Information exhibits the Bitcoin Retail Investor Demand Change has turned adverse, an indication that the small arms are shedding curiosity within the cryptocurrency.

Bitcoin Retail Quantity Has Gone Down Over The Previous Month

In a brand new put up on X, CryptoQuant neighborhood analyst Maartunn has talked in regards to the newest pattern within the Bitcoin Retail Investor Demand Change, which is an on-chain indicator that measures the 30-day change within the demand of the retail holders.

The retail buyers are the smallest of entities on the community. As such, the scale of their transfers tends to be small as effectively. The Retail Investor Demand Change makes use of the transaction quantity related to transfers carrying a worth of lower than $10,000 as a proxy for the demand amongst this cohort.

When the worth of the metric is constructive, it means the retail investor quantity has witnessed a rise over the previous month. Alternatively, it being beneath zero suggests this group has lowered its exercise.

Now, here’s a chart that exhibits the pattern within the Bitcoin Retail Investor Demand Change over the previous couple of years:

The worth of the metric seems to have dipped into the pink zone in latest days | Supply: @JA_Maartun on X

As displayed within the above graph, the Bitcoin Retail Investor Demand Change spiked to a notable constructive degree earlier, however for the reason that asset’s all-time excessive (ATH) above $124,000, the metric’s worth has fallen off quick and has now dipped into the adverse zone.

The present worth of the indicator suggests the transaction quantity related to transfers valued at lower than $10,000 has dropped by round 5.7% over the previous month. Thus, it appears the retail buyers are leaving the cryptocurrency.

“They’re the vacationers of the crypto market right here for the hype, gone when it fades,” notes Maartunn. The most recent flip in retail sentiment has come because the Bitcoin worth has declined by round 10% for the reason that ATH.

From the chart, it’s seen that the final time the Retail Investor Demand Change fell into the adverse area was across the time of BTC’s dip beneath $100,000 again in June. What adopted this bearish sentiment among the many small arms was a surge within the asset to new ATHs. It now stays to be seen whether or not hype fading among the many retail buyers would act as a contrarian sign for the cryptocurrency this time as effectively.

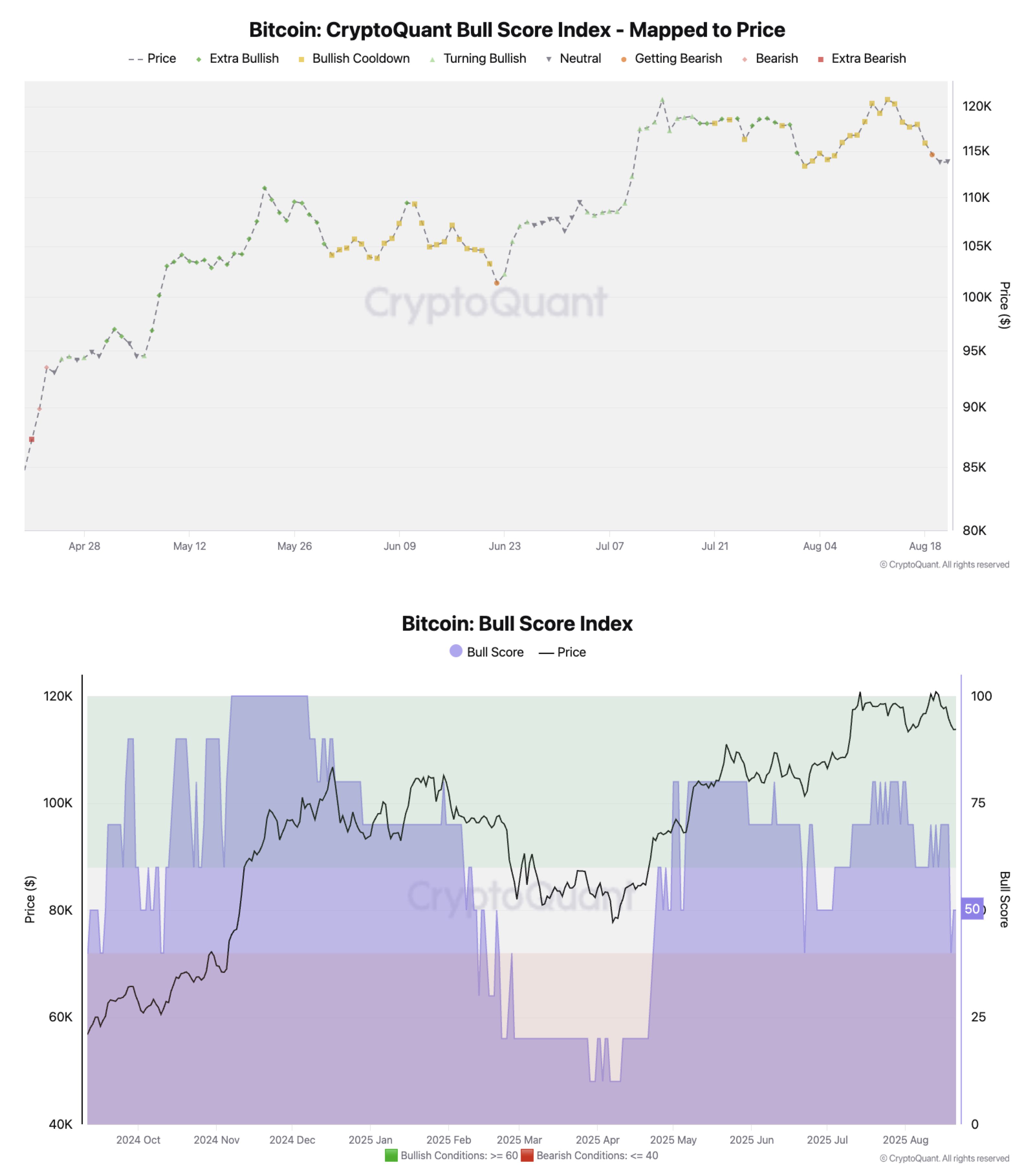

In another information, CryptoQuant’s Bull Rating Index, which tells us in regards to the part BTC is in primarily based on numerous on-chain indicators, has declined into the impartial area lately, because the analytics agency’s head of analysis, Julio Moreno, has identified in an X put up.

The pattern within the BTC Bull Rating Index over the previous 12 months | Supply: @jjcmoreno on X

“For danger administration functions, additional softening within the index signifies worth may go decrease,” explains Moreno.

BTC Value

Bitcoin has seen its drawdown deepen throughout the previous day as its worth has slipped beneath $112,300.

Seems like the worth of the coin has been sliding down throughout the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.