As Sui’s DeFi ecosystem expands, Cetus is poised to stay at its middle, regularly evolving through group governance. With ongoing improvements (intent-based buying and selling, automated vaults, multichain swaps) and a “liquidity as a service” ethos, Cetus helps form Sui right into a vibrant, interconnected DeFi panorama.

About Cetus Protocol

Cetus Protocol is a pioneering decentralized alternate (DEX) and concentrated liquidity AMM constructed on the Sui community (and likewise deployed on Aptos). Launched as one of many first DEXs in Sui’s DeFi panorama, Cetus serves as a vital liquidity hub and infrastructure element for the community. Its mission is to supply a robust, versatile liquidity community that makes on-chain buying and selling environment friendly for all customers and property.

In apply, Cetus presents a hub of DeFi instruments – from high-capacity swap swimming pools with concentrated liquidity to a built-in aggregator and launchpad – all designed to maximise liquidity utilization and improve person expertise.

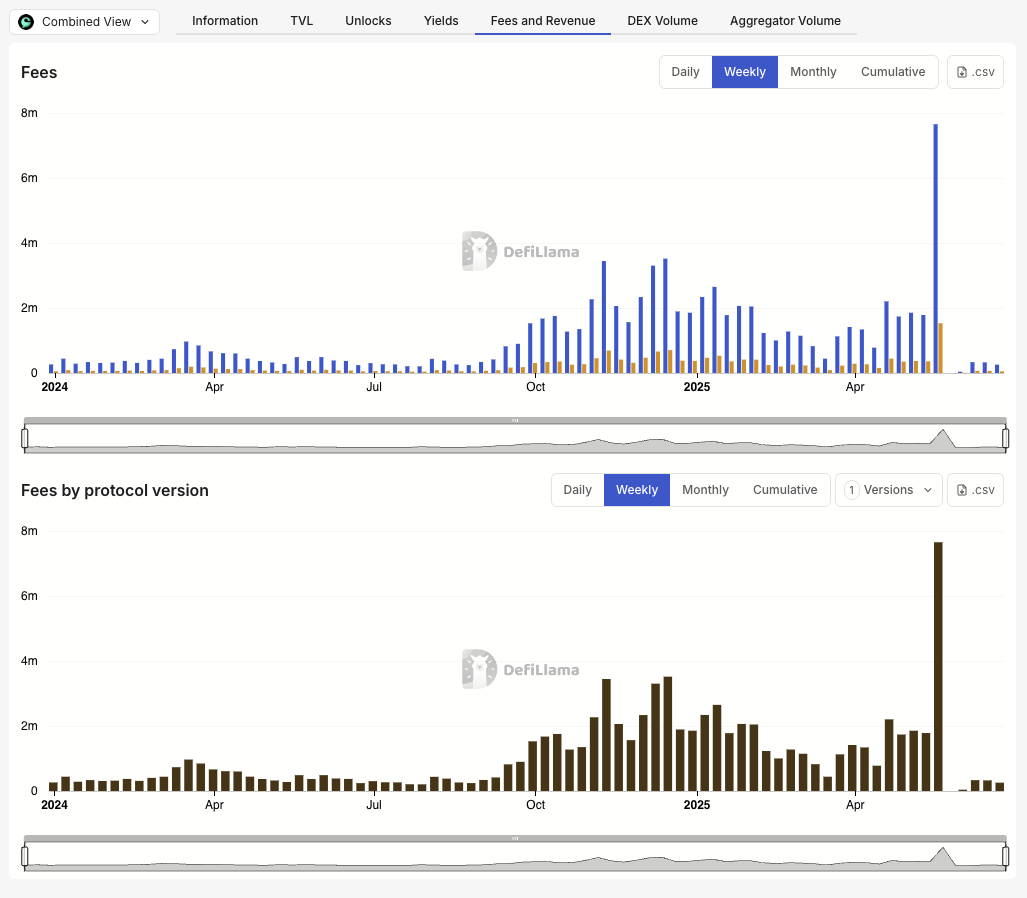

Supply: DefiLlama

Because the main DEX on Sui, Cetus performs a pivotal position within the ecosystem. It allows deep liquidity for native tokens on the Sui ecosystem, permitting merchants to swap with low slippage and enabling new initiatives to bootstrap liquidity through its swimming pools and Asset Launch launchpad. In essence, Cetus has turn out to be a background DeFi protocol on Sui, simplifying on-chain buying and selling and attracting a rising person base with its revolutionary options.

