transfers stay sluggish and costly. Stablecoins are a reputable various that resonates with companies and shoppers. This focus might disrupt entrenched correspondent banking networks and provides stablecoin adopters an edge within the profitable discipline of cross-border funds.

Charts from EY-Parthenon

Corporations most eager about lowering value and growing cost velocity

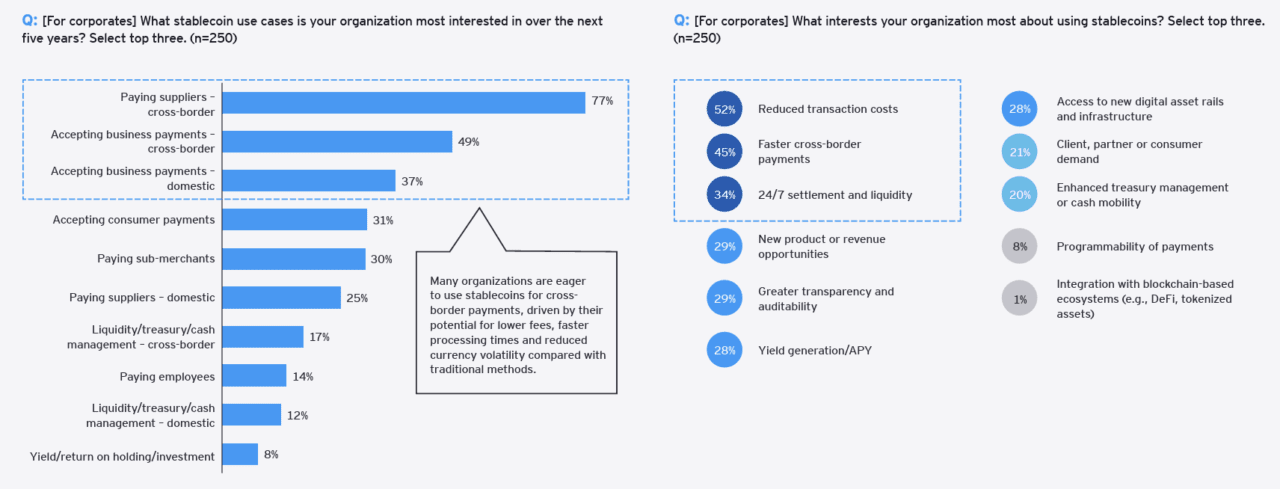

Probably the most attention-grabbing use case is cross-border funds (77%), with curiosity largely pushed by discount in transaction prices and quicker funds.

The overwhelming curiosity in value financial savings and velocity is a reminder that stablecoins will succeed or fail primarily based on tangible worth, not hype. For companies, even modest reductions in cross-border charges can translate into vital financial savings at scale. Banks face the problem of turning this effectivity right into a aggressive benefit, providing higher pricing and quicker settlement whereas managing dangers.

Charts from EY-Parthenon

Sensible implementation

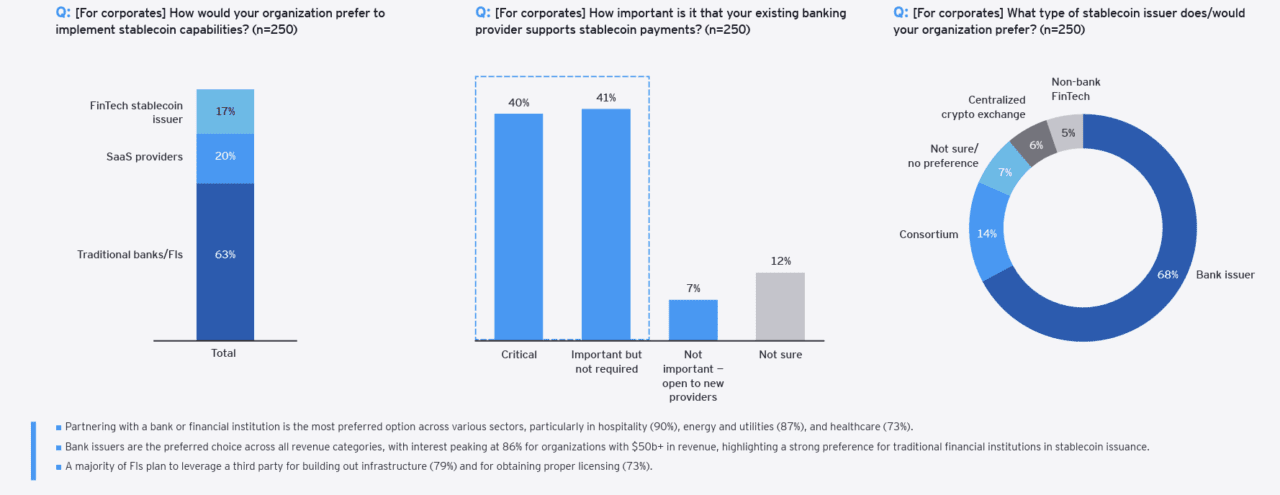

The survey discovered that organizations need to their conventional banking companions for entry to stablecoins, and that almost all monetary establishments, 79%, plan to leverage a 3rd get together for stablecoin infrastructure.

The discovering that almost all organizations plan to entry stablecoins by current banking companions is critical. It suggests that companies need entry to stablecoins with out having to cope with the complexity that comes with the brand new cost rail. As an alternative of investing in-house to leverage the brand new expertise, they’re trying to trusted intermediaries like banks to deal with the heavy lifting of facilitating the infrastructure. For banks, that is each a possibility and a warning. Establishments that transfer rapidly to construct dependable, third-party-powered stablecoin providers can strengthen consumer relationships, whereas laggards threat being bypassed solely.

Charts from EY-Parthenon

Picture by Sebastian Svenson on Unsplash

Views: 69