Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin lastly broke by means of its all-time highs this week, reaching $112,000 and holding agency above the important thing psychological degree of $100,000. After weeks of regular momentum and bullish consolidation, the breakout marks a serious shift in market construction, confirming that bulls are actually in full management. The transfer has reignited optimism throughout the market, with sentiment turning decisively constructive as BTC enters value discovery as soon as once more.

Associated Studying

The breakout wasn’t simply technical—it was backed by robust positioning throughout derivatives markets. In keeping with knowledge from Coinglass, Bitcoin’s weekly liquidation heatmap reveals a dense cluster of liquidity across the $105,700 degree. This space may act as a magnet within the brief time period, with some merchants anticipating a quick sweep into that zone earlier than BTC resumes its upward trajectory.

This surroundings now favors bulls, with each technical ranges and on-chain knowledge aligning to assist additional upside. So long as Bitcoin continues to shut above $100K and dips stay shallow, the trail of least resistance seems to be increased. With liquidity, momentum, and macro sentiment aligning, the approaching weeks may very well be essential as BTC units the tone for the remainder of the market—and doubtlessly the beginning of a full-blown bullish part.

Bitcoin Stays Sturdy Amid Tight Situations

Bitcoin posted one other bullish week, reaching a brand new all-time excessive of $112,000 earlier than pulling again barely to carry above the important thing $100,000 degree. Regardless of the power, market sentiment has but to flip totally euphoric. A cautiously bullish tone dominates as macroeconomic circumstances stay tight, with excessive US Treasury yields and rising instability in world commerce persevering with to weigh on danger property.

In contrast to many altcoins, that are nonetheless buying and selling properly under their earlier cycle highs, Bitcoin seems to be thriving on this high-stress surroundings. Its resilience is being carefully watched, as capital continues to favor BTC over smaller, extra risky property. This relative power reinforces Bitcoin’s standing as a macro hedge, particularly in unsure financial circumstances.

Prime analyst Ted Pillows added to the dialogue by highlighting knowledge from Coinglass, which reveals vital liquidity sitting across the $105,700 degree on the BTC weekly liquidation heatmap. In keeping with Pillows, this cluster may function a short-term magnet, suggesting {that a} fast sweep of that zone could happen earlier than Bitcoin resumes its upward transfer.

“Liquidity at $105K is thick. A dip into that space may filter late longs earlier than the following leg increased,” he famous.

With Bitcoin holding key ranges and sentiment remaining grounded, the setup is favorable for continuation, however not with out potential volatility. If BTC can defend the $100K–$105K vary and reclaim $110K, the following push towards new highs could arrive prior to anticipated. For now, bulls stay in management, however merchants are staying alert as world markets stay on edge.

Associated Studying

BTC Holds Above Key Averages

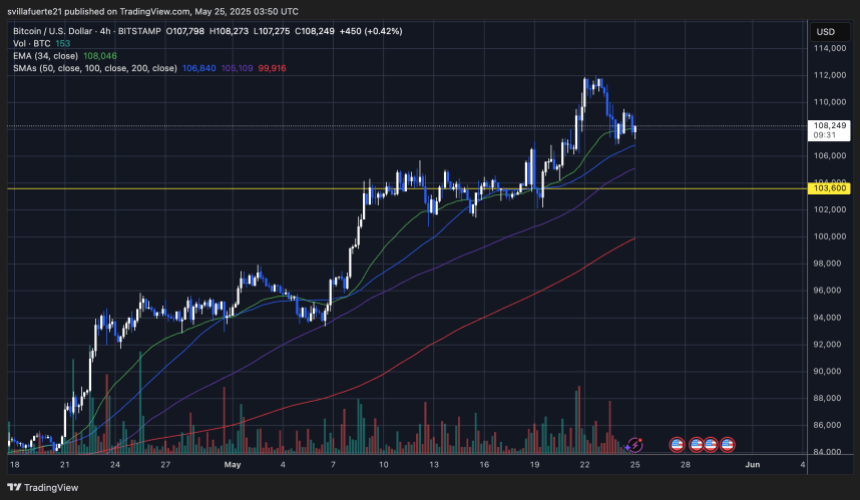

Bitcoin is buying and selling at $108,249 on the 4-hour chart after a powerful push to $112,000 earlier within the week. The chart reveals BTC at the moment consolidating above a confluence of key transferring averages, together with the 34 EMA ($108,046), 50 SMA ($106,840), and 100 SMA ($105,109), all of that are trending upward. These ranges now function dynamic assist zones, holding the short-term construction bullish so long as value stays above them.

Regardless of the rejection close to $112K, BTC has prevented any aggressive selloff and continues to respect the mid-range ranges of its current breakout. The $103,600 degree, marked in yellow, is a key horizontal assist and beforehand acted as a resistance ceiling. It now gives a powerful base if any deeper correction happens.

Quantity has declined throughout this pullback part, indicating that the promoting stress is probably going corrective reasonably than the beginning of a pattern reversal. If bulls can keep management above $106K and reclaim momentum above $110K, a retest of the current highs is probably going.

Associated Studying

For now, the 4-hour pattern stays intact. All eyes are on whether or not Bitcoin can maintain above the clustered assist and proceed constructing a base for the following leg increased.

Featured picture from Dall-E, chart from TradingView