Bitcoin is going through renewed volatility because it struggles to interrupt above the $112,000 all-time excessive. After weeks of consolidation close to file ranges, market contributors are watching carefully for a decisive transfer that might sign the following main development. Bullish momentum stays intact, however hesitation at key resistance retains either side on edge.

Macroeconomic situations are including gas to the hypothesis. The US Congress just lately handed President Donald Trump’s long-awaited legislative invoice—dubbed the “huge, stunning” invoice—simply forward of the self-imposed July 4 deadline. In parallel, the newest job market knowledge beat expectations, signaling a stronger-than-expected financial system and boosting threat urge for food throughout world markets.

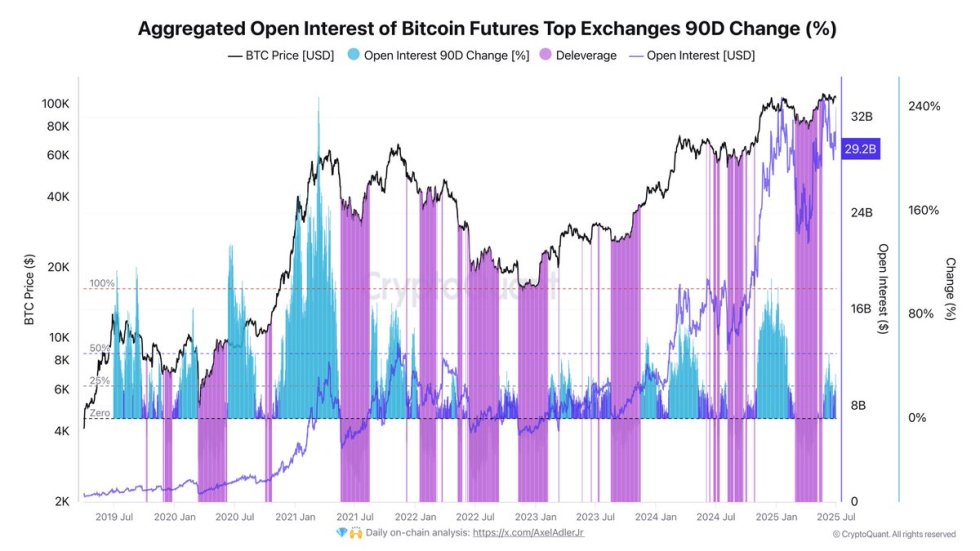

Within the derivatives area, CryptoQuant knowledge exhibits that the 90-day change in open curiosity (OI) has turned damaging—a traditionally vital sign. When this metric dips under zero, it usually signifies capitulation amongst merchants and compelled liquidations, which have a tendency to chill off leverage and reset the marketplace for more healthy worth motion. As Bitcoin navigates this risky mixture of technical resistance and shifting macro tailwinds, the approaching days might be decisive in figuring out whether or not a breakout above $112K is imminent or if one other correction lies forward. Merchants stay alert because the stakes proceed to rise.

Bitcoin Inches Nearer To Breakout As Bulls Tighten Grip

Bitcoin bulls stay firmly in management, however a decisive breakout into worth discovery continues to be wanted to verify the following leg of the rally. After climbing 47% since its April lows, Bitcoin now trades lower than 2% under its $112,000 all-time excessive. The market is heating up, pushed by waning macroeconomic uncertainty, sturdy equities efficiency, and rising investor optimism.

Nonetheless, with resistance so shut, the following few days might be pivotal. A agency push above the all-time excessive might unlock a robust enlargement part, whereas failure to interrupt by might result in a corrective retrace. Analysts are carefully watching each technical and on-chain knowledge to gauge the following transfer.

Prime analyst Darkfost shared key insights into derivatives exercise, highlighting the significance of monitoring the 90-day change in open curiosity (OI). This metric provides a snapshot of how leveraged the market is. When the 90d OI share flips damaging, it sometimes alerts mass liquidations or capitulation amongst overexposed merchants, leading to a pointy drop in open curiosity.

In keeping with Darkfost, these deleveraging occasions—particularly throughout bull markets—have constantly created enticing alternatives to construct lengthy positions or dollar-cost common (DCA) within the spot market. They scale back threat by flushing out weak arms and clearing extreme leverage. With present knowledge exhibiting a latest dip in OI adopted by stabilization, many merchants view this as a possible reset forward of a breakout.

As Bitcoin consolidates close to historic highs, the stage is about. Both bulls push past resistance and into uncharted territory, or bears acquire short-term management. For now, momentum favors the upside—however affirmation stays key.

BTC Value Motion Stays Vary-Sure Under ATH

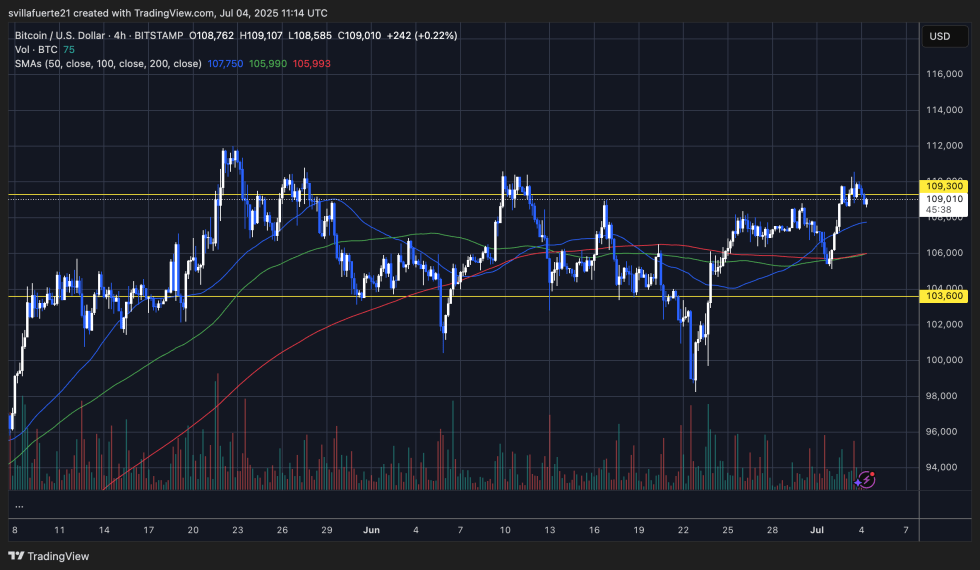

Bitcoin continues to commerce under the important thing resistance at $109,300, as seen on the 4-hour chart. After failing to ascertain a transparent breakout above this stage, the worth has retreated barely to round $109,010 on the time of writing. The zone between $108K and $109.3K has change into a important space of consolidation, with each bulls and bears combating for short-term management.

The 50, 100, and 200-period shifting averages are all trending upward and converging close to the $106K–$106.5K area, offering sturdy dynamic assist. Value stays above these shifting averages, suggesting a bullish construction stays intact regardless of the latest stalling.

Quantity has decreased through the latest leg up, hinting at potential exhaustion, however not essentially a reversal. A retest of the $109.3K resistance or a breakdown towards the $106K–$105K assist zone might happen earlier than any decisive transfer.

The decrease assist at $103,600 continues to function a key stage that, if damaged, might sign a deeper retrace. For now, Bitcoin is in a decent consolidation vary, and merchants are ready for a breakout above $109.3K or a breakdown under $106K to find out the following development route. Till then, volatility and uncertainty are prone to persist.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.