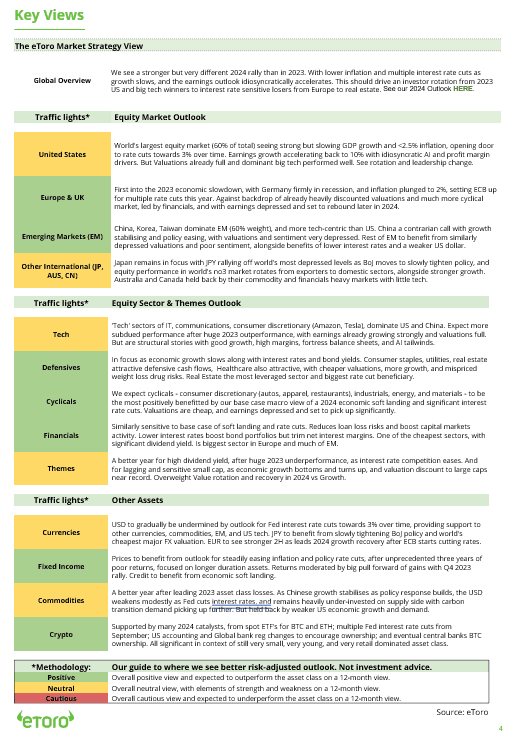

Markets have been on a rollercoaster for the reason that US declared its tariff “Liberation Day” on April 2. Buyers have been scrambling to regulate portfolios, looking for shelter from the trade-war storm whereas sniffing out any silver linings.

Defensive is the New Offense

After the tariff bombshell, a transparent pattern emerged: rotation into defensive sectors and away from trade-sensitive cyclicals. In Europe, historically “boring” performs like utilities, actual property, and defence shares abruptly turned stars as tariff jitters set in. Conversely, sectors tied to international commerce took a success – luxurious items, banks, and industrials slumped, and tech shares wobbled. The message: if an organization’s earnings depend upon globalization, buyers are tapping the brakes.

Not everyone seems to be fleeing development totally, however there’s a newfound choosy strategy. Some favour companies over items in client performs and cash-rich giant caps over fragile small caps. In different phrases, high quality and resilience are the secret. And gold is gleaming once more – each as a diversifier and recession hedge.

Rethinking the Map The tariff shock has upended regional preferences too. US equities, as soon as stalwart, abruptly look shakier on development fears. Many buyers assume that “Liberation Day will in all probability not characterize the short-term backside for US equities.

The UK, hit with a milder 10% tariff, has proven resilience; London’s FTSE fell lower than continental indexes. Some even assume Britain would possibly snag a aggressive edge – items made within the UK face decrease US tariffs than EU-made ones, probably encouraging a little bit of reshoring to British shores.

Europe, regardless of dealing with a hefty 20% US tariff, isn’t being deserted – the EU has each the clout and coverage instruments to buffer the influence. In the meantime, rising Asia has been largely put within the penalty field. With key Asian economies dealing with 30%+ tariffs, many managers are trimming publicity to Asian and different EM equities. For UK and European buyers, staying nearer to dwelling feels safer for now.

