Be a part of Our Telegram channel to remain updated on breaking information protection

JPMorgan and Goldman Sachs have raised the chances of a recession within the US, the previous citing Donald Trump’s “excessive” insurance policies because the crypto and inventory market crash.

The capitalization of the digital asset market plummeted over 3% within the final 24 hours, with Bitcoin briefly tumbling beneath $80K.

In the meantime, the US inventory market shed greater than $1.7 trillion in worth after President Donald Trump declined to rule out the potential for a recession this yr.

JPMorgan Raises Recession Odds To 40%

As Trump retains the potential for a recession this yr open, economists at JPMorgan have elevated the chances of a recession to 40%, from 30% beforehand.

“We see a cloth threat that the US falls into recession this yr owing to excessive US insurance policies,” the analysts stated.

Goldman Sachs analysts are additionally bearish, elevating their likelihood of a recession within the subsequent 12 months to twenty% from 15% beforehand.

The analysts warned that the chances of a recession will doubtless proceed except Trump modifications course.

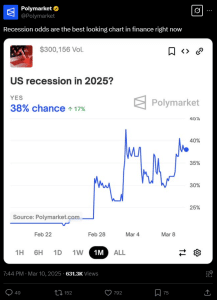

Customers of the decentralized betting platform Polymarket additionally raised the probabilities of a recession in 2025. Within the final month, odds for a contract on the platform have risen 18% to 38%.

Crypto Concern And Greed Index Indicators ”Excessive Concern”

Crypto investor sentiment stays fearful. The Crypto Concern and Greed Index presently stands at 24, signaling “Excessive Concern.” This marks a 4-point enhance within the final 24 hours. Nonetheless, the index remains to be down 21 factors in comparison with a month in the past.

In the meantime, Trump financial adviser Kevin Hassett stated in a March 10 interview with CNBC that there are “a variety of causes to be extraordinarily bullish concerning the economic system going ahead.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection