Hey Everybody!

There’s been a variety of noise these days round Google ($GOOGL). Between lawsuits, AI battles, and aggressive headlines, it’s straightforward to marvel: Has Google misplaced its moat? For a lot of, the story has shifted from “invincible tech large” to “dinosaur underneath siege”, with some headlines evaluating it to Yahoo within the 2000s.

I get the issues… Epic Video games trials, DOJ respiration down their neck, regulators in Europe getting extra aggressive, and Microsoft ($MSFT) with OpenAI — it’s sufficient to make anybody hesitate. Even YouTube is underneath stress, combating for consideration towards TikTok.

However right here’s the factor — when everybody’s wanting on the headlines, getting brainwashed by the noise… I prefer to look underneath the hood of the automotive, similar as I do after I hear some bizarre noise in my outdated Toyota Prado 2006. So let’s have an in-depth look:

The Noise: AI Wars, Lawsuits & Dangers

U.S. Division of Justice (DOJ) antitrust case

E.U. investigations, lawsuits and costs

Intense AI competitors from powerhouses like OpenAI, Microsoft, and Meta

Rising competitors in Search from AI-driven options (Chat GPT)

YouTube’s battle with TikTok for consumer consideration

Aggressive cost-cutting and layoffs in non-core “moonshot” tasks

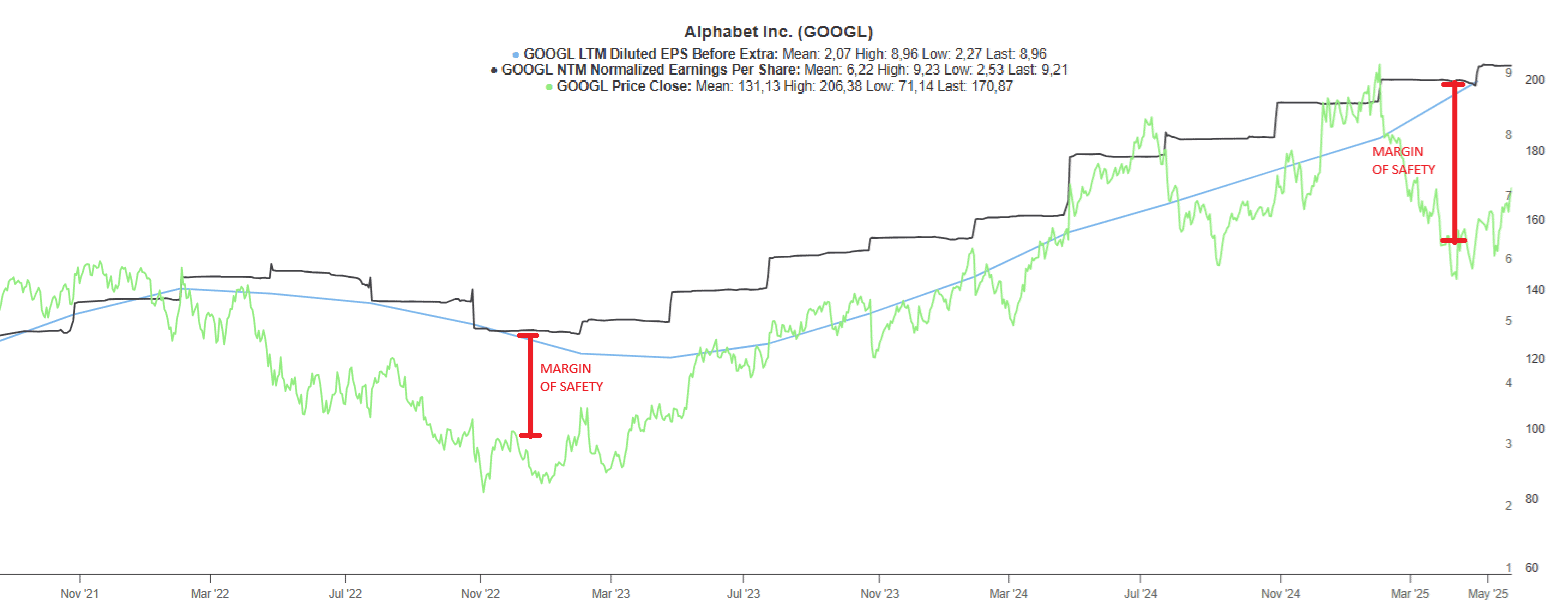

In 2022 and early 2023, ($GOOGL) underperformed as rates of interest rose and margins compressed. Wall Road doubted its potential to adapt. Nevertheless, we see one thing totally different: a fortress enterprise presently at a uncommon valuation disconnect.

Key Highlights: Why Google Stays a Powerhouse

Regardless of the noise, Alphabet (father or mother firm of Google ($GOOGL)) continues to dominate in essential areas:

Dominates 90%+ of worldwide search by way of Google.

Owns market-leading platforms: YouTube, Android, Google Cloud, Gmail….

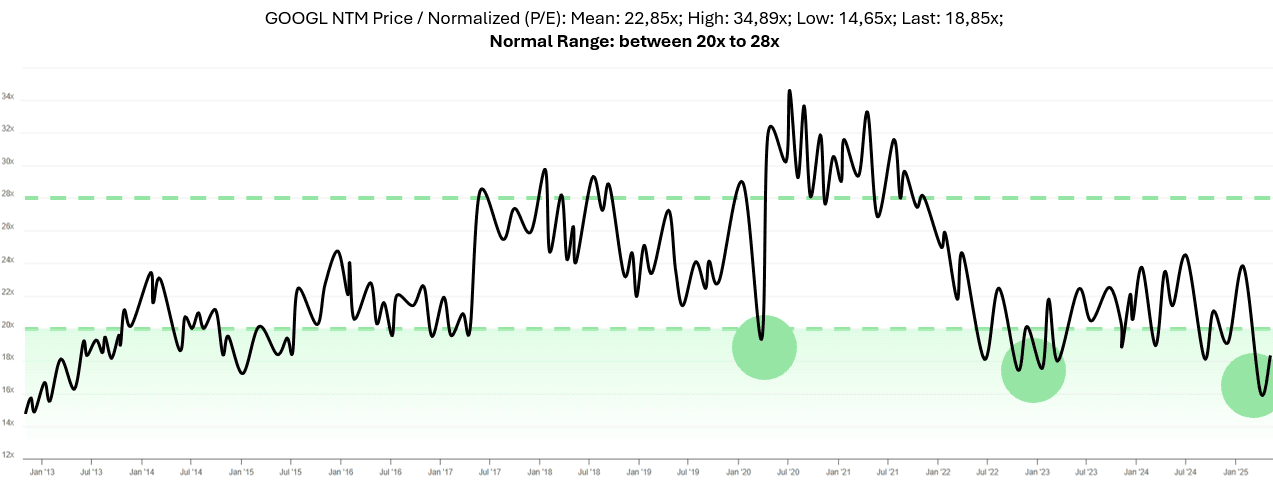

Compelling valuation: lower than 20x earnings with a large internet money place.

Gemini AI is deeply built-in throughout Workspace, Cloud, and Advertisements.

Nonetheless rising income at double digits – even at a colossal $300B+ scale.

Value self-discipline: over $7B in annualized financial savings from layoffs and efficiencies.

Strong capital returns: $70B+ in share buybacks as margins get well.

Possesses one of many strongest steadiness sheets globally.

Enterprise Mannequin Overview: Unpacking Google’s Moats & Competitors

🔒 Google’s Enduring Moats

Search Monopoly: As talked about above.

Information Benefit / Community: Billions of customers and knowledge throughout platforms.

Scale: Google has an enormous scale and money to compete and outrun others.

Excessive Switching Prices: Google companies are deeply embedded in consumer workflows.

Supply: Rand Fishkin @randderuiter on X

⚔️ Key Rivals

Whereas fierce, Google ($GOOGL) maintains dominance as a result of unmatched scale and distribution.

Search: Microsoft ($MSFT) (Bing + OpenAI integration)

Video: TikTok, Netflix ($NFLX), Instagram ($META)

Cloud: AWS ($AMZN), Azure (Microsoft)

AI Basis: OpenAI, Anthropic, Meta

Autonomy (Waymo): Tesla FSD ($TSLA)

🧱 Key Strengths

Alphabet’s ($GOOGL) power isn’t simply in its model — it’s within the structure of the web. Google Search, Maps, Android, Chrome, YouTube — these aren’t simply companies. They’re habits. They’re defaults. The type of instruments folks don’t simply use — they depend upon. That dependency is highly effective. It’s why regardless of all of the competitors Alphabet retains rising.

Alphabet’s power can also be in scale and flexibility. Google is investing closely in Propietary TPUs for AI compute, Information Facilities, AI throughout Search, Workspace and Advertisements. Google tradition of fixing and shaping requirements will guarantee they persistently attempt to invent.

Fundamentals & Technicals Guidelines: A Deeper Dive

Earlier than I put money into any firm, I am going via a full guidelines — not simply to see if the numbers look good, however to actually perceive how the enterprise works and why/the way it would possibly develop over time.

I don’t depend on hype, headlines, or AI-generated content material. I prefer to depend on key knowledge, traits, and monetary well being. This guidelines I constructed primarily based on guidelines helps me break issues down throughout fundamentals, valuation, profitability, administration, and even technical alerts. I give every line merchandise a rating, to not be overly scientific — however to remain constant, take away emotion, and make higher selections over the long run.

If an organization doesn’t meet my requirements, it doesn’t make it into my portfolio. It’s that straightforward.

🧰 Monetary Power: Google ($GOOGL) A True Fortress Constructed to Final

Investor Confidence: Huge funds like Ackman, Klarman, Griffin, Loeb are invested.✅

Earnings & Valuation:

EPS (TTM) is $8.96 // P/E round 17x. ✅

Projected progress of 15% CAGR suggests a good P/E as much as 28x, providing a big margin of security. ✅

Earnings are secure and rising, from $5.80 in 2023 to ~$8.96 in 2025. ✅

Supply: TIKR Terminal. Graph exhibits the deviation in valuation and the margin of security.

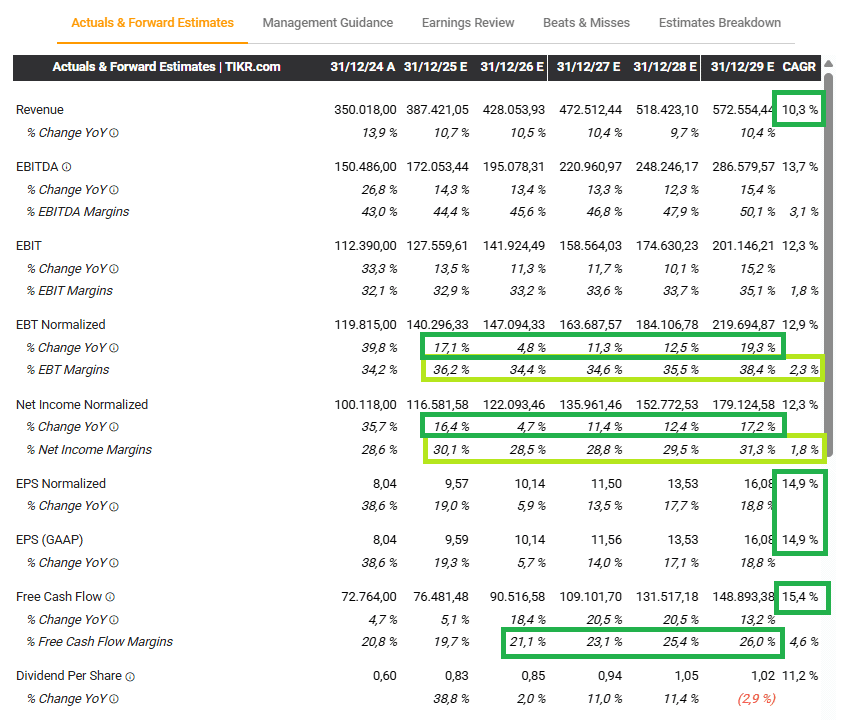

Profitability & Margins:

