Key Takeaways:

Pattern Analysis added 11,520 ETH value almost $35 million, lifting complete holdings to 601,074 ETH ($1.83 billion).The agency has borrowed $958 million in stablecoins from Aave, persevering with an aggressive leveraged accumulation technique.Founder Jack Yi says Pattern is positioning for a main 2026 bull market, dismissing short-term volatility as noise.

A significant Ethereum whale has doubled down once more. On-chain knowledge reveals Pattern Analysis persevering with its aggressive ETH accumulation, at the same time as derivatives markets flash elevated danger and short-term sentiment stays divided.

Learn Extra: Ethereum Whale Strikes 40,000 ETH After 10 Years, Unlocking $120M+ From ICO Pockets

Pattern Analysis Buys One other $35M in ETH Utilizing Borrowed Capital

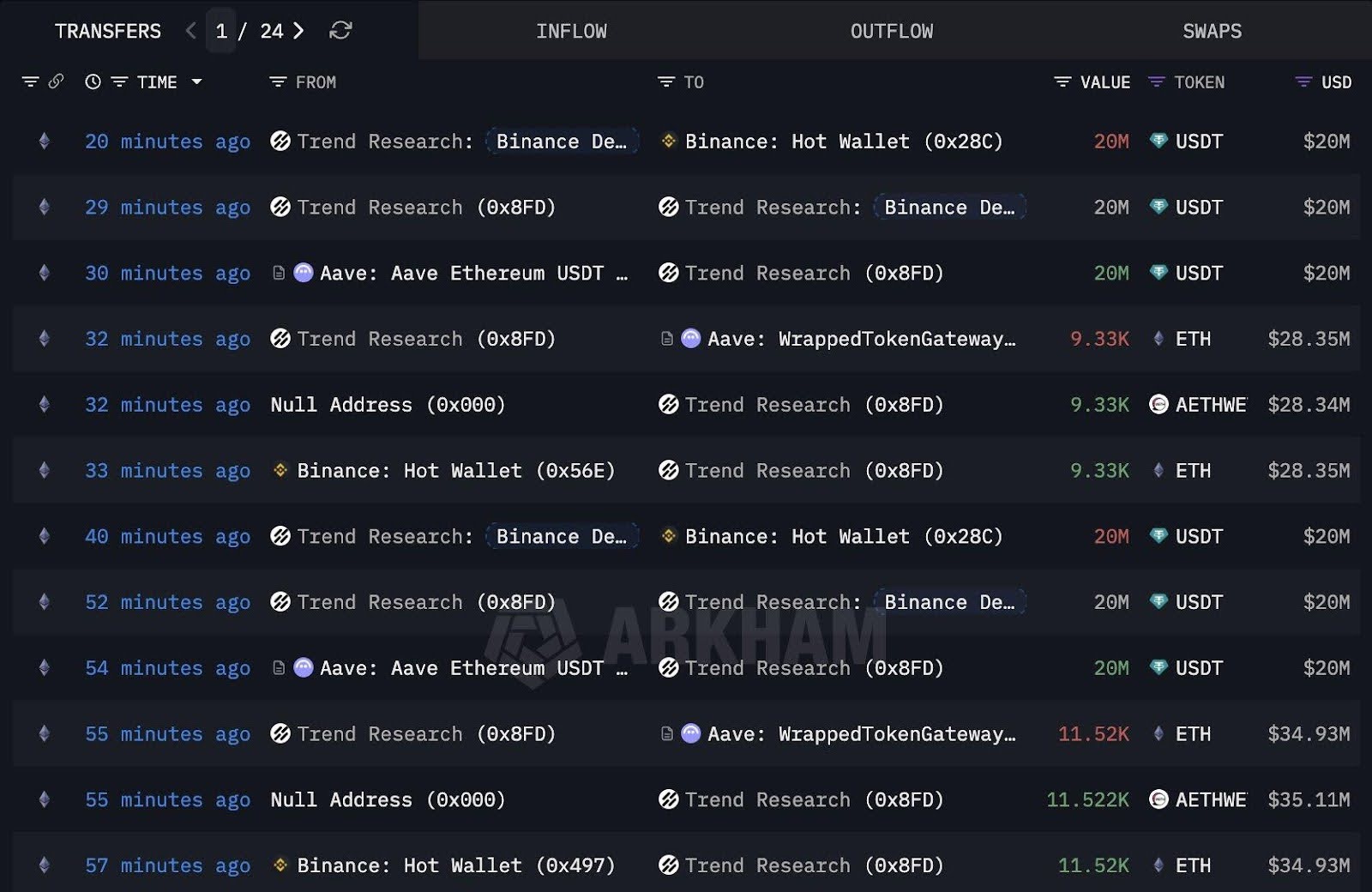

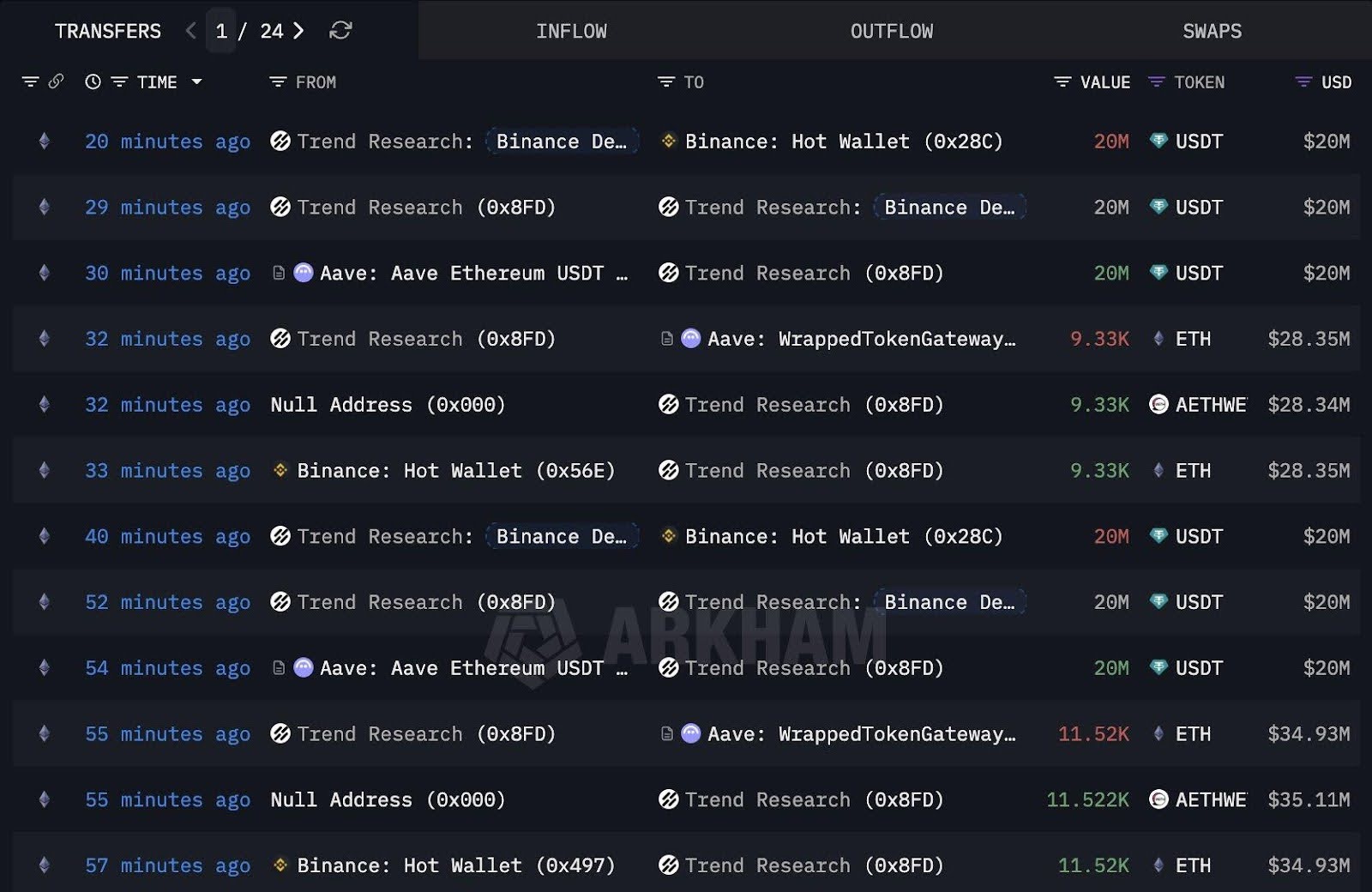

Blockchain analytics platform Lookonchain reported {that a} whale pockets linked to Pattern Analysis bought 11,520 ETH, spending roughly $34.93 million. The acquisition pushed the agency’s complete Ethereum place to 601,074 ETH, valued at round $1.83 billion at present costs.

The data on-chain present that the corporate has been borrowing USDT on Aave always, and the general stablecoin loans have presently hit an all-time excessive of $958 million. In keeping with Binance withdrawal, the common ETH entry value of Pattern Analysis is round $3,265, which covers a big a part of the place in proximity to the magic market.

This development emphasizes a deliberate strategy: Pattern shouldn’t be timing bottoms however dimension it by leveraging even when value fluctuations are unstable.

Learn Extra: BlackRock Transfers $114M in Bitcoin and Ethereum to Coinbase in Main Institutional Transfer

Leverage, Not Timing, Drives the Accumulation Technique

Pattern Analysis is leveraging DeFi to scale publicity not like firms like Greenback-cost averaging or when treasury inflows are used. Borrowing of stablecoins over collateral that has been already obtained permits the agency to extend its ETH place with out collateral gross sales or hoping for value declines.

