Warren Buffett is making headlines along with his retirement, marking the top of an period at Berkshire. In the meantime, Massive Tech did its half final week, providing simply sufficient optimism to maintain the rebound narrative alive. However with oil costs sliding once more to start out the week—and tariffs, charge choices, and progress issues piling up—markets are nonetheless balancing between glass-half-full momentum and glass-half-empty macro threat.

Warren Buffett Steps Down – Greg Abel Takes the Helm at Berkshire

Legendary investor Warren Buffett is stepping down on the age of 94. He’s handing over the management of his holding firm, Berkshire Hathaway, to Greg Abel.

Abel is under no circumstances an unknown determine within the monetary world. The 62-year-old has been with Berkshire since 1999 and was given accountability for the corporate’s non-insurance companies in 2018.

Buffett constructed Berkshire into an organization valued at over $1.16 trillion. In 2024, its group of companies generated $47.4 billion in working revenue.

On the annual shareholders’ assembly over the weekend, Buffett additionally criticized Donald Trump’s commerce coverage—although with out mentioning the president by identify. “Commerce shouldn’t be a weapon,” he stated.

Regardless of latest market turbulence, Berkshire’s inventory has confirmed resilient. It closed at a brand new report excessive close to $540 on Friday, up round 20% year-to-date.

All eyes might be on Monday’s market response, although long-term traders are prone to view the management transition positively.

Massive Tech’s Earnings Buffet Fuels the Rally

One after one other, tech heavyweights delivered steering that pointed to regular demand throughout units, cloud, software program, and digital advertisements. The reviews weren’t flawless (Apple was the standout miss), however they went a great distance in easing fears of an imminent tariff-driven hit to income.

Alphabet stayed in step with its no-guidance coverage.

Microsoft guided above the Road, with Azure nonetheless operating hot- demand is outpacing knowledge middle capability.

Amazon’s revenue outlook got here in gentle, however CEO Andy Jassy famous they haven’t seen any softening in demand.

Meta saved issues regular with advert spend steering roughly in step with consensus.

Earnings season helped ease issues round AI capex too. Meta raised its full-year spend forecast, and Microsoft signaled AI-related funding will continue to grow, simply at a slower tempo subsequent 12 months, excellent news for names like Nvidia and Broadcom. But it surely wasn’t all clean. Tesla quietly dropped its steering to return to income progress in 2025. Apple flagged a $900 million hit from tariffs this quarter.

General, it was a reassuring week for traders on the lookout for indicators that the market rebound is likely to be greater than only a bounce. The backdrop continues to be unsure, however markets are leaning towards a glass-half-full take, for now. That stated, the danger of renewed volatility stays, particularly for tech, because the commerce tensions play out. We gained’t know the complete impression of the tariffs till subsequent quarter’s earnings. Within the meantime,it might be greatest to favor a barbell strategy: staying defensive, whereas holding onto high quality tech names tied to long-term progress themes.

The Massive Image: Cautiously Optimistic (With a Aspect of Protection)

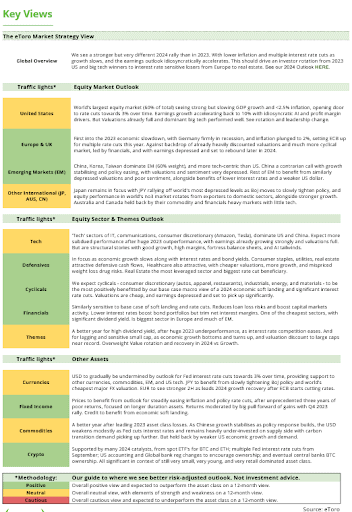

So the place does all this go away us? In a nutshell, latest developments spotlight a cautiously optimistic market that’s nonetheless hedging its bets. Massive Tech’s energy is a bullish beacon so far- these corporations have proven they’ll navigate storms (tariffs, prices) and are investing for future progress, which provides confidence that the financial system isn’t falling off a cliff, simply but. On the similar time, macro alerts (falling short-term yields, oil weak spot, defensive sector rotation) flash that many traders are getting ready for a possible slowdown or at the very least a tougher setting within the coming months.

For retail traders, a couple of actionable themes emerge:

High quality over Junk: In unsure instances, markets are favoring high quality – whether or not it’s worthwhile Massive Tech, steady staple shares, or sector leaders in comm companies. Corporations with robust stability sheets and secular progress drivers are safer harbors.

Keep Nimble on the Macro: The expansion vs. inflation debate will swing with every new knowledge level. Be prepared for volatility round key reviews (jobs, CPI) – they may tip the size on sentiment. If inflation surprises on the draw back, it might set off a risk-on reduction (good for cyclicals). If progress knowledge actually rolls over, don’t be stunned if we see a deeper defensive shift (and maybe central banks slicing extra).

Alternatives in Laggards: Regulate these beaten-down areas like small-caps or vitality. They’re dangerous, sure, but additionally value-rich. If indicators emerge that recession fears have been overdone- say, a rebound in PMIs or a truce in commerce tensions- these might snap again quick. Even a touch that the Fed would possibly minimize charges greater than anticipated this 12 months might ignite components of the market which have lagged.