Working Margins are 32.7%, up from 25% in 2015, constant progress. ✅

Whereas aggressive, Meta and Microsoft margins are larger. 🟨

Return on Fairness (ROE) is 34.6%. ✅

Debt: With a low Debt-to-Fairness ratio of 0.07x and $74.9 billion in free money circulation (TTM), Google has immense monetary flexibility. ✅

Supply: TIKR Terminal. Analysts anticipate subsequent 5 years of double digits progress and margin enlargement

Enterprise Mannequin & Moats: Their robust financial moat comes from model, knowledge, scale, and consumer switching prices. As per my guidelines a (4/5 rating) ✅

Resilience & Administration: Google ($GOOGL) rapidly recovered from previous crises, demonstrating robust resilience. Administration is extremely aligned with shareholders, with founders retaining important voting energy and CEO closely tied to inventory. ✅

Shares buy-backs: Purchased again $15 billion in regular shared final quarter. ✅

Enticing Valuation: A P/E of 18x and EV/EBITDA of 12.5x are under the thresholds for this progress, suggesting good worth and margin of security ✅

📉 Technical Evaluation: The Value Tells a Story

The inventory’s value motion reinforces confidence in its trajectory.

Constant Progress: Google ($GOOGL) has proven a constant uptrend over 10 years, with common annual progress price of ~18.6%, usually hitting All-Time Highs. ✅

Favorable Entry: The present value may probably be a very good shopping for alternative at NTM Ahead P/E of 18x. ✅

Supply: AMWorld,utilizing datasets from TIKR

Diversification Notice: Whereas robust, Google’s tech focus means it won’t diversify your portfolio a lot in the event you’re already tech-heavy. ❌

As a part of this rule-based guidelines Google ($GOOGL) scores excessive over the minimal 70% that I anticipate for any firm to have the ability to be part of the record of “Worth Progress Compunders” a the ultimate scores sits at:

Alphabet ($GOOGL): ✅ Last Rating: 89/100 – EXCELLENT!

What concerning the Future?

Actual Dangers (And Why I’m Watching Carefully)

