Key Takeaways:

WLFI $USD1, a stablecoin tied to Trump’s camp, hit $1.25 billion in day by day buying and selling quantityPractically $991 million of the quantity was from simply 10 buying and selling pairs, totally on PancakeSwap V3Market observers level to its speedy progress as a reputable menace to stablecoin giants like USDT

The crypto market simply witnessed an surprising breakout. WLFI $USD1, the dollar-pegged stablecoin sponsored by entities associated to former U.S. President Donald Trump, noticed a staggering 24-hour quantity whole of $1.25 billion. This spike did extra than simply elevate eyebrows — it has prime stablecoins together with USDT on discover.

WLFI’s Meteoric Rise: From Quiet Launch to Market Disruptor

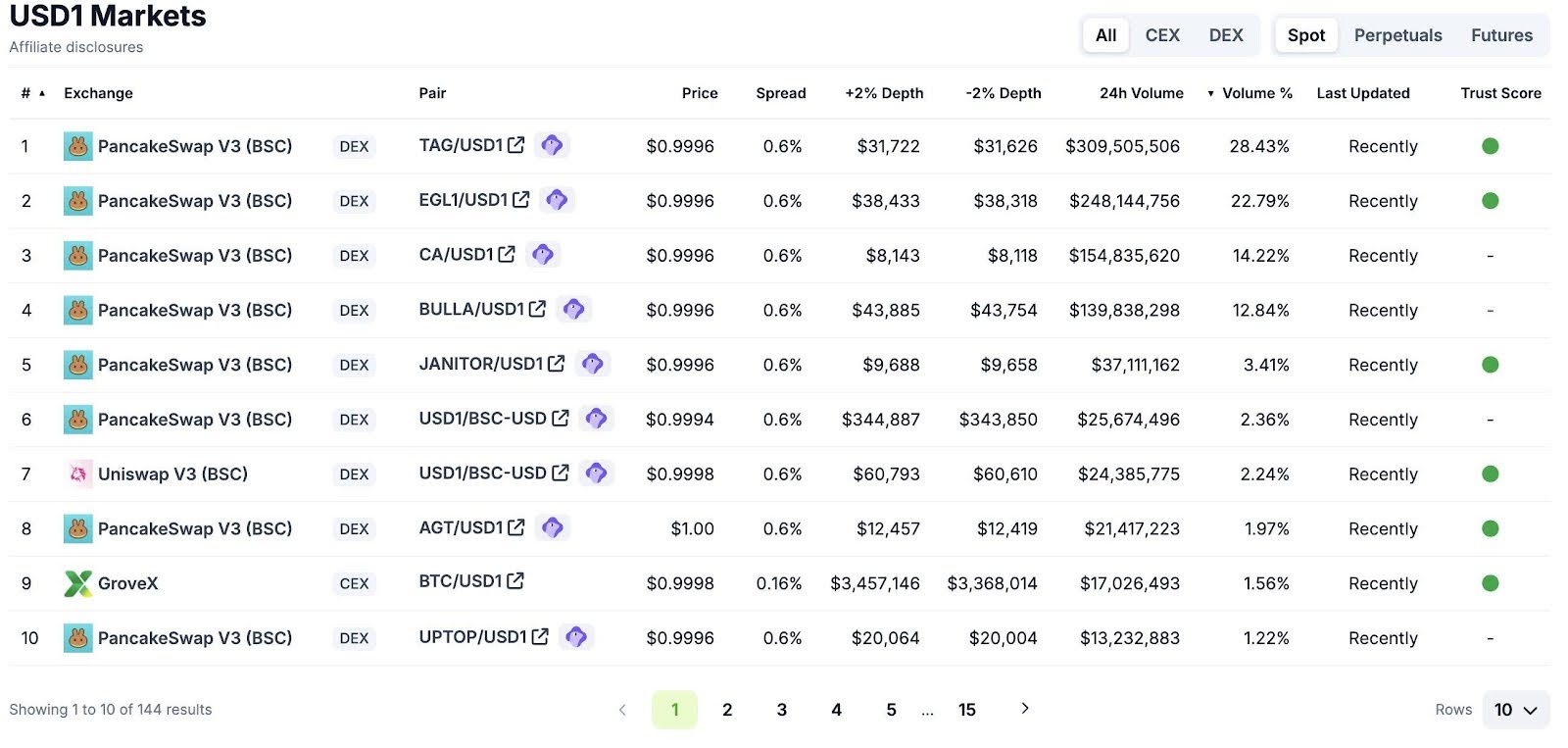

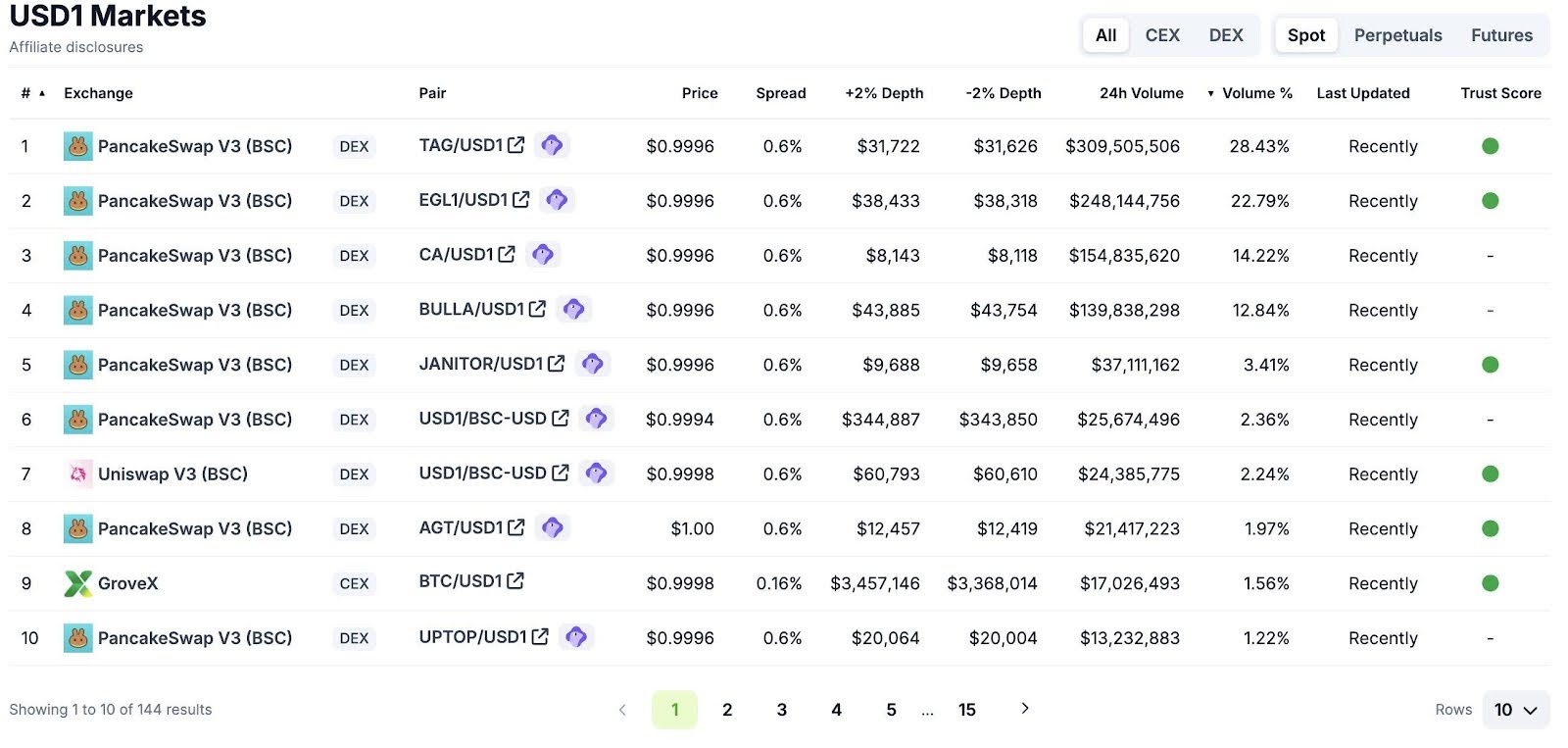

USD1 just isn’t a median stablecoin. Launched with out a lot fanfare, it’s now the item of intense curiosity due to what’s been taking place available in the market. Based mostly on on-chain knowledge, the token’s 24-hour quantity surged to $1.25 billion on June 29, 2025, with almost $991 million coming from its first 10 buying and selling pairs.

