Forward of the extremely anticipated FOMC assembly later immediately, the whole crypto market cap is up a good 0.5% to over $4.1T. The Bitcoin value is regular above $116,000, and merchants are typically upbeat, anticipating BTC USD to blow up above $118,000 and in the direction of all-time highs set in mid-August.

Whereas confidence is excessive, the tempo at which the Bitcoin value will tick increased largely is determined by macro components. This time round, eyes are on Jerome Powell and the FOMC. In addition to the speed minimize determination, their feedback on the economic system and financial coverage within the coming months earlier than the tip of the 12 months may have an enormous bearing on capital inflows, not solely to Bitcoin crypto but additionally to different greatest cryptos to purchase.

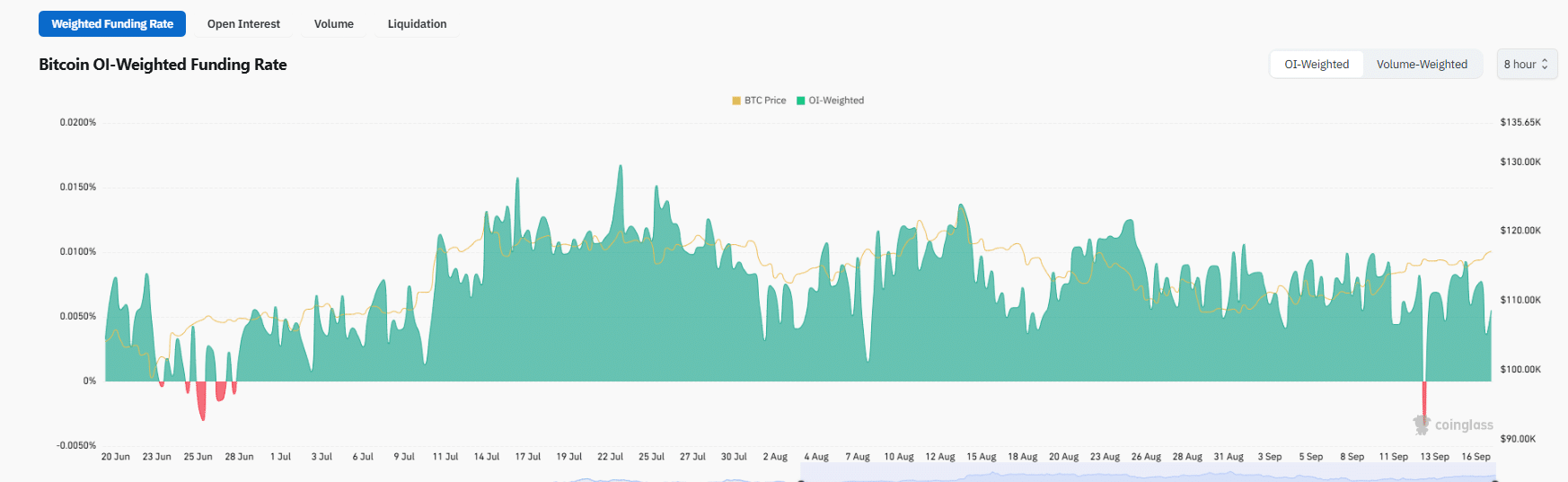

As of September 17, the world’s most beneficial crypto is up practically +4% previously week, per Coingecko. On Coinglass, BTC USDT buying and selling exercise is respectable. Over $21M of leverage BTC USD shorts have been closed within the final day. On the similar time, the funding fee is constructive, which means the final sentiment is bullish as longs are paying shorts to carry their positions.

(Supply: Coinglass)

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

Over $9B in Stablecoins Flood High Crypto Exchanges

Taking a look at on-chain knowledge, it’s probably that BTC ▼-0.21%, prime altcoins, and even a few of the prime Solana meme cash will edge increased, pushing funding charges extra into the constructive territory.

Newest on-chain knowledge reveals that during the last 36 hours earlier than the FOMC assembly, roughly $9B in prime stablecoins, together with USDT and USDC, was moved to crypto exchanges.

Over the past 1.5 days earlier than the FED assembly, roughly $9 billion in stablecoins flowed into exchanges. pic.twitter.com/dD1WwK2tlv

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 17, 2025

Stablecoins play a key function within the crypto ecosystem, permitting merchants to get publicity to prime cash and appearing as a secure refuge throughout instances of turbulence. Every time stablecoins are moved to crypto exchanges like Binance, Coinbase, and Bybit, it might recommend that holders are eager on shopping for, a web constructive for holders.

On the flip facet, when altcoins, together with ETH or BNB, transfer to exchanges, it’s bearish. If there are bulk inflows to exchanges, token costs could crash days later.

Over the past 1.5 days, there was a single $2Bn stablecoin switch to Binance, the only largest motion in over a 12 months.

$2B WORTH OF STABLES JUST GOT DUMPED INTO BINANCE.

RIGHT BEFORE FOMC. 👀

VOLATILITY INCOMING. pic.twitter.com/YIjEYrv1tT

— Kyle Chassé / DD🐸 (@kyle_chasse) September 17, 2025

One analyst on X mentioned these inflows are a transparent signal of shopping for intent and “recent powder” that might ignite crypto fireworks.

🚨 $2B in stablecoins simply hit Binance – the most important influx in over a 12 months.

And it occurs proper earlier than the FOMC.

You don’t transfer that sort of dimension with out intent. It’s recent powder, and it’s now sitting on-exchange.

— Alex Soh (@AlexSoh14) September 17, 2025

DISCOVER: Finest New Cryptocurrencies to Put money into 2025

Will BTC USD Explode To Recent New All-Time Highs Above $130,000?

Merchants can solely wait and see what the FOMC will determine on rates of interest. Ought to they slash charges and challenge much more fee cuts by the tip of the 12 months, BTC USD might simply rally above $124,500 to succeed in recent all-time highs.

24h7d1y

On X, one analyst already notes that the Bitcoin value is buying and selling at a +7% premium to its short-term price foundation, with merchants concentrating on $130,000.

The value is presently buying and selling at a 7% premium to Quick-Time period Value Foundation, goal = $130K pic.twitter.com/w2oeS62cS1

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 17, 2025

At this fee, BTC USD is up +7% from the common value short-term holders purchased it at. Quick-term holders are all addresses that purchased BTC within the final 155 days. Presently, this cohort of Bitcoin holders is within the cash.

In the meantime, the Bitcoin Danger index, which assesses the market vulnerability, is +23%, which is low by historic requirements. This studying reveals that the market is calm, decreasing the chance of undesirable sharp pullbacks or liquidations.

Bitcoin Danger Index – the upper the worth, the extra harmful the present market configuration relative to the final 3 years, with elevated chance of fast pullbacks/liquidations.

Presently, the index is at a low stage of 23%, the surroundings is calm, chance of sharp… pic.twitter.com/RDSjxfTWVg

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 16, 2025

If historical past guides, BTC USD might soar by one other +40%, inserting the Bitcoin value above $150,000 by the tip of the 12 months.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

Over $9B in Stablecoins Moved To Exchanges, BTC USD To $130,000?

Bitcoin value agency forward of FOMC assembly

$9Bn in stablecoins moved to crypto exchanges

FOMC more likely to slash charges

Will BTC USD surge to $130,000 within the coming weeks

Why you’ll be able to belief 99Bitcoins

Established in 2013, 99Bitcoin’s staff members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Skilled contributors

2000+

Crypto Initiatives Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now