Be part of Our Telegram channel to remain updated on breaking information protection

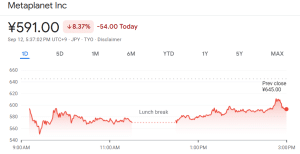

Metaplanet shares plunged 8% after UBS reopened a brief place, becoming a member of Morgan Stanley in betting towards Asia’s largest Bitcoin holder.

UBS had closed an earlier quick however re-entered with a 73.1 million share place, underscoring mounting strain from Wall Avenue as a weak Bitcoin worth and Metaplanet’s sliding share worth threaten to undermine each its enterprise mannequin and its capability to boost funds for extra purchases.

Funding banks together with Jefferies and JPMorgan additionally stay quick, although some friends like Goldman Sachs and Citigroup have lately reduce their positions. When traders quick a inventory, they’re betting that its share worth will drop.

Metaplanet’s share worth is now down greater than 31% over the previous month, in line with Google Finance.

Metaplanet share worth (Supply: Google Finance)

Bitcoin is down nearly 3% previously month.

Morgan Stanley Is The Greatest Brief

Morgan Stanley MUFG has the most important quick place on the Bitcoin stacking firm, holding practically 20 million Metaplanet shares in its place. One of many agency’s buying and selling desks had decreased its quick place barely, however one other one of many buying and selling desks added much more shares, in line with a submit by Vincent on X.

Institutional Brief Place ( Metaplanet 3350 ) Evaluation ,Sep 11,2025

1. Largest quick holder: Morgan Stanley MUFG with practically 20 million shares (2.83%), including 1.92M shares.

2. Morgan Stanley MUFG (second line merchandise): A separate desk reveals 17.68M shares, with a small discount… pic.twitter.com/k31UmWU0Gp

— vincent (@vincent13031925) September 15, 2025

Whereas UBS re-opened its quick place, Jefferies upped its place by practically 2 million shares.

Another banks are closing out their quick positions on Metaplanet.

Goldman Sachs decreased its quick place’s measurement by greater than 6 million shares. Equally, JP Morgan and Citigroup slashed their order sizes by 4 million and 9 million shares, respectively. Barclays additionally trimmed 4.5 million shares.

“The price to borrow Metaplanet (3350) for shorting has surged to an annualized 54%, indicating that out there shares to lend are extraordinarily scarce and that shorting has turn into very costly,” Vincent mentioned.

Metaplanet Premium Continues To Collapse Alongside With Different DATs

Metaplanet is ranked because the sixth-largest Bitcoin holder globally with 20,136 BTC on its stability sheet, in line with information from Bitcoin Treasuries.

Prime ten largest company BTC holders (Supply: Bitcoin Treasuries)

It holds extra BTC in its reserves than CleanSpark, crypto trade Coinbase, and Elon Musk’s electrical automobile producer Tesla.

Metaplanet goals to develop its Bitcoin stash to 30K BTC by the top of this 12 months.

Nonetheless, whereas Bitcoin’s worth has traded flat over the previous week, Metaplanet’s share worth has slid greater than 15%. This has put strain on the corporate’s “Bitcoin premium,” which is the distinction between the corporate’s capitalization and the worth of the Bitcoin that it holds on its stability sheets.

Again in June, traders have been paying over eight instances the worth of the Bitcoin Metaplanet owns to buy the corporate’s shares. That’s now fallen to solely two instances the worth. Analysts have warned that this drop in premium may put the corporate’s Bitcoin accumulation technique in danger.

Metaplanet will not be alone in its premium struggles. Different digital asset treasury (DAT) companies are additionally in danger. Michael Saylor’s Technique (previously MicroStrategy), the most important Bitcoin holder globally with 638,460 BTC on its stability sheet, has seen its share worth drop greater than 9% within the final month.

Abroad Investor Funds For $1.44 Billion Elevate Due Tomorrow

Regardless of the declining premiums, Metaplanet has turned to offshore traders to boost extra capital and develop its Bitcoin reserves. The corporate has lately mentioned that it’ll challenge 385 million shares through a global providing to boost roughly 205 billion yen ($1.44 billion).

Funds for these shares is due tomorrow, with supply set for Sept. 17.

Of the $1.44 billion the corporate is seeking to increase, round $1.25 billion of the proceeds will go towards shopping for extra Bitcoin between September and October this 12 months. The remaining $138.7 million is earmarked for increasing the corporate’s Bitcoin income-generation enterprise.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection