Positioned on the intersection of Layer 1 infrastructure and Layer 2 rollup execution, Initia is designed to supply builders a extremely customizable surroundings with native help for a number of digital machines – together with MoveVM, WasmVM, and EVM.

Backed by main buyers like Binance Labs and Delphi Digital, and approaching its Token Era Occasion (TGE), Initia has already captured vital market consideration by its dual-layer structure, lively testnet participation, and rising hypothesis on pre-market buying and selling platforms.

About Initia

Initia is a Layer 1 blockchain platform constructed on the Cosmos SDK, built-in with Layer 2 rollup options to create an “interwoven” multichain ecosystem.

The challenge has attracted funding from main enterprise capital corporations akin to Hack VC, Delphi Digital, and Binance Labs. Its Sequence A funding spherical valued the challenge at roughly $350 million.

Presently, Initia is making ready for its mainnet launch – anticipated in early 2025, following two profitable testnets that drew 194,294 eligible customers for its token airdrop.

Moreover, Initia has introduced that two main exchanges, Bybit, Kraken, MEXC, Gate.io… will checklist the INIT token on the time of its Token Era Occasion (TGE).

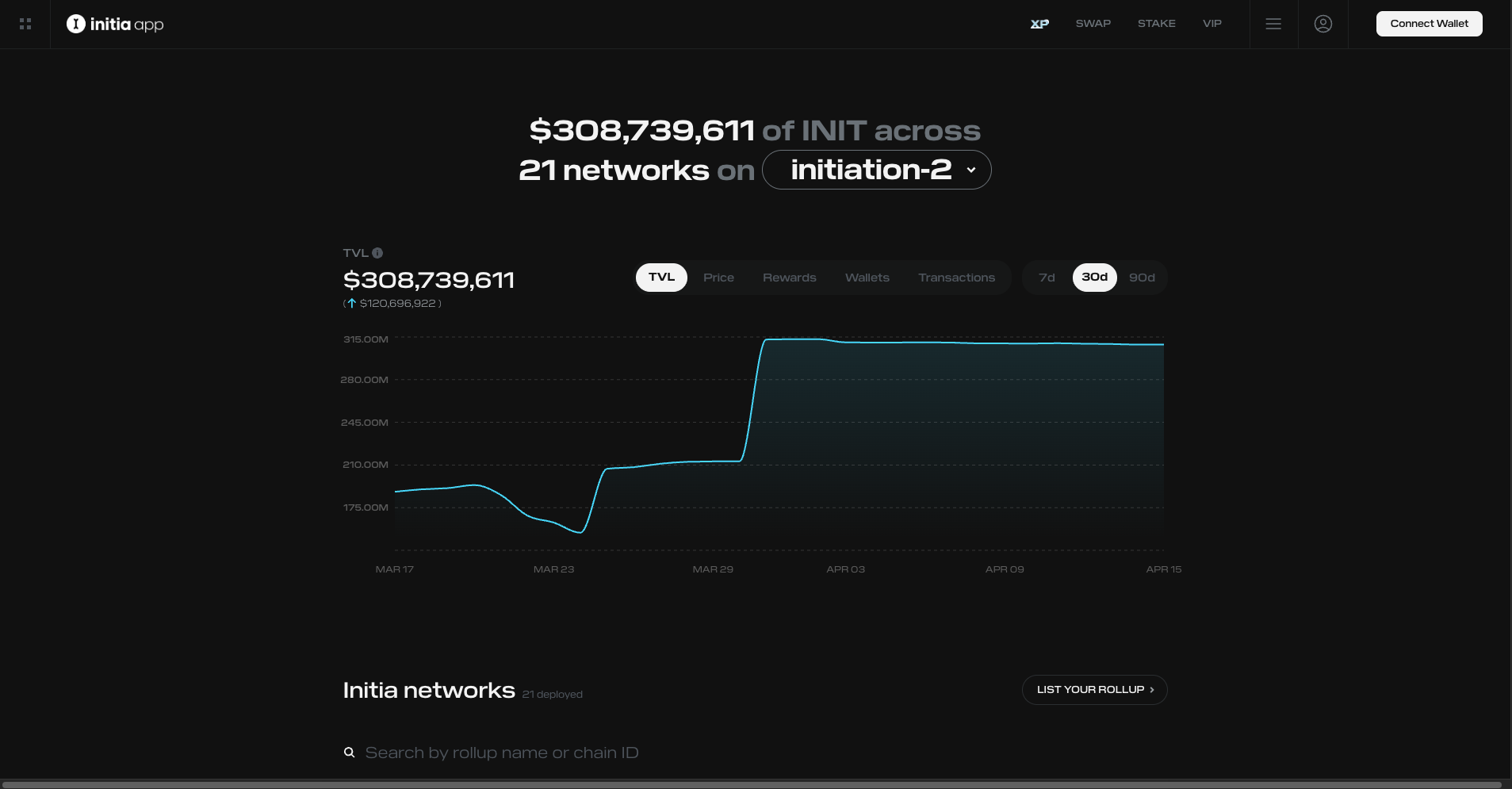

Initia stats – Supply: Initia

Initia Tokenomics

Token Allocation

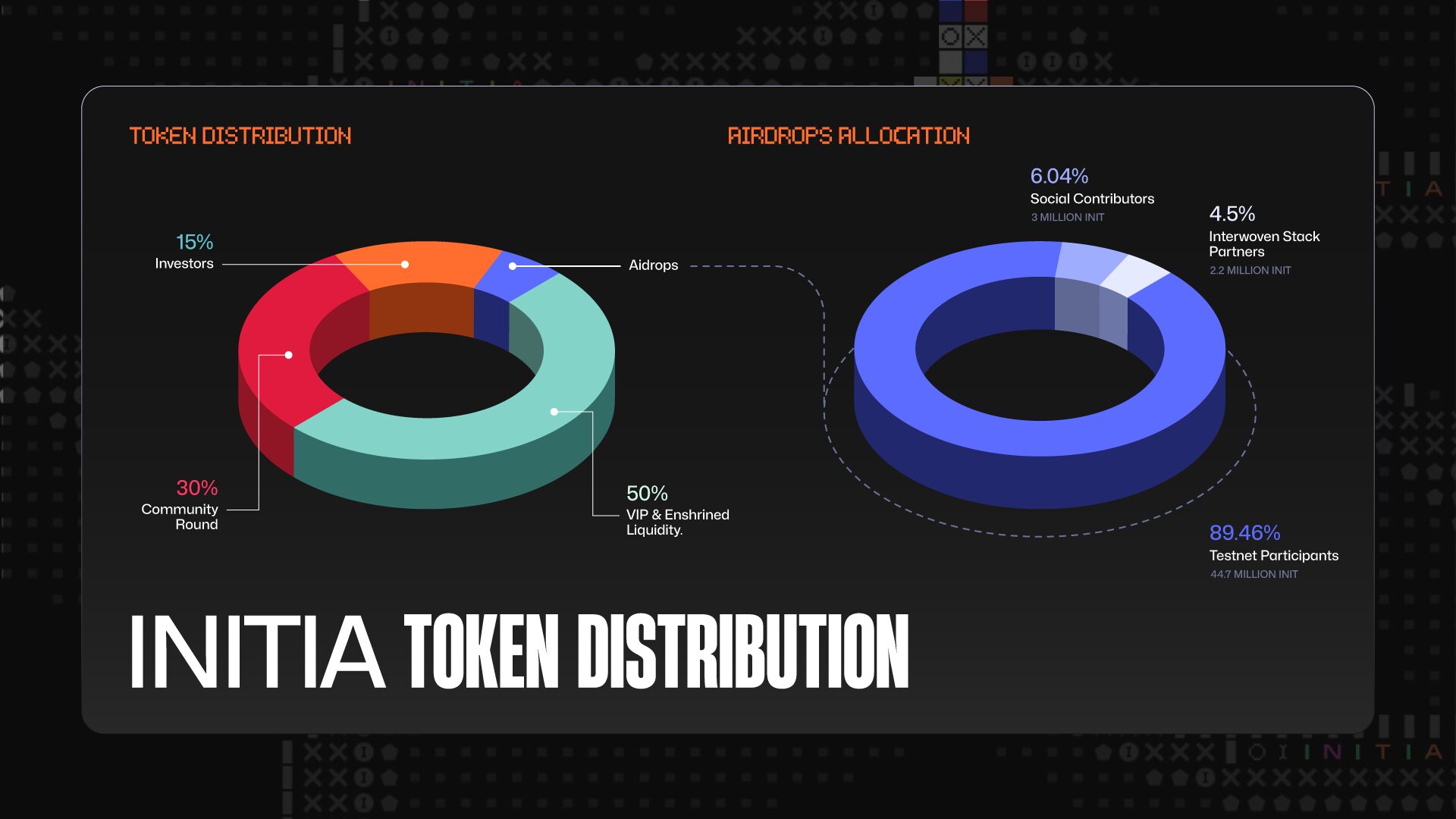

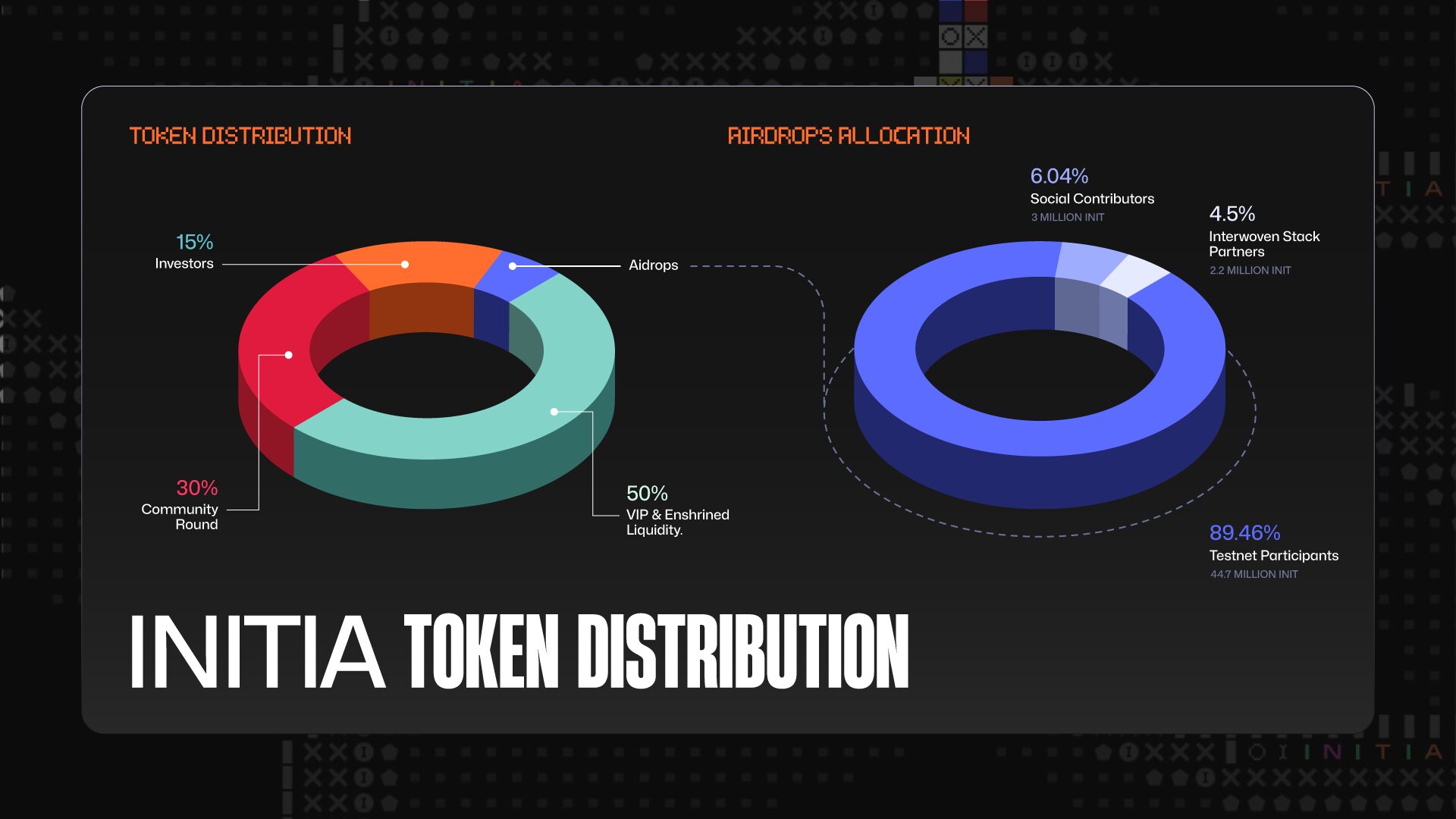

VIP & Enshrined: 50percentCommunity Spherical: 30percentInvestor: 15percentAirdrop: 5%

INIT allocation

INIT Airdrop Allocation

The workforce has allotted 5% of the whole provide (equal to 50 million INIT tokens) for the airdrop, distributed among the many following three teams:

Testnet individuals: 89.46% (44.7 million INIT)Social contributors: 6.04% (3 million INIT)Interwoven Stack companions: 4.5% (2.2 million INIT)

General, Initia’s airdrop allocation is neither too massive nor too small. Subsequently, on the time of TGE, the INIT token is unlikely to face vital promote stress from the airdrop recipients.

