Bitcoin is at the moment consolidating just under the psychological $120,000 stage, cooling off after final week’s surge to a brand new all-time excessive. Whereas bulls keep management, worth motion has slowed, giving room for Ethereum to take the highlight with a pointy breakout above $3,600.

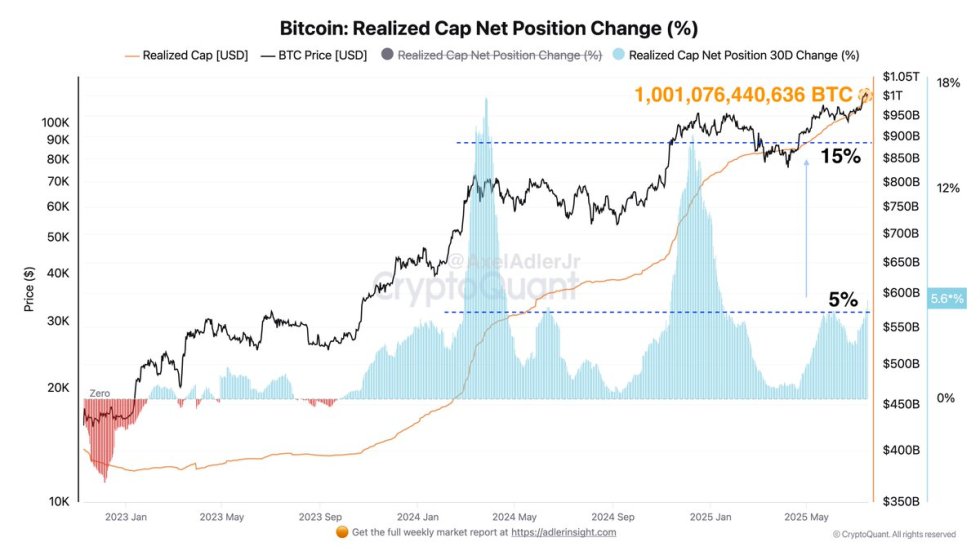

Amid this evolving surroundings, contemporary on-chain knowledge from CryptoQuant highlights a historic second for Bitcoin. The community’s Realised Cap — a metric that values every coin on the worth it final moved — hit a brand new all-time excessive.

This milestone underscores the rising power and maturity of Bitcoin’s capital base, particularly as institutional curiosity and long-term holding traits proceed to rise. So as to add a bullish observe, this interval of consolidation follows a significant regulatory improvement: the US Home of Representatives has formally handed three key crypto payments, together with the GENIUS and Readability Acts, ushering in long-awaited authorized readability for digital belongings.

A Sign of Bitcoin’s Rising Maturity

Prime analyst Axel Adler has highlighted a major milestone for Bitcoin: the community’s Realised Cap has formally surpassed $1 trillion for the primary time in its historical past, marking a brand new all-time excessive. Not like conventional market capitalization — which multiplies the present worth by whole provide — Realised Cap calculates the worth of every coin primarily based on the value at which it was final moved. This technique affords a clearer and extra grounded view of the capital that’s truly invested and held throughout the Bitcoin community.

Adler explains that this metric filters out speculative extremes and emphasizes cash which might be actually being held by market contributors, making it a extra dependable indicator of Bitcoin’s underlying power. As an instance the importance of this milestone, he notes: “If an organization earned $1 each second, it might take 31,710 years to build up one trillion {dollars}.” This comparability places into perspective the immense scale of worth now saved throughout the Bitcoin ecosystem.

As Bitcoin consolidates beneath $120,000 following its latest all-time excessive, the rise in Realised Cap reinforces the concept this cycle is constructed on a stronger basis than in earlier rallies. With rising institutional adoption, regulatory readability rising within the US, and rising long-term holder conviction, many analysts imagine that Bitcoin is on the verge of one other expansive progress part within the coming months.

BTC Value Consolidates After Breakout

Bitcoin (BTC) is at the moment consolidating beneath the psychological $120,000 stage after a powerful multi-week rally. The 12-hour chart reveals BTC buying and selling between a transparent vary, with resistance at $123,230 and assist at $115,730. This horizontal construction alerts a wholesome pause after a major transfer, permitting the market to digest beneficial properties and probably put together for the following leg greater.

Regardless of minor pullbacks throughout the vary, worth motion stays above all key transferring averages: the 50 SMA ($111,306), the 100 SMA ($108,314), and the 200 SMA ($102,603), all trending upward. This alignment suggests bullish momentum stays intact, with the 50 SMA appearing as dynamic assist throughout shallow corrections.

Quantity stays elevated in comparison with earlier in July, indicating continued participation and powerful curiosity from consumers. So long as BTC maintains its construction above the $115K–$116K area, bulls are more likely to stay in management. A confirmed breakout above $123,230 may open the door to new all-time highs, whereas a breakdown beneath $115,730 would possibly set off short-term draw back towards $111K.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.