The Bitcoin worth is at the moment at $107,050, having climbed 1.5% in a single day, and is displaying more and more bullish power amid the continued Israel-Iran battle, with tomorrow’s Federal Reserve FOMC Conferences looming.

Tomorrow, the Fed will announce its plans for rates of interest, with prediction platform Polymarket having ‘No change’ sitting at 98% likelihood of being appropriate and a 25 bps lower at 2%.

I feel it is advisable to put $BTC in context.

We made a brand new ATH 3 weeks in the past.We’re consolidating above former ATHs.We have corrected 5% from ATHs.

Sure the LTF is uneven and has information stress.

However do not let the results of zooming in distract from what this chart actually appears like. pic.twitter.com/Hc3sXcl2V8

— Chilly Blooded Shiller (@ColdBloodShill) June 15, 2025

Bitcoin Value Completely Positioned For A Huge Transfer To The Upside Heading Into FOMC

With the Fed’s FOMC conferences only a day away, Bitcoin is sitting simply 4.2% away from breaking a contemporary all-time excessive, which got here lower than a month in the past when it hit $111,814 on Could 22.

No matter exterior world occasions, specifically the battle between Iran and Israel, which has seemingly escalated following a potential hit on the US Embassy in Tel Aviv, Bitcoin seemingly can’t be stopped.

If these occasions had occurred just some months in the past, BTC would’ve seemingly damaged construction and plummeted beneath $100k. Nevertheless, Bitcoin worth has retested the sub-$103,000 degree twice already this month, and each instances, it bounced completely off of help and again above $105,000.

Zooming out on the chart, Bitcoin appears unimaginable on an HTF (excessive time-frame). Though present world affairs and looming FOMC conferences make BTC look barely uneven on an LTF (low time-frame), it’s nonetheless an extremely bullish chart after holding regular above the warfare breakout degree of $103,800.

A 25 bps reduce from the Fed or an announcement of no change will seemingly see Bitcoin worth head for contemporary all-time highs as danger property will proceed to see heavy inflows from institutional and retail buyers.

DISCOVER: High 20 Crypto to Purchase in June 2025

Exchanges Are Working Out Of Bitcoin: One other Sign That A Large Transfer Is Doubtless On The Means

(SOURCE)

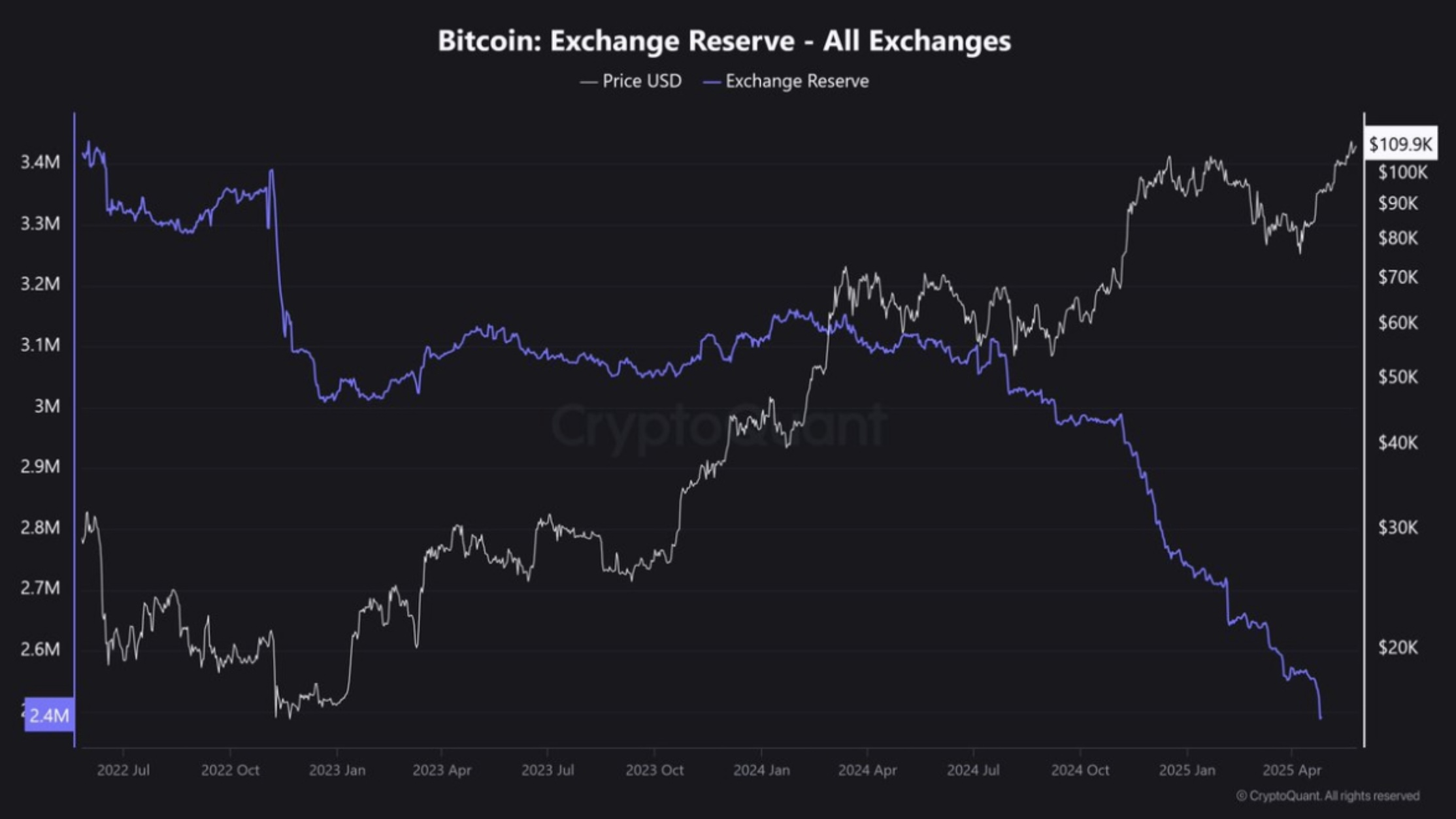

Because the Bitcoin chart continues to carry regular slightly below its all-time excessive, BTC provide on exchanges is vanishing. The final time this occurred, Bitcoin exploded.

There was an enormous exodus of BTC from exchanges in late 2022 and into early 2023. On the similar time, the Bitcoin worth went from $16,600 to almost double to $31,000 by April 2023.

This key indicator is main many merchants and analysts to imagine that the availability shock attributable to the shortage of accessible Bitcoin will result in the true BTC pump of this bull market cycle.

Contemplating notable figures equivalent to Binance founder CZ, who said his perception that Bitcoin’s worth may exceed $500,000 this cycle, coupled with the power proven by the main digital asset within the face of a WW3 breakout, these lofty BTC targets appear extra actual than ever.

Establishments Proceed To Purchase Bitcoin And Ethereum Whereas Retail Buyers Keep Sidelined In Concern

BLACKROCK HAS BOUGHT ETH FOR 9 DAYS IN A ROW

BlackRock’s ETHA ETF has obtained over $492M of inflows previously 9 consecutive buying and selling days.

Good morning Ethereum Bulls. pic.twitter.com/liWW1HcLpz

— Arkham (@arkham) June 6, 2025

Not solely does the Bitcoin worth look nice from a TA perspective, however the fundamentals are extraordinarily bullish proper now. Japan’s MetaPlanet simply this morning introduced a contemporary 1,112 BTC purchase, totalling $116.5 million.

This will increase MetaPlanet’s holdings to 10,000 Bitcoin, transferring it above Coinbase to ninth place within the largest Bitcoin holders record. It now sits behind the Hut 8 Mining Company, which holds a reported 10,273 BTC. Yet another buy from MetaPlanet may see the Japanese agency overtake Hut 8 into eighth place.

On the Ethereum aspect, crypto intelligence platform Arkham posted 9 days in the past that BlackRock has been constantly shopping for ETH, including $492 million price in only a nine-day accumulation interval.

Whereas many retail buyers are scared to purchase the dip with the continued battle within the Center East, establishments equivalent to MetaPlanet and BlackRock are shopping for Bitcoin and Ethereum at discounted costs. Because the outdated adage goes, ‘scared cash don’t become profitable’, and these companies stay by that motto.

The seemingly final result from this week is the Fed saying charges to be reduce by 25 bps or keep flat, and a potential de-escalation within the Center East. These outcomes will seemingly be the springboard for an influx to danger property, led by Bitcoin worth printing contemporary highs and Ethereum regaining $3000 earlier than pushing on towards its earlier all-time excessive of $4878, per CoinGecko.

EXPLORE: Finest Meme Coin ICOs to Put money into 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Why you possibly can belief 99Bitcoins

Established in 2013, 99Bitcoin’s crew members have been crypto consultants since Bitcoin’s Early days.

90hr+

Weekly Analysis

100k+

Month-to-month readers

50+

Knowledgeable contributors

2000+

Crypto Tasks Reviewed

Comply with 99Bitcoins in your Google Information Feed

Get the newest updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now