As well as, with a complete provide of 1 billion tokens and pre-market buying and selling on Bitget, MEXC and Aevo at the moment starting from $0.60 to $0.70 per INIT, Initia is at the moment valued at round $600 – 700 million in FDV.

Allocation for airdropStandardsTestnet individuals89.46%Customers who engaged in two testnet of InitiaSocial contributors6.04%Group member with particular position on Discord, lively social on XInterwoven Stack Companions4.5%Lively customers from companions: LayerZero, IBC and MilkTIA

INIT Value Prediction

Market Comparability

The value comparability desk on this article will embrace tasks with comparable know-how and strategic course to Initia. Particularly, two distinguished tasks chosen for comparability are Celestia (TIA) and Motion (MOVE).

Initia vs Celestia

From a technological perspective, each Initia and Celestia pursue a modular blockchain structure, separating core layers akin to consensus, execution, and information storage. The important thing distinction lies of their growth course:

Celestia goals to turn into a foundational layer for all sorts of blockchains, focusing completely on information availability (DA) options.Initia, alternatively, seeks to construct an built-in multichain ecosystem that serves each as an infrastructure layer and a complete growth surroundings for decentralized functions (dApps).

As of the time of writing, Celestia (TIA) has a market capitalization of roughly $1.5 billion and a completely diluted valuation (FDV) of round $2.7 billion, with its token buying and selling within the $2.4 – 2.5 vary. TIA reached a neighborhood peak of practically $20 shortly after its launch in late 2023, earlier than correcting according to the broader market development.

In the meantime, Initia remains to be pre-TGE, with pre-market costs of $0.60 to $0.70 – implying an FDV of roughly $600 – 700 million. This already positions INIT at greater than 25% of Celestia’s FDV, regardless of the challenge not but having a functioning mainnet or any deployed Minitia chains in manufacturing. The truth that INIT’s valuation is approaching Celestia’s means that hypothesis is driving its pricing, moderately than confirmed adoption.

With macro uncertainty and excessive pre-launch pricing, Initia faces notable short-term dangers. To keep away from post-TGE worth shocks, it might be prudent for the workforce to checklist INIT at a extra conservative vary of $0.30 – $0.40, significantly if buying and selling circumstances stay weak – thereby making a extra natural development path much like how Arbitrum or Optimism scaled post-launch.

That mentioned, the 2 tasks serve very totally different segments of the modular blockchain stack. If Initia realizes its multichain imaginative and prescient, it may help dozens of scalable, interoperable, app-specific rollups.

It may justify a valuation on par with and even exceeding Celestia’s. A $2.5 billion FDV would suggest a token worth of round $2.5.

Initia vs Motion

Each Initia and Motion observe the appchain mannequin, enabling apps to launch unbiased, customizable chains.

Motion makes use of a “Transfer-as-a-Service” mannequin, easing deployment for Transfer-based tasks throughout infrastructures. In distinction, Initia helps a number of tech stacks with shared safety and liquidity in a single unified community.

MOVE trades at ~$0.30 with a $745M market cap and ~$3B FDV. Of this, 2.45 billion tokens have already entered circulation, accounting for twenty-four.5% of the whole provide.

MOVE peaked close to $1.45 post-mainnet and Binance/OKX listings earlier than correcting with the market in Q1 2025.

Technologically and investment-wise, Initia rivals Motion, but its FDV is simply one-fifth (~$630M). As such, INIT may probably attain a worth of $3, matching Motion’s present FDV.

This can be a sensible situation — if Initia harnesses its tech and attracts a powerful developer neighborhood.

Initia Value Prediction

With out main change listings, INIT might mirror DYM’s path — average FDV and flat post-TGE worth motion.

If listed on Binance, INIT may debut with the next FDV much like MOVE and TIA. INIT may launch nearer to the $1–1.5 vary with upward momentum, supplied post-listing exercise helps sustained demand.

Conclusion

Primarily based on the evaluation above, Initia demonstrates sturdy potential to turn into a core infrastructure hub for future appchains.

Though it has but to bear its TGE, the present totally diluted valuation (~$630–700 million), comparable to a token worth of $0.63–$0.70, already displays excessive market expectations.

Initia may hit $3B in FDV, pushing the INIT worth close to $3.

Learn extra: ETH Value Prediction in April: Quick & Mid Time period Evaluation.