Notably, Cetus is greater than a single DEX – it’s a collection of interoperable modules inside Sui’s DeFi. For instance, its “Tremendous Aggregator” function sources liquidity from all main Sui venues to make sure customers get the most effective costs.

Its Intent Buying and selling module allows superior order varieties reminiscent of on-chain restrict orders and automatic dollar-cost averaging (DCA) straight via good contracts. This extensible, “Liquidity as a Service” strategy means different builders and dApps can simply combine Cetus’s liquidity and even construct on high of it through SDKs.

Total, Cetus’s complete toolkit and deep liquidity have made it an indispensable element of Sui’s rising DeFi ecosystem.

Adoption and Development Metrics

Since launch, Cetus Protocol has gained vital traction on Sui, underpinning its significance within the community’s development. As of mid-2025, Cetus has amassed over $236 million in complete worth locked (TVL) (totally on Sui community), making it the biggest DeFi protocol on the chain.

Stage 2: Again to the Prime 5 DEX Aggregator record of all chains by day by day quantity. 💥#Cetus 🐳 pic.twitter.com/ROvzYGG0AY

— Cetus🐳 (@CetusProtocol) June 25, 2025

Every day buying and selling volumes usually attain a whole lot of thousands and thousands of {dollars} (e.g. ~$295M in 24h quantity), reflecting excessive utilization and liquidity depth. Cumulatively, Cetus has facilitated greater than $57 billion in buying and selling quantity throughout 144 million trades – a powerful scale for a comparatively new blockchain. The platform has additionally engaged a broad person base, with over 15 million on-chain accounts interacting with Cetus’s swimming pools or swaps.

These information underscore Cetus’s dominance on Sui. Even after a difficult safety incident in Could 2025, Cetus demonstrated resilience by shortly relaunching and restoring liquidity with group and Sui Basis assist.

Inside weeks, over 50% of the misplaced TVL was restored (~$120M) and Cetus regained its place as the highest DEX on Sui. The Sui group even accredited an on-chain improve to freeze and get better the stolen funds, highlighting the ecosystem’s dedication to Cetus’s stability.

Supply: Sui

By mid-2025, TVL of Cetus climbed again above pre-exploit ranges, reflecting sturdy person belief and sustained development. In abstract, Cetus Protocol has turn out to be the de facto liquidity base for Sui’s DeFi, with strong utilization statistics and a roadmap geared toward additional increasing the Sui-Aptos Transfer-based DeFi universe.

Inside simply 48 hours, the Sui group united to go a important on-chain vote — marking a pivotal second for all the ecosystem. Cetus extends our deepest gratitude to the >90% of validators and stakers who voted in favor. No matter your stance, your participation… https://t.co/UN2DrlDRTw

— Cetus🐳 (@CetusProtocol) Could 29, 2025

Technical Evaluation of Cetus Protocol

Good Contract Structure on Sui (Transfer-Based mostly Design)

Cetus Protocol is constructed on a set of autonomous good contracts deployed on the Sui community (additionally on Aptos), implementing an Automated Market Maker (AMM) optimized for Sui’s object-centric mannequin. Not like Ethereum’s account-based system, Sui treats property and contract states as objects, enabling parallel execution and granular management.

Cetus leverages this by minting every liquidity place as a singular NFT (referred to as Place NFT), recording particulars like token pair, tick vary, and liquidity quantity. These NFTs act as proof of possession and may be transferred or staked in different contracts, enhancing composability.

Impressed by Uniswap v3 structure, this design is made safer on Sui due to Transfer’s strict useful resource management, which prevents duplication or loss. Cetus additionally makes use of a factory-contract structure the place a central Manufacturing facility deploys Pool contracts for every token pair and charge tier. Every Pool operates independently, permitting a number of trades and liquidity actions to be processed concurrently—boosting throughput and reducing latency.

Transfer’s security options assist with dependable accounting of tokens and predictable habits, even beneath complicated interactions. By absolutely embracing Sui’s distinctive structure, Cetus delivers a safe, high-performance AMM framework that helps scalable, environment friendly DeFi infrastructure on-chain.

Concentrated Liquidity AMM Design (CLMM Mechanics)

Cetus Protocol makes use of a Concentrated Liquidity Market Maker (CLMM) mannequin to maximise capital effectivity. Not like conventional AMMs that unfold liquidity throughout an infinite value vary, Cetus permits LPs to focus liquidity inside a selected vary, making their capital simpler and incomes increased charges. For instance, in a USDC/USDT pool, an LP can goal a good vary like 0.995–1.005, guaranteeing most trades use their liquidity.