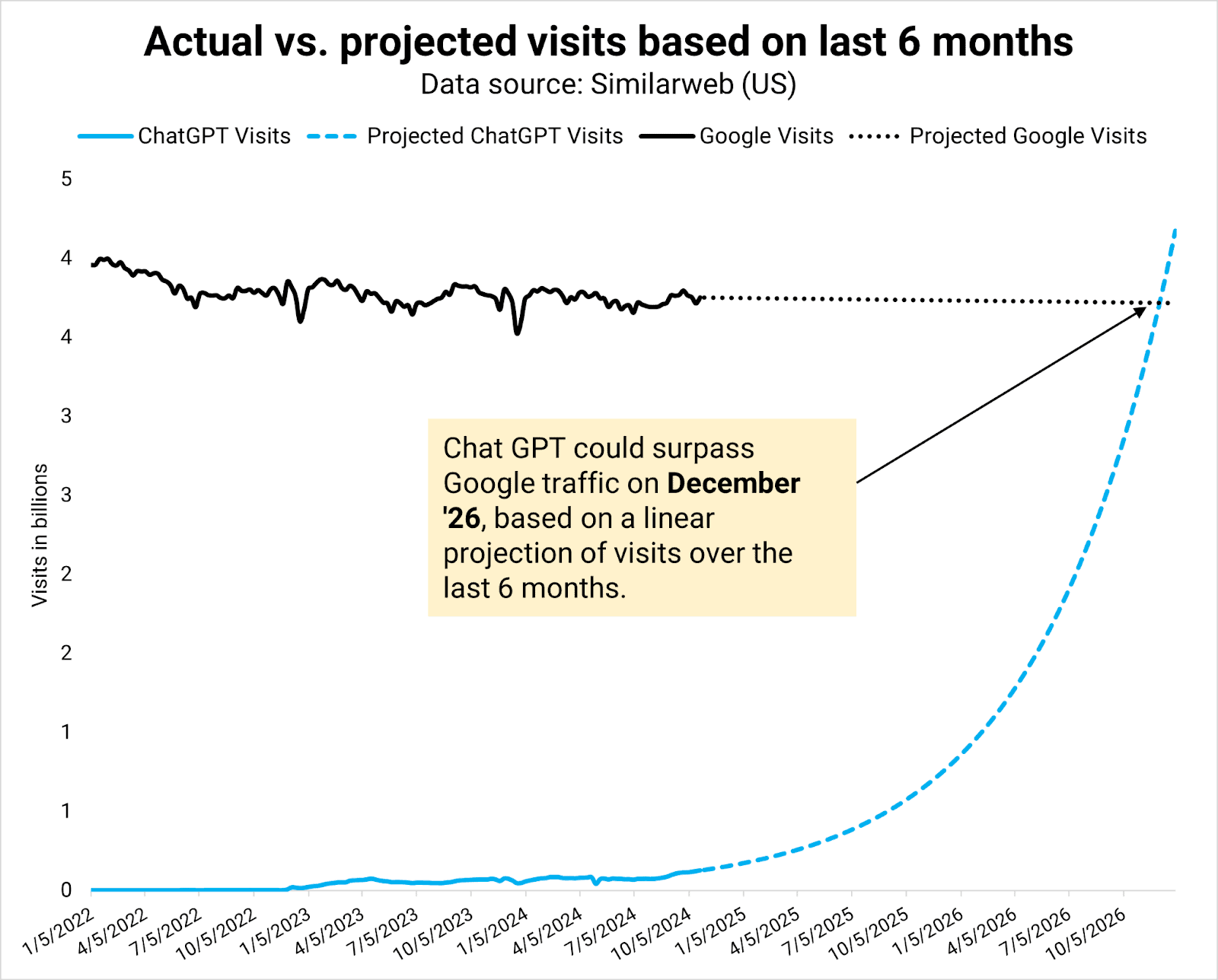

I’ll be sincere — if there’s one factor that retains me up at evening about Google ($GOOGL), it’s the shift in how we seek for data. For the primary time in many years, Google Search feels weak. Instruments like ChatGPT and different generative AI fashions have fully modified the way in which folks work together with the web. As an alternative of scrolling via ten blue hyperlinks, you ask a query — and the reply simply seems. It’s quick, pure, and in lots of circumstances, extra useful than a standard search outcome. If this shift continues, and extra folks get used to AI-first search experiences, Google ($GOOGL) may face actual disruption to its core enterprise — the one that also brings in most of its income.

Supply: growth-memo.com / gpt-search. ChatGPT forecasted progress

That’s not one thing I take evenly, and it’s a threat I’m watching very carefully by understanding key metrics and KPI’s on AI and search utilization at each quarter. However in the event you suppose twice historical past equally repeats, and related has occurred already with the video app Zoom $ZM, the end result… $MSFT with it’s scale and community took them out of the race by together with Groups free of charge of their workspace bundle.

Outlook for the Future: A Generational Compounder?

With Google Search, YouTube, and Android, Alphabet controls the elemental “pipes and platforms” of the web. This immense energy, mixed with its rising AI management and disciplined capital allocation, may rework it right into a generational compounder. as the whole main AI productiveness suite supplier: Gemini + Workspace + Cloud + Advertisements. The last word free-AI full office.

