Markets have been below stress as traders await phrase from Federal Chairman Jerome Powell. The Each day Breakdown appears at expectations.

Earlier than we dive in, let’s be sure to’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all you want to do is log in to your eToro account.

What’s Taking place?

Tomorrow morning isn’t a Fed assembly, however Chair Powell will give a speech at 10 a.m. ET from the Fed’s annual Jackson Gap summit.

Powell, who usually holds his playing cards shut when speaking Fed coverage, has been extra open at instances when talking from Jackson Gap. As an example, in final 12 months’s Jackson Gap speech, he advised traders it was time for the Fed to change its rates of interest plans — in different phrases, it was time to decrease rates of interest.

The Fed minimize charges by 50 foundation factors on the subsequent assembly, then did two 25 foundation level cuts over the subsequent few months.

Will we get related transparency tomorrow? Eh…

Whereas Powell would possibly tip the Fed’s hand but once more, the dynamics are completely different proper now. Inflation is rising and the labor market is decelerating. Each of these metrics are transferring in the other way from the Fed’s twin mandate — that are secure costs (i.e. inflation) and most employment.

The Backside Line: No matter Powell says (or doesn’t say) may transfer markets. With the market at the moment pricing in about an 80% likelihood of a fee minimize on the Fed’s September assembly, traders could also be hoping for some affirmation tomorrow. However traders can be listening for different clues too, making an attempt to decipher how the Fed will navigate the remainder of this 12 months. That might have an effect on markets with traders now anticipating two fee cuts by year-end.

Wish to obtain these insights straight to your inbox?

Join right here

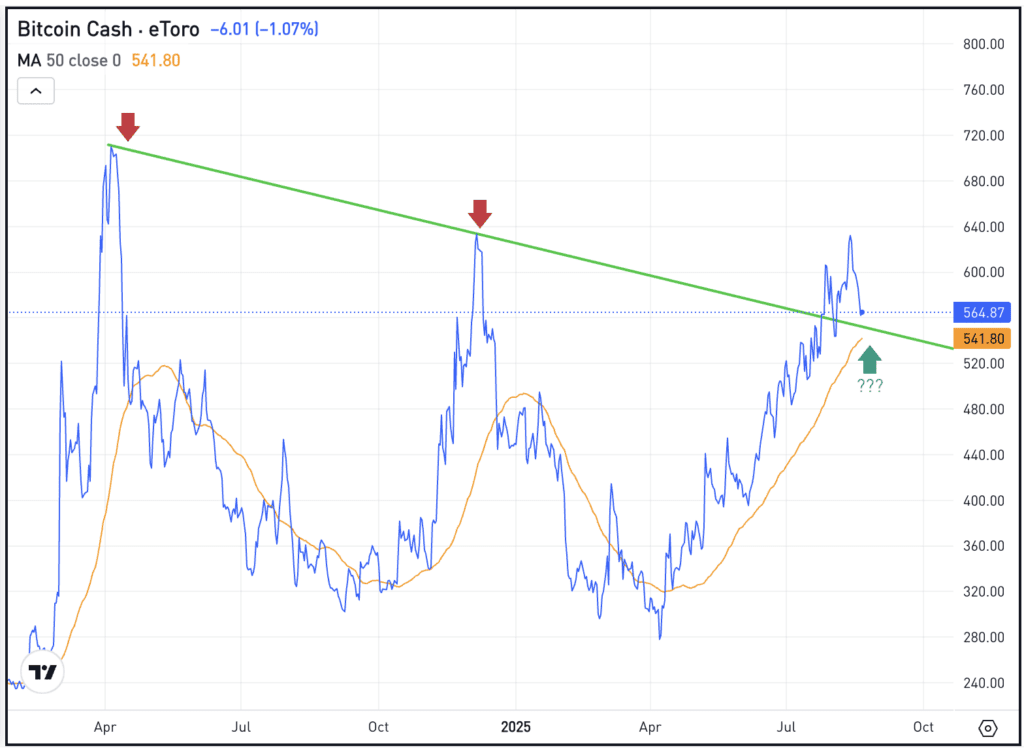

The Setup — Bitcoin Money

With the massive rallies we’ve seen in crypto during the last six weeks, Bitcoin Money looks like it’s been misplaced within the shuffle.

Now pulling again, bulls are questioning if consumers will step in close to the $550 space. Not solely does this space carry the rising 50-day transferring common into play, nevertheless it additionally retests the prior downtrend resistance line (marked in inexperienced). This measure stored BCH in examine by way of June, earlier than a breakout in July despatched Bitcoin Money above this mark.

Even when traders aren’t planning to commerce BCH proper now, they will add it to their watchlist or set alerts proper from the asset web page.

What Wall Road’s Watching

WMT

Shares of Walmart are slipping decrease this morning after the retailer reported earnings. Whereas income and same-store gross sales expectations beat analysts’ estimates, earnings of 68 cents a share missed estimates of 74 cents a share. Coming into the report, shares have been up greater than 12% on the 12 months and up 37.5% over the previous 12 months. Dig into Walmart’s fundamentals.

INTC

Intel has been extremely unstable recently. Shares tumbled 7% on Wednesday, after rising 7% on Tuesday and falling 3.7% on Monday. Actually, final week, Intel inventory rose greater than 20%. There’s been loads of headlines driving Intel inventory recently, however with out query shares have been extra unstable. Try the chart for INTC.

Disclaimer:

Please word that as a consequence of market volatility, a few of the costs could have already been reached and eventualities performed out.

The submit Get Prepared for the Fed appeared first on eToro.