Because the market value strikes outdoors this vary, the place turns into inactive however stays intact till re-entered. LPs can open a number of positions throughout quite a lot of ranges to implement customized methods. Cetus makes use of a tick-based system for value granularity, with swimming pools providing six charge tiers (0.01% to 2%). Every tier corresponds to a separate pool, letting the market self-select between low-slippage swaps or increased rewards for unstable property.

A key function is vary orders, which perform as on-chain restrict orders. LPs can present liquidity on one facet of the value (e.g., solely token A) and successfully “promote excessive” or “purchase low” whereas incomes swap charges. This combines automated buying and selling with capital effectivity. Total, Cetus presents a CEX-like expertise in a totally decentralized setup, enabling deep liquidity, environment friendly swaps, and superior methods.

Supply: Cetus

Cetus Charge Construction and Optimization Mechanisms

Each swap on Cetus incurs a charge primarily based on the pool’s tier (e.g., 0.05%), with 80% going to energetic LPs and 20% to the protocol treasury. Charges are distributed solely to LPs whose ranges embody the present value, rewarding these offering actual liquidity. LPs can select from six charge tiers starting from 0.01% to 2%, permitting swimming pools to self-regulate: low-fee tiers appeal to quantity for secure pairs, whereas increased tiers compensate for riskier property.

Not like typical DEXs that reward liquidity measurement, Cetus makes use of a fee-based liquidity mining mannequin. The CETUS tokens are pretty distributed primarily based on the precise charges a place generates. This discourages idle capital and ensures incentives go to productive LPs, bettering capital effectivity and decreasing pointless emissions.

Supply: DefiLlama

To simplify liquidity administration, Cetus offers Vaults that automate rebalancing and charge compounding. Its Intent Buying and selling module allows automated methods like DCA or restrict orders, executed absolutely on-chain. Sui’s low-cost, high-speed infrastructure makes these superior options possible.

Lastly, Cetus features a Swap Aggregator, sourcing liquidity from all Sui DEXs to make sure greatest execution. This enables customers to commerce seamlessly throughout the Sui ecosystem with minimal slippage, reinforcing Cetus’s place because the main buying and selling venue on Sui.

Oracle Performance and Cross-Chain Integration

Cetus Protocol extends past being a DEX by providing built-in oracle and cross-chain options. Its concentrated liquidity swimming pools function on-chain value oracles, recording swap-based value information and enabling time-weighted common value (TWAP) queries.

Builders can entry this information supply straight from pool contracts to derive dependable, manipulation-resistant value feeds—excellent to be used in lending protocols or automated methods on Sui. This removes reliance on exterior oracles, reducing integration prices and dangers.

Supply: Cetus

Cetus can be inherently multi-chain, supporting asset transfers between Sui, Aptos, and 20+ networks through the Wormhole bridge. Although Cetus doesn’t custody bridged property, it offers an interface for customers to maneuver tokens reminiscent of USDC and CETUS throughout chains. Whereas bridge-related dangers exist, integrations with Wormhole and Axelar spotlight Cetus’s dedication to multichain liquidity.

Its structure additionally aligns carefully with Sui’s parallel execution and object-centric mannequin. Initiatives can reference Cetus pool objects or combine straight through SDKs, making Cetus a foundational liquidity layer. Builders can supply token incentives/rewards to personalized swimming pools, creating composable DeFi use circumstances. Altogether, Cetus combines high-performance AMM design with oracle instruments, multichain entry, and developer-friendly integrations—positioning it as a core infrastructure protocol on Sui.

CETUS Tokenomics and Incentives

A deep dive into the Cetus Protocol could be incomplete with out analyzing its tokenomics. The mission offers a dual-token mannequin:

These tokens are central to the protocol’s incentive construction, governance mechanism, and long-term sustainability technique.

Supply: Cetus

CETUS Token Utility and Governance Position

CETUS token is designed to facilitate and incentivize participation within the Cetus DeFi ecosystem, relatively than act as a general-purpose foreign money. Holding CETUS doesn’t confer possession or income rights in a authorized sense, but it surely does entitle holders to partake in protocol governance and profit from the protocol’s development via utility options.

It’s price emphasizing that CETUS isn’t a income share token in a direct sense – protocol charges collected don’t routinely move to CETUS holders. Nonetheless, the protocol’s mannequin makes use of these charges for sustaining rewards (e.g. buyback or funding incentives) and insurance coverage, which not directly advantages the group and may assist the token’s worth.