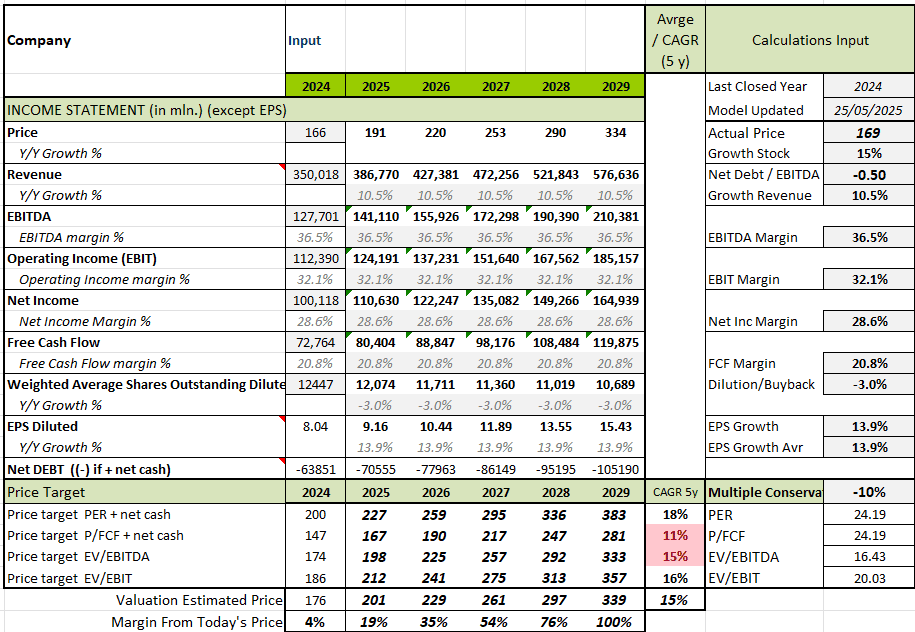

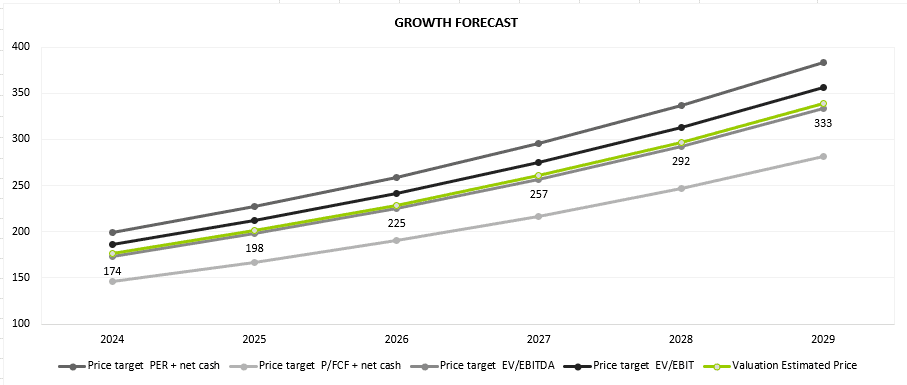

🎯 My Forecast Value: A Conservative Estimate

After analysing an organization rating, I am going then to analyse its intrinsic valuation and its forecast over the subsequent 5 years. On this case, for this evaluation I’ve not taken under consideration any margin enhance. That is my “Regular” state of affairs primarily based, “Bear” and “Bull” circumstances are extremes I could share sooner or later.

Supply: AMWorld

($GOOGL) Forecasted 5-12 months CAGR > +15% ➔ Wonderful long-term progress potential!

✅ Conclusion: A Misunderstood Compounder

So after this evaluation, in a similar way as after I hear some noise in my 20 yr outdated Toyota Prado, I test underneath the hood, and I realise after checking every part with the mechanic, that these are regular noises of every day operations and {that a} Prado is a automotive constructed to final, similar as Google ($GOOGL). Each round 20 years outdated, however nonetheless with a variety of potential. Each had been constructed to final.

Anyhow, after this humorous comparability of my outdated automotive with Google ($GOOGL)…

I’ve seen this sample earlier than — with Netflix, Meta, and now Google. The market overreacts to vary. Most buyers get caught up within the noise: lawsuits, TikTok, the AI arms race. We select to deal with the strong fundamentals. Alphabet ($GOOGL) is undeniably a top-tier enterprise presently buying and selling at what we take into account mid-tier valuations. And that’s the place long-term buyers discover their edge.

Google with its scale, adaptability and MOATs will nonetheless be one of the vital essential firms within the digital world in 2, 5 and 10 years.

🟢 My Verdict: A Excessive-High quality Compounder. Alphabet – Google ($GOOGL) stays a core place in our portfolio.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.