This technique enhances the potential of upside and the liquidation danger. However, there is no such thing as a historic report of compelled deleveraging but on chain implying that Pattern is insulated towards steep declines.

Founder Jack Yi Alerts Conviction in 2026 Macro Tailwinds

Why Pattern Analysis Is Ignoring Quick-Time period ETH Swings

Pattern Analysis founder, Jack Yi, restated in a public posting that the corporate will carry on including ETH no matter fluctuating costs of a number of hundred {dollars}. He characterised Pattern as one of many largest ETH bulls within the trade, and that one can not construct giant positions at optimum lows.

Pattern Analysis plans to keep up its largest allocation in ETH, whereas additionally holding positions in BTC, BCH, BNB, and a heavier publicity to WLFI, a token linked to the World Liberty Monetary ecosystem.

Pattern Analysis Emerges as One of many Largest ETH Holders

Pattern Analysis is now one of many largest identified Ethereum holders on the planet with over 600,000 ETH, though the corporate is a privately held, unlisted firm. This place makes it not but included in quite a few monitoring dashboards comparable to these of the publics, regardless of its on-chain footprint competing with these of the publicly-traded crypto treasuries.

With an lively borrowing and shopping for cycle versus the passive treasuries, Pattern is an attention-grabbing participant within the liquidity of Ethereum. The provision within the spot market due to the massive withdrawals of ETH in exchanges is lower than common and will pose a problem when the demand is excessive.

Concurrently, the leveraged accumulation presents systemic danger in case of a pointy change out there. Giant debtors compelled to unwind have prior to now traditionally led to cascading liquidations throughout DeFi protocols.