Be a part of Our Telegram channel to remain updated on breaking information protection

Bullish, the crypto change backed by PayPal co-founder Peter Thiel, surged 15% in premarket buying and selling after hovering as a lot as 218% on its NYSE debut yesterday, with Cathie Wooden’s ARK Make investments snapping up a $172 million stake.

The corporate raised $1.1 billion within the providing, with BlackRock amongst heavy-weight traders that purchased shares.

ARK’s Innovation ETF acquired 1.7 million shares, whereas its Subsequent Era Web and Fintech Innovation ETFs added greater than 800,000 mixed. Bullish elevated its share issuance to 30 million forward of the IPO to accommodate sturdy demand.

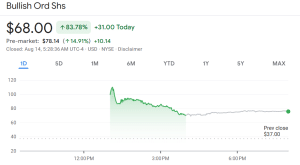

Buying and selling underneath the ticker “BLSH,” shares of the corporate pumped to an intraday excessive of $118, representing a 218% acquire from its $37 IPO worth, information from Google Finance exhibits.

Bullish inventory worth (Supply: Google Finance)

Forward of the IPO, Bullish had deliberate to lift between $568 million and $629 million. Weeks after its preliminary submitting, the agency submitted an up to date F-1 doc with the US Securities and Change Fee (SEC) that outlined plans to challenge 20.3 million shares. This may have valued the corporate at $4.2 billion.

Nearer to the IPO, the corporate opted to extend the variety of shares it will challenge to 30 million, citing sturdy demand from companies comparable to asset administration large BlackRock and Cathie Wooden-led ARK Make investments, who each expressed curiosity in shopping for as much as $200 million value of shares.

Ark Make investments purchased 2,532,693 shares of the Bullish $BLSH IPO as we speak 👀 pic.twitter.com/MXMdF6R8vP

— The Market Matrix (@MarketMatrixs) August 14, 2025

Bullish additionally granted its underwriter, led by JPMorgan, Citigroup and Jefferies, a 30-day choice to promote a further 4.5 million shares.

Regardless of a pullback to shut its first buying and selling session off at $68, Bullish inventory nonetheless ended the day with a acquire of over 83%.

Bullish Failed With 2021 Try To Go Public

Bullish had initially deliberate to go public via a particular function acquisition firm (SPAC) in 2021, however the deal fell via.

Whereas it was a setback on the time, that failed IPO may need positioned the corporate to profit from the favorable US crypto regulatory setting underneath President Donald Trump’s administration.

Since Trump entered the White Home in January, he has pardoned Silk Street founder Ross Ulbricht, signed an govt order to discover the creation of a US Strategic BTC reserve, and has additionally delivered on a number of different marketing campaign guarantees he made final yr.

Along with that, regulators have began to behave on steerage acquired by the President’s Working Group on Digital Property. This contains the US Securities and Change Fee (SEC), who launched “Undertaking Crypto” to ease licensing necessities, and the US Commodity Futures Buying and selling Fee (CFTC), who kicked off its “Crypto Dash” initiative in latest weeks.

Amid the favorable regulatory setting, institutional traders have additionally began to purchase into Bitcoin and have slowly began exploring altcoins. This follows final yr’s launch of spot Bitcoin and spot Ethereum ETFs within the US. Over simply the previous week, these funds have pulled in billions of {dollars} mixed.

In an interview with CNBC yesterday, Bullish CEO Tom Farley, who can also be the previous President of the NYSE, commented on the timing of his agency’s IPO.

“It appears like this can be a very good time for crypto,” he stated, earlier than highlighting the passing of the GENIUS Act and the progress being made on the CLARITY Act.

“I pledged that we’d carry again American liberty and management and make the U.S. the crypto capital of the world… The Genius Act creates a transparent and easy regulatory framework to ascertain and unleash the immense promise of dollar-backed stablecoins.” –President Trump pic.twitter.com/F46visJFi8

— The White Home (@WhiteHouse) July 18, 2025

Each of these developments, Farley says, “are offering a straightforward on-ramp for establishments to drive into crypto.”

“The final leg of progress in crypto within the final 10 years was principally all retail and if you happen to look now, the institutional wave has begun, it’s right here, it’s a query of how large it is going to be,” he added.

Commenting on the demand Bullish’s IPO has seen from establishments, Farley stated “it appears like institutional traders assume this might be the second.”

When requested how large he thinks the institutional wave might turn into, he stated that the chance is “completely gigantic.”

Bullish Joins Rising Record Of Crypto IPOs

A number of different companies working within the crypto area have taken benefit of the enhancing regulatory panorama within the US of their bid to attract institutional funding.

In June this yr, USD Coin (USDC) issuer Circle raised roughly $1.1 billion and debuted with a inventory worth surge of round 168-168.5%.

In the identical month, eToro confidentially filed paperwork with the SEC for its personal IPO, aiming for a valuation of above $5 billion.

In the meantime, Gemini, the crypto change run by the Winklevoss twins, confidentially filed its IPO S-1 kind earlier this yr, working with main underwriters comparable to Citigroup, JP Morgan and Goldman Sachs. Stories counsel the IPO might happen by the top of Q3 this yr.

Different companies comparable to Grayscale Investments, BitGo, Kraken, and OKX have all indicated intentions to record publicly.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection