Ethereum’s nonprofit arm rolled out a serious safety drive on Might 14. It goals to shore up wallets, good contracts, and the community itself. The transfer comes as more cash flows onto the blockchain, with a plan large enough to guard “trillions” in digital belongings.

Initiative Scope And Targets

In response to the Basis, the trouble known as the Trillion Greenback Safety Initiative. It has three steps. First, the staff will scan every thing from pockets design to consensus guidelines. They’ll hunt for weak spots in code and within the community. Then, they’ll decide the highest fixes and work with builders to roll out updates. Lastly, they’ll share what they be taught and assist customers, corporations, and regulators stand up to hurry on Ethereum safety.

2. Ethereum should obtain “Trillion Greenback Safety” – a world the place:

– Billions of people really feel secure holding $1000 onchain, collectively amounting to trillions of {dollars}

– Particular person orgs are comfy storing $1 trillion inside a single contract or utility.

— Ethereum Basis (@ethereumfndn) Might 14, 2025

Skilled Staff And Roles

Primarily based on reviews, two in‑home leads will co‑chair the venture. Fredrik Svantes handles protocol safety analysis. Josh Stark sits on the Basis’s administration staff. They’ll lean on three outdoors specialists: Samczsun, Mehdi Zerouali, and Zach Obront. These names carry weight in crypto circles. Collectively, they’ll information audits, recommend fixes, and form the plan.

ETHUSD buying and selling at $2,569 on the 24-hour chart: TradingView.com

Market Response And Information

ETH’s worth has jumped greater than 40% for the reason that Pectra replace on Might 7, hitting practically $2,755 earlier than a slight pullback. Analysts level to key help within the $2,000–$2,300 band. If that holds, many anticipate a push towards $3,000. In response to Coinglass knowledge, derivatives quantity climbed 25% to $121 billion, whereas open curiosity grew 4.5% to greater than $32 billion. These figures underline rising curiosity from huge merchants.

Influence On DeFi Dominance

Ethereum nonetheless holds roughly half of all DeFi worth. Whole worth locked (TVL) on Might 14 sat at about $80 billion, which is sort of 50–60% of the entire locked throughout blockchains. By tightening safety at each stage, the community hopes to maintain its lead. Establishments specifically search for clear security measures earlier than committing extra funds.

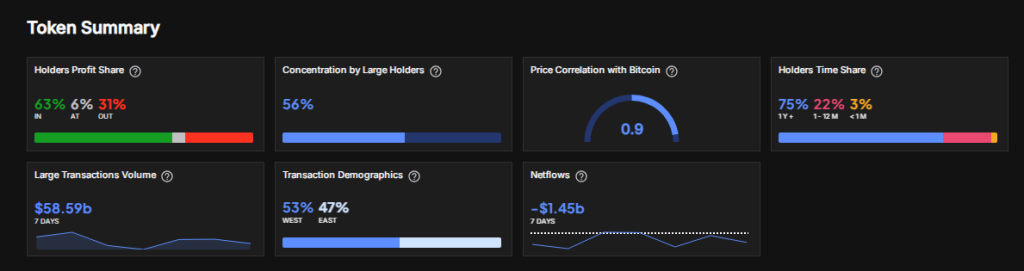

Ethereum on-chain exercise. Supply: IntoTheBlock

This safety push comes at a key second. On‑chain exercise has picked up, and so have the stakes. Excessive‑profile hacks in previous cycles value customers a whole lot of tens of millions. A public, effectively‑run audit might help ease fears and hold cash transferring in. It might additionally elevate the bar for different good‑contract platforms that wish to draw customers away from Ethereum.

Nonetheless, the actual take a look at will likely be execution. The Basis must set clear timelines and observe progress in public. Patches needs to be straightforward to undertake, and messages should attain finish customers in easy phrases. A slick report received’t calm nerves if wallets keep complicated or if updates lag.

Featured picture from Gemini Imagen, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.