The financial logic is that CETUS incentivizes person participation (liquidity, quantity, and so forth.), which grows the platform, generates charges, then used to additional reward customers and improve the platform, making a constructive suggestions loop.

Supply: Coingecko

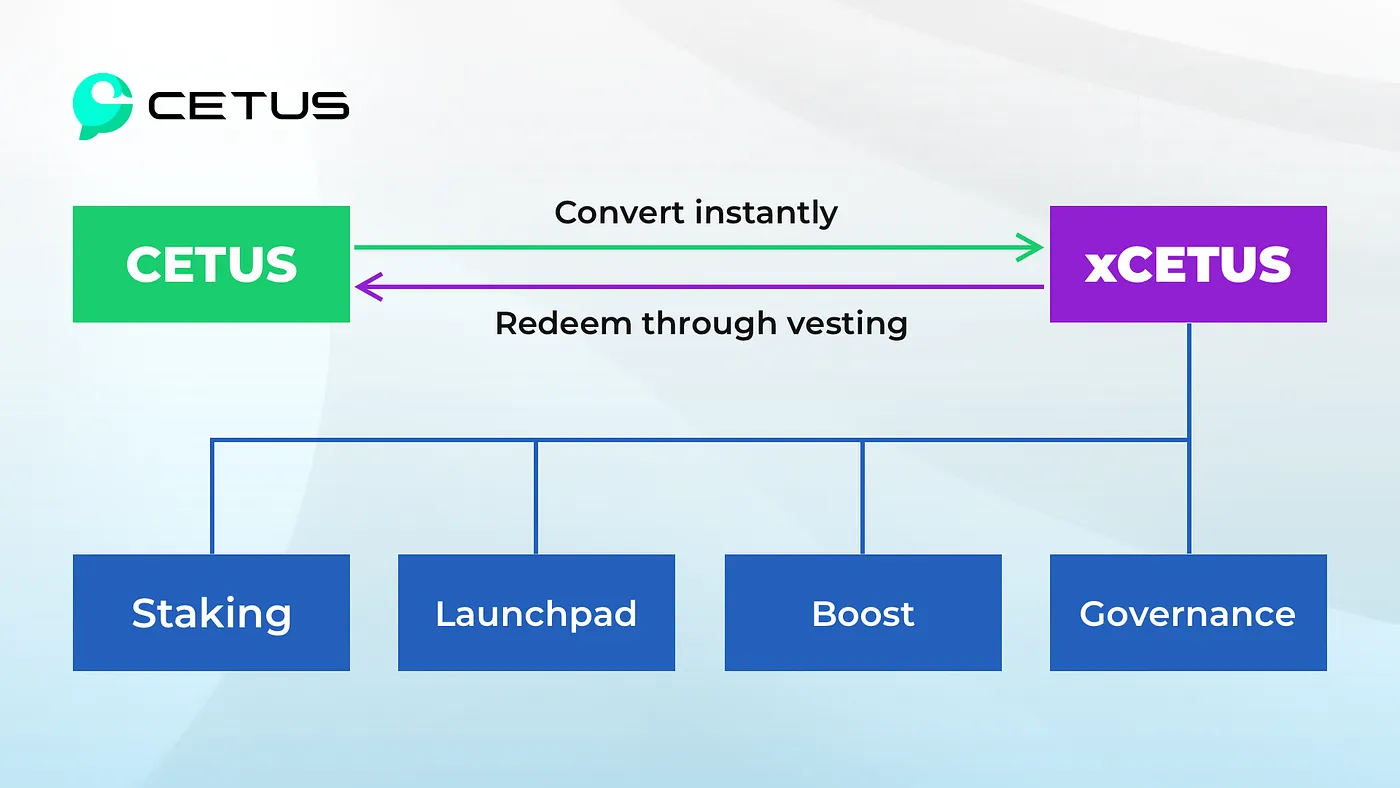

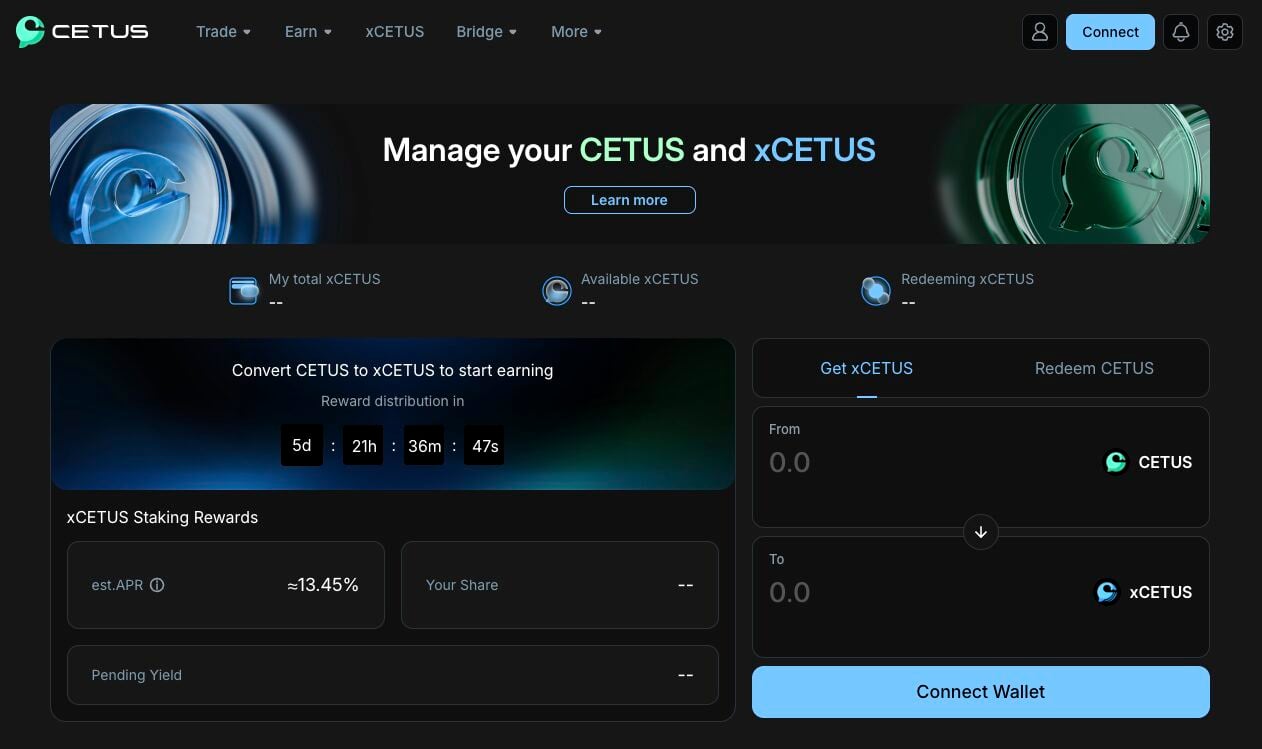

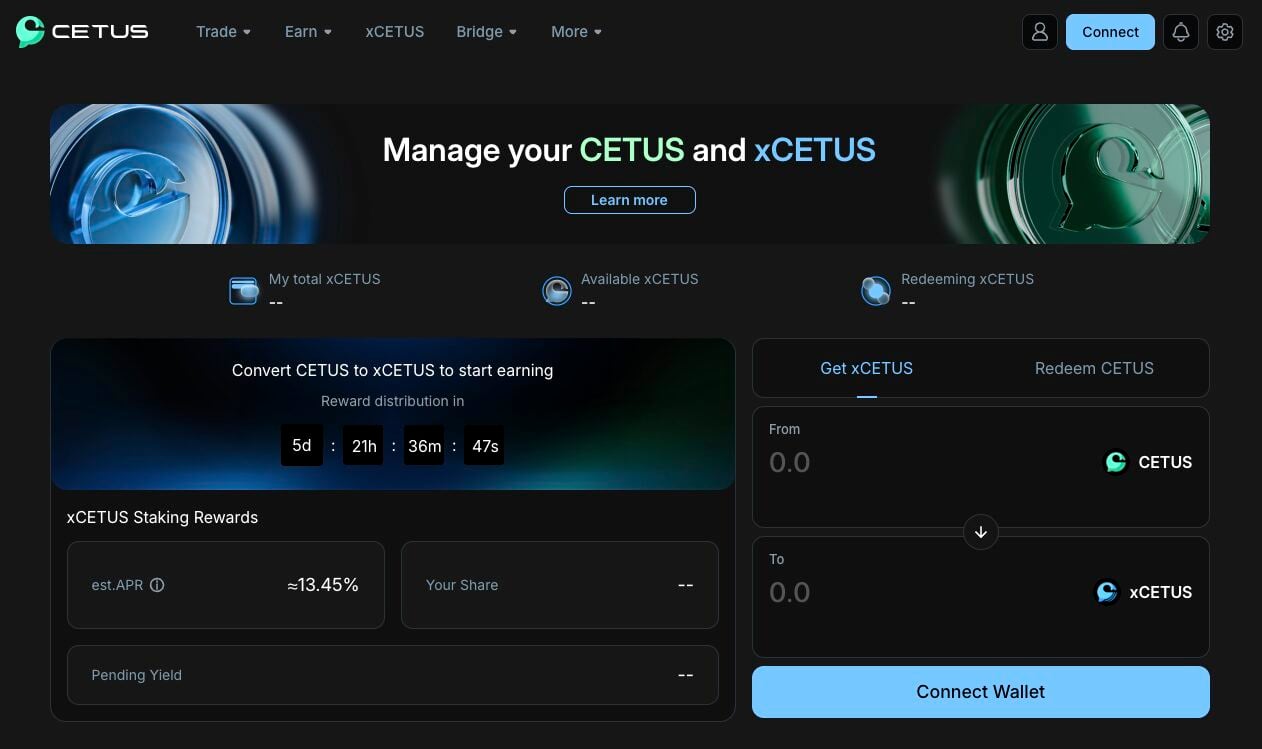

xCETUS: Staked Escrowed Token and Governance

To advertise long-term alignment and decentralized governance, Cetus makes use of an escrowed token mannequin: xCETUS. When customers stake (lock) their CETUS, they obtain a non-transferable xCETUS token at a 1:1 charge initially.

xCETUS represents voting energy and loyalty standing inside the protocol. The design is much like vote-escrow fashions (like Curve’s veToken idea) however with a versatile twist: customers can select how lengthy to vest in the event that they need to convert again to CETUS.

Key points of xCETUS:

Prompt Conversion: Customers stake CETUS anytime to obtain xCETUS at a 1:1 charge with no lock-in. Whereas staked, customers retain full governance rights and entry to loyalty advantages.Governance Energy: Solely actively held xCETUS counts for voting. If xCETUS is in redemption, it loses