Sentiment, Commodities & Currencies

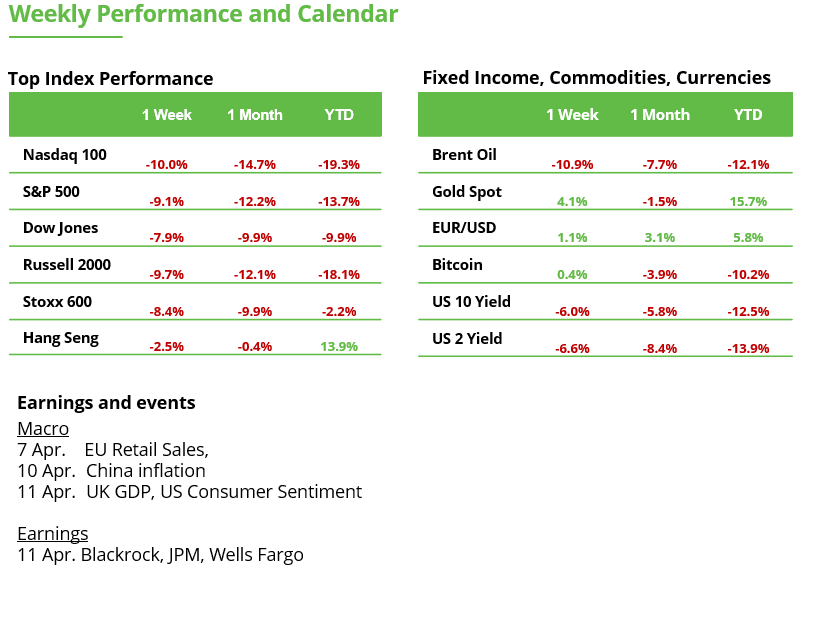

Within the speedy aftermath, risk-off sentiment spiked. International shares plunged – US indices fell round 5% in a day – and buyers dashed for canopy in protected havens like bonds, gold, and the Japanese yen. Authorities bond yields slid as costs jumped, and oil costs slumped on fears of a trade-induced slowdown. Notably, the US greenback fell as a substitute of strengthening, as markets wagered the Fed must counteract the expansion hit. The euro and even the pound firmed towards the dollar amid the turmoil.

Backside line: buyers in Europe and the UK are hunkering down, leaning into protection and trimming publicity to the attention of the storm. There’s cautious hope a negotiated truce will emerge – however nobody’s betting on it but. For now, portfolios are stocking up on high quality names plus further money, bonds and gold for security. It’s the basic “hope for the perfect, hedge for the worst” playbook because the mud settles from Liberation Day.

Can US quarterly figures reassure regardless of tariffs and lack of confidence?

Donald Trump’s new tariffs are presently overshadowing every thing else within the markets. Recession fears are rising, and investor sentiment is at a low level. Nonetheless, new potential catalysts are on the horizon: U.S. inflation knowledge and the beginning of earnings season.

Financial institution earnings as a market barometer: On Friday, U.S. banks will kick off the earnings season. J.P. Morgan and Wells Fargo would be the first to report, providing an preliminary glimpse into the broader financial image and the way the primary quarter has unfolded. The market is raring for constructive alerts.

Sharply lowered expectations: Monetary corporations within the S&P 500 are anticipated to publish earnings development of simply 2.6% year-over-year (see chart). Forecasts have been considerably revised downward in current months. Present estimates stand at lower than 40% of what was anticipated on the finish of December. The monetary sector will not be alone – earnings expectations have been reduce throughout all eleven S&P 500 sectors. A 2.6% improve would even be beneath common; for the S&P 500 general, earnings development of seven.3% is forecast.

Early warning indicators for the economic system: Current U.S. survey knowledge is sending clear warning alerts. Client expectations for the long run have dropped to a twelve-year low. Financial institution earnings now present key insights into lending exercise, credit score danger provisioning, and web curiosity margins. Buyers ought to intently monitor whether or not there are indicators of a weakening actual economic system and the way pronounced they already are.

Overreaction or justified concern? On Friday, panic unfold throughout the banking sector. Losses from the all-time excessive prolonged to 16%, and the index fell to its lowest stage since September. On the every day chart, the RSI indicator dropped beneath the 30 stage – sometimes an indication of an oversold market.

Trump’s calculus: Donald Trump’s commerce coverage will not be solely aimed toward overseas companions, however can also be strategically motivated domestically. Whereas excessive tariffs punish U.S. buying and selling companions, Trump seems to have a powerful curiosity in pushing bond yields decrease. Decrease yields scale back refinancing prices for current U.S. authorities debt, probably saving billions, creating fiscal room that might later be used for tax cuts. A weaker economic system or perhaps a recession is being knowingly accepted. Markets have already began pricing on this state of affairs. On Friday, the yield on the 10-year U.S. Treasury briefly fell beneath the 4% mark. In January, it was nonetheless as excessive as 4.8%.

Bottomline: This week will reveal whether or not company earnings and inflation knowledge can assist restore investor confidence. Traditionally, markets fall rapidly and sharply, whereas recoveries are typically slower and sometimes much less dynamic – endurance is crucial. On the identical time, the pricing in of tariff-related dangers is creating new buying and selling setups and recent market alternatives.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.