Nearly all of the liquidity was funnelled into PancakeSwap V3 on Binance Sensible Chain (BSC) which now serves as WLFI main ecosystem. Analysts consider this was a strategic play in a bid to make use of BSC’s low charges and deep liquidity to shortly scale person participation.

What makes this much more noteworthy is the WLFI was capable of attain this quantity with minimal publicity from CEX. Many of the quantity got here from DeFi purposes, suggesting an elevated demand for stablecoins in decentralized finance and probably dissatisfaction with the way in which legacy gamers like USDT and USDC have been conducting themselves.

Learn Extra: World Liberty Monetary Invests $4M in AVAX and MNT Regardless of Portfolio Losses

A Trump-Backed Token? Unpacking the Political Affiliation

Although WLFI doesn’t explicitly come from Donald Trump or his marketing campaign, its model and backers are a direct throughline to his political base. Selling the stablecoin are some crypto influencers who’re related to supporting Trump’s run in 2024; WLFI is rumored to be backed by donors and supporters from inside Trump’s circle.

The seems to be marketed in direction of crimson meat consuming retail buyers and politically energetic merchants. That’s not too dissimilar from the humorous rise of so-called meme tokens like MAGA Coin or TrumpCoin, however in contrast to these extremely unstable meme cash, WLFI is constructed to keep up a 1:1 peg to the U.S. greenback, theoretically giving it an edge relating to perceived belief and utility.

Whereas the Trump affiliation is actually tacking on buzz, it’s WLFI’s liquidity and technical growth that has folks .

Learn Extra: World Liberty Monetary of Trump to Introduce USD1 Stablecoin Backed by U.S. Treasuries

Stablecoin Market Dynamics: WLFI vs. the Titans

Might WLFI Problem USDT’s Dominance?

Tether (USDT) and Circle’s USDC have lengthy been the stablecoin stars, with USDT main in DeFi quantity, and USDC being the selection for compliance and institutional use. However newcomers like WLFI are illuminating market demand for different choices.

WLFI’s $1.25 billion quantity day places it within the race for the highest spot within the non-centralized stablecoin market, no less than within the short-term. For comparability:

USDT usually data $50–70B in day by day quantity, however that features tons of of buying and selling pairs throughout dozens of exchangesWLFI achieved over 1.7% of USDT’s day by day quantity in simply sooner or later, with out assist from main centralized exchanges like Binance or Coinbase

WLFI’s speedy motion inside DeFi may point out that customers are experimenting with it as a high-liquidity substitution for swapping, yield farming and collateralization — use-cases traditionally dominated by USDT and USDC.

On-Chain Metrics Recommend Natural Progress

On-chain knowledge signifies that WLFI’s liquidity swimming pools have garnered tens of hundreds of distinctive pockets addresses, implying a real neighborhood of particular person customers as distinct from bots or wash-trading initiatives.

Key figures:

There have been greater than 17,000 energetic wallets in WLFI Buying and selling pairs within the final 24 hours$350M of WLFI was locked in DeFi, unfold primarily throughout BSC and Ethereum bridgesThe stablecoin is conserving the true to the U.S. greenback inside ±0.1%, a stable efficiency metric for a brand new token

These statistics additionally enhance WLFI’s credibility as a long-term operation. Although to a handful of skeptics the promotion trick may merely be inflicting the surge, the quantity, peg, and person interplay stay in standing for sustainable progress.

Regulatory Questions Loom

Regardless of its speedy growth, WLFI’s authorized standing is unclear. And given it’s a dollar-pegged token that’s principally being utilized in DeFi, it may be a focus for U.S. regulators, particularly if its backers embrace political figures or main marketing campaign donors.

Regulators have lately ratcheted up their scrutiny of stablecoins, particularly those who develop shortly and whose reserves aren’t absolutely disclosed, with the SEC and the U.S. Treasury rising their oversight. WLFI claims to be 100% hedged by money equal devices however as but we now have not seen any audited financials.

If WLFI plans to increase and probably facilitate transactions in centralized exchanges the regulators want to offer readability and transparency.

Amidst rising buying and selling quantity, media publicity, and DeFi momentum, WLFI has reached a pivotal inflection level.