voting energy—stopping governance manipulation by present customers.Redemption Mechanics: Customers select a vesting interval (15 to 180 days).Cancel Anytime: Pending redemptions may be canceled earlier than completion to regain xCETUS.Loyalty Utility: xCETUS ranges up person tiers, unlocking perks like higher Launchpad allocations or charge advantages.Ecosystem Position: xCETUS governs mining rewards, charge settings, and treasury use. Holding it might additionally enhance entry to unique token gross sales.

Supply: Cetus

The xCETUS mannequin is highly effective. It aligns with long-term participation, permitting speedy governance participation however delaying full worth till exit. This mannequin is extra versatile than a hard and fast multi-year lock. Customers select their lock time when exiting, buying and selling time for worth. Those that stay staked assist the protocol’s stability and keep away from token loss. Any collected penalties strengthen Cetus’s monetary scenario.

From a governance perspective, xCETUS holders will vote on proposals as soon as Cetus DAO is absolutely on-chain. Moreover, xCETUS hyperlinks to Launchpad participation. When new initiatives launch tokens through Cetus’s Asset Launch, xCETUS quantities decide customers’ whitelist eligibility or allocation measurement. This provides a direct financial profit to holding xCETUS, doubtlessly offering entry to profitable token gross sales for rising Sui initiatives.

Supply: Cetus

Total, the CETUS/xCETUS tokenomics are geared in direction of sustainable, long-term development: CETUS incentivizes person exercise and liquidity provision; xCETUS encourages holding and aligned governance; the twin mannequin rewards real contributors and disincentivizes mercenary capital.

For extra: Sui Deep Dive: A Complete Evaluation

Cetus within the Sui Ecosystem

Cetus Protocol performs a pivotal position within the Sui ecosystem as its major liquidity engine and DeFi infrastructure layer. As the primary and most dominant DEX on Sui, Cetus allows deep, environment friendly, and versatile buying and selling via its concentrated liquidity AMM mannequin, which drastically improves capital effectivity and reduces slippage for customers.

This design makes Cetus the default venue for token swaps, liquidity provisioning, and value discovery throughout the community. Greater than only a DEX, Cetus acts as a modular constructing block for Sui-based purposes. In brief, Cetus is the liquidity spine, oracle layer, and governance gateway of the Sui blockchain.