Gregory Pudovsky

Revealed: June 25, 2025 at 12:18 pm Up to date: June 25, 2025 at 12:18 pm

Just lately, Infini Card — as soon as seen as a fast-growing crypto cost participant — abruptly shut down its world crypto card enterprise. The shutdown has reignited business issues over the sustainability of crypto cost enterprise fashions. Skinny money flows, shrinking revenue margins, rising compliance prices, and elevated settlement bills finally overwhelmed the platform’s monetary capability. However whereas Infini’s collapse remains to be contemporary, a brand new wave of platforms is rising with much more complicated monetary constructions designed to increase the phantasm of quick development.

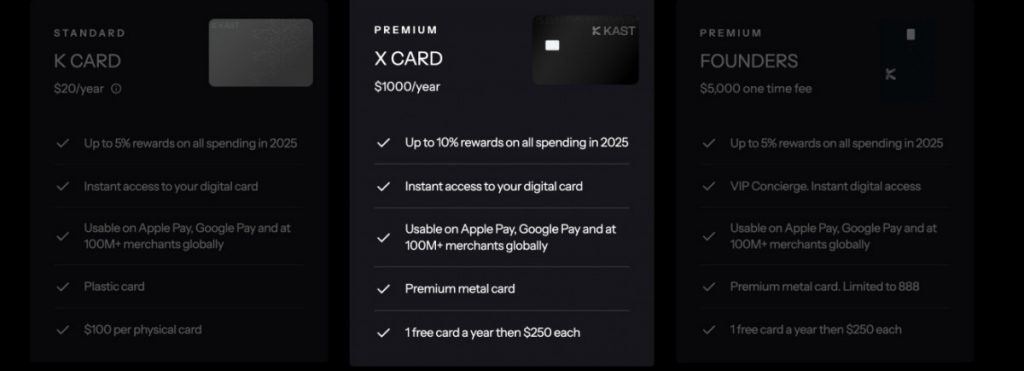

Amongst them, KAST has gained important consideration by offering as much as 10% cashback in Kast factors that diverges sharply from conventional cashback logic. Not like typical cashback, the place customers obtain spendable money or stablecoins after every transaction, KAST gives reward factors that can’t be redeemed instantly. These factors can solely be transformed into KAST’s native token after a future Token Era Occasion (TGE). Even then, customers face unlock schedules and secondary market volatility earlier than any actual cashback can happen.

On the floor, this mannequin offers platforms with substantial short-term monetary flexibility. As a result of issuing factors requires no quick money outlay, initiatives can gas early-stage development whereas minimizing near-term funding stress. The excessive cashback charges simply appeal to customers, who might overlook that what they’re receiving is basically a deferred, unguaranteed token technology promise.

At its core, each level issued is a future redemption obligation. Because the pool of excellent factors grows, the system’s dependency on new capital inflows and future token worth appreciation deepens. Steady person acquisition and contemporary liquidity injections are required to soak up the eventual promoting stress within the secondary market. If person development slows or market situations deteriorate, systemic redemption danger can floor quickly.

Some platforms might not directly depend on ongoing enterprise funding to behave as a backstop — propping up token costs, sustaining market confidence, and delaying redemption stress. Whereas these capital infusions are sometimes introduced as development funding, parts of them might successfully be diverted towards supporting token liquidity and worth stability, masking the system’s underlying fragility.

Essentially, tokenized cashback doesn’t eradicate redemption obligations — it merely hides, delays, and compounds them over time. Each token distributed at the moment creates an actual money movement legal responsibility that should ultimately be paid. If the platform’s underlying profitability fails to match the mounting token liabilities, aggressive cashback incentives might finally push platforms towards sudden collapse eventualities.

The construction echoes dangers we’ve seen earlier than. In recent times, platforms like Celsius, Voyager, and others have employed equally leveraged development fashions: attracting customers with high-yield guarantees whereas missing ample sustainable earnings to backstop these obligations. When market situations reversed, funding dried up, and regulators stepped in, these methods unraveled with astonishing velocity, abandoning a path of collapsed tokens and unrecoverable person losses.

Not like Infini, which instantly burned by means of money whereas propping up unsustainable cashback gives, KAST shifts the burden to the longer term by means of tokenization. Brief-term it seems wholesome, however lengthy -term redemption liabilities have gotten larger and larger.The mix of unstable token costs, unsure unlocking schedules, fragile secondary market liquidity, and escalating reliance on ongoing fundraising creates a fragile systemic danger which will ultimately unwind sharply.

Regulatory uncertainty additional complicates these fashions. Are such tokenized cashback schemes successfully unregistered securities? Do they cross into the realm of illicit fundraising? Have customers been given full, clear disclosure of their true redemption rights and dangers? In a worldwide setting of quickly evolving crypto regulation, these questions might get an increasing number of attentions from regulators.

In an business the place steady profitability stays elusive, the enterprise mannequin must return to fundamentals: actual earnings fund cashback; rewards are quick and spendable; and customers’ rights are clear, predictable, and free from difficult token economics.

Infini’s collapse might not be an remoted incident. As tokenized cashback fashions proceed to develop aggressively, maybe now’s the second for the business to pause and mirror on what really constitutes sustainable monetary innovation.

The extra compelling the expansion story sounds, the extra vital it turns into to acknowledge the ballooning redemption gap quietly rising behind it.

Disclaimer

Consistent with the Belief Undertaking tips, please notice that the data offered on this web page isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation in case you have any doubts. For additional info, we recommend referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Gregory, a digital nomad hailing from Poland, isn’t solely a monetary analyst but additionally a useful contributor to numerous on-line magazines. With a wealth of expertise within the monetary business, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is at present devoted to writing a ebook about cryptocurrency and blockchain.

Extra articles

Gregory, a digital nomad hailing from Poland, isn’t solely a monetary analyst but additionally a useful contributor to numerous on-line magazines. With a wealth of expertise within the monetary business, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is at present devoted to writing a ebook about cryptocurrency and blockchain.