Trying ahead, the broader market route will possible hinge on resolving that key query: Are we extra anxious a couple of progress slowdown or lingering inflation? If progress fears ease (or central banks present they’ll cushion the autumn), we would see a rotation again into riskier property. If, nevertheless, inflation proves sticky and limits coverage assist whereas earnings begin to weaken, the market might keep range-bound or uneven, leaning on these large secure names.

For now, the market’s message is blended however not gloomy. Tech is flying, shoppers are nonetheless spending (albeit extra fastidiously), and central banks have gotten buddies moderately than foes. Simply don’t be stunned if the highway will get bumpy.

Manufacturing Improve Meets Uncertainty – Oil Costs Proceed to Slide

At first of the week, oil costs are as soon as once more beneath strain. Rising manufacturing and lingering demand issues amid the continued commerce battle are contributing to a fragile technical image.

Brent is buying and selling at 57 US {dollars} per barrel. Nevertheless, the sell-off was initially halted simply above the April 9 low of 55 {dollars} (see chart).

OPEC+ has agreed to extend manufacturing by greater than 400,000 barrels per day beginning in June. And that will not be the top of it. Saudi Arabia has signaled the potential of additional will increase of the same scale.

Oil corporations are beneath strain as falling costs weigh on profitability. On the similar time, vitality prices are declining, which reduces inflationary strain – a doubtlessly constructive sign for the Fed.

Technically, the market stays susceptible. Help at 55 {dollars} is essential. A sustained transfer above 72 {dollars} – the place to begin of the latest sell-off – can be wanted to regain merchants’ confidence.

Oil (Brent) day by day chart

BoE Charge Resolution: UK Braces for a Reduce

Developing this week: central banks take the stage. The Financial institution of England meets on Thursday, and markets are overwhelmingly betting on a charge minimize. A charge discount might have speedy impacts: interest-sensitive sectors like homebuilders and utilities would possibly get a lift from cheaper borrowing prices. Decrease mortgage charges can spur house demand, and utility corporations might take pleasure in decrease curiosity bills (making their juicy dividend yields much more enticing in a lower-rate world). General, the BoE’s resolution will set the tone for UK markets: a minimize would possibly cheer the inventory market and housing corporations, whereas a shock maintain might jolt the forex increased. With 4 whole BoE cuts priced in for 2025, Governor Andrew Bailey’s commentary might be simply as essential.

Macro Tug-of-Warfare: Progress Scares vs. Inflation Fears

The market temper is oscillating between progress jitters and inflation worries. Currently, the pendulum is swinging towards progress issues and we will see it within the bond market. The two-year US Treasury yield (delicate to Fed strikes) has been trending close to latest lows, even because the Fed has hinted at pausing hikes. This slide in yields suggests merchants are looking for security and bracing for a slowdown. In different phrases, the market is successfully yelling that the Fed needs to be slicing charges quickly.

Fed Charge Resolution: Markets Demand Alerts as Trump Will increase Strain

Buyers are hoping for clear alerts from Jerome Powell: However the Fed doesn’t have a crystal ball. Given the unresolved tariff points, it’s prone to ship a cautious message. The administration, in the meantime, continues to publicly strain Powell. The Fed should protect its independence and credibility. Particularly on this delicate market part, it can not afford financial coverage errors.

Charge resolution on Wednesday night: The administration has a significant affect on market expectations. It’s fueling hypothesis about charge cuts, and protectionist commerce coverage is weighing on the expansion of the US financial system. Regardless of this, a charge minimize in Could is seen as unlikely. Nevertheless, markets anticipate 4 extra charge cuts of 25 foundation factors every by the top of the 12 months: in July, September, October, and December.

All eyes on J. Powell: His press convention is taken into account a key second for the markets. We anticipate an evaluation of the financial impression of tariffs and potential draw back dangers. It’s a balancing act for the Fed. Powell should sign assist, however not an excessive amount of, as a way to keep away from triggering extra market volatility. Markets are questioning whether or not their charge expectations are correct or whether or not a correction is required. Within the present setting, virtually any situation appears potential.

US recession dangers have elevated: Whether or not a recession is on the horizon relies upon largely on commerce coverage. A decision within the commerce dispute with China continues to be pending. Precious time is passing as the worldwide financial system waits for readability. The extra the US financial system cools, the better the strain on the Fed.

US inventory index close to key resistance: The S&P 500 has staged a major restoration in latest weeks, forming an ABC sample. Nevertheless, the upward transfer stalled slightly below the March 25 excessive at 5,786 factors. Except this stage is sustainably damaged, the medium-term downtrend stays intact. A financial coverage impulse by means of Fed communication might present the momentum wanted to interrupt by means of this resistance this week. A dovish message, that means one supportive of charge cuts, might give the inventory market recent upside.

Backside line: The Fed is prone to stay on maintain for now however stays beneath strain to behave. Financial weak spot, tariff uncertainty, and the US administration’s affect enhance the danger of financial coverage misinterpretation by traders. A dovish message might notably assist tech, progress shares, and rate-sensitive sectors reminiscent of actual property and utilities. If clear alerts are missing, setbacks in equities might comply with, particularly amongst cyclicals and export-oriented corporations.

S&P 500 day by day chart

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.