A significant US inventory index is about to welcome its first crypto-focused alternate subsequent week. Coinbase will formally be a part of the S&P 500 forward of buying and selling on Might 19. The transfer comes greater than three years after its direct itemizing on Nasdaq, and it cements the agency’s standing amongst large-cap names.

Affirmation Of S&P 500 Inclusion

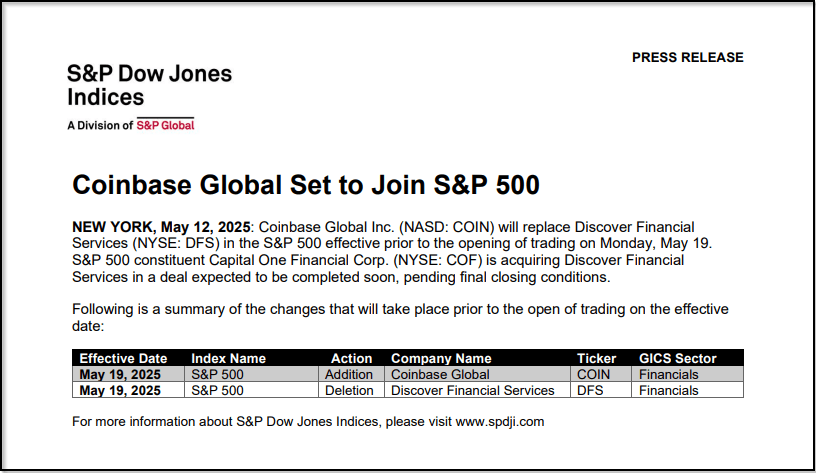

In line with S&P Dow Jones Indices, Coinbase is ready to interchange Uncover Monetary Providers within the benchmark earlier than markets open on Monday. This follows the corporate assembly strict guidelines—optimistic earnings in the newest quarter and throughout the prior 4 quarters. It’s no small feat for a enterprise whose fortunes have swung wildly with crypto costs.

Supply: S&P Dow Jones Indices

Earnings And Income Developments

Primarily based on experiences, Coinbase posted income of $7.4 billion in 2021 however then swung to a lack of $1.1 billion in Q2 2022. In Q1 2025, income reached $2 billion, up 24% from the identical interval final 12 months, though it fell about 10% from This autumn 2024. Web revenue, nonetheless, plunged 94% to $66 m after the agency marked its crypto holdings to market. These numbers underline how tied Coinbase stays to Bitcoin, Ether and different tokens.

Coinbase simply grew to become the primary and solely crypto firm to affix the S&P 500.

This milestone represents what the true believers, from retail traders to institutional traders to our staff and companions, knew all alongside.

Crypto is right here to remain. https://t.co/MnMRCX8pMg

— Brian Armstrong (@brian_armstrong) Might 12, 2025

Market Response And Inventory Efficiency

Buyers have thus far given the corporate a vote of confidence. Shares jumped greater than 10% in prolonged buying and selling on Monday, as index funds monitoring the S&P 500 gear up so as to add Coinbase to their portfolios. Over the previous two years, the inventory has climbed roughly 250%, despite the fact that it’s down almost 17% thus far this 12 months whereas Bitcoin has climbed near 10%.

Strategic Growth And Business Impression

Primarily based on experiences, Coinbase plans to accumulate Deribit for $2.9 billion, in one of many largest offers in crypto historical past. The acquisition would deliver choices buying and selling into its suite of merchandise and enhance income potential. On the identical time, it provides integration dangers and debt service that traders will likely be watching carefully.

Outlook For Crypto And Regulation

In line with analysts, the inclusion indicators rising acceptance of digital property by conventional finance. Below the present administration, regulators have taken a extra permissive stance towards crypto companies. Rival exchanges akin to Gemini and Kraken are already eyeing their very own public listings. Nevertheless, volatility in token costs may nonetheless ship Coinbase’s earnings swinging, which in flip may have an effect on its standing within the S&P 500.

This milestone marks a turning level for Coinbase and the broader crypto sector. As indexing funds movement into the inventory, the alternate will achieve extra visibility amongst mainstream traders. But the enterprise faces a tightrope stroll: balancing progress via large offers like Deribit whereas managing dangers tied to crypto’s well-known worth swings.

Featured picture from StartupNews.fyi, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.