Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is going through a vital take a look at as bulls and bears lock into a good battle across the $2,500 stage. Regardless of repeated makes an attempt, bulls have but to ascertain management above this key resistance, whereas bears have been unable to push the worth to new lows, signaling an indecisive however more and more tense standoff. This value compression comes at a time when broader market sentiment is shifting. The US inventory market has simply reached a brand new all-time excessive, and analysts consider crypto might be subsequent to comply with.

Associated Studying

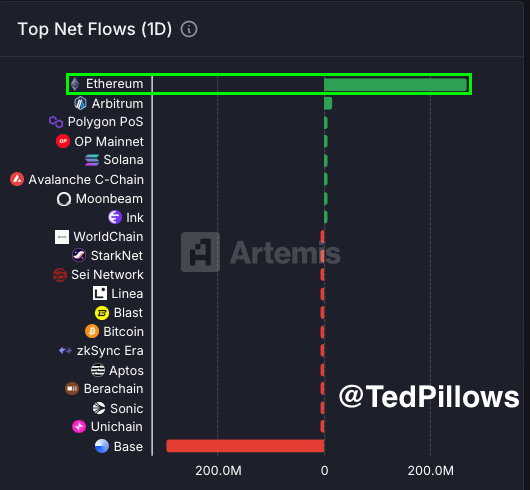

Fueling that optimism is contemporary knowledge from Artemis exhibiting that Ethereum recorded over $269 million in internet inflows previously 24 hours. This sharp enhance in capital shifting into ETH displays renewed investor confidence and will act as a catalyst for additional value motion. As world liquidity tendencies upward and danger urge for food returns, Ethereum continues to achieve momentum.

Nonetheless, the $2,500 stage stays a serious hurdle. A confirmed breakout above it might set off a pointy transfer increased, doubtlessly main the best way for altcoin restoration. Till then, ETH merchants stay on alert, looking forward to both a clear breakout or one other rejection in what might be a defining second for Ethereum’s mid-term route.

Ethereum Builds Energy As Altseason Awaits Breakout

Ethereum has been consolidating in a broad vary, buying and selling between $2,200 and $2,800 for a number of weeks. This tight band of value motion displays a broader indecisiveness throughout the altcoin market, with merchants nonetheless ready for a definitive breakout to kickstart the long-anticipated altseason. Regardless of occasional surges in momentum, ETH has but to interrupt above the $2,800 mark—a stage that might open the door for sustained upside and renewed altcoin exercise throughout the board.

The macroeconomic surroundings stays a wildcard. With combined inflation knowledge, geopolitical dangers, and a unstable rate of interest outlook, markets are reacting cautiously. But, amid this backdrop, Ethereum continues to point out resilience. Many analysts consider that after ETH breaks out of this vary, it might act because the set off for a broader altcoin rally.

Including to the bullish outlook is contemporary knowledge shared by prime analyst Ted Pillows, who highlighted a big shift in investor habits. In accordance with Pillows, Ethereum noticed over $269 million in internet inflows within the final 24 hours, signaling renewed demand from institutional and retail gamers alike. These inflows, tracked by Artemis, level to rising confidence and will function the inspiration for Ethereum’s subsequent leg increased.

Whereas uncertainty lingers, momentum is quietly constructing. Ethereum’s means to carry above $2,200 and appeal to capital throughout macro headwinds suggests energy beneath the floor. For altseason to actually ignite, ETH should get away of its present vary and push decisively into increased territory. Till then, merchants and traders proceed to look at carefully, figuring out that after the breakout occurs, it might shift your complete market cycle ahead.

Associated Studying

ETH Consolidates Beneath 200-Day SMA

Ethereum is at present buying and selling at $2,427, consolidating beneath the important thing 200-day easy shifting common (SMA) at $2,544. After bouncing off assist close to $2,200 earlier this month, ETH has managed to carry above the 100-day SMA ($2,167) and regain some construction. Nevertheless, the worth stays capped by a cluster of resistance ranges, together with the 50-day SMA ($2,534) and the 200-day SMA, each of that are converging close to $2,540—a important zone for bulls to reclaim.

The chart exhibits that Ethereum has been buying and selling inside a broad vary between $2,200 and $2,800 for a number of weeks, reflecting indecision available in the market. The failure to interrupt by the $2,800 zone earlier in June has stored ETH in a sideways sample. Quantity has additionally declined, suggesting warning amongst merchants as ETH checks this tight band of resistance.

Associated Studying

A powerful day by day shut above the $2,540–$2,550 area might verify a bullish breakout and reignite momentum towards the $2,800 stage. On the draw back, a drop beneath $2,300 would weaken the present setup and expose Ethereum to additional losses.

Featured picture from Dall-E, chart from TradingView