Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink (LINK) is up 21% from its Sunday lows, gaining momentum in an in any other case unsure macro and geopolitical atmosphere. Whereas international tensions proceed to spark volatility throughout markets, Chainlink has stood out for its resilience, supported by a sequence of robust partnerships and rising on-chain fundamentals. The latest worth motion alerts a possible shift in development, however analysts warn {that a} confirmed breakout continues to be wanted earlier than bulls can totally take over.

Associated Studying

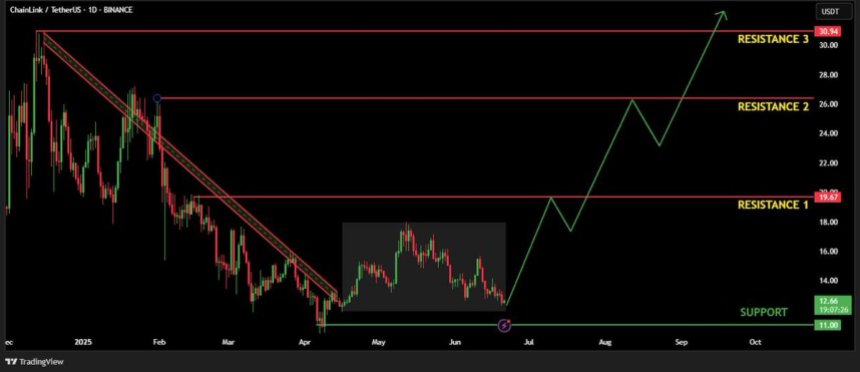

High analyst Henry Lord of Alts highlighted that LINK has endured months of persistent downtrend and unusually quiet worth habits. Nevertheless, latest strikes recommend that one thing is altering beneath the floor. Quantity is rising, volatility is choosing up, and LINK is forming a base construction that might mark the top of its accumulation part.

Regardless of this energy, Chainlink stays technically locked inside a consolidation vary. A clear breakout above key resistance ranges will probably be essential to set off the subsequent part of upward momentum. Till then, merchants are cautiously optimistic as LINK teases a bigger transfer.

Chainlink Prepares For A Decisive Transfer

Chainlink is at the moment buying and selling over 25% under its Might excessive, reflecting the broader market affect of rising macroeconomic uncertainty and geopolitical tensions, particularly the latest Center East conflicts. Regardless of these pressures, LINK has managed to carry inside a gradual consolidation vary, signaling resilience because the crypto market awaits its subsequent decisive transfer.

Sustaining costs above present ranges is essential. A breakdown right here might open the door for deeper corrections. Nevertheless, analyst Henry believes the tides could also be turning. In line with Henry, Chainlink has endured months of downtrend and silence, however a structural shift is now underway. His evaluation highlights that the long-standing downtrend has been damaged, and LINK has entered a transparent accumulation and consolidation part.

“These zones typically come earlier than the loudest strikes,” Henry notes. Traditionally, such phases have preceded explosive rallies, and this time could also be no totally different. If momentum picks up, a breakout towards the $25–$30 vary wouldn’t be stunning.

Henry additionally factors out that intervals of inactivity typically masks the actions of good cash—shopping for quietly earlier than the broader market catches on. Whereas it’s simple to miss property throughout calm phases, that’s typically when the groundwork for main strikes is laid. For now, Chainlink stays on watch.

Associated Studying

LINK Worth Evaluation: Indicators of Reversal Emerge

Chainlink is displaying early indicators of a development reversal after months of constant decline. As seen within the 12-hour chart, LINK just lately rebounded from the $11.50 stage and is now buying and selling above $13.20. This restoration follows a steep drop that marked a brand new native low, however the bounce has pushed the value above the 50-day easy transferring common (SMA), now performing as short-term help at $13.50.

Importantly, LINK is now testing the 100-day SMA (round $14.65), which beforehand served as resistance in late Might and early June. If bulls handle to interrupt and consolidate above this stage, the subsequent goal lies close to the 200-day SMA at $14.16—a confluence zone which will act as a essential resolution level for development continuation or rejection.

Associated Studying

Whereas the macro construction stays bearish, this short-term accumulation vary suggests rising demand, particularly as the value begins to kind greater lows. A transparent break above $14.65 with quantity might affirm the breakout and sign the beginning of a bigger transfer towards the $17–$18 vary.

Featured picture from Dall-